Jacobs Stock Photography Ltd/DigitalVision via Getty Images

A Quick Take On ev Transportation Services

ev Transportation Services, Inc. (EVTS) has filed to raise $27 million in an IPO of its common stock, according to an S-1 registration statement.

The firm designs and manufactures electric lightweight commercial utility vehicles.

EVTS has had very limited sales history for its single product, the FireFly.

When we learn management’s pricing and valuation assumptions for the IPO, I’ll provide an update.

ev Transportation Overview

Brookline, Massachusetts-based ev Transportation was founded to develop all-electric vehicles that are ‘easily configurable for a wide variety of applications.’

Management is headed by founder, Chairman, president and CEO David Solomont, who has been with the firm since inception in May 2015 and was previously Chairman of CommonAngels, an investment group and before then, Chairman of OYO Toys.

The company’s primary vehicle, the FireFly, provides the following capabilities in various configurations/options:

-

Parking management

-

Security and perimeter patrol

-

Parks and sidewalk maintenance

-

Utility meter reading

-

Property management

-

University and corporate campuses

-

Last mile urban small package and food delivery

The FireFly is pictured below:

FireFly Vehicle (SEC EDGAR)

As of June 30, 2022, ev Transportation has booked fair market value investment of $16.8 million in equity and convertible debt as of June 30, 2022 from investors.

ev Transportation – Customer Acquisition

The firm is currently focused on selling the FireFly to essential services and urban e-deliver markets. It sells exclusively through a network of four distributors selected on a regional basis.

Management plans to expand its dealer network to between 8 and 12 by the end of 2022.

EVTS acquired the assets from the company that developed the FireFly vehicle, eFleets.

Sales and Marketing expenses as a percentage of total revenue have remained extremely high as revenues have been close to zero, as the figures below indicate:

|

Sales and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

8723.2% |

|

2021 |

105108.3% |

|

2020 |

5400.1% |

(Source – SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, was 0.0x in the most recent reporting period. (Source – SEC)

ev Transportation’s Market & Competition

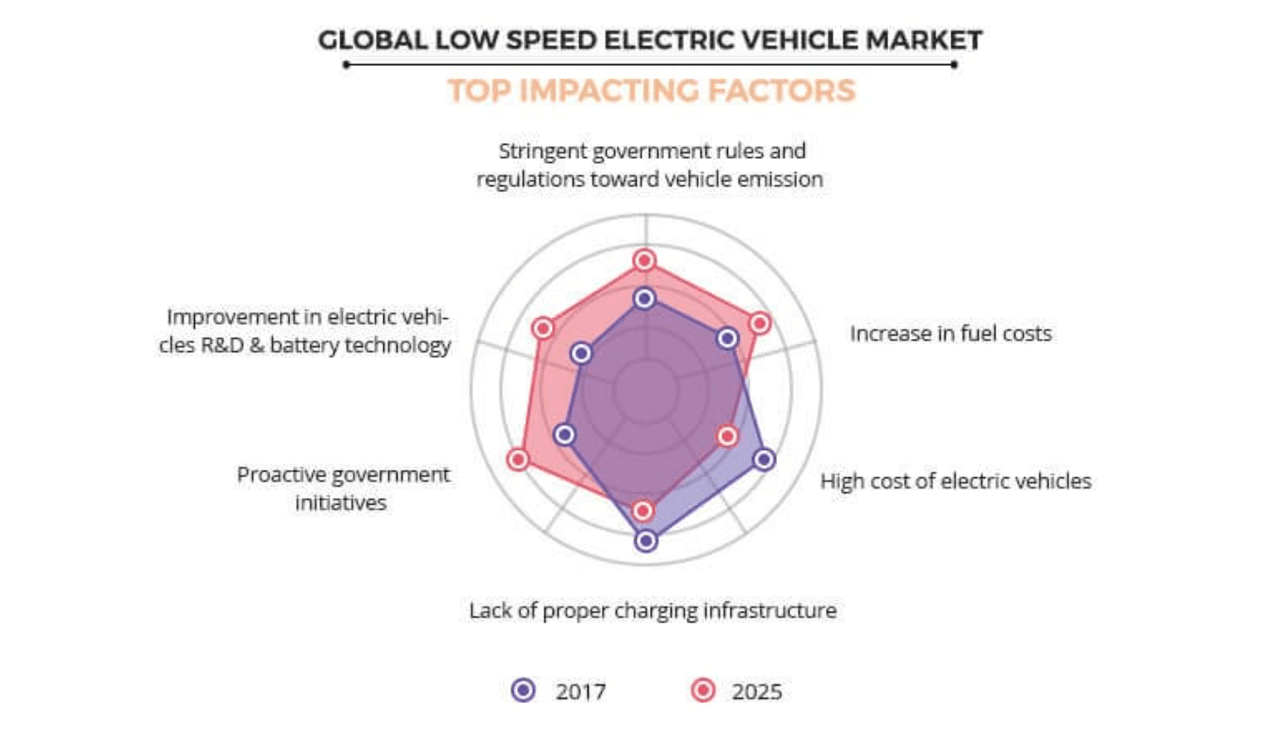

According to a 2019 market research report by Allied Market Research, the global low speed electric vehicle market was an estimated $2.4 billion in 2017 and is forecast to reach $7.6 billion by 2025.

This represents a forecast CAGR of 15.4% from 2018 to 2025.

The main drivers for this expected growth are technological enhancements leading to improved functionality, lower maintenance costs and increasing government incentives and requirements for low- or no-emission vehicle operations.

Also, below is a graphic showing the expected change between 2017 and 2025 for various factors affecting the low speed EV market:

Global Low Speed Electric Vehicle Market (Allied Market Research)

Major competitive or other industry participants include:

-

Cushman

-

Westward Industries

-

Electra Meccanica

-

Arcimoto

ev Transportation Services Financial Performance

The company’s recent financial results can be summarized as follows:

-

Variable but tiny topline revenue

-

Little gross profit but high gross margin

-

High and increasing operating losses

-

Substantial and growing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 8,337 |

3447.7% |

|

2021 |

$ 1,183 |

-86.4% |

|

2020 |

$ 8,697 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 7,500 |

3091.5% |

|

2021 |

$ 1,161 |

-8.5% |

|

2020 |

$ 1,269 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

89.96% |

|

|

2021 |

98.14% |

|

|

2020 |

14.59% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$ (3,133,323) |

-37583.3% |

|

2021 |

$ (4,581,430) |

-387272.2% |

|

2020 |

$ (2,530,268) |

-29093.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ (3,425,752) |

-41090.9% |

|

2021 |

$ (4,761,828) |

-57116.8% |

|

2020 |

$ (2,530,268) |

-30349.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ (3,123,490) |

|

|

2021 |

$ (3,916,015) |

|

|

2020 |

$ (1,322,020) |

|

As of June 30, 2022, ev Transportation had $4,137 in cash and $8.6 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was negative ($5.8 million).

ev Transportation Services IPO Details

ev Transportation intends to raise $27 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

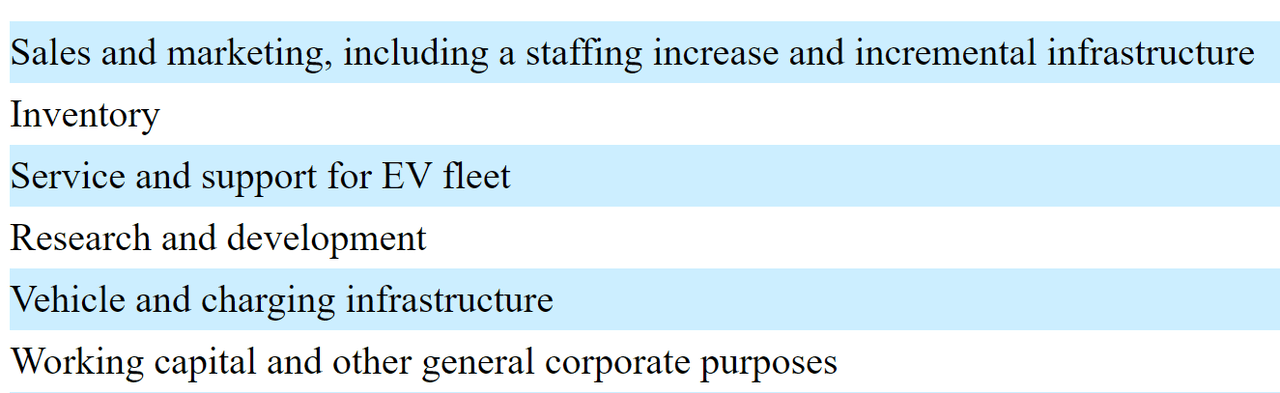

Management says it will use the net proceeds from the IPO as follows:

Use Of IPO Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm ‘is not a defendant in any material pending legal proceedings.’

However, it goes on to state,

The Company is a party to a lawsuit in the United States District Court for the Eastern District of Michigan seeking a declaratory judgment that it is the clean title holder of the “FireFly” trademark. The claim is a result of a long-past failed contract manufacturing relationship. The trademark is registered to evTS in the U.S. Patent and Trademark office. One of the defendants in the action has asserted certain counter-claims against the Company seeking its own declaratory judgment and making claims for unjust enrichment and abuse of process. The Company believes the counter-claims are without merit.

David Solomont, our Chief Executive Officer, has outstanding federal tax obligations and related tax liens totaling approximately $458,000 which relate to his personal tax returns for the tax years 2003 – 2006, 2008 and 2011 – 2018. Mr. Solomont has submitted an offer in compromise to the IRS.

(Source – SEC)

The sole listed bookrunner of the IPO is Maxim Group.

Commentary About ev Transportation’s IPO

EVTS is seeking public capital market investment for its general corporate expansion efforts in the United States.

The company’s financials have shown small, fluctuating topline revenue, tiny gross profit but high gross margin, significant and growing operating losses, high and increasing cash used in operations.

Free cash flow for the twelve months ended June 30, 2022, was negative ($5.8 million).

Sales and Marketing expenses as a percentage of total revenue have been extremely high; its Sales and Marketing efficiency multiple was zero in the most recent reporting periods.

The firm currently plans to pay no dividends and intends to retain any future earnings to reinvest back into its operations and growth initiatives.

The market opportunity for low speed electric vehicles is reasonably large but expected to grow at a CAGR of above 15% for the coming years, so the firm enjoys strong industry growth dynamics.

Maxim Group is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (65.6%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook is its reliance on one product for all of its sales, limited sales history and its tiny capitalization against much larger and entrenched industry participants.

When we learn management’s pricing and valuation assumptions for the IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Be the first to comment