“Until you realize how easily it is for your mind to be manipulated, you remain the puppet of someone else’s game.” – Evita Ochel

There’s an old saying that uncertainty breeds opportunity, and if that’s the case, there is plenty of opportunities now. While the overall severity and government reaction to the COVID-19 outbreak has been much more severe than we would have ever believed, my view continues to be that investors should focus on the paved road ahead rather than potholes in the construction zone today.

There will be some turbulent and rough rides along the way, but ultimately investors who stay with their plan will be rewarded. This uncertainty also breeds incredible volatility. Besides the VIX, which remains above 40 after reaching levels above 80, several other indicators show just how extreme the moves of the last five weeks have been. In many cases, the moves are unlike anything anyone has ever seen before.

We’ve used the word unprecedented more in the last month than in the last five years. That leads to investors stepping out of their comfort zone, leaving their plan and wind up making decisions they never would have made during “normal” circumstances. RATIONAL fact-based reasons that are usually found right in front of us are very hard to come by. That leaves some investors resorting to guessing, speculating, and jumping into premature strategies. It seems like the thing to do these days.

The aforementioned volatility has already claimed many victims. The 34% drop from an all-time high into a bear market left bodies everywhere. Traders who tried to play the subsequent wild swings found themselves beaten and maimed. There have been five 10-to-1 upside volume days since March 1, but the first three were followed by 10-to-1 downside volume days. However, the last two on April 6th and April 9th were NOT followed by a huge downside reversal.

Then there was the crowd that believed the market had much more downside and positioned themselves that way. They were met with a guillotine in the form of a 27+% rally off the lows. Investing isn’t easy under normal circumstances. It surely becomes much more difficult when we think we can outwit everyone else and be perfectly positioned in an unprecedented period.

Instead, the game plan required what was suggested back in March just before the S&P plumbed the lows in this BEAR market.

“Thoughtfulness” not “panic” is what is required now.”

“The challenge now, navigating this BEAR market using common sense.”

My suggestion was to take on a tone that made it simple, “Do not allow yourself” to get stretched in any one direction. That has worked out well as the S&P is 27% off the lows and about 16% from the old highs. In between, we experienced a 34% decline in 21 trading days and now find ourselves in a 27+% rally in the last 18 trading days. Not exactly “smooth sailing”.

This is not a time to let emotion prevail. Then again there is never a time to let emotion into the equation when it comes to investing. It is time to simply execute the plan. The “retest” scenario is THE debate that rages on. Some say the present-day retracement has come too far too fast. There are plenty of analysts calling for a retest and many others simply say:

“The worst is not yet behind us, Another massive decline is coming, and the Bear market will now enter a more explosive stage.”

It is easy to see why those folks are all lined up like dominos. Data going back 60 years shows that after large declines, the S&P has tested its initial low about six weeks later on average. That would align with the arrival of weaker seasonality with May.

Others are relying on what is also a fact today. Complicating the entire picture is what has been stated here before. This is NOT your typical market decline and historical patterns may NOT prevail.

Buyers’ fatigue, technical resistance, angst over how the economy reopens were all reasons stocks started the trading week with a downward bias. An early morning selloff was met with some buying at the end of the day, the S&P finished down 1%. Both the Russell and the Dow 30 were somewhat weaker, but the Nasdaq bucked the selling trend and closed higher on the day.

The next two trading days told investors that volatility is still with us. The S&P gapped higher at the open on Tuesday rising 85 points, then gapped lower at the open on Wednesday and posted a 62 point decline. The Dow followed the same pattern, up 550 points one day, then down 445 points the next. More of the same undecided trading action on Thursday as stocks fluctuated between gains and losses, but a late-day rally led by the large-cap Technology stocks left the S&P 500 higher by 0.58%. Breadth amongst sectors was more mixed with Energy lagging and Health Care rose over 2%.

Overnight headlines set the tone for the final day of trading. First, it was reported that Gilead’s (GILD) COVID-19 treatment was showing signs of success. Then, Boeing (BA) announced plans that it would resume production at its Puget Sound plant. Finally, a White House Press Conference outlined plans and criteria for bringing the economy back online. While there has never been any doubt that the US economy would come back online at some point, these three events, taken together, raised optimism.

Friday was a positive day for the Bulls as the DJIA and S&P rallied between 2.6 and 3% respectively. The S&P 500 closed the week up 3%, while the Nasdaq remained strong adding 6% in the same time frame. All of this price action left many scratching their heads looking for reasons to doubt the advance.

Economy

The devastation from the “lockdown” while not surprising is staggering.

March retail sales plunged -8.7% and dropped -4.5% excluding autos, after February declines of -0.4%. The headline drop is the largest ever, not surprisingly. Sales excluding autos, gas and building materials, which factor into GDP estimates, fell -3.5%.

Bloomberg’s weekly reading on consumer comfort fell another 5.4 points this week down to 44.5 which is the lowest level since late October of 2016. That is the second-largest weekly decline on record behind last week’s 6.4 point decline.

Empire State manufacturing index dove -56.7 points to -78.2 in April after plunging -34.4 points to -21.5 in March. The April reading is a record low.

Philly Fed manufacturing index crashed -43.9 points to -56.6 after the -49.4 point plunge to -12.7 in March. This is the worst print since -57.1 in July 1980. The record low is -57.9 from December 1974

Industrial Production fell 5.4 percent in March, as the COVID-19 pandemic led many factories to suspend operations late in the month. Manufacturing output fell 6.3 percent; most major industries posted decreases, with the largest decline registered by motor vehicles and parts. The decreases for total industrial production and manufacturing were their largest since January 1946 and February 1946, respectively.

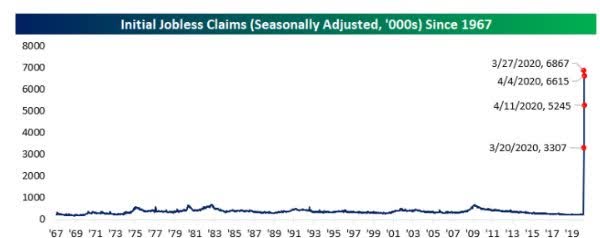

The pain has not stopped for the U.S. labor market. Initial jobless claims remain at extremely elevated levels coming in at 5.24 million this week. This week’s report was a small improvement from the past few weeks coming in below expectations (5.62 million) as well as the past couple of weeks’ readings which have been well above 6.5 million.

Last week, seasonally adjusted claims totaled 6.61 million which makes the 1.37 million drop to 5.245 million this week the largest single week decline on record. That is a small consolation given the fact that it was still the third-largest weekly reading on record.

Source: Bespoke

NAHB housing market index cratered 42 points to 30 in April, the largest monthly drop on record (data back to 1985). This is the lowest print since June 2012 as the survey captures more of the COVID-19 shutdowns. This follows the 2 point decline to 72 in March.

Housing starts plummeted -22.3% to 1.21 million in March after dropping -3.4% to 1.56 million in February. The 1.62 million was a 14-year high. Single-family starts declined -17.5% to 0.85 million, while multi-family starts were down -31.7% to 0.36 million. Building permits fell -6.8% to 1.35 million following the -6.3% slide to 1.45 million.

Global Economy

The cost of this medically-induced global shutdown is overwhelming. The enormity of what we are dealing with can be found in these statistics.

As of last week, global liquidity injections/fiscal stimulus totaled nearly $16 trillion or 18% of global GDP. $8 trillion from central banks/IMF, and nearly $8 trillion from national fiscal moves. The U.S. is by far the leader, with total monetary and fiscal stimulus now up to $7.5 trillion, or 35% of GDP. $4.8 trillion on the monetary side or 22% of GDP and $2.7 trillion on the fiscal front or 13% of GDP.

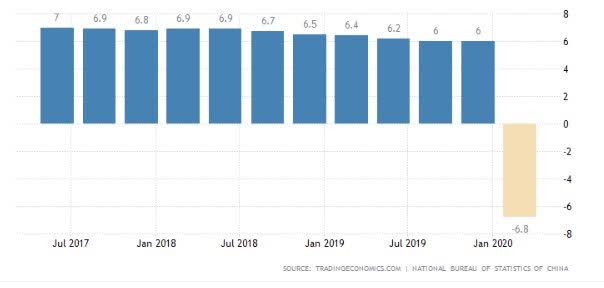

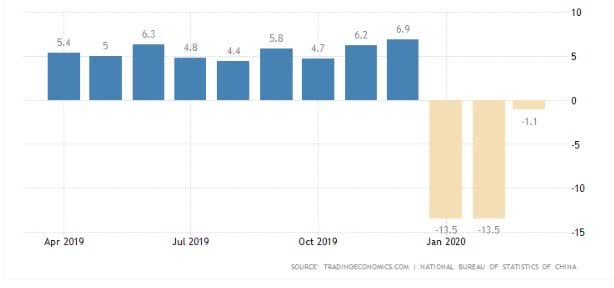

The Chinese economy shrank 6.8 percent year-on-year in the first quarter of 2020, after a 6 percent growth in the last three months of 2019 and compared with market forecasts of a 6.5 percent decline. It is the first GDP contraction since records began in 1992, reflecting the severe damage caused by the COVID-19 outbreak after the authorities enforced a near two-month-long shutdown of all non-essential business activity.

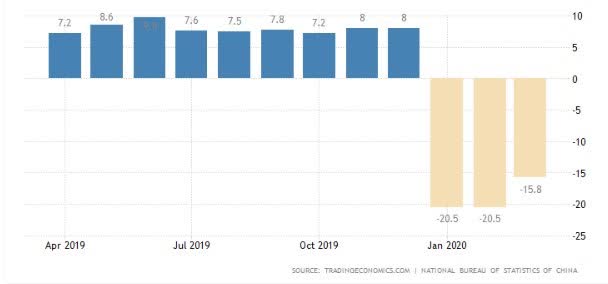

China’s retail trade declined by 15.8 percent year-on-year in March 2020, following a 20.5 percent slump in January-February. The latest reading was worse than market forecasts of a 10% fall, amid ongoing coronavirus outbreak, with people remaining afraid to go to crowded places like shopping malls, restaurants and movie theaters.

China’s industrial production dropped by 1.1 percent year-on-year in March 2020, after a 13.5 percent plunge in January-February and compared with market expectations of a 7.3 percent fall, amid a partial recovery in the economy following restrictions of business activities and travel movement due to the COVID-19 outbreak.

China’s command economy is better set-up to handle this shock than the U.S. because it is less reliant on market signals for production decisions. “Reopening” in China is a government decision, while the American economy is far more dependent on political and consumer mindsets that could take longer to recover.

Earnings Observations

It’s that time of year again. The time when corporate America reports financial results for the prior three months. Normally, we call it earnings season, but given the fact that most of the US economy has been shut down and no timetable is set for when it re-opens, for a lot of companies out there, there isn’t much in the way of earnings, revenues, or guidance to speak of. Instead, this reporting period will likely be a lot of companies trying to put the best spin on how much (or little) cash they have on hand to withstand the shutdown.

Refinitiv Research Earnings Estimates:

Q1’20 earnings are expected to decline by 9.0%. Excluding the energy sector, the earnings growth estimate is -7.5%. Of the 21 companies in the S&P 500 that have reported earnings to date for Q1’20, 76.2% have reported earnings above analyst estimates.

Q1’20 revenue is expected to increase by 0.7% from Q1’19. Excluding the energy sector, the growth estimate is 1.9%. 71.4% of companies have reported Q1’20 revenue above analyst expectations.

The forward four-quarter (Q2’20-Q1’21) P/E ratio for the S&P 500 is 18.3.

Credit Suisse says in 13 recessions since 1935, it’s taken trailing 12-months earnings per share 2.5 years on average to regain their prior peak, with the fastest recovery occurring in just two quarters and the slowest in 17.

Historically, it also has taken twice as long for earnings to recover relative to GDP. It’s almost certain this crisis will be steeper than most. Many analysts expect Q2 GDP to contract by at least 20% or more. But if the virus continues to exhibit signs of peaking, they also expect the economy to begin to quickly improve, suggesting the earnings recovery could be quicker, too.

However, this may not be your “typical” recession.

The Political Scene

On Thursday the White House offered the governors of each state a 3 phase blueprint to reopen the U.S. economy. It’s very simple now. If decisions are made to keep people out of work and we keep putting up roadblocks instead of dealing with the reality of the situation regarding this disease, then we will start to see businesses fall like dominos.

The Small Business Loan Bailout Program has already run out of money. Congress has decided to play politics again, and as of the end of the week, it still hasn’t resolved the issue.

The election is less than seven months away. The outcome is going to be partly driven by what happens with the economy during that period (which should see plenty of good news as the stimulus measures pump money into the system) and also how things unfold with the coronavirus. That latter subject will not just be a question of what happens during the next few weeks – but how the virus is detected and dealt with as part of an effort to contain any new outbreaks. The basic talking points for each side of the political aisle have already been formulated. Now they are going to have to wait and see how things develop from here so that their strategies can be fine-tuned.

The more radical of the Democratic candidates have been removed from the race. President Trump is no doubt the preferred choice for much of the business community. However, a Biden presidency would be unlikely to stand in the way of the U.S. economy’s deeply-seated need to burst its way higher into a new boom next year. Biden has already pledged to pick a woman as his running mate and you can bet that the eventual candidate will be relatively young and have a reputation of being a fighter. Stay tuned.

The Fed

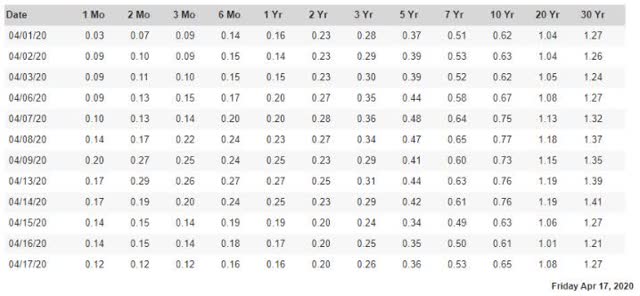

The 10-year Treasury bottomed at 0.40% over the worldwide fears that are present. The 10-year note yield rallied off those lows to 1.18% before falling back to close the week at 0.65%, down .08% from last week.

The 3-month/10-year Treasury curve inverted on May 23rd, 2019, and remained inverted until mid-October. The renewed flight to safety inverted the 3-month/10-year yield curve once again on February 18th, and that inversion ended on March 3rd. The 2/10 Treasury curve is not inverted today.

Source: U.S. Dept. Of The Treasury

The 2-10 spread was 30 basis points at the start of 2020; it stands at 45 basis points today.

Sentiment

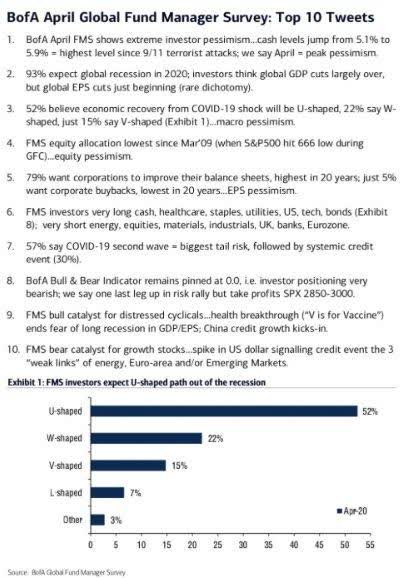

No surprise, Bank of America’s global fund manager survey shows investment pros have 5.9% of their money in cash, up from 5.1% at the end of March. That’s the highest allocation to cash since after the 9/11 attacks.

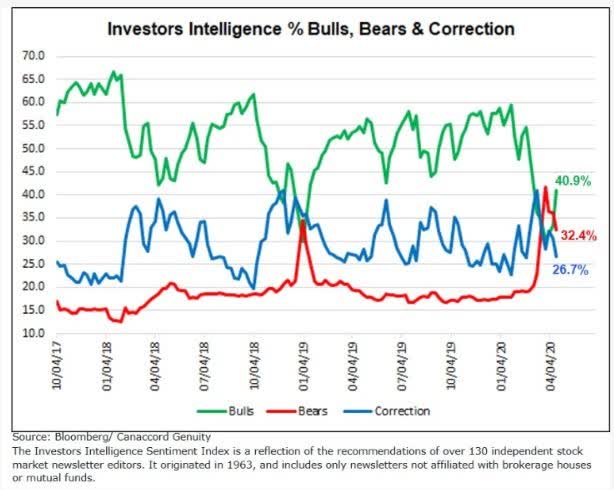

The percent of bullish newsletter writers bounced back, according to Investors Intelligence. Bullish sentiment jumped to 40.9% from 33.3% in the prior survey, the largest one-week percent gain since 6/1/16.

Bearish sentiment dropped back below bullish sentiment for the first time in four weeks, declining to 32.4% from 36.2%. The percent of newsletter writers calling for a correction slipped to 26.7% from 30.5%.

Crude Oil

During last weekend, OPEC+ (which includes Russia, Mexico, Bahrain, and several other minor producers as well as the core OPEC membership) agreed to cut output 9.7 million BPD, just shy of the 10 million that had been expected by analysts ahead of the past week of tense meetings. What’s remarkable is that G20 countries not involved in OPEC+ will add cuts as well, though the 5 million BPD of production expected to be removed by those countries will be market-based and may take as much as a year to work through the system.

These actions are likely to reduce total output by 15% by year-end, but not before a 31% decline in demand versus January levels at the lows. As a result, inventories will end up rising by over 2 billion barrels at the peak before demand recovery in the back half of the year restores balance. Under this framework, it’s pretty easy to see why WTI trades at under $20.

The Weekly inventory report reveals U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 19.2 million barrels from the previous week. At 503.6 million barrels, U.S. crude oil inventories are about 6% above the five-year average for this time of year.

Total motor gasoline inventories increased by 4.9 million barrels last week and are about 12% above the five-year average for this time of year.

The trading in WTI remains volatile. Price settled at $18.07, down $5.12. In the last two weeks, WTI has lost $10.26 or 36% of its value.

The Technical Picture

Other than minor setbacks, the rally off the lows continues. Using the close (2,237) on March 23rd the S&P has gained 27%. If we use the intraday low of 2,919, the gain is 30%.

The index has now reached its highest level since that low was established and is now above the 20-day moving average (2707/green line) and the 50-day MA (2810/blue line). Investors now ponder the notion that we could experience a “W” pattern emerge where the index retreats before moving higher. Other analysts say the lows will be tested and a contingent is calling for lower lows to be established.

No need to guess what may occur; instead it will be important to concentrate on the short-term pivots that are meaningful. However, the Long Term view, the view from 30,000 feet, is the only way to make successful decisions. These details are available in my daily updates to subscribers.

Short-term views are presented to give market participants a feel for the current situation. It should be noted that strategic investment decisions should NOT be based on any short-term view. These views contain a lot of noise and will lead an investor into whipsaw action that tends to detract from the overall performance.

Insider buying by CEOs, CFOs and board directors in large U.S. companies hit $1.1B in March, the biggest total since October 2013.

Get ready, two of the largest tech giants Apple (AAPL) and Alphabet (GOOG) (NASDAQ:GOOGL) are getting together to track COVID-19 in an attempt to stop the spread of the virus. Yes, get ready to hear all the complaints about “privacy”.

Not very long ago any idea like this would have been unthinkable. In the middle of a health scare, maybe we will see common sense deployed. We can only hope we see some of that mindset in use in the coming days/weeks.

If this can work to the extent the companies tell us, and if it is widely adopted, it could be a GAME-CHANGER. That is if it doesn’t run into “interference” from minority (numbers not race) factions.

Perhaps the agenda-driven detractors can find themselves willing to be grateful for the innovation and the benefits these companies provide. Perhaps the entire overblown “privacy” issue will no longer be a threat to the bottom line of the large-cap tech companies that are assets to society.

It is ironic that many of the worrywarts that have been warning about what we are doing to future generations by operating with a trillion-dollar deficit before the coronavirus hit are the same people that stand in silence as they are content in following the one-sided advice on dealing with a virus. What was a medical issue is no longer “just” a medical issue now. It was unfortunately turned into a huge financial issue as well. Some are so blinded with emotion that they forget everyone deals with the risk of having medical issues every day of their lives.

Now with deficits in the trillions, with every dollar in essence “ordered” by the one-sided approach is taken, it is time to look at the “other” side. I do wonder how this “virus” will impact generations to come. I seriously doubt it will be positive. For sure the actions taken will have a direct effect on the financial world and investing down the road. There will be MANY lives lost over this financial calamity known as “lockdown”. We are at the beginning of the health calamity caused by the financial ramifications of the lockdown.

Incessant fear-mongering has been present from the beginning. That has exacerbated this situation and will affect recovery. After any type of reopening of the economy, why will people still be afraid? One only has to look at what has been fed to us in the last six weeks. ONLY the worst came forth. As an example, when was the last time we heard anyone in the mainstream or for that matter anywhere else state that 85% (some websites that track this are reporting that 96%) of the cases are MILD.

I doubt we will ever see the fear-mongers display any intestinal fortitude and “step” up, admitting they endorsed a myopic view that saw no other way to deal with the health scare. They “endorsed” and “approved” what could turn out to be a HUGE consequence for all future financial markets that are meant to serve the needs of people everywhere.

In 3+ months 35,000 deceased here in the U.S. due to a disease. In three weeks 22 million now without income. Which one is out of the ordinary?

Balance? It was never used. Here is what should be terrifying now. This price tag is still yet to be determined.

Individual Stocks and Sectors

Whenever there are selloffs in the stock indices as soon as the situation settles down a little, the “bottom-picking” army comes marching on to the scene. Now don’t get me wrong, each investor has their situation to contend with and for sure many should be looking at quality stocks that can be bought at a discount.

Many companies will struggle in the post COVID economy, and their price action reflects that. Therefore, I am more inclined to look for opportunities in stocks that have remained in a bullish configuration. I’ve assembled an extensive list of names that despite the BEAR market drop of 34% have NOT fallen into a BEAR market backdrop.

Coincidentally these companies look to be able to weather the storm and actually may benefit in the weaker economy ahead. In my view, they now offer the BEST way to stay involved in the present environment that remains very uncertain. When you see a stock making new ALL time highs in the BEAR market, it’s time to take notice.

Finally, in the uncertain post Covid world it will be important to be involved with companies that are strong enough to RAISE their dividends. Johnson & Johnson (JNJ), Costco (COST) and Procter & Gamble (PG) are three such companies that deserve to be in any portfolio.

Like everything else in the world of investing, searching for income is very challenging now. Who the survivors will be and what is safe are questions that each of us will have to wrestle with now. When I find myself in a bind, I like to follow the “‘experts”, the people that have had the story correct for a while now.

The Stanford Chemist is where I now look to for income ideas in the world of CEFs and ETFs.

As late as March 19th, the Coronavirus forecasts in some states here in the U.S. were staggering. The average person should now be staggered by how alarmingly inaccurate they were. California was another that fell into the “alarmist” category with a prediction of 25 million infections. As of Friday, the state total was 26 thousand cases, far below what Californians were told. Perhaps it’s time to revisit the opening quote:

“Until you realize how easily it is for your mind to be manipulated, you remain the puppet of someone else’s game.”

That “game” has been costly. In past missives, I relayed my initial fears about the medical community’s approach to the virus situation from the beginning. For sure their message was faulty. As time went on there was little to no talk of “balance” in their messaging. While all of that was taking place, the stock market listened intently to every word/phrase being uttered and the results were staggering. People weren’t only loading up on toilet paper, they were loading up on news content as well. How ironic that these two items now go hand in hand.

“Doctors think differently than economists. They put patients with a potential for brain damage in an artificial coma to stop swelling, and when it stops, they bring them out. This fits with the Hippocratic Oath all doctors take, which states “First, do no harm.” The idea is to “limit” damage and then “restart” a more normal body with fewer problems.”

“The economy doesn’t work that way. You can’t just “turn it off” and then “restart it” as if nothing happened. When you turn off an economy you create permanent damage. While this is impossible to prove, there is no precedent in history from which to judge, it is easy to surmise.”

They go on to tell us all as investors and citizens we ALL need to be aware of the “other” serious consequences that have befallen MILLIONS of Americans. For sure there are passionate arguments on both sides of this argument. I raised my concerns earlier. Suffice to say, when presented with a problem the best way to proceed is with “BALANCE”. During this event, investors haven’t seen any of that on display.

So while we all wrestle with that debate today, there is another complication looming that may become a larger concern. A concern that will affect millions from the average individual looking to get their paycheck back to all of the people involved in managing their portfolios. From the active to the passive, from the self-managed to those run by money managers, all told the number is in the hundreds of thousands.

As the government moves closer to the decision of reopening the economy, it appears this will become a HUGE issue that will divide the country based on political affiliation. Instead of everyone pooling our vast resources and moving in the same direction with a common goal to help the majority of the citizens, the opposite has already started. Instead of using the heavy machinery at our disposal to pave the way to reopening the economy, roadblocks are already being put. The childish “bickering” is about to get worse and it’s a major concern for investors now.

This “political issue” has the chance to slow down the recovery to a crawl. The efforts to weaponize and politicize the virus will do major harm to the recovery. Let’s face it, this was going to be a difficult road without the petty bickering. It may be near impossible to traverse this road with the 20/20 hindsight from ‘the “experts” appearing every time we listen to the news or read an article on the topic. Thankfully most of us have plenty of toilet paper to clean up the mess that we are about to be exposed to.

It’s all about woulda, coulda, shoulda arguments that should be relegated to meaningless commentary; instead they are headlines. I surface this issue because if this continues on the present path, there is little doubt the stock market can stay resilient for long. Regardless of where a person falls on this debate, the obvious conclusion is there is no ONE clear cut answer and probably never will be. It’s time to deal with reality and compromise.

Investors need to step back and block out this noise and watch what the stock market is telling them. The headlines are something neither you nor I can control. We played the cards that were dealt out in the past, and we play the cards that are dealt out now. In this environment do NOT lose sight of the fact that markets tend to overreach. The decline wasn’t typical, the rebound may take on the same attributes.

There is little reason to change the mindset that was mentioned last week:

“For anyone with a time frame longer than six months to a year, I cannot help but feel that they are getting an enormous opportunity to buy great companies and what will turn out to be bargain prices.”

As always there are many ways to navigate the investing scene at any given time. In this environment today one of the better ways is to stay BALANCED. It’s nice to own stocks that are making new highs after a 34% market decline less than 4 weeks ago.

Please allow me to take a moment and remind all of the readers of an important issue. I provide investment advice to clients and members of my marketplace service. Each week I strive to provide an investment backdrop that helps investors make their own decisions. In these types of forums, readers bring a host of situations and variables to the table when visiting these articles. Therefore it is impossible to pinpoint what may be right for each situation.

In different circumstances, I can determine each client’s situation/requirements and discuss issues with them when needed. That is impossible with readers of these articles. Therefore I will attempt to help form an opinion without crossing the line into specific advice. Please keep that in mind when forming your investment strategy.

to all of the readers that contribute to this forum to make these articles a better experience for everyone.

to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

Members of the Savvy Investor Marketplace service get straight forward advice and client satisfaction is always a priority. A difficult stock market environment for sure. At one point a 34% decline in prices. However, IF you don’t have stocks making new all-time highs, you need to review your strategy.

Everyone wants to know what is next after the 26+% rebound rally. I employ a time tested strategy that formulates decisions with a HIGH probability of occurring. It is modeled to include analysis of historical trends, “Elliott Wave” and both short/longer-term technical indicators.

The time to join is now.

Disclosure: I am/we are long EVERY STOCK/ETF IN THE SAVVY PLAYBOOK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am short the VIX using ETFs.

This article contains my views of the equity market, it reflects the strategy and positioning that is comfortable for me.

IT IS NOT A BUY AND HOLD STRATEGY. Of course, it is not suited for everyone, as each individual situation is unique.

Hopefully, it sparks ideas, adds some common sense to the intricate investing process, and makes investors feel calmer, putting them in control.

The opinions rendered here, are just that – opinions – and along with positions can change at any time.

As always I encourage readers to use common sense when it comes to managing any ideas that I decide to share with the community. Nowhere is it implied that any stock should be bought and put away until you die.

Periodic reviews are mandatory to adjust to changes in the macro backdrop that will take place over time.

Be the first to comment