JasonDoiy

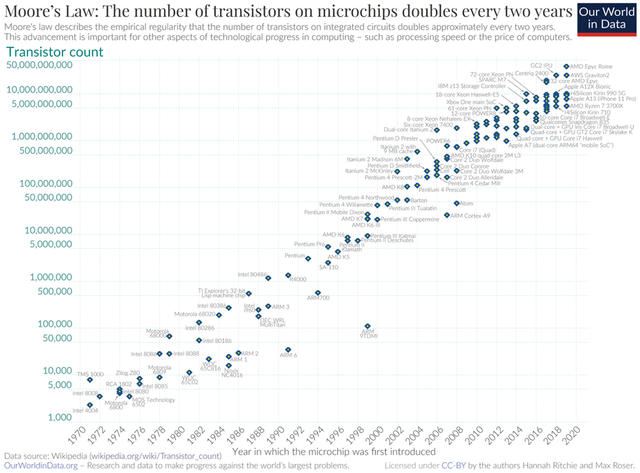

In 1965, Intel (NASDAQ:NASDAQ:INTC) co-founder Gordon Moore made his now famous prediction that computer processing power would double every year. While that prediction was fairly accurate, he revisited the idea in 1975, updating his estimate to about 18 months for the doubling of computing power. That prediction, known as Moore’s Law, held for the next 40 years, give or take, depending on who you ask. It is that growth in computing power that has underpinned much of the growth in wealth and prosperity due to higher productivity made achievable by microchips.

CHIPS and Science Act

This piece of legislation is politically important to the democrats, but not necessarily important to long-term growth. The onshoring of production and jobs was inevitable in the wake of the pandemic. Just-in-time inventory management for processors from overseas no longer makes sense. With even the slightest hiccup, JIT fails, and when it comes to semiconductors, that is (as we have seen) a disaster.

Intel broke ground on a $20 billion manufacturing facility in Ohio last week. The project is expected to employ about 7,000 construction workers and will have about 3,000 employees once open in 2025, give or take. The project is eligible to receive up to $6 billion in funding from the CHIPS Act and has already received enormous tax abatements from the local municipality where it is being built. While I am not generally a fan of subsidizing large, profitable firms, I think the advantage in this case is that the added funding and favorable tax treatment allows Intel to gain more certainty in terms of its cost of capital, a critical factor in deciding to pursue projects of this scale.

While the Ohio project will be impactful in “reshoring” jobs and manufacturing ability, it is one of many reasons why Intel is attractive right now, especially for long-term investors.

With the end of Moore’s Law, or at least the slowing, many companies are investing in new technologies, researching new materials, and exploring new processes for chip development. This has largely taken the form of large firms buying small companies that were started on the basis of the need for new computing technology, if our society expects our economy to grow like it has in the last 50 years.

The objective of these investments is to, at minimum, extend the runway for Moore’s Law, and ideally create revolutionary technologies that allow our computing power to continue to grow at a rapid exponential rate.

To wring out as much as possible from what we already have, companies like NVIDIA (NVDA) focus on specific processing functions rather than “all-purpose” chips. In NVIDIA’s case, they largely focus on chips for graphical functions, allowing their technology to effectively tease out more power than would otherwise be possible.

To bolster its efforts in developing new technology, Intel purchased Habana Labs at the end of 2019 for $2 billion. Habana seeks processing power that is exponentially above currently attainable levels through the development of AI processors. In addition to that acquisition, the company continues to invest in new R&D and manufacturing capabilities. The company had its grand opening of an expansion project in Oregon, an investment of $3 billion. The Oregon site is the home of the global technology development organization, a group with the specific objective of extending Moore’s Law through new transistor architectures, wafer processes and packaging technologies.

In my opinion, these investments in innovation, capacity, and future computing power are underappreciated.

Valuation

Current valuation for Intel is the lowest in years, while the future opportunity set is better than it has been in recent memory, driven by new investments and government initiatives. The P/E ratio based on trailing twelve-month earnings is about 7x while the forward P/E is about 12x, both based on GAAP earnings. These ratios are 45-70% below the sector median, and also below Intel’s 5-year average for these metrics. The P/B is about 1.28x, far below the sector median of 3.01x, and well below Intel’s 5-year average.

Yield

Intel pays out $1.46/share, a yield of nearly 5% based on the current stock price. At this point, the dividend appears to be safe with a payout ratio of about 35%, slightly above the sector median, but still below Intel’s 5-year average. The company has grown the dividend for the previous 7 consecutive years, although the growth rate is below its peers. Over the last 5 years, the dividend has grown at a compound annual growth rate of about 6.3%.

At the current valuation and with the relative safety of the dividend, Intel is attractive not only from a potential future growth perspective, but certainly as a dividend play. As a shareholder, I think the company has been unjustly sold off to the current low levels.

Performance

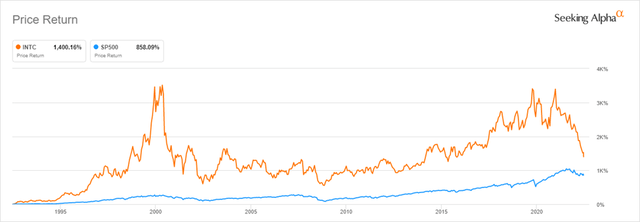

The stock never quite reached its tech bubble high from 2000 before falling to current levels. While the valuations of tech stocks, even those that made real products and services and earned real profits, were elevated to say the least, Intel has continued to build a growing, profitable business with high margins, return on equity, and return on assets.

Intel Performance versus the S&P 500 (Seeking Alpha)

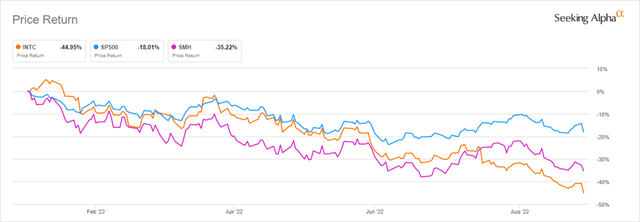

The recent drawdown has been significant with the stock down over 40% year-to-date, far underperforming the broader market and its industry peers. Not only do I think this creates an opportunity for long-term investors in U.S. stocks, but specifically in the semiconductors, and Intel in particular.

Year-to-Date Performance of Intel versus the S&P 500 and VanEck Semiconductor Index (Seeking Alpha)

Mission Critical Function

While Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOG) (GOOGL) are all working on their respective projects within the semiconductor space and computing power more generally (including quantum computing), Intel remains the leader in tech development and use within a broad array of products, as historically chips have had a general use.

As mentioned above, companies like NVIDIA have made a splash by focusing on GPUs, growing in importance and size very quickly. But their products, as well-made and important as they may be, are not a substitute for Intel’s products. Similar things could be said about firms like Qualcomm (QCOM) and Broadcom (AVGO) that focus on specific niches of the computer processing market.

Finances are Strong

The last two years since the beginning of the pandemic have been difficult for many companies, Intel included. Supply chain and shipping issues, lockdowns, and politics have made this a particularly challenging environment.

Despite these challenges, Intel has been able to preserve revenue, and in some areas of its business, grow while also maintaining healthy gross margins. Profitability has been stable while in a bit of a holding pattern, but cash flow from operations has been strong, and easily covers the dividend and most capex activities. Total assets of the company have grown from $153 billion to $170 billion over the last two years while liabilities have shrunk from $72 billion to $69.2 billion, resulting in an increase of equity from $81 billion to $101.2 billion. For reference, where the stock is trading gives the company a market cap of about $120 billion. Said another way, the market is placing about a $20 billion valuation on the growth prospects for Intel.

Investment Strategy

Like with many investments I make, I try first to cover all bases. So, while I believe my thinking on this is directionally correct, and have a meaningful position in Intel, I am humble enough to know I could be wrong. It would be frustrating to be correct about the industry, but to miss the rebound and future growth by only investing in one company. In order to mitigate that risk, I also own exposure to the semiconductor space through the VanEck Semiconductor Index (SMH).

The VanEck Semiconductor Index holds a relatively concentrated portfolio of 26 stocks located around the world, with the three largest positions in Taiwan Semiconductor Manufacturing (TSM), NVIDIA, and Texas Instruments (TXN) representing about 24% of fund value. The allocation to Intel represents about a 4.2% position. Allocated approximately 78% to the U.S. and 22% to the rest of the world, the fund has an expense ratio of 0.35% and current yield of about 0.80%.

Year-to-Date Performance of the VanEck Semiconductor Index versus the S&P 500 (Seeking Alpha)

Final Thoughts

I have been a long-term shareholder in Intel. To say that I am underwhelmed by the performance of the stock over the last 1-2 years is an understatement. That said, I believe that the company is critical to broad economic growth in this country and abroad. The company’s investments in new technology, materials, and processes give me hope that Intel will continue to drive technological progress. While the near term is difficult to predict, the long-term is a bit clearer. Given the growth of businesses, population, and most importantly data creation, the need for processing power and storage will continue to grow at an exponential rate. I believe that Intel will be a major beneficiary of that trend. Thank you for reading, and I look forward to your feedback in the comments section below.

Be the first to comment