Saranya Yuenyong/iStock via Getty Images

Overview

I believe Intapp (NASDAQ:INTA) is undervalued by 34%. The INTA platform uses proprietary AI technology to help companies maintain their current clientele and develop new connections, while also facilitating smooth execution of deals and engagements. The professional and financial services sectors, which include private capital, investment banking, legal, accounting and consulting, generate a combined $3 trillion in global revenues annually, making it a large and important market for INTA’s solutions.

Business description

Intapp develops cloud-based, AI-enhanced software for the business and finance sectors. INTA platform uses proprietary AI to facilitate the maintenance of existing clientele and the development of new connections while simultaneously facilitating the smooth execution of deals and engagements.

Large addressable market

The business of providing services in the fields of finance and business is one of the most vital in the entire world. According to INTA’s estimates, the private capital, investment banking, legal, accounting, and consulting sectors within this industry generate a combined $3 trillion in annual global revenues. I think there is a good reason for these verticals with a high TAM, because they are important to the growth and development of the global economy.

There is a close network of interdependence between the various professional and financial service providers, who often work together to serve a common client or assist in the completion of a single transaction, like an initial public offering. It is also popular for a single professional services firm, like one of the “Big 4” accounting firms, to offer a wide range of services to a single client.

Professional services firms’ client management strategies diverge significantly from those of most corporations. When working with clients, they often have to coordinate a network of interdependent entities that spans departments, processes, and individuals. Therefore, I think it is crucial for these companies to have robust processes in place for managing privacy and security, possible conflicts of interest, and ethical barriers in order to assess and mitigate risk. Because the revenue models of these companies are usually based on success fees or billable hours, client relationship management is especially important.

As you might imagine, a professional or financial services firm can’t thrive without strong client relationships. These relationships are invaluable to the success of any professional or financial services firm, and it is through their cultivation and maintenance that these businesses can expect to reap the greatest long-term economic value from their offerings to their clients. There is an effort underway by many businesses in the professional and financial services sectors to adopt a more systematic and interconnected method of dealing with the relationship lifecycle. I believe that ensuring client satisfaction throughout the entire lifecycle leads to significant gains in winning and retaining new business by providing the appropriate insights to the right professionals at the proper moment. However, any defects in these procedures endanger the customer’s satisfaction and ultimately the relationship with the company. That’s why I believe businesses in the financial and professional sectors are looking for comprehensive, all-in-one answers that can help them achieve their goals at every stage of the business lifecycle.

To that end, I think INTA has a great chance to capitalize on the current market conditions in the professional and financial services sectors. Companies like INTA, which provide industry-specific, cloud-based software solutions, are in high demand because legacy systems cannot meet the technological needs of modern professional services firms.

Purpose-built solution to solve the problem with legacy solutions

The INTA platform was designed with the specific needs of professional and financial services businesses in mind. The industry-specific templates it provides ensure a consistent look and feel as well as a standard vocabulary and data model. These professionals’ specific needs can be easily accommodated by the software’s flexible configuration options. Unlike horizontal software solutions that have been adapted for these businesses, INTA software is designed specifically for the needs of the professionals who will be using it. It also integrates smoothly with the rest of the company’s IT and infrastructure and provides quick returns on investment.

Moreover, these solutions offer a full stack for clients’ complex workflows, centralizing and protecting all of a company’s most vital data and procedures in the cloud. My opinion is that INTA stands out from other software providers because it offers all of the features that users have come to expect from modern cloud software.

Decades of experience is a competitive advantage itself

Over the past 20 years of serving the industry, I believe INTA has developed a unique understanding of the processes and systems that are required for the business and operations excellence of the targeted firms.

In my opinion, INTA has an edge over the competition because of the large number of employees they have who have worked in the industry they serve, as well as the fact that they have developed unique relationships with the CEOs, CIOs, and CFOs of these companies. By maintaining these relationships, INTA is able to hold periodic meet-ups with industry advisory boards that provide invaluable insights into the problems that businesses face and the ways in which technology can help. Therefore, I think INTA has a distinct advantage over the competition in determining, prioritizing, and developing its software platform to satisfy the industry’s ever-changing technological requirements.

Plenty of growth levers to pull

I believe INTA has enormous room for expansion. The cloud is becoming the preferred method for delivering mission-critical applications due to its increased security and lower cost. More and more people in the workforce are warming up to cloud computing, which will hasten the expansion of cloud services within businesses. It is my opinion that the demand for purpose-built technology and software solutions among the next generation of professionals is helping to drive the initial phases of a powerful adoption cycle of cloud-based solutions.

Beyond that, INTA has room to expand its client base. I have faith in this being achieved because INTA’s land and expand strategy permits sustainable expansion over multiple years. Most of the time, clients buy INTA modular solutions to handle a specific use case. Over time, they add more modules, add more users, and deploy to other aspects of their company. According to INTA, an additional $1 billion in ARR in Intapp sales opportunities could be generated from the top 100 customers if they fully implemented INTA to serve all of their users across the board (note this data is likely dated, but it still indicates a large TAM).

Last but not least, INTA’s future may hold a more aggressive posture on the international stage. For INTA, 30% of its revenue in 1Q23 came from markets outside the US. I think there’s a big need for INTA solutions all over the world, which means there’s a chance for INTA to grow its business by going global.

Forecast

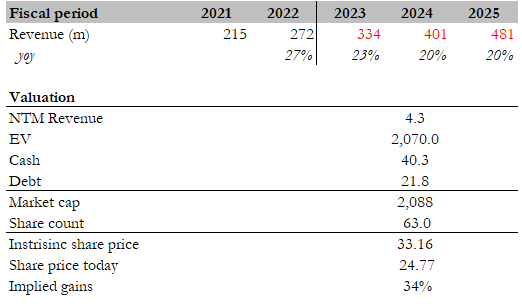

Based on my investment thesis, I believe INTA can maintain a healthy growth rate in the near term, reaching $450 million in revenue in FY25. This is based on my belief that the TAM is massive and that INTA has numerous growth levers at its disposal to extend its growth runway. Because the company is currently losing money due to reinvestment, it should be valued based on forward revenue basis.

I believe INTA should continue to trade at a similar range as it is today – around 4.3x forward revenue.

Author’s estimates

Key risks

Disruption from horizontal application companies

Customer relationship management is central to the needs of these end markets, along with other specialized applications. Intapp’s market share could be threatened if competitors such as Salesforce (CRM) and Microsoft (MSFT) invest sufficiently in vertical specialization of their platforms and form the appropriate partnerships with system integrators to add industry expertise on implementation.

Conclusion

Based on my estimates, INTA has a 34% upside. Intapp is a company that develops cloud-based software for the business and finance sectors. Their platform uses artificial intelligence to help businesses maintain and develop new client relationships, as well as facilitate the execution of deals and engagements. Intapp believes that the private capital, investment banking, legal, accounting, and consulting sectors within this industry generate a combined $3 trillion in annual global revenues, creating a large addressable market for their solutions.

Be the first to comment