SeanShot

Investment Thesis

Pinterest (NYSE:PINS) rallies despite posting negative surprises. Its guidance for Q3 is noticeably lower than analysts’ consensus. And yet the stock pops. This is normally a telling sign that all the sellers of the stock have washed out. For potential investors, this is a positive setup.

Consequently, I reverse my previous sell rating on this stock. Experience tells me that when a stock jumps on bad news, that’s typically a positive sign that a bottom has been found.

Paying 5x sales for Pinterest strikes me as a fair multiple for the stock. However, there are a lot of caveats to discuss ahead. Let’s press ahead.

Revenue Growth Rates Still Positive

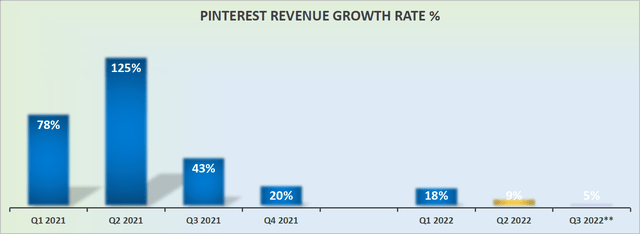

Pinterest revenue growth rates

Pinterest’s Q2 posted some growth, up 9% y/y, against what was the toughest comparable quarter of last year.

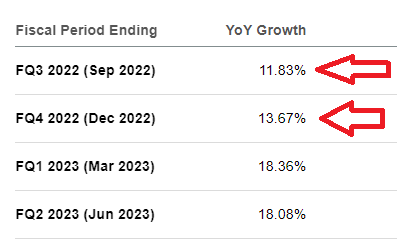

Analysts’ revenue consensus

Meanwhile, looking ahead, Pinterest’s Q3 guidance is decidedly lower than consensus as Pinterest guides for approximately 5% y/y revenue growth compared with close to 12% for expectations.

Pinterest’s analysts’ consensus revenue

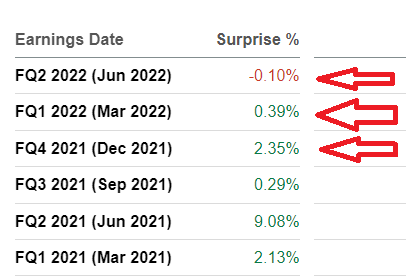

Over the last several quarters, Pinterest has not been the sort of company that guides conservatively to then handily beat revenue estimates.

As you can see from the red arrows above, Pinterest’s revenue beats have become increasingly smaller with the passage of time, ending with a minor miss yesterday.

Given that the stock has rallied on a revenue estimate miss, I believe that investors have now given up selling this stock.

Pinterest’s Near-Term Prospects

Pinterest’s new CEO Bill Ready makes his splash. If you follow Pinterest closely you know that for a prolonged period of time, Pinterest has been attempting to crack its e-commerce opportunity.

Consequently, as you would expect, the earnings call put a lot of emphasis on driving investors’ attention toward its e-commerce opportunity. Along these lines, Ready stated,

Having spent most of my career in commerce and payments, I recognize that there are many places to buy online, but there are very few online destinations where you can actually shop, that is to browse and discover and get inspired before you buy.

Ready has been on the job for less than a month. Going forward Ready’s main job will be to stop the decline in monthly active users.

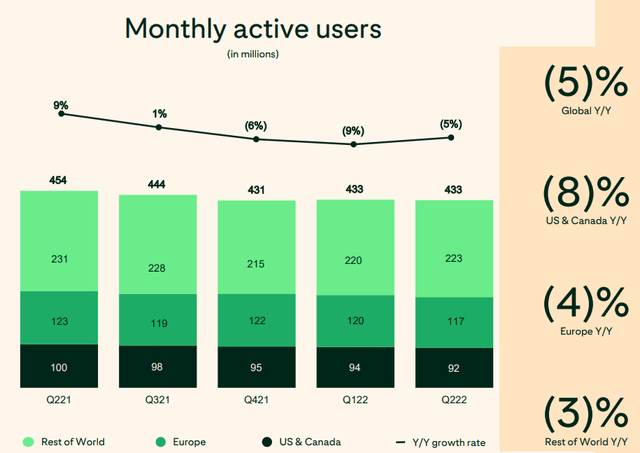

Pinterest Q2 2022 presentation

As you can see above, monthly active users were down 5% y/y. That being said, on a positive note, one could make the argument that MAUs appear to have stabilized, with 433 million MAUs in both Q1 and Q2.

Ready contended throughout the earnings call that Pinterest’s users are already on the platform for inspiration and discovery and that getting Pinterest to go one step further and take action has huge potential.

To that, I would counter Tripadvisor (TRIP) is one of the most searched websites in the world, for very high intent consumers looking for holidays, and that they have struggled to monetize that intent. Hopefully, Pinterest will be able to succeed under new management.

Profitability Profile Will Worsen. But It May Be OK?

As I alluded to already, I don’t believe that the stock rallied on any sort of tangible positive news. I believe that the stock rallied, as investors now believe that Pinterest’s share price is likely to have found its bottom.

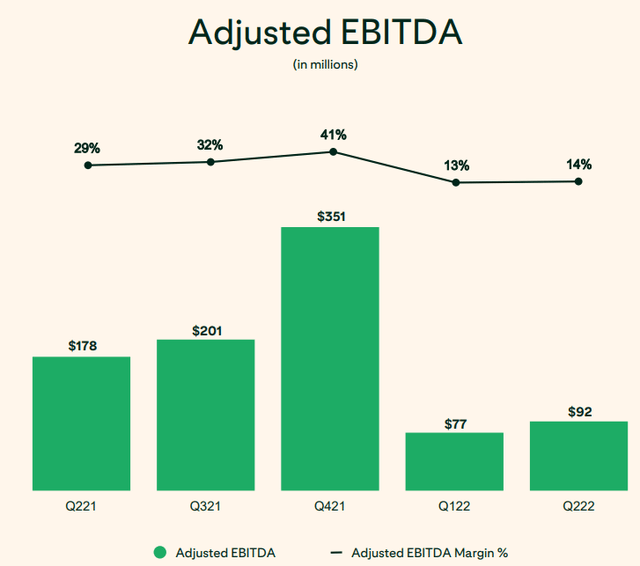

Pinterest Q2 2022 presentation

As you can see above, on a y/y basis, Pinterest’s adjusted EBITDA went from 29% margins to 14% y/y. And given that its guidance for Q3 points to Pinterest’s operating expenses growing to circa $500 million, this implies that Pinterest is guiding for its adjusted EBITDA margin to compress slightly into Q3.

Could it be that investors were expecting Pinterest to report even worse EBITDA results? After all, if we look elsewhere to the likes of Snap (SNAP), even though that company is not formally guiding for Q3, we do know that they declared that Q3 would see ”flattish” revenue growth rates.

Consequently, it could be said that the market had already been significantly spooked enough by Snap’s results, that anything better than that, was viewed in a positive light.

PINS Stock Valuation – Close to 5x Sales

I recognize that Snap and Pinterest are fairly different business models. One caters to youth and has a ton of competition from the likes of TikTok (BDNCE) and Meta’s (META) reels.

While for Pinterest one could tenuously make the argument that Pinterest’s demographic has less competition. While I don’t buy that argument and given that Pinterest’s user base continues to decline over time, I’m even less inclined to buy that argument, I nevertheless believe it makes some sense to compare the two companies’ valuations.

Both companies are priced somewhat similarly. Snap is priced at 4x forward sales, while Pinterest after its 20% after-hours pop is priced at 5x forward sales, closer to one turn more expensive than Snap.

That being said, there was a time when Snap was the most expensive of all social media platforms, and Pinterest was the one that traded at a discount to Snap.

The Bottom Line

The market is voting with its feet. The market is very much clawing for any sort of profitable growth company whose stocks have been obliterated and fallen more than 70% from previous highs.

While I fail to see much in the way of positive news in the quarter, I’m inclined to believe that investors have given Pinterest a pass this quarter. After all, lest we forget, this has been a truly horrible period for advertising companies broadly.

Be the first to comment