Chip Somodevilla

Intel Corporation (NASDAQ:INTC) has a problem. Over the last decade, the company failed to innovate, and as a result lost market shares both in the chip design and foundry businesses to companies such as Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA), Taiwan Semiconductor Manufacturing Company (NYSE:TSM) (“TSMC”), and others. A lot of Intel bulls believe that Beijing’s potential invasion of Taiwan will be able to solve the company’s problems since, in case of an invasion, TSMC will likely lose most of its capabilities to produce its latest chips, while chip designers such as Apple (NASDAQ:AAPL) will be forced to once again cooperate with Intel due to the lack of alternatives.

However, the notion that Beijing’s invasion of Taiwan is somehow beneficial for Intel has several flaws, which this article aims to describe. It will also explain why such an invasion will likely make it even harder for Intel to recover after years of underperformance.

Hope Is Not A Strategy

After the Russian invasion of Ukraine earlier this year, it became impossible to ignore geopolitical risks when deciding whether to invest in companies with significant exposure to non-western countries. Even though analysts don’t believe that CCP Chairman Xi Jinping has already decided whether to invade Taiwan or not, despite the constant violations of the Taiwanese airspace, there are nevertheless reports, that state that Beijing aims to at least have the military capabilities to invade the island nation by 2027. If such an invasion were to take place, then Intel’s major foundry competitor TSMC would most likely lose a significant portion of its capabilities to create the latest chips, possibly creating a scenario under which various chip designers could decide to turn to Intel for help.

However, it’s foolish to think that such a scenario will be beneficial for Intel itself. We shouldn’t forget that the Chinese market generates the biggest amount of revenue for Intel in comparison to other markets. So, in case of an invasion, Intel will almost certainly lose that market, which will more than likely negatively affect its share price and prevent it from fully executing its transformation plan. At the same time, in recent quarters TSMC has been actively diversifying its business by building foundries outside of Taiwan, which should ensure that the company stays in the business even in the worst-case scenario.

Just recently, it was reported that TSMC has finished constructing the main facility of its upcoming $12 billion factory in Arizona, and the production of 5nm chips for Apple there is scheduled to begin in 2024. At the same time, TSMC has been producing 5nm chips since 2020, while Intel’s own version of 5nm called 20A is scheduled to enter production only in 2024, which shows that the manufacturing technology of the latter is still below the level of its main competitor.

On top of that, at the end of 2021 TSMC began to talk to the German government about building a factory in Europe, while at the same time it already started the construction of a $7 billion factory in Japan, which should be completed in 2024.

What’s also important to note is that TSMC is also eligible for receiving subsidies to build new factories via the recently passed CHIPS Act as long as the company promises not to build advanced foundries in China anymore in the following years. Considering that TSMC generates only ~10% of annual revenues in China, the company is even less exposed to the Chinese market than Intel itself and could benefit from the new law even more than its American-based counterpart.

In addition to all of this, TSMC also continues to outspend Intel on CapEx. This year alone TSMC’s capital expenditures are expected to be around $40 billion, while Intel’s capital expenditures in FY22 are forecasted to be ~$23 billion. As a result, if Beijing indeed decides to invade Taiwan in 2027, then TSMC still has enough time and resources to diversify itself and expand to other countries in order to minimize the downside of such a scenario.

Considering all of this, it makes it nearly impossible for Intel to benefit from such an invasion. At the same time, the company’s latest earnings results show that any disruptions to its operations due to such invasion will only make it harder for the business to execute a turnaround due to its own exposure to the Chinese market. The latest earnings report for Q2 revealed that Intel has once disappointed its shareholders, as its revenues during the period decreased by 17.3% Y/Y to $15.5 billion, as sales were down across the board both in the client computing and in data center businesses. What’s worse is that the company decreased its guidance for FY22 and now expects to generate only $65 billion to $68 billion in revenues this year, below the initial consensus of $74.35 billion. Even Intel’s CEO Pat Gelsinger himself admitted that the results were below the company’s standards.

As a result, it becomes impossible to see how Intel can benefit from Beijing’s potential invasion of Taiwan in the future. The company still can’t even release its flagship chips in accordance with its own initial schedule. Hoping that the invasion will take TSMC out of business is foolish, as the company is in the middle of great diversification and while a significant portion of its production capabilities will be diminished in case of an invasion, it will still be in the business producing chips for its clients.

Reasons For Optimism?

Considering that the intelligence community doesn’t believe that the invasion will happen anytime soon, it becomes safe to assume that Intel won’t experience any major geopolitical disruptions to its operations anytime soon and won’t lose a significant portion of the revenues that it currently generates in China. As a result, the company nevertheless has time to execute a turnaround and at least try to catch up to its competitors in the following years.

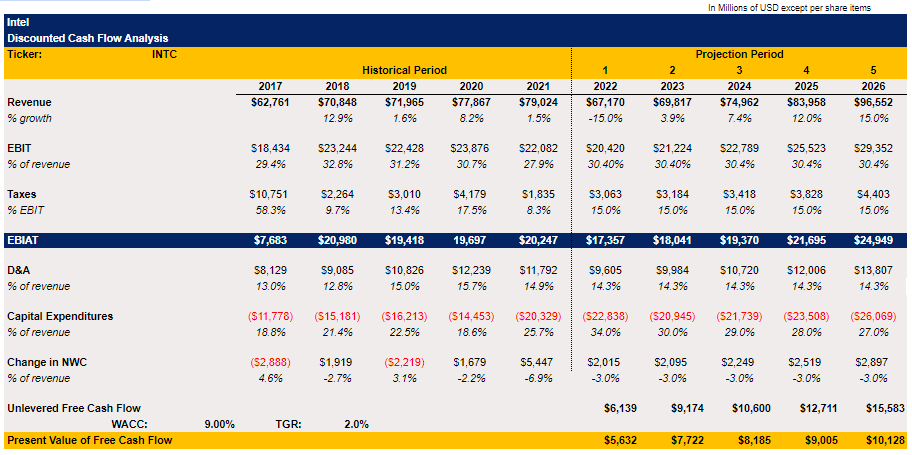

The good thing for investors at this stage is the fact that at the current share price it appears that the downside is already priced in. All the major delays so far have already been announced, shareholders know that the top-line performance will disappoint this year, and the recovery isn’t expected to be swift at all given the latest underperformance. That’s why to find out how much upside Intel has solely based on the fundamentals I decided to create a DCF model, in which revenue estimates for this year are in-line with the management forecast for FY22, while in FY23 a gradual growth begins and lasts until the terminal year. All the other metrics are mostly averages of the previous three years, while the capital expenditures are mostly in-line with the management estimates. WACC in the model is 9%, while the terminal growth rate is 2%.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

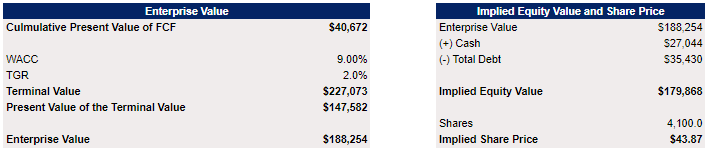

The model shows that Intel’s enterprise value is $188 billion, while its fair value is $43.87 per share, which represents an upside of around 50% from the current levels.

Intel’s DCF Model ( Historical Data: Seeking Alpha, Assumptions: Author)

My model is also almost in-line with the average consensus street price target for Intel of $39.84 per share.

Intel’s Average Consensus Price Target (Seeking Alpha)

Considering this, we could safely assume that solely based on the fundamentals Intel is trading at a discount and its stock has room for growth. However, there’s always a risk that the company continues to underperform, and cuts its guidance even more due to the turbulent macroeconomic environment, which will force the reevaluation of the assumptions in the model that could lead to a lower upside or even a downside. At the same time, Beijing’s potential invasion of Taiwan will create more downside than upside for Intel due to the company’s exposure to the Chinese market along with the fact that its major foundry competitor has enough resources to accelerate the diversification of its business, which in the end will almost certainly negatively affect Intel’s share price.

The Bottom Line

A year ago, I couldn’t even imagine that I would be waking up to the sound of Russian cruise missiles flying over my apartment in Ukraine. However, the invasion happened and the world has changed forever ever since. As we live in this new and uncertain reality, investors should start paying closer attention to various geopolitical risks and opportunities and adjust their portfolios accordingly.

While at first, it makes sense to think that Beijing’s invasion of Taiwan will be beneficial for Intel, since it could take TSMC out of the business, investors shouldn’t forget that Intel itself has major exposure to China and as a result would be at risk of losing a significant portion of its revenues in case of an invasion.

At the same time, Intel’s latest poor performance shows that the company will likely continue to lose market share to other foundries and chip designers until it improves its manufacturing capabilities. In case of an invasion, it will be harder to do so for Intel without a major source of income, which could put its whole transformation strategy at risk. In addition, an invasion will undoubtedly negatively affect the company’s stock and in the end, investors would be unable to recoup its investments for a long time, if ever.

However, the good news is that the latest reports suggest that the invasion is unlikely to happen any time before 2027. Therefore, Intel at least has a few years to execute a turnaround strategy, while investors also have time to decide whether investing in the company due to its relatively significant upside outweighs all the geopolitical risks that come with it.

Be the first to comment