Chip Somodevilla

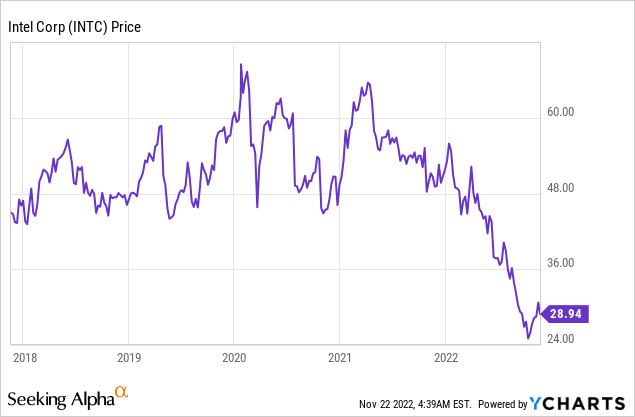

Intel (NASDAQ:INTC) is one of the largest and most iconic semiconductor chip designers and manufacturers in the world. Despite this, the company has seen its stock price get butchered by over 57% from its all-time highs in April 2021. As the company fell behind on the production of its 7nm (nanometer) chip and was overtaken by competitor Taiwan Semiconductor Manufacturing (TSM), who are already manufacturing much smaller 3-nanometer chips. The good news is Intel’s new CEO Pat Gelsinger, has some prestigious credentials. Pat is an Intel veteran who was mentored by the legendary Intel founder and CEO, Andy Grove who actually wrote the book on management (“high output management”). Pat has gotten off to a strong start since taking the helm in 2021, he has streamlined the business and even spun off its self-driving car unit Mobile eye at $21 billion valuation. Intel is also poised to benefit from the $50 billion U.S CHIPS Act, which offers incentives to companies such as Intel to build more manufacturing plants in the U.S.A. Despite the positives, Intel still has a long way to go, in this post I’m going to breakdown the company’s third-quarter financial results and valuation, let’s dive in.

Third Quarter Earnings

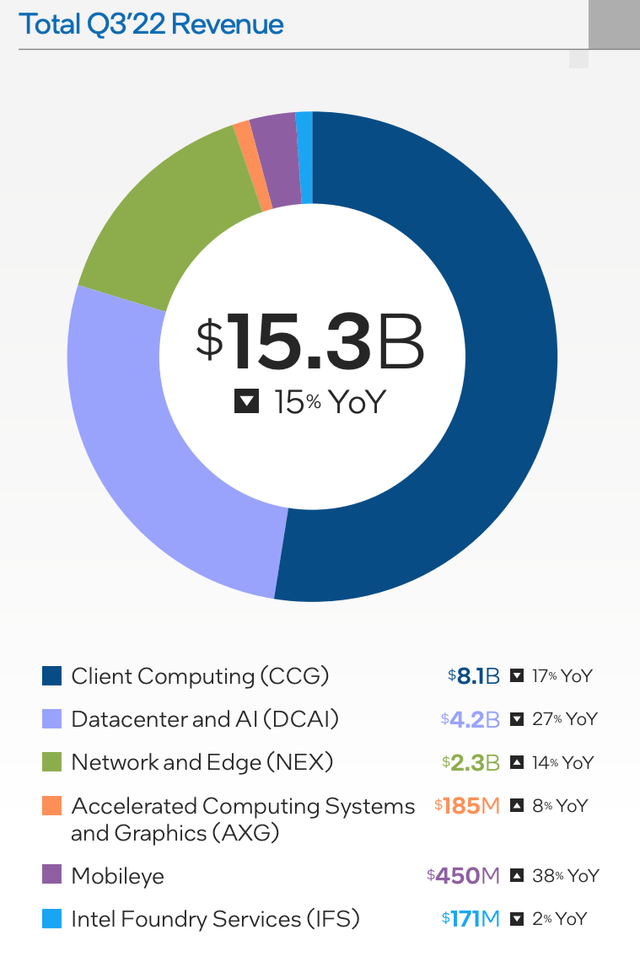

Intel reported mixed financial results for the third quarter of 2022. Revenue was $15.34 billion, which declined by 15% year over year but beat analyst expectations by $36.84 million.

Intel Revenue (Q3,22 report)

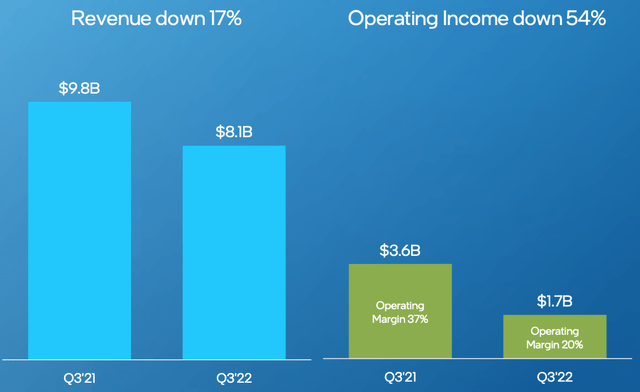

Breaking down revenue by segment, starting with Client Computing Group which makes up approximately 52% of total revenue. This segment reported revenue of $8.1 billion, which increased by 6% quarter over quarter, driven by higher average selling prices [ASPs]. This is a key metric to watch and could signal a “bottom” for Intel’s largest segment after huge declines. For example, Client Computing Group segment revenue is still down 17% year over year. In addition, Operating Income for this segment also plunged by an eye-watering 54% to $1.7 billion. The fall was mainly driven by the macroeconomic environment which has spurred a cyclical downturn in semiconductors due to flailing demand. This was most prominent in consumer, education, and small-medium business markets.

Client Computing Group (Q3 Report)

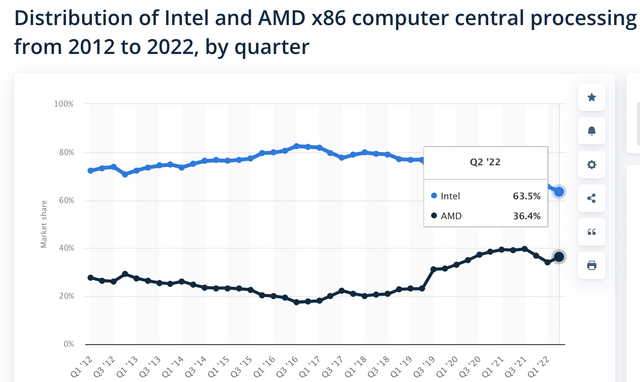

A positive is the semiconductor industry tends to be cyclical by nature. There was a huge shortage in 2020, which caused profits to boom for many semiconductor manufacturers. Now we are seeing an adjustment downwards, but the long-term secular trend is still positive. According to one study, the Semiconductor Industry was valued at $555.9 billion in 2021, and is forecast to grow at a 6.21% compounded annual growth rate to reach over $1 trillion by 2031. Therefore assuming Intel can maintain a dominant position in the market for Central Processing Units [CPUs], the company should be poised to benefit. Intel’s CPU market share was between 70% and 80% between the years of 2012 and 2018. However, competitor AMD started to gain market rapidly post 2019 and the gap has closed, with Intel having ~63.5% market share and AMD at 36.4%.

Intel vs AMD market share (Q3,22)

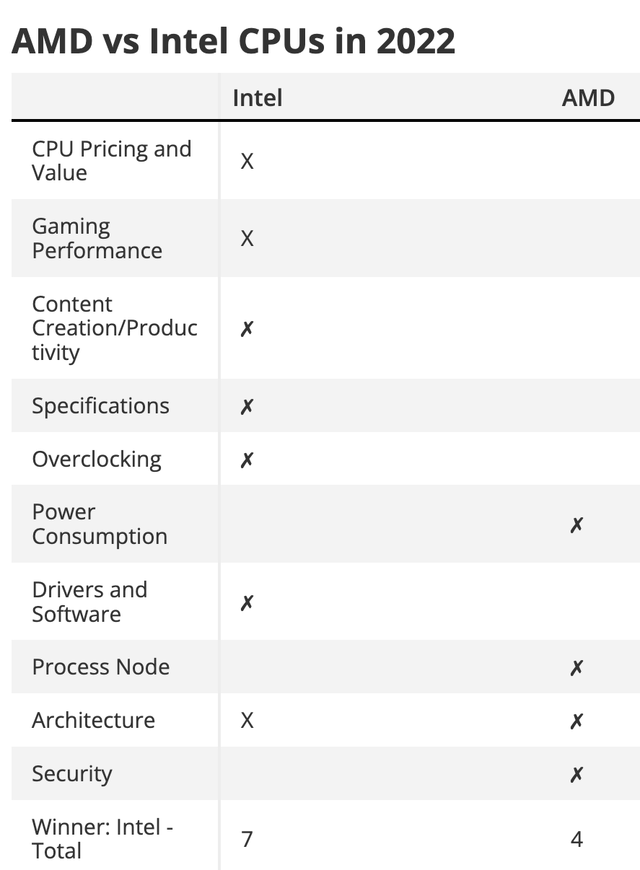

According to a popular review website, Intel’s latest desktop CPU beats AMD by 7 points to 4. The main winning points come from Intel’s low price and value, whereas AMD scores higher for power consumption. The review analyzed Intel’s Raptor Lake (Alder Lake) which has a new hybrid architecture. Therefore, it looks as though in client computing Intel is still the king, for value and relative performance.

AMD vs Intel (Q3,22)

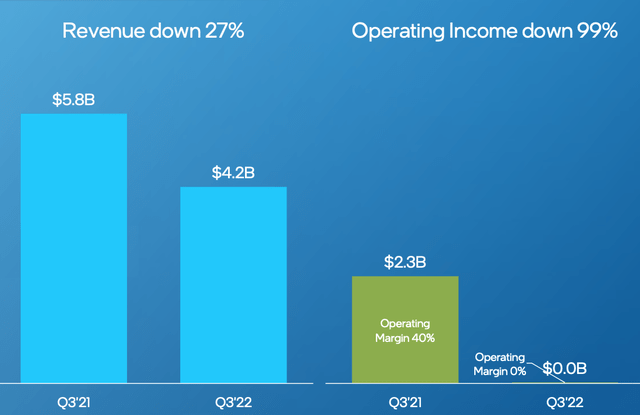

Intel’s second major segment is its Data Center and AI business. This unit reported revenue of $4.2 billion which was down by 27% year over year. Operating profit for this segment was butchered by 99% year-over-year to just $17 million. These atrocious results were driven mainly by competitive market pressures. In my previous post on competitor AMD, I reported that AMD’s EPYC is the world’s highest-performance server process for data centers. Its products have been deployed across all three major cloud infrastructure providers (AWS, Azure, and Google Cloud). In addition, to data centers in China managed by titans such as Tencent. Intel trails behind AMD massively in this segment, as Cloud providers care more about high performance and low power consumption than just upfront cost.

Intel data center and AI (Q3 report)

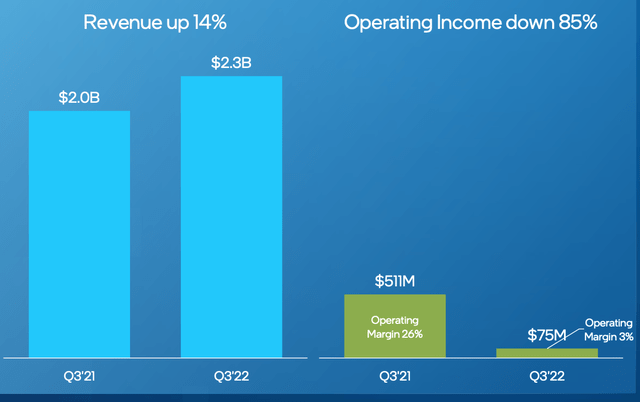

Intel’s third segment its Network and Edge Group [NEX], reported positive results with revenue of $2.3 billion, up 14% year over year. This was driven by increased demand for its 5G, ethernet, and network edge products. The 5G industry was valued at ~$5.13 billion in 2020 and is forecasted to grow at a blistering 65.8% compounded annual growth rate, reaching a value of nearly $800 billion by 2023. Intel is poised to benefit from this industry as the company has expanded its 5G portfolio across hardware and software.

In the short term, Intel has to battle the low product demand which has been mainly driven by macroeconomic factors. This has resulted in a devaluation of inventory and an 85% decline in operating income for this segment.

Network and Edge Group (Q3 earnings report)

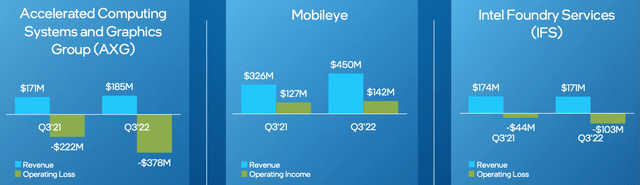

Intel’s “emerging” business segments include its accelerated computing and graphics group (AXG), which generated revenue of $185 million and increased by 8% year over year.

Its self-driving car segment Mobileye reported revenue of $450 million which increased by $124 million year over year. The company has recently IPO’d the Mobileye (MBLY) segment at a valuation of ~$21 billion. I personally believe this is a smart move as mastering autonomous driving is a major challenge and requires a lot of uncertain capital to be deployed. Therefore raising capital via the public markets makes a lot more sense especially given the challenges Intel’s core business is facing.

Intel emerging segments (Q3,22)

Intel reported overall Operating profit of $1.7 billion which increased by $570 million quarter over quarter. However, it is still down 54% year over year, due to lower revenue and increased 10nm chip mix. Despite this Normalized Earnings per share was $0.59, which beat management expectations by a substantial $0.24.

Intel has a solid balance sheet with $23 billion in cash and short-term investments. The company does have high debt of over $39.5 billion, but just $2.3 billion of this is current debt, due within the next 2 years. The company has a forward dividend yield of 5.04%, which is fairly good for a technology company, as the majority don’t pay a dividend or if they do it is usually within the 1% to 2% range.

Advanced Valuation

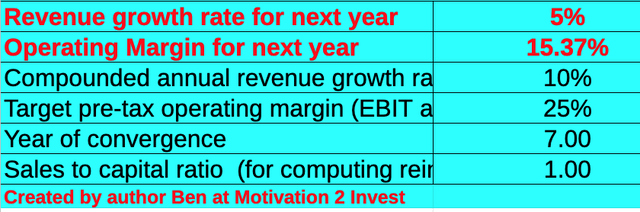

In order to value Intel, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 5% revenue growth for next year and 10% per year, over the next 2 to 5 years. I am forecasting a recovery in the semiconductor market and Intel to maintain a leading position in the consumer CPU industry.

Intel stock valuation 1 (created by author Ben at Motivation 2 Invest)

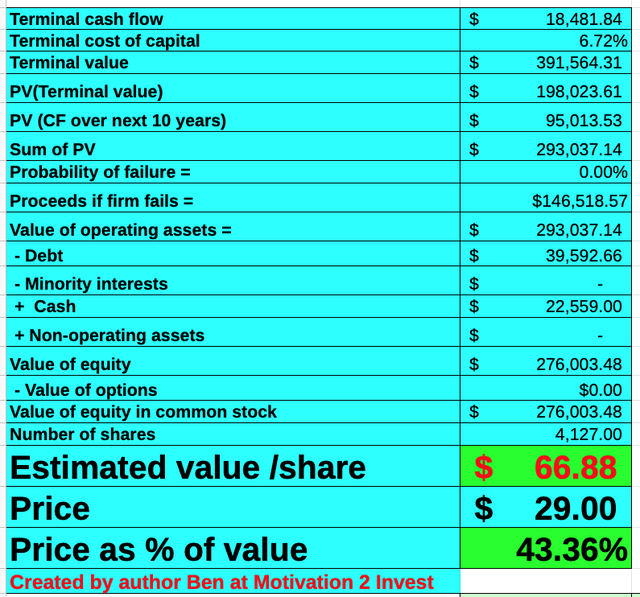

In order to improve the accuracy of the valuation, I have capitalized the company’s R&D expenses, which has lifted the operating income. I forecast the operating margin to grow to 25% in 7 years, as the semiconductor prices increase, and its network & edge group continues to grow.

Intel stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $67 per share, the stock is trading close to $29 per share at the time of writing and thus is 57% undervalued.

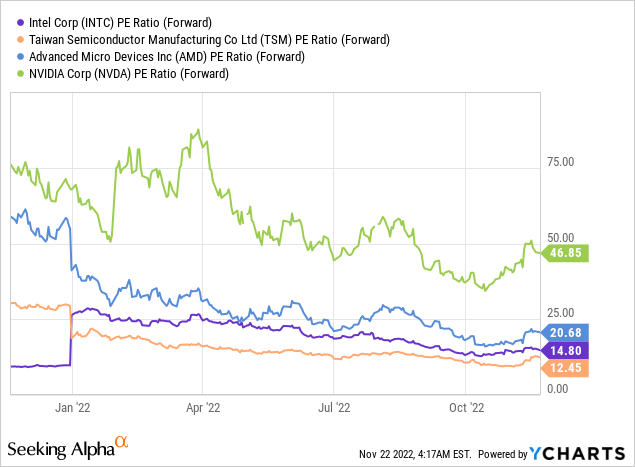

As an extra datapoint Intel trades at a Price to Earnings ratio = 9, which is 29% cheaper than its 5-year average. Intel also trades cheaper than most other semiconductor companies such as AMD and NVIDIA (NVDA). However, it should be noted that Taiwan Semiconductor Manufacturing (TSMC) is trading cheaper with a PE ratio = 12. Warren Buffett’s Berkshire Hathaway recently invested $4 billion in TSMC and the company is the leading semiconductor foundry in the world. Even Intel has had to become a customer of TSMC after its foundry business had manufacturing issues. I wrote a full post on the company you can read here.

Risks

Technology Laggard

Intel is lagging in its foundry manufacturing to players such as TSMC and in its Datacenter segment to AMD. In the technology world, staying ahead of the pack with continued innovation is vital for long-term success. Therefore, Intel may be a “value trap” despite its consumer computing segment still holding a leading position.

Recession/Cyclical Semiconductor Demand

The semiconductor industry is going through a cyclical downturn, which hasn’t been helped by the high inflation and rising interest rate environment. Many analysts are forecasting a recession which isn’t great for Intel as it attempts to turnaround its business.

Final Thoughts

Intel is a diversified semiconductor company that is still the market leader in desktop PC CPUs. CEO Pat Gelsinger is executing his turnaround strategy well and the $50 billion CHIPS act will act as a tailwind on the manufacturing side. However, the company still has a long way to go, Intel is undervalued but due to the uncertainty I will label it as a “hold”. As I believe there are better investment options out there at this time, which have more certainty.

Be the first to comment