400tmax/iStock Unreleased via Getty Images

Intro

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is one of the few technology companies that, having doubled its capitalization during the pandemic, does not show signs of a stable correction. This article is an attempt to understand how high inflation and the expected tightening of monetary policy in the US will affect the company.

High inflation as a new reality

According to the latest data, the consumer price index in the US rose by 8.5% in March. This is the highest level since 1981, but some experts consider this level to be the peak.

In fact, the statistics are mixed. On the one hand, the core CPI index (excluding the price of food and energy) rose by only 0.3% mom while the market had expected growth of 0.5% mom. For the year, the index rose by 6.5%, which coincided with expectations. On the other hand, the core Producer Price Index jumped a record 9.2% yoy in March. This was above market expectations of 8.4% yoy. The Producer Price Index is considered a forward indicator, as the increase in production costs is subsequently passed on to consumers.

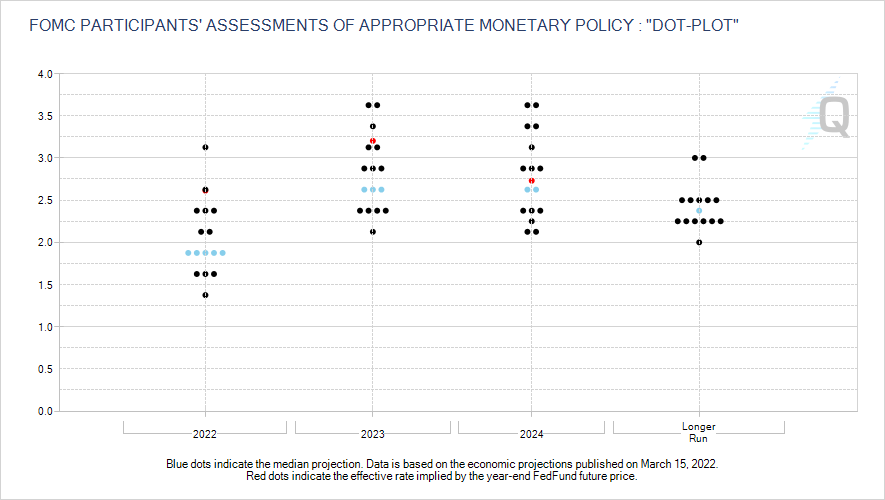

Now, there is practically no doubt that the Fed will actively raise rates. For example, St. Louis Federal Reserve Bank President James Bullard wants to get rates up to 3.5% by the end of the year. But it may happen that the actions of the Fed will not be enough to curb inflation.

cmegroup.com

The fact is that part of the reasons for high inflation lies outside the United States. Firstly, the military conflict between Russia and Ukraine caused a sharp rise in prices in the grain market and the energy market. For example, wheat in the US rose to a ten-year high precisely because of this factor. Secondly, the slowdown in China’s GDP growth due to large-scale quarantine threatens to continue problems in supply chains. This factor is also not to disappear in the near future.

In general, it is likely that inflation in the US is really close to the peak. But after reaching this peak, not a return to the previous level will follow, but a plateau phase. In my opinion, this should be taken as the base scenario.

Inflation is a catalyst

I believe that the crisis state of an economy and high inflation as a derivative of this state ultimately have a positive effect on the online advertising market. I have a logical and historical confirmation of my point of view.

It is generally difficult for businesses in today’s world to raise prices. The Internet allows consumers to quickly compare where a product or service costs less, and therefore, an increase in price usually means a decrease in market share for businesses. In a situation where a business is very constrained in terms of pricing policy, the issue of promoting goods and services through advertising becomes a top priority.

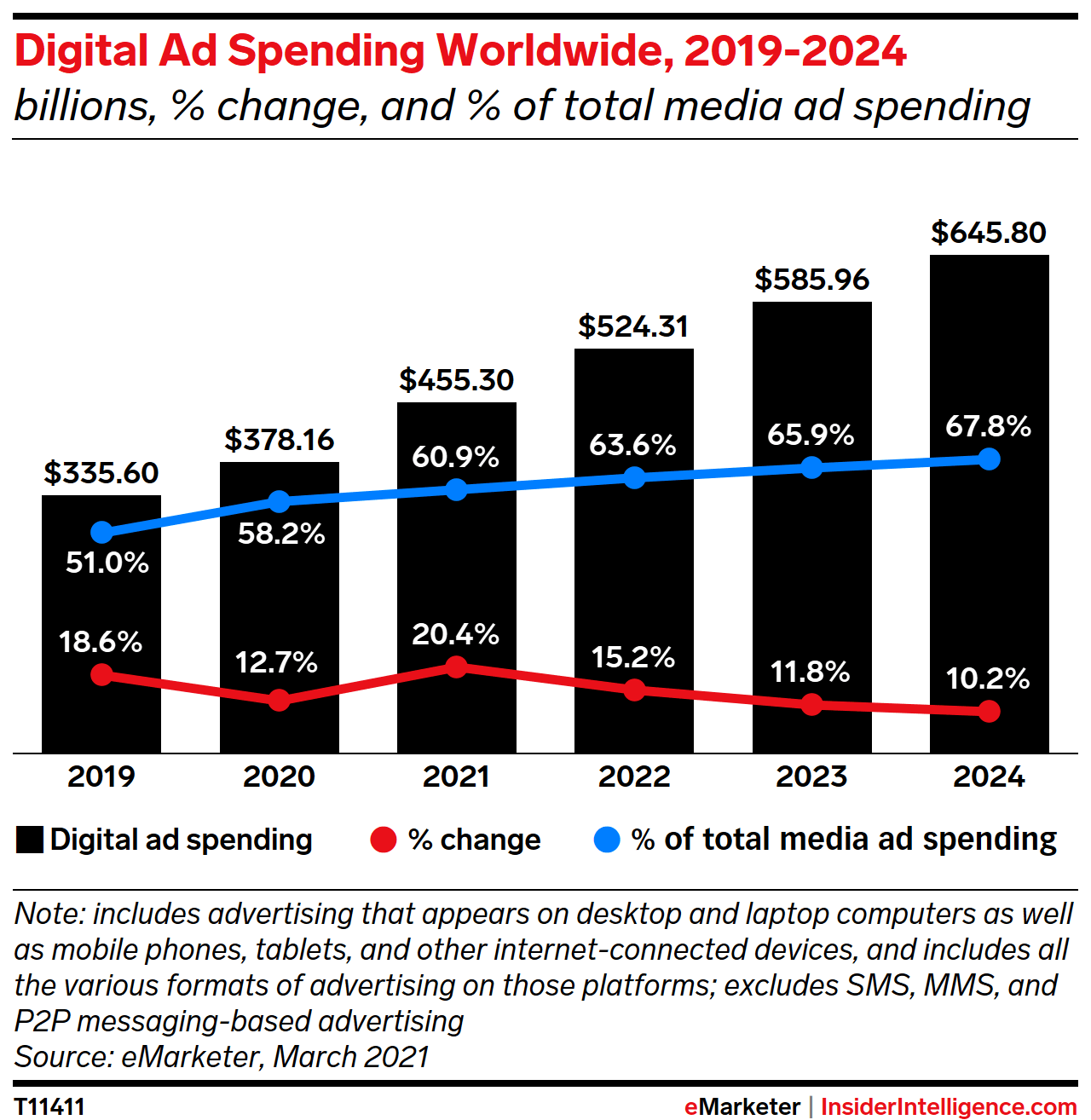

At the same time, crisis phenomena tend to accelerate existing trends. With the denser introduction of the Internet into our lives, digital advertising is gradually increasing its share in the total advertising business. I think high inflation conditions will accelerate this trend in the US.

eMarketer

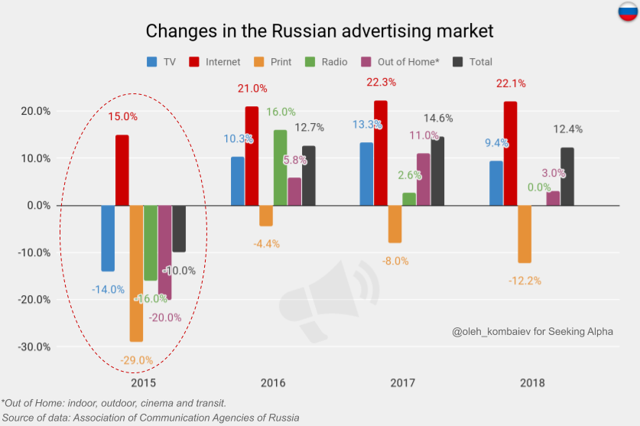

It is interesting to note that there is a fairly recent historical example of how a crisis situation associated with high inflation had a positive impact on the online advertising market.

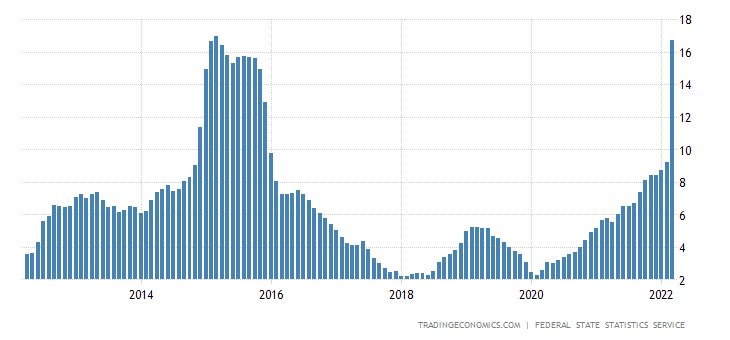

The introduction of anti-Russian sanctions in 2014, as well as the collapse of oil prices, have led to a GDP decline in 2015 by 2.8%. At the same time, inflation in Russia rose to 16%:

tradingeconomics.com

Due to the high sensitivity of advertising budgets to the economic factors, the advertising market in Russia declined by 10% YOY in that year. The only sector that avoided the decline was internet advertising:

In 2016, the Russian advertising market grew by 11.5% YOY, fully offsetting the fall of the previous year. The segment of online advertising increased by 21% YOY – almost twice faster than the market.

In my opinion, this example proves well that in an economic downturn and high inflation, businesses tend to increase their spending on online advertising.

Risk of stagflation

However, it is one thing when we are talking about a growing economy with high inflation, and another thing if the situation worsens to stagflation.

I agree that it is too early to talk about stagflation given the relatively low current unemployment in the US. But, along with the fact that the Fed is starting to tighten monetary policy, on the other hand, this means the end of the fiscal stimulus that took place during the quarantine period. In addition, the period of the moratorium on eviction, the return of student loans and so on ends. Add to this persistent disruptions in supply chains and volatility in financial markets and the outlook is not very optimistic. If the economy starts to shrink and unemployment rises, the Fed will not be able to do anything, it will hit the market hard. CME Group recently published an article on this topic. I recommend reading it.

The impact of unexpected inflation on large cap is another risk

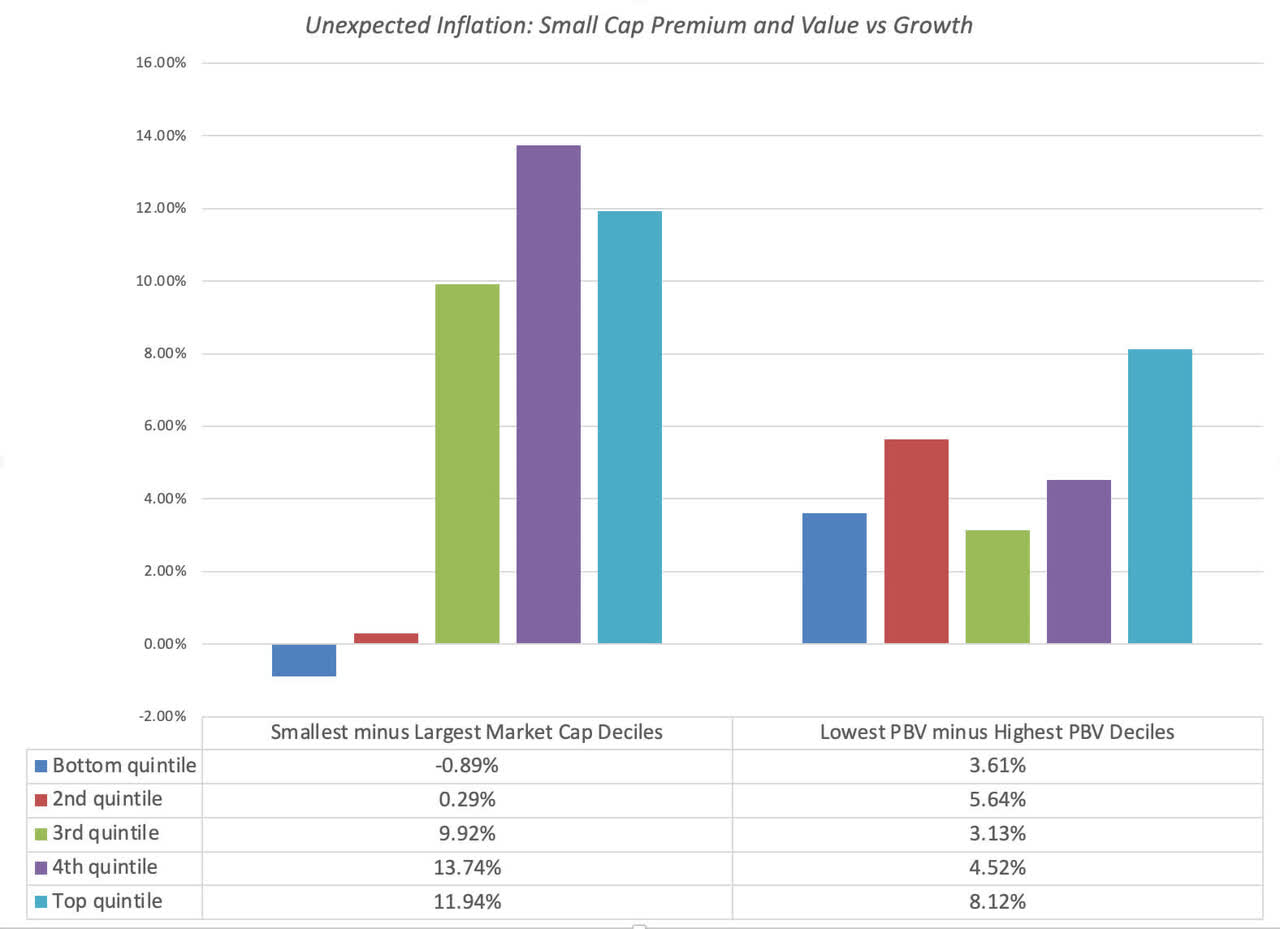

I am a regular reader of Professor Aswath Damodaran’s blog, and he has an interesting article on inflation. The main point of his little research is that there is a difference between expected and unexpected inflation. The second case is exactly what we have now in the USA.

He also cites an interesting statistic over the past 94 years, according to which small-cap companies, in general, lose less value in the face of high unexpected inflation:

aswathdamodaran.blog

This risk factor is common to all large-cap companies, and Alphabet in particular.

Is Alphabet overvalued now?

Now let’s look at how the current price of the Alphabet corresponds to its fundamental value. In my opinion, in the context of the observed increase in the cost of capital (bond yields) in the US, the best tool for this is DCF modeling.

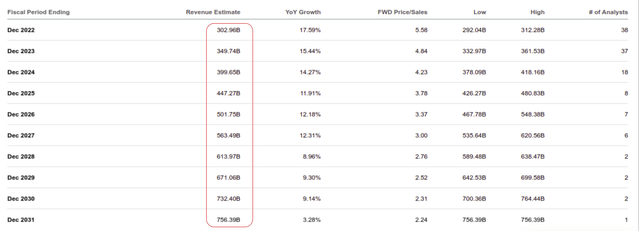

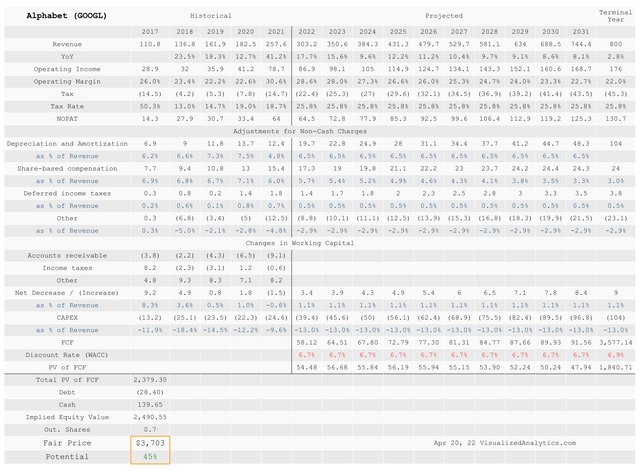

To be the least subjective, when predicting Alphabet’s revenue for the next decade, I proceeded from the average expectations of analysts:

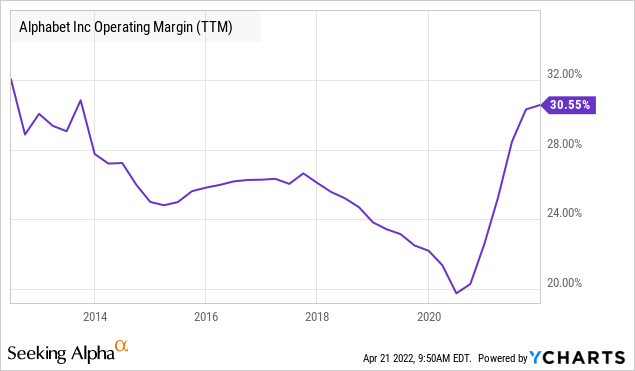

I went by the assumption that Alphabet’s operating margin will gradually reduce to 22%. I agree that given the current level of this indicator of the company, my outlook can be considered negative. But when forecasting for a long period of time, one must avoid being optimistic and, in addition, take into account the likely increase in competition.

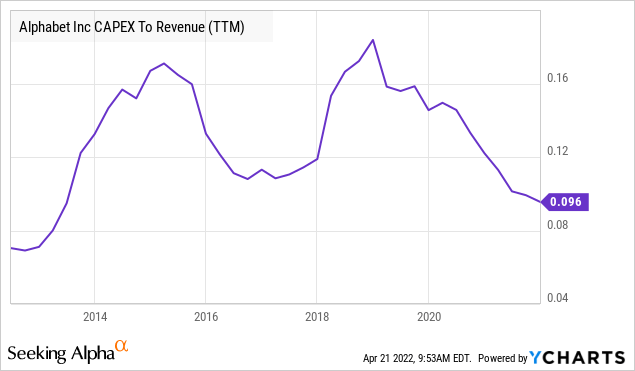

The relative size of CAPEX is assumed to be 14%, which is close to the long-term average:

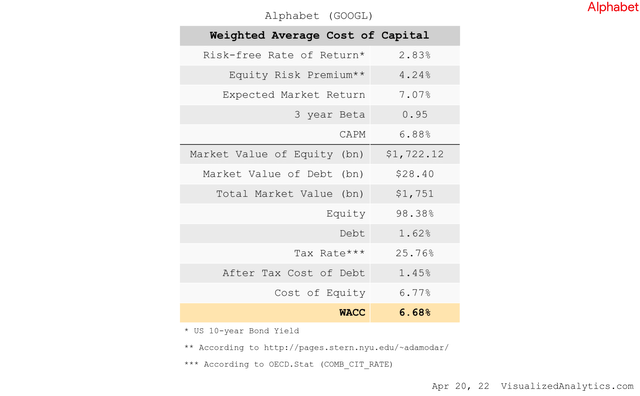

Here is the calculation of the Weighted Average Cost of Capital:

Some notes on the WACC calculation:

- In order to calculate the market rate of return, I used values of equity risk premium (4.72%) and the current yield of UST10 as a risk-free rate (2.83%).

- I used the current value of the three-year beta coefficient. For the terminal year, I used Beta equal to 1.

- To calculate the Cost of Debt, I used the interest expense for 2020 and 2021 divided by the debt value for the same years.

And finally, here is the model itself:

The DCF-based target price of Alphabet’s shares is $3,703, offering ~45% upside. And this is considering that my margin forecast is quite negative…

Bottom line

I believe that in the face of tightening monetary policy and the likely continuation of high inflation, Alphabet is one of the best options in order not to lose your investment. There are risks I wrote about that keep me from recommending a buy. But I definitely do not advise selling shares of the company with a speculative purpose.

Be the first to comment