ZeynepKaya/E+ via Getty Images

Inovio (NASDAQ:INO) has flown high over the last few years, but is hovering at a share price of under $2.00 as I write on 07/16/2022. I last checked on Inovio right at the beginning of the pandemic in 05/2020’s “Inovio: Coming Of Age In A Pandemic” (“Coming of Age”).

Since then, things have been going downhill for Inovio.

During the pandemic’s early years, Inovio shares were buffeted up and down by every news cycle

Coming of Age described a list of 110 aspirants with COVID-19 vaccines in development. Inovio and Moderna (MRNA) were the two solo US companies on the list whose candidate vaccines were in the clinic.

It also noted:

The fact that Moderna and Inovio are the lone American entrants currently in the clinic should not be taken as any suggestion that they are likely to be the first to cross the finish line. There are dozens of other aspirants, including such notables as Pfizer (PFE) and Johnson & Johnson’s (JNJ) Janssen Pharmaceuticals who will soon be crowding into the clinic. I expect that there will be plenty of jockeying for the lead among top contenders, with the possibilities of a dark horse always there.

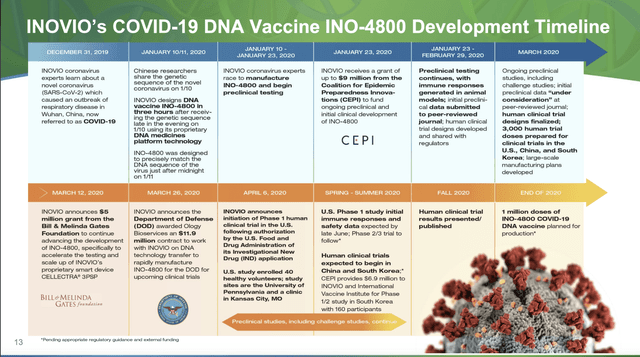

I further noted how Inovio had been burnishing its technology for decades working to insert its DNA directly into cells. I quoted founder CEO Kim’s plan for cobbling studies to support a Q4, 2020 EUA submission for Inovio’s COVID-19 vaccine candidate INO-4800. At the time Inovio was working from the following bold development timeline:

Inovio 05/2020 presentation (seekingalpha.com)

As the pandemic roiled America during 2020, COVID stocks including Inovio were all the rage. Robinhood named Inovio as one of its top 10 stocks most traded on its platform for the month 04/2020; this put Inovio in rarefied territory with the likes of Microsoft (MSFT), Disney (DIS), Aurora Cannabis (ACB) and Tesla (TSLA).

Seeking Alpha’s Inovio news feed was saturated with dramatic announcements of the ups and downs of a cohort of ~20 COVID-19 vaccine stocks. This was a disparate group including the big boys like Pfizer, Merck (MRK) and AstraZeneca (AZN), and the little guys like Inovio, Dynavax (DVAX), and Novavax (NVAX) on down to the tiny iBio (IBIO).

One day COVID-related stocks would surge, another they would ebb. They were at the tender mercy of the day’s news feed. In 09/2020 the news feed was particularly brutal for Inovio with its announcement of questions from the FDA:

…about the company’s planned Phase 2/3 trial of its COVID-19 vaccine candidate INO-4800, including its CELLECTRA® 2000 delivery device to be used in the trial. Until the FDA’s questions have been satisfactorily addressed, INOVIO’s Investigational New Drug Application (IND) for the Phase 2/3 trial is on partial clinical hold. The company is actively working to address the FDA’s questions and plans to respond in October, after which the FDA will have up to 30 days to notify INOVIO of its decision as to whether the trial may proceed.

Time can run exceedingly slow with the FDA, as spring 2021 melted into summer, Inovio’s phase 3 trial plans were still in limbo. It was not until 11/2021 that Inovio received clearance to go ahead with its phase 3 trial.

Inovio is still working on a COVID-19 vaccine but no one cares much

As COVID has waxed and waned it has placed strains on Inovio. Initially Inovio’s announcement of plans to develop COVID-19 vaccines that would target the recently discovered Omicron variant provided a modest boost. Recently however, things are not looking so good.

In 03/2022 Inovio announced that it was pausing development of its phase 3 INO-4800 trial. It was reacting pursuant to its Data Safety Monitoring Board (DSMB) recommendation reflecting the potential impact of the Omicron variant on the study.

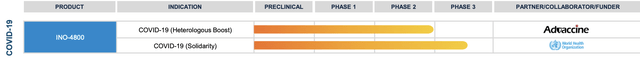

Despite Inovio’s intervening setbacks it has not given up on INO-4800 as a COVID-19 vaccine. Its latest (as I write on 07/15/2022) presentation slide continues to advance INO-4800 as shown below:

Inovio presentation Powering a New Decade of DNA Medicines (Inovio website)

During its 05/2022, Q1, 2022 earnings call (the “Call“), and its more recent 06/2022 CEO presentation at Jefferies 2022 Global Healthcare Conference (the “GHC”), the forward strategy for INO-4800 was updated.

During the Call, Inovio described its new heterologous boost strategy for INO-4800. CEO Shea described the situation as follows:

As the COVID-19 pandemic evolves towards the endemic phase, the need for booster vaccines to protect against severe illness and death represents a growing and strategic opportunity. In light of this, we now believe that Inovio can have the greatest impacts and serve the most pressing public health needs by focusing on COVID vaccine on our heterologous booster strategy. And this is where a different vaccine is used to boost a primary vaccination.

At the GHC it described its path forward in advancing its boost strategy. In this regard it is looking at ex-US jurisdictions as follows:

…we are focusing on really the heterologous boost indication for INO-4800 and we are in the process of talking to a number of regulators in predominantly ex-US countries about conducting heterologous boost studies. And there, what we will be doing is we’ll be taking participants who’ve received prime regimens with other vaccines, and then we will be boosting them with INO-4800. And then we will be looking at non-inferiority in terms of the antibody and cellular immune responses generated by either INO-4800 or a comparative vaccine. And this is a regulatory path that’s becoming increasingly acceptable outside of the US.

CEO Shea advised that the populations in the countries it was working with had either received inactivated or viral vector vaccines. Accordingly these were the modalities its initial trials of INO-4800 would test compared to currently authorized COVID-19 vaccines. She was unwilling to name the countries Inovio was working with at this point. She will do so in “coming months”.

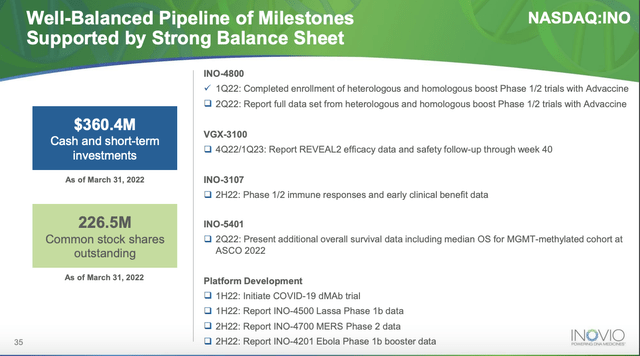

Inovio’s finances are adequate for its near term needs.

During the Call, Inovio reported cash, cash equivalents and short-term investments of $360.4 million at Q1, 2022 quarter’s end, compared to $401.3 million as of December 31, 2021.

This shows a significant quarterly cash burn of ~$40 million. Its cash used in operating activities was $61.9 million. (10-Q p. 29). Financing activities for the quarter provided $28.4 million from an ATM offering. It has ample cash for operations for a year however liquidity must be an ongoing concern for management given the paucity of near term catalysts.

CEO Shea implicitly recognized this when during the GHC, she stated that Inovio was:

…currently looking at our different programs, reprioritizing resources against those programs and expect to be making some more announcements over the summer as to how we’re going to do that. But overall, I would expect our cash burn to go down, and we’ll certainly be looking to extend our cash runway.

She stated more details on this would be announced during the summer, thus giving herself leeway into September. My biggest concern with Inovio is that it seems unable to close. It has been developing its impressive DNA delivery mechanisms for a lengthy period. It has yet to secure approval for any product.

Consider that it was in the lead with Moderna in getting its COVID-19 vaccine into a clinical trial. Then it got waylaid by the FDA’s partial hold. Was this just bad luck or was it that it was unable to adequately explain its CELLECTRA delivery device?

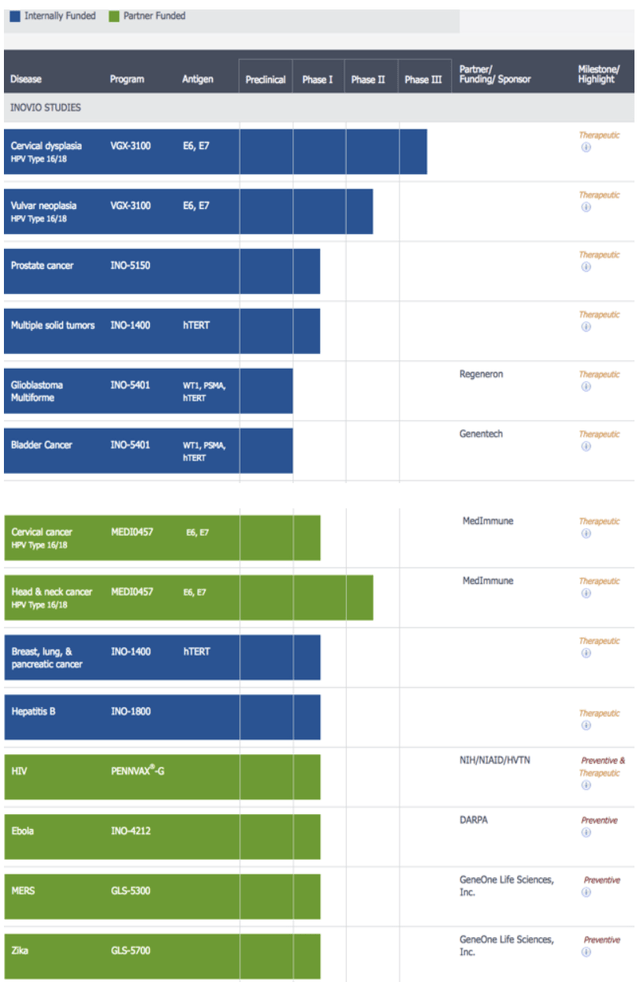

Back in 08/2017 my first Inovio article showed its pipeline below:

Inovio pipeline in 2017 (seekingalpha.com)

Its lead therapy VGX-3100 remains on its pipeline today. During the Call, SVP Skolnick advised that because of the FDA’s requirement for one or possibly more clinical trials its previously anticipated 2023 VGX-3100 BLA filing was no longer expected. As he stated:

…Given the likelihood of at least one additional trial, we no longer expect to submit a BLA in 2023 for VGX-3100. We maintain full conviction in our DNA medicines and in our development programs in HPV diseases. Given our prior evidence of our DNA medicines platform, specifically VGX-3100 to both regress lesions caused by HPV-16 and 18 and to clear HPV-16/18 virus from those lesions.

Inovio’s list of upcoming catalysts below is distressingly devoid of near term catalysts:

Inovio presentation Powering a New Decade of DNA Medicines (Inovio website)

Summary

Inovio carries a current market cap of ~$0.451 billion. Its relatively clean balance sheet with its nice cash balance just about justify this market cap. I do not expect Inovio to have any financial distress anytime in the near future.

That said, there is nothing about Inovio that makes me want to open a position in this stock. Concomitantly, for those who are already shareholders, there appears to be no reason to sell at its current price.

Be the first to comment