peepo/E+ via Getty Images

“Flying Taxis” may sound like science fiction, but they are increasingly becoming a reality. If you’ve ever sat in traffic for many hours, then the pain point these flying cars solve is truly obvious. According to one study, an eye watering 4.7 billion hours per year is wasted sitting in traffic in the top 15 US cities. In addition, 70% of the global population is forecasted to be living in cities by 2050, up from 55% today. In addition, nearly one third of all US CO2 emissions come from the transportation sector. Thus, to solve this traffic problem we can improve road layouts or even try building tunnels (which is very expensive) or we can take to the skies. The global Electric Vertical Takeoff and Landing (eVTOL) market was worth $5.4 billion in 2021 and is forecasted to grow at a rapid 23% CAGR to reach over $23 billion by 2028.

eVTOL Concept (Uber Elevate)

Of course, I don’t believe “Flying Taxis” are the answer to all congestion problems, but they are a safer, more versatile and cost effective alternative the aging fleet of Helicopters.

According to a whitepaper by Uber Elevate, eVTOL developers claim that the safety level is four times that of most helicopters. In addition, the majority of helicopter accidents occur due to human error from the pilot. Thus with advanced autonomous flight control systems, this can further mitigate risks in the future or even just provide guided flight assistance.

Joby Aviation (NYSE:JOBY) is a true pioneer in the eVTOL industry, as it was founded in 2009, earlier than other competitors in the industry, such as Lilium (LILM) (2015) and Archer (ACHR) (2018). Despite many companies racing to take advantage of the eVTOL industry the market opportunity is huge, worth $500 million per year in LA alone. In addition, Joby has leading technology, a first mover advantage, are founder-led and backed by some of the biggest names in technology from Uber (UBER) to Toyota (TM).

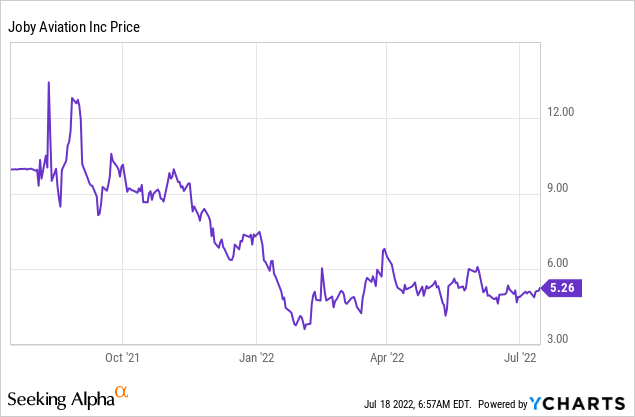

The company went public in 2021 via a SPAC (Special Purpose Acquisition Company) called RTP which was backed by LinkedIn Co-Founder Reid Hoffman. The stock price had a few spikes in share price but due to investor redemptions, Hedge Fund Trading and the rising interest rate environment the whole SPAC industry has been butchered. Given these factors, Joby now trades at ~$5 which at approximately 2.7 times its $1.2 billion in cash on hand. Thus let’s dive into four key advantages, which is poised to enable Joby to take flight in the future.

The Uber of the Sky

Leading Technology – Advantage 1

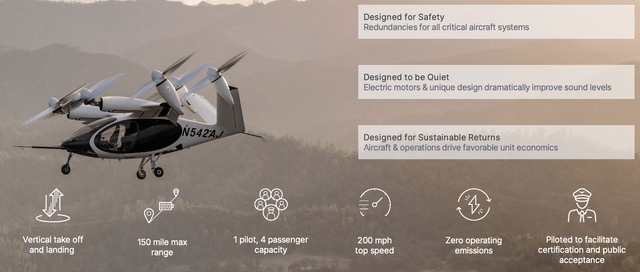

Joby’s eVTOL is a six rotor vehicle which can house one pilot and up to four passengers. It can travel at a maximum speed of 200mph, which is significantly faster than the maximum speed of a civilian Helicopter (160mph).

Joby Aviation (Investor Presentation)

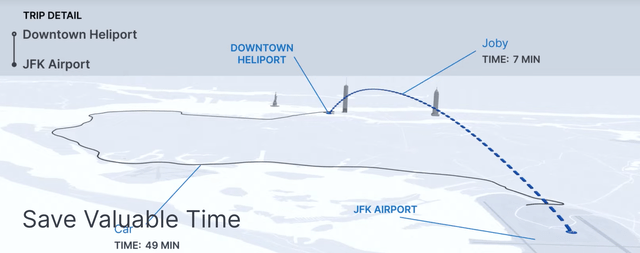

Joby has now proven the Flying Taxi concept and in July 2021, its eVTOL did a 155-mile flight on a single charge in 77 minutes. The main use case touted by the company will be airport pickup and drop off in congested cities. According to Joby, a trip in New York City from a downtown helipad to JFK airport, would take just 7 minutes by the flying taxi, as opposed to 49 minutes by a standard taxi.

Joby Aviation (Joby Website)

Joby’s flying taxi also has extremely low noise levels which make it ideal for city pickups and drop offs. According to this quote by Aviation Week;

“The aircraft would almost certainly be undetectable against the everyday noise background of an urban environment.” – Guy Norris (Aviation Week)

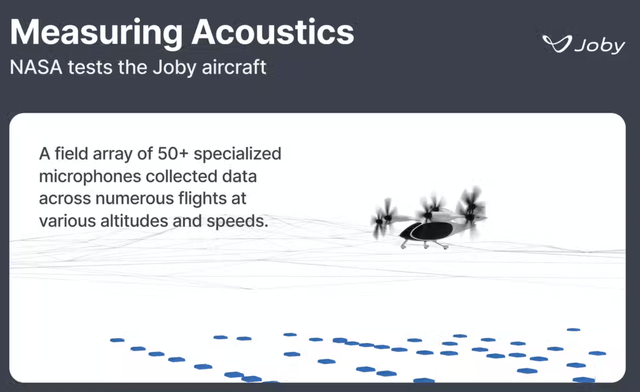

Joby recently completed an advanced noise test with NASA which confirms the low noise profile. NASA engineers measured the aircraft’s acoustic profile during take-off and landing and found it to be below 65 dBA. This is landmark news as that noise level is comparable to a normal conversation, at a distance of 330 feet (100 meters) from the flight path.

Joby NASA Noise test (Joby Aviation)

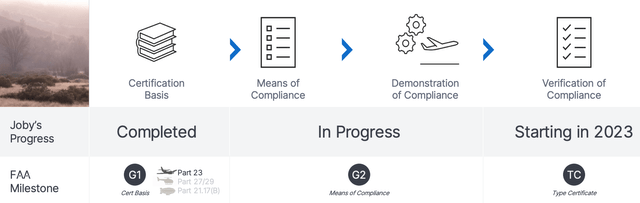

Certification, Testing and Regulation are the main challenges for the company, before they can reach commercial operations by 2024. So far progress has been good with the company achieving a U.S. Air Force Airworthiness and FAA Special Airworthiness Certificate for its second production vehicle. Joby was also the first eVTOL developer to sign a G-1 (stage 4) certificate with the FAA in 2020.

More recently (May 2022), the company has received a Part 135 Air Carrier Certificate from the FAA. This certificate has been achieved a couple of months earlier than expected, which is a positive sign. In order to operate a commercial operation the company requires two more certificates (Type and production).

FAA Certification (Investor presentation)

Go to Market Partners/Investors – Advantage 2

In 2018, Joby Aviation raised $100 million in a Series B funding round backed by Intel Capital (Venture arm of Intel (INTC)), the world’s largest car maker Toyota, JetBlue Airways (JBLU) and even Tesla Backer Capricorn Investment Group.

The early stage backers of the company give them many competitive advantages. For instance, Joby cemented a manufacturing partnership with Toyota in 2020 which means their platform is scalable, which is key.

Elon Musk has previously stated in prior interviews that

“Making a prototype is relatively easy, scaling the manufacturing is the real challenge”.

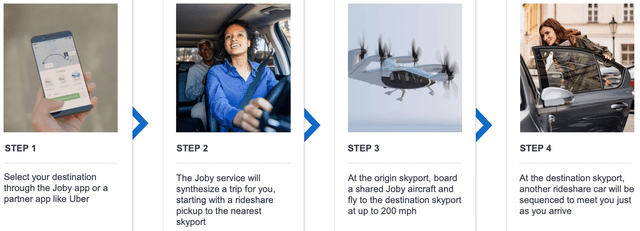

In addition, the market leader in ride sharing, Uber, provided a $75 million investment into Joby, when the company acquired Uber’s flying taxi development Arm Uber Elevate. This is a landmark strategic partnership as it now means Joby flights will be able to be booked directly from the Uber App which had 118 million users in 2021. The vision of Joby and Uber Elevate is to make ordering a flying taxi as easy as ordering a normal taxi.

Joby Uber App (Investor Presentation)

LinkedIn Co-Founder Reid Hoffman, who funded the original SPAC (RTP) should also offer vast experience, connections and knowledge as a master of “Blitzscaling” which was the title of his bestselling book.

Founder Led/Insider Holding – Advantage 3

Joby Aviation was founded by JoeBen Bevirt, a serial entrepreneur who self financed Joby in the early days after selling his companies Velocity11 and GorillaPod. The company’s early days focused on testing various different motors, software and battery types. This research was at the cutting edge and even led to NASA’s LEAPTech program and even the NASA’s electric plane the X-57 Maxwell, which looks very similar to Joby’s vehicle today.

Investing into companies which are founder led and management has “Skin in the Game” is one of the key parts of my investment strategy at Motivation 2 Invest.

In this case, Founder JoeBen Bevirt owns 16.32% of the company and the executive chairman of the board Paul Sciarra owns 9.94%. Both Bevirt and Sciarra purchased 55,137 more shares each at the end of May 2022 at an average price of $5.67/share and cost of approximately $312,000 each. In the words of the great investor Charlie Munger “Show me the incentives and I will show you the outcome”. The fact the founder has “skin in the game” means his incentives are more closely aligned with shareholders, which is a positive.

Favorable Economics – Advantage 4

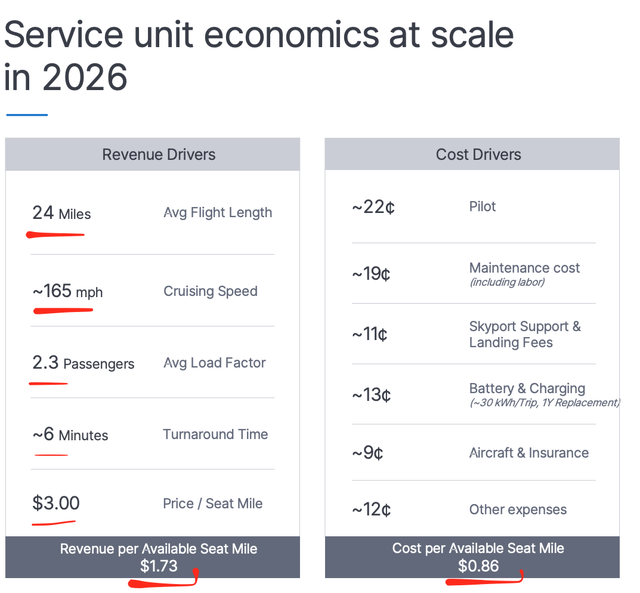

Joby’s business model has favorable economics on paper, like any business Revenue – Costs = Profit. In this case, the average revenue per seat mile is forecasted to be $1.73 and the average cost would be $0.86, thus the average profit is expected to be $0.87 per seat mile or a ~50% margin which isn’t bad.

Joby Economics (Investor presentation)

Joby has a strong balance sheet with $1.2 billion in cash and short term investments with low debt of just $700,000.

Risks

No Revenue Yet – Early Stage

For clarity the company is not making any revenue yet as they are still in the pre launch stage. Thus this is a speculative venture capital style investment. The good news is the stock is trading at just a $3.19 billion market after the 50% plummet in share price, the stock is trading at approximately 2.7 times its cash on hand.

Competition

As mentioned prior there are many companies aiming to take to the skies in the flying taxi market. These include, Lilium, EHang (EH), Archer and many more. Vertical Aerospace (NYSE:EVTL) recently saw a 72% gain in share price after American Airlines (AAL) agreed to make pre-delivery payments for 50 electric vertical takeoff and landing aircraft. Although Jet Blue Airlines was an early investor into Joby, I would like to see some Airline Preorders for the company’s product.

Crash?

On February 16, 2022, a remotely piloted prototype crashed during a test flight in rural California and sustained substantial damage. Apparently the test crew was “pushing the limits” of the vehicle, but as it was remotely piloted nobody was harmed. The National Transportation Safety Board determined it was caused by component failure. Although, I don’t think this is a major issue during the testing stage, one major crash over a city would decimate the eVTOL industry and the stock price as a result.

Self Driving Cars and Remote Working

Many eVTOL companies base their value proposition on avoiding traffic and faster transport. However, with companies such as Tesla (TSLA) and Google’s Waymo (GOOG) (GOOGL) making strong progress with Self Driving Vehicles, this “wasted time” in traffic could be converted to productive, leisure or sleep time. In addition, the trend of remote working which has accelerated since the pandemic has made Business Travel not as necessary as pre pandemic.

Final Thoughts

In the words of Elon Musk,

“Life needs to be more about solving problems you need to wake up and be excited about the future”

Flying taxis are one of those industries which captivate the imagination. One day (by 2024) according to Joby, we may see flying taxis in our city skies and it becomes as normal as hailing an Uber. However, there is still a long way to go with technical challenges, regulation and the cultural shifts required to be overcome. Joby Aviation is one of the leaders in the eVTOL industry. They have strong partnerships with Uber and Toyota which gives them a strong competitive advantage both in go-to-market and production. The stock price has plummeted due to the macro environment. However, longer term this looks to be a great stock for those who want exposure to the eVTOL industry. As mentioned prior, this is still a speculative investment, as it’s not generating any revenue, but this would likely make a small addition to one’s Venture capital/speculative portfolio.

Be the first to comment