winnond

Elevator Pitch

I have Medical Properties Trust (NYSE:MPW) rated as a Hold. The REIT’s current dividend yield and price-to-AFFO (Adjusted Funds From Operations) multiple are appealing compared to healthcare REIT peers and history. But MPW’s rent coverage ratios were on the decline in the most recent trailing 12-month period. A positive re-rating of Medical Properties Trust’s valuations is dependent on the stabilization in its coverage ratios, which might take some time considering the current macroeconomic conditions. Therefore, I have chosen to rate MPW as a Hold, rather than a Buy.

MPW Stock Key Metrics

MPW describes itself as “a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities” in its media releases. Investors should pay attention to Medical Properties Trust’s key metrics relating to its Q2 2022 financial results announcement in assessing the REIT as a potential investment candidate.

Medical Properties Trust’s Q2 2022 financial results were reasonably good, but its full-year fiscal 2022 management guidance didn’t meet the expectations of the market.

Normalized Funds from Operations or NFFO per share for MPW rose by +7% YoY from $0.43 in the second quarter of 2021 to $0.46 in the most recent quarter, as indicated in the REIT’s Q2 2022 results press release. The REIT’s actual Q2 2022 NFFO turned out to be +2% better than what the Wall Street analysts’ consensus forecast of $0.45 per share.

On the flip side, it came as a negative surprise that Medical Properties Trust didn’t raise its NFFO guidance, even though the REIT’s second-quarter NFFO beat investors’ expectations.

MPW’s FY 2022 NFFO per share guidance, which remained the same as what was announced in the prior quarter, was $1.78-$1.82. In other words, the mid-point of Medical Properties Trust’s full-year NFFO guidance was $1.80, and this is equivalent to a +3% growth vis-a-vis the REIT’s FY 2021 NFFO per share of $1.75. However, the sell-side analysts were projecting a higher NFFO per share estimate of $1.82 for MPW in fiscal 2022 before the REIT issued its latest management guidance.

As such, it wasn’t surprising that MPW’s stock price declined by -5% on August 3, 2022 after the REIT announced its Q2 results in the morning before trading hours. In fact, Medical Properties Trust has underperformed the broader market since it disclosed its unchanged full-year management guidance. Specifically, MPW’s total return (adjusted for dividends) of -24.7% for the past two months was worse than the S&P 500’s -13.4% pullback in the same time frame.

In the subsequent section, I evaluate Medical Properties Trust’s current valuations in light of its recent price weakness.

Is Medical Properties Trust Stock Undervalued Or Overvalued?

Medical Properties Trust is undervalued based on both peer and historical valuations.

MPW’s Peer Valuation Comparison

| Healthcare REIT | Consensus Forward Next Twelve Months’ Price-to-AFFO Valuation Multiple | Consensus Forward Next Twelve Months’ Dividend Yield Metric |

| Medical Properties Trust | 8.1 | 10.2% |

| Sabra Health Care REIT, Inc. (SBRA) | 8.9 | 9.2% |

| Omega Healthcare Investors, Inc. (OHI) | 10.1 | 9.1% |

| CareTrust REIT, Inc. (CTRE) | 11.3 | 6.2% |

| Physicians Realty Trust (DOC) | 14.4 | 6.2% |

| Healthcare Realty Trust Incorporated (HR) | 15.5 | 5.8% |

| Ventas, Inc. (VTR) | 16.0 | 4.5% |

| Healthpeak Properties, Inc. (PEAK) | 16.5 | 5.1% |

| Welltower Inc. (WELL) | 20.8 | 3.9% |

Source: S&P Capital IQ

As indicated in the peer valuation comparison table presented above, MPW boasts the lowest forward price-to-AFFO multiple and the highest forward dividend yield among its healthcare REIT peers.

In addition, Medical Properties Trust’s valuations also seem to be cheap when compared to where the REIT was trading at in the past. MPW’s current price-to-AFFO ratio of 8.1 times is much lower than the REIT’s five-year and 10-year mean price-to-AFFO multiples of 13.9 times and 12.8 times, respectively as per S&P Capital IQ data. Similarly, Medical Properties Trust’s five-year and 10-year average dividend yields of 6.1% and 6.4%, respectively aren’t as high as its current 10.2% dividend yield.

Undervaluation alone isn’t sufficient to warrant a Buy rating for MPW, I touch on the key potential re-rating catalyst for Medical Properties Trust in the next section.

When Is MPW A Buying Opportunity?

MPW is a buying opportunity when the coverage ratios for Medical Properties Trust’s portfolio as a whole and hospitals specifically have stabilized.

A July 14, 2022 Seeking Alpha News article cited a Credit Suisse (CS) research report for MPW highlighting that “the outlook for hospitals has gotten more challenging with ongoing labor cost pressures, muted admin volume growth and a decline in high margin COVID-19 patient volume.” The CS analyst’s concerns seem to be validated by rent coverage trends for MPW as highlighted below.

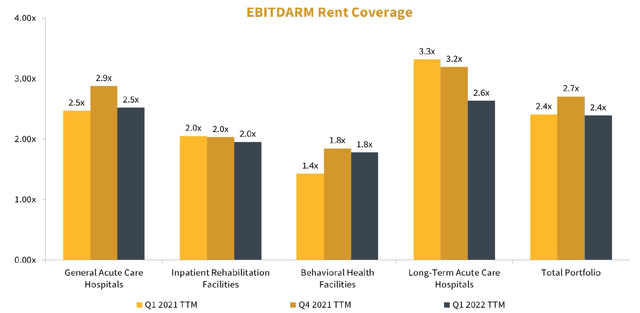

Medical Properties Trust’s Rent Coverage Ratios By Property Type

MPW’s Q2 2022 Supplemental Information Report

As per the chart presented above, MPW’s EBITDARM (Earnings Before Interest, Taxes, Depreciation, Amortization, Rent, Management Fees) rent coverage ratio for general acute care hospitals decreased from 2.9 times for the trailing 12-month period ended Q4 2021 to 2.5 times for the trailing 12-month period ended Q1 2022. The REIT’s EBITDARM rent coverage metric for long-term acute care hospitals also decreased from 3.2 times to 2.6 times over the same period. Note that Medical Properties Trust discloses “coverages one quarter in arrears” as indicated in its Q2 2022 investor call, so Q1 2022 is the most updated quarter when it comes to coverage ratios.

The overall portfolio EBITDARM coverage ratio for Medical Properties Trust went down from 2.7 times for the trailing twelve months’ period up to Q4 2021 to 2.4 times for the trailing twelve months’ period up to Q1 2022.

At the REIT’s most recent second quarter results briefing, Derek Johnston, an analyst from Deutsche Bank (DB) commented that “the slipping coverage ratios are a bit of an issue.” This is an indication that the investing community is concerned about the decline in MPW’s coverage ratios, which is a key factor that has negatively affected the REIT’s price performance.

In response to the comment on coverage ratios, Medical Properties Trust emphasized at the Q2 2022 results call that “in any year, the first quarter is the weakest quarter” for hospitals, but the REIT acknowledged that “in this particular first quarter, it’s exponentially weaker than any other quarter would be.” More importantly, MPW disclosed that its quarterly rent coverage ratios have improved in Q2 2022 and “are up from where they were in the first quarter, quarter-over-quarter.”

Nevertheless, there is a high likelihood that Medical Properties Trust will only reverse its current share price decline when actual results indicate that the REIT’s rent coverage ratios have stabilized.

What Is MPW Stock’s Long-Term Outlook?

According to long-term financial projections sourced from S&P Capital IQ, Wall Street sees Medical Properties Trust delivering a +1.3% AFFO CAGR for the FY 2022-2026 period.

There is the risk that MPW’s actual AFFO growth in the long run turns out to be lower than what the market is anticipating. The main factor is acquisitions; if Medical Properties Trust’s pace of acquisitions slows and a high proportion of deals are done at unfavorable capitalization rates, the REIT’s future growth prospects might fall below expectations.

Medical Properties Trust has already mentioned at its Q2 investor briefing that actual acquisitions for full-year fiscal 2022 will “very likely be on the low end of” its $1-$3 billion guidance, as a result of what it refers to as “the rapid and dramatic development in the capital markets and the global economic environment.”

It is necessary to watch Medical Properties Trust’s acquisition activity closely, as this will have a huge bearing on MPW’s long-term growth outlook.

Is MPW Stock A Buy, Sell, or Hold?

MPW stock is a Hold in my view. Medical Properties Trust is undervalued, but I don’t think the catalyst (coverage ratio stability) needed to re-rate the stock will be realized anytime soon. In conclusion, a Hold rating for MPW is fair.

Be the first to comment