Rainer Puster/iStock via Getty Images

The Trade Desk (NASDAQ:TTD) is one of the leaders in the fast-growing ad tech market. So far, the company has been delivering for customers with its programmable buy-side advertising platform. However, TTD has not been spared from 2022’s bear market and is down close to 30% YTD. Moreover, the company’s revenue growth has declined in the last six months, largely due to the slowdown in the cyclical digital advertising sector.

The ad tech industry TTD operates in is extremely crowded and rapidly evolving, making picking long-term winners challenging. While I like the company’s business model, the threat of competition is a prominent risk factor. Given the disjointed industry structure, it remains unclear whether TTD will be able to build a durable economic moat in the coming years. Moreover, at today’s rich valuation, there is little in the way of a margin of safety if The Trade Desk’s high growth narrative fails to play out as expected. In this article, I outline the bull and bear case for TTD and my thoughts on the company’s value proposition and future returns/growth outlook. Let’s dive in

Industry overview

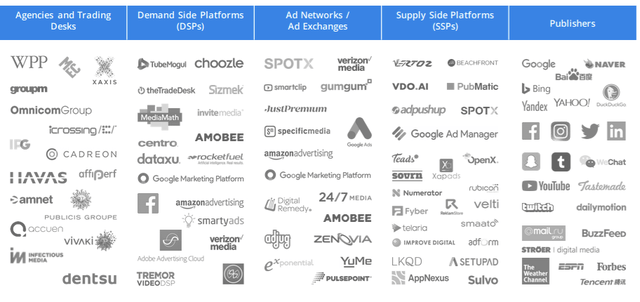

The digital advertising industry consists of 1. buyers (advertisers), 2. sellers (websites with ad inventory), and 3. Marketplaces (intermediaries who match buyers and sellers).

Digital Adverting Industry Breakdown (Statista Digital Advertising Report, 2021)

The digital advertising industry is going through disruptive change. As digital media grows, audiences and ad supply are becoming more fragmented. The growing long tail of mobile applications, streaming services and websites make it challenging for advertisers to reach a large target audience. These trends have created opportunities for companies such as TTD to implement automated ad-buying technology that enables fast, efficient and price-effective media-buying options for advertisers and their agencies.

Business & Revenue Model

The Trade Desk is an exclusive programmatic buy-side digital advertising platform that gives advertisers direct access to over 15,000 digital advertising publishers. TTD’s self-service, cloud-based platform allows ad buyers to create and manage data-driven digital advertising campaigns across various formats. These include display, video, audio, native and social, on devices such as computers, mobile and connected TV (CTV). TTD’s software integrates with major inventory, publisher and data partners. The company’s APIs also allow clients to develop customized applications on top of the platform.

The company’s customers are primarily large advertising agencies and other service providers – TTD enters into ongoing master services agreements (MSAs) with these customers. To monetizes its clients, TTD charges a platform fee based on a percentage of a client’s total spend on advertising. Additional revenue is generated by providing data, other value-added services, and platform features.

Why I like The Trade Desk

1. Omnichannel and cross-device ad-buying capabilities

Uniquely TTD offers programmatic ad buying across all media channels and devices. This is attractive for advertisers as it increases the reach of their ad campaigns and allows more data to be captured from different audiences. Moreover, TTD’s platform allows clients to acquire data from numerous third-party vendors seamlessly and efficiently. This enables advertisers to measure the effectiveness of their ad campaigns. By offering a broad selection of third-party measurement partners, clients have increased optionality to assess campaign performance.

Over time TTD’s services will become more valuable as it adds more ad exchanges, third-party data providers and publishers to its platform. In its short operating history, TTD already obtains adverting inventory from 105 integrated ad exchanges and supply-side platforms and sources third-party data from over 200 vendors. In an increasingly fragmented media environment, this broad access is extremely valuable to advertisers wanting to maximize their return on investment.

2. Rapid growth in adverting for streaming services

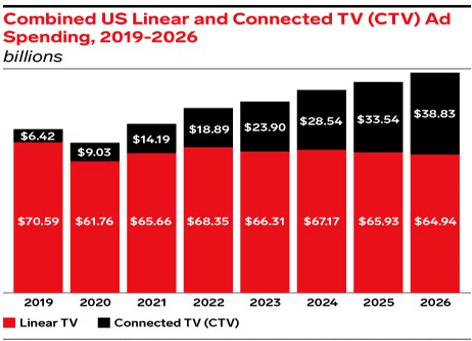

Today Television is the largest category of advertising spending; however, the way people are consuming entertainment is rapidly changing. Currently, there is a considerable shift from linear TV to streaming services and connected TV. In 2022 50% of consumer watch time was allocated to streaming services. By contrast, TV advertisers directed only 22% of their TV ad budgets to streaming.

Linear vs Connected TV Ad Spend (eMarketer)

This gap between viewership and ad spending is stark. Moreover, streaming services (e.g. Netflix, Paramount) are developing additional ad-supported tiers to their platforms. This means that over the next 3-5 years, we will see a massive influx of ad dollars flow into streaming services and connected TV.

Why does this matter for TTD?

Connected TV advertising has become a meaningful component of The Trade Desk’s business focus over the last two year. Investing heavily in CTV publisher agreements and growth initiatives, TTD now has exposure to over 120 million connected TV devices in the US alone. The company has also stated that CTV will be a key investment focus for the foreseeable future. Subsequently, TTD is well positioned to benefit from the inevitable surge in adverting demand across CTV platforms over the next 3-5 years.

3. Strong relationships with customers and ad suppliers

TTD’s scale is one aspect of its competitive advantage. When deciding which adverting platforms to partner with, sell-side publishers inherently choose the buyers with the largest customer base to maximize their ad inventory revenue. As a first mover in the programmatic ad-buying space, TTD has built a customer base of close to 1000 enterprise clients, each representing hundreds of individual advertisers. Scale has allowed the company to establish robust relationships with publishers and third-party data providers and increases the barriers to entry for smaller ad-buying competitors. This makes it challenging for new entrants to offer comparable advertising options.

Moreover, TTD’s platform is inherently sticky as the company’s real-time analytics, performance optimization, and predictive models integrate directly into the client’s ad campaign. Subsequently, this creates high switching costs. Expanding the number of relationships with publishers and third-party data providers creates a strong flywheel effect. Invariably this should lead to more publisher agreements, greater customer loyalty and an inflow of new customers.

Counter Thesis

1. Competition

The ad tech market is hotly contested and rapidly evolving. In the connected TV sector, Roku (ROKU) currently holds a commanding presence and stands out as a key threat. Today, 40% of US streaming in done via Roku. Roku’s acquisition of demand-side ad-buying platform DataXu means that ad-buyers wanting to advertise on Roku TVs must exclusively use DataXu’s platform to do so. Subsequently, this eliminates a large percentage of the CTV market competitors such as TTD can buy inventory from. Other notable competitors include Google and Meta Platforms. These players command a considerable share of the buy-side ad tech market. Google is one of TTD’s largest advertising inventory suppliers, yet it is also one of its largest competitors. In the future, as TTD grows, google may limit the company’s access to its advertising inventory to bolster demand for its own buy-side ad platform (Google Ad Manager).

2. Concentration risk

As noted in its FY2021 annual report, TTD’s two largest clients represent 20% of the company’s gross billings. Subsequently, a loss of these customers would severely impair the company’s future revenue growth. Moreover, TTD’s revenue is highly dependent on the total ad spend of its customers. If this were to decline due to macro or other external factors, TTD would be financially impacted. Moreover, advertisers may choose to switch from those that utilize TTDs platform; such actions will again negatively impact the company’s top line.

3. Valuation Risk

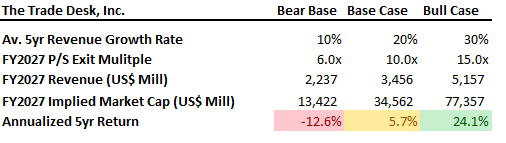

As I mentioned before, while I like TTD’s business model, valuation stands out as a key risk factor to the stock’s future returns. At Today’s lofty valuation, the market has not factored in the inherent uncertainty and cyclicality of the fragmented ad tech industry. Inherently the market has priced in quite aggressive future growth assumptions for TTD at its current 18.7x P/S multiple. The company will likely experience significant multiple compression if these assumptions fail to play out. Below I have laid out some very high-level 5yr year return scenarios for the company.

5 Year Return Scenarios (OJRB Investment Research)

As you can see, my base case scenario, which assumes 20% annual revenue growth and a 10x P/S multiple, implies that TTD will generate a below-market annualized return of approximately 5.7%. As such, I wouldn’t be comfortable buying the stock at today’s price.

Conclusion

In summary, The Trade Desk is a quality company with a lot of growth potential. While the digital ad tech industry is highly competitive, the company is building a defensible edge over its competitors. However, with the sector highly cyclical and constantly shifting, it is hard to determine where the company will land in the next 5-10 years. Subsequently, I believe the company’s stock price is too high at US$54 per share given the industry it operates within. As for a recommendation, I think a “hold” strategy would be most appropriate.

Be the first to comment