Kwarkot/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

There are a going number of equal-weighted ETFs investors can use instead of the market-weighted version of that index’s ETF. While there is usually some “wiggle room” in such equal-weighted ETFs, the premise is not allowing a handful of stocks to dominate the ETF. It also increases the weight of the smaller stocks in the ETF versus a market-weighted ETF. Here I will compare the Invesco S&P 500 Equal Weight Real Estate ETF (NYSEARCA:EWRE) against the popular Real Estate Select Sector SPDR Fund (NYSEARCA:XLRE). For investors holding the S&P 500 stocks elsewhere, like in the SPDR S&P 500 ETF (SPY), you have REITs exposure. Adding one of these would allow you to increase that weighting in your portfolio.

Key index

Both ETFs use the Real Estate Select Sector Index, which S&P describes as:

All components of the S&P 500® are assigned to one of the eleven Select Sector Indices, which seek to track major economic segments and are highly liquid benchmarks. Stock classifications are based on the Global Industry Classification Standard (GICS®). Capping is applied to ensure diversification among companies within each index. There are 31 stocks in the Index.

Source: spglobal

Invesco S&P 500 Equal Weight Real Estate ETF review

SeekingAlpha describes this ETF as:

The investment seeks to track the investment results (before fees and expenses) of the S&P 500® Equal Weight Real Estate Index (the “underlying index”). The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. The underlying index is composed of all of the components of the S&P 500® Real Estate Index, an index that contains the common stocks of all companies included in the S&P 500® Index that are classified as members of the real estate sector, as defined according to the Global Industry Classification Standard (“GICS”). EWRE started in 2015.

Source: seekingalpha

EWRE has $283m in assets and currently yields 2.83%. Invesco charges 40bps in fees. That gives the other ETF a 30bps performance advantage, which also has a slight yield advantage too.

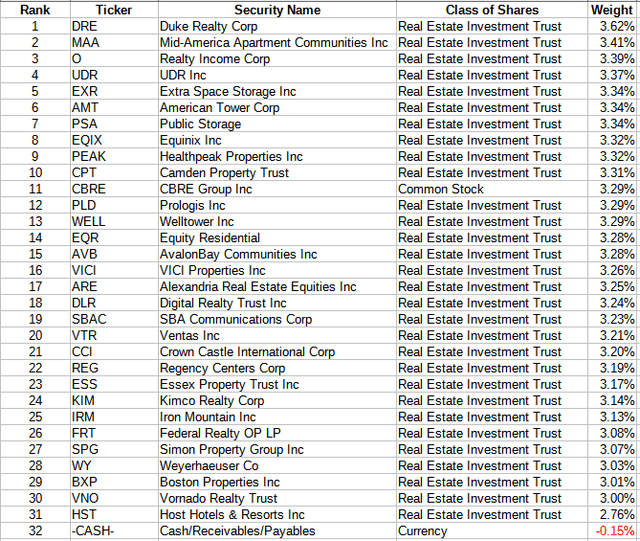

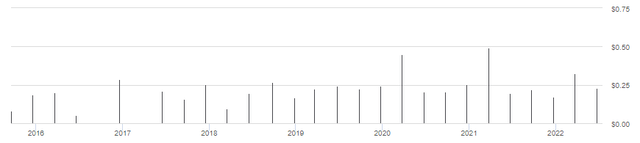

EWRE holdings review

The ETF and Index are rebalanced quarterly. This increases the expenses of this ETF compared to XLRE, which only needs to rebalance when an Index component changes. With the rebalancing having occurred in June, I went researching to explain why the weights for 7/1/22 ranged from 2.7% up to 3.6%. The Methodology PDF explained how that was possible:

Weighting. The indices are reset to equal weight quarterly after the close of business on the third Friday of March, June, September, and December. The reference date for weighting is the second Friday of the reweighting month and changes are effective after the close of the following Friday using prices as of the reweighting reference date, and membership, shares outstanding, and IWFs as of the reweighting effective date.

Source: S&P U.S. Indices Methodology

The second half of June was very volatile and the stocks have moved away from the 3.22% weighting each had post-rebalancing. This quarterly rebalancing has resulted in a 21% turnover rate for EWRE and helps explain the higher cost to investors for this ETF. This is a complete list of the holdings.

Invesco.com; compiled by Author

All but one holding is a REIT, and they manage properties, with the Top 10 being 33.76% of the portfolio.

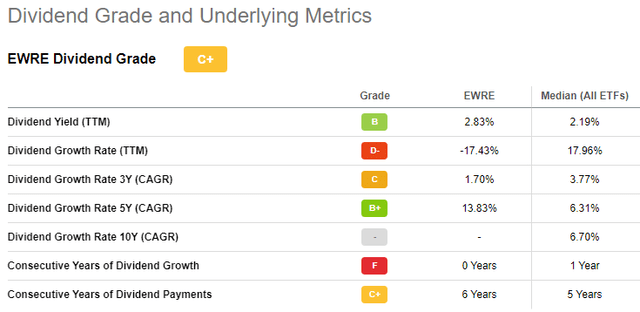

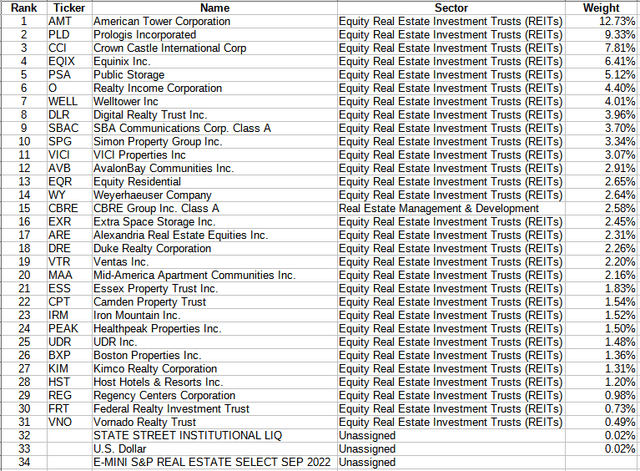

EWRE distribution review

The chart reveals two important things about the payouts. First, is they are done on a quarterly basis, a very common trait for equity-based funds. Second, there is little consistency or growth in the payouts. That is reflected in the grade Seeking Alpha gives to the dividend history.

seekingalpha.com EWRE DVD scorecard

Real Estate Select Sector SPDR ETF review

SeekingAlpha describes this ETF as:

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Real Estate Select Sector Index (the “index”). Under normal market conditions, the fund generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index. The index includes securities of companies from the following industries: real estate management and development and REITs, excluding mortgage REITs. The fund is non-diversified. Benchmark: S&P Real Estate Select Sector TR USD. XLRE started in 2015.

Source: seekingalpha

XLRE has $4.7b in assets and currently yields 3.1%. Here the managers only charge 10bps in fees.

XLRE holdings review

As expected, XLRE holds the same assets as EWRE, only weighted differently.

XLRE holds 295 contracts of the E-Mini futures, which helps keep the ETF fully invested even as it holds cash assets. XLRE classifies CBRE Group (CBRE) not as Common Stock, but as a Real Estate Management company, as does EWRE elsewhere in their data. Being market-cap weighted, the Top 10 represent 57.46% of the assets, with the largest weight being 3X that of EWRE’s top holding.

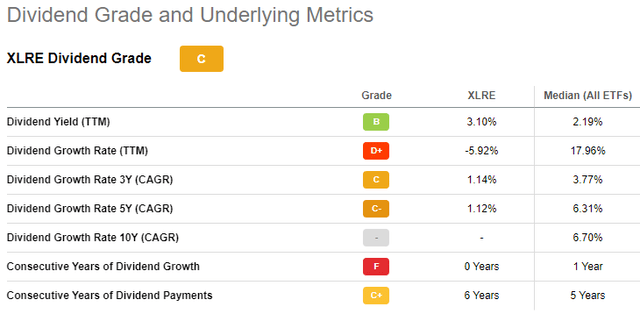

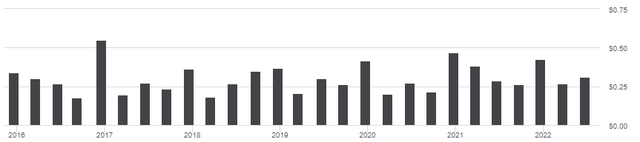

XLRE distribution review

Here we see, as one might expect, a familiar payout pattern as the other ETF. As mentioned, using market-weights results in XLRE having a 27bps yield advantage over EWRE. Despite that, SeekingAlpha grades these results slightly lower.

seekingalpha.com XLEW DVD scorecard

Comparing ETFs

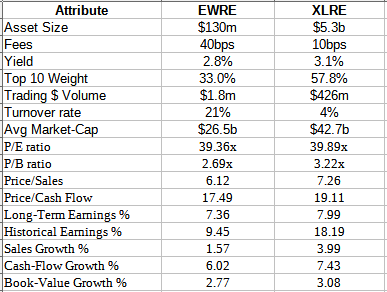

Using various sites, I collected Value and Growth metrics for both ETFs.

Various sites; compiled by Author

The Value data, such a Price/Book, Price/Sales, and Price/CF favor EWRE, whereas the Growth data (Earnings, CF, BV) favors XLRE. From a trading viewpoint, XLRE is much easier for large orders as it has much higher trading volume and narrower bid/ask spreads.

As expected, XLRE is more dependent on how its Top 10 perform compared to EWRE. American Tower is almost 4X more important to XLRE than to EWRE. On the flip side, the smallest 10 positions in EWRE are 30.6% of the portfolio, compared to only 12.1% for XLRE. Basically, any stock held by EWRE equally drives performance (as expected), whereas the bottom third of XLRE has much less ability to drive performance, good or bad. Also, 19 XLRE holdings have a lower weight than the smallest position held by EWRE.

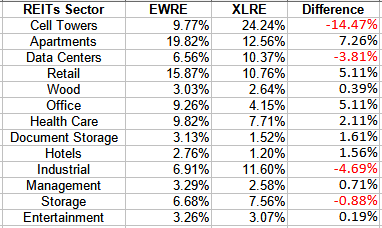

By weighting the same holdings differently, REIT sector exposures could, and do, vary widely in some cases.

Multiple sources; compiled by Author

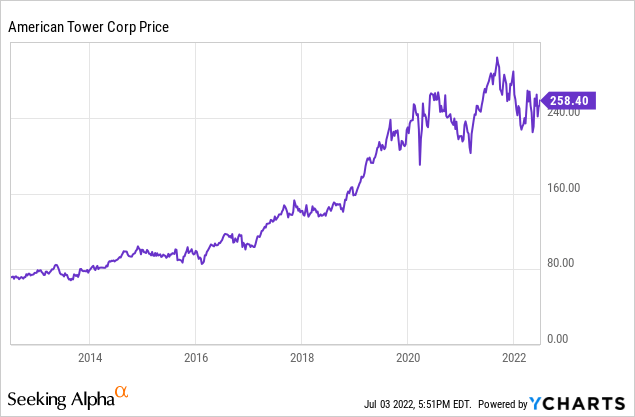

Investor opinion on Cell Towers could easily drive the choice between these two as it’s the greatest weighting difference. Again, one’s assessment about American Tower (AMT) becomes critical. Here is how AMT has performed. As reference, AMT importance to XLRE is twice what Apple (AAPL) is to SPY.

Other big sector differences are: Apartments, Retail, and Office.

Portfolio strategy

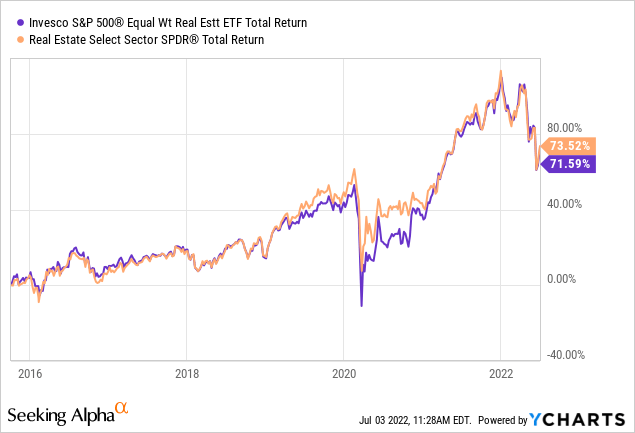

Performance-wise, the two ETFs paralleled each other closely most of the time so other data is needed to decide which, if either, is worth adding to an investor’s portfolio.

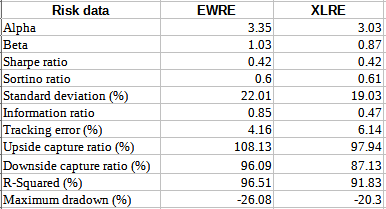

jhinvestments.com

Beta says EWRE has wider price movements, and this is also seen in the fact EWRE captures more of the upside movements and, unfortunately, of the downside movements too. It also experienced a worse maximum drawdown. Sharpe and Sortino ratios are also available from PortfolioVisualizer where, unlike this source, clearly shows XLRE as the better ETF.

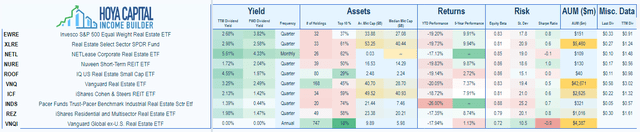

Another approach for investors looking to increase their exposure to smaller REITs is to consider the IQ U.S. Real Estate Small Cap ETF (ROOF). Other ETFs have a specialized focus, like the Nuveen Short-Term REIT ETF (NURE) or the NETLease Corporate Real Estate ETF (NETL), both of which I covered some time back. Neither ETF includes Mortgage REITS, or mREITs, so investors would need to consider that exposure separately.

Final thought

I did not attempt to sway my readers in the need to add a REITS ETF to their allocation; I will leave that to the Seeking Alpha Contributors who specialize in that area; like some of the other Hoya Capital Income Builder writers or Hoya Capital Real Estate itself. But for those interested in getting started, here is a list of popular REIT ETFs; some being sector diverse, others more focused.

Be the first to comment