Andrew Burton

Alibaba (NYSE:BABA) dropped below $60 recently, its lowest point since going public in 2014. Alibaba’s stock has been battered due to various transitory reasons in recent years, bringing its peak to trough share price decline to a whopping 82%. However, despite the temporary setbacks, Alibaba remains one of the world’s most prominent and promising companies. In addition, Alibaba has significant growth prospects and remarkable earning potential. Meanwhile, its share price has been sold down to incredibly cheap levels. The Chinese uncertainties are fading, and Alibaba’s stock will likely go much higher in future years. Furthermore, the bottom may be in for Alibaba, and the company will report earnings in several days. Better-than-expected results could send shares substantially higher soon, making Alibaba a high-probability success story in the immediate, intermediate, and long term.

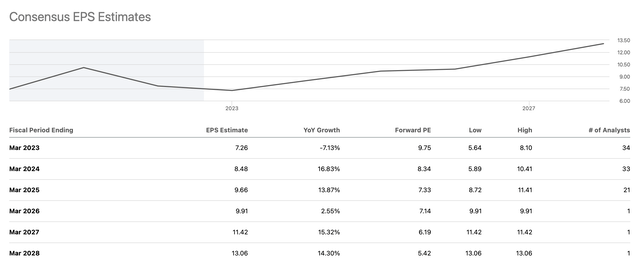

Alibaba’s Technical Image

3-Year Chart

Peak to trough ($320-$58), Alibaba’s stock declined by a staggering 82%. The e-commerce giant is trading like the company is going out of business, while nothing could be further from the truth. The recent $58 low is around Alibaba’s post-IPO low in 2015 and marks a highly shallow point for the company’s stock price. We also saw the CCI fall below -200 and the RSI dip below 30 recently, illustrating oversold technical conditions. Also, there may be a limit to how much selling could occur in Alibaba’s stock. This stock has been battered senselessly for about two years, and seller exhaustion could be setting in. We may have seen shares bottom at the extreme low, around $58. Alibaba’s stock should stabilize around current levels, recover, and move higher as we advance.

Zero COVID: It’s a Matter of Time

Despite rising cases, China is relaxing its COVID-19 restrictions. There is increasing fatigue over lockdowns and travel limitations in the country of more than 1.4 billion people. Moreover, COVID-related constraints have significantly affected China’s economy. Therefore, it isn’t surprising that we see China’s government act by loosening quarantine constraints and other measures. The slight policy easing implies that China may continue to cut down on harsh COVID-related regulations and that the government remains highly conscious regarding the well-being of China’s economy. Reducing drastic government-imposed measures benefits the Chinese economy and should help improve Alibaba’s price action as we move on.

China’s Huge Singles Day Shopping Festival

China’s Singles Day shopping festival just ended, and Alibaba got a big piece of the pie. It’s important to mention that Singles Day dwarfs Black Friday and Cyber Monday in terms of sales volume. This dynamic should reflect positively on China’s biggest e-commerce platform. Citi analysts said they were conservatively forecasting Alibaba’s GMV to range from 545 billion yuan to 560 billion yuan ($75 billion to $77 billion) for the event, a growth of approximately 0.9% to 3.6% YoY.

Alibaba’s Valuation Is Ridiculous

Alibaba has a ridiculously low valuation, and this disconnect provides an excellent risk/reward opportunity. The company’s earnings should bottom at approximately $7.30 this year.

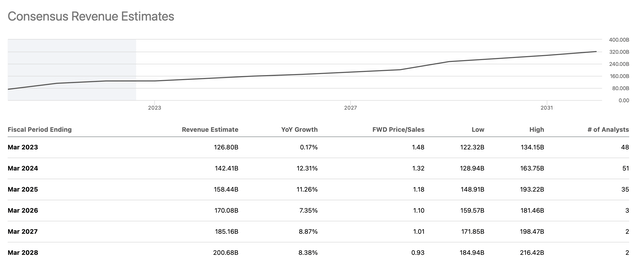

EPS Estimates

EPS estimates (SeekingAlpha.com )

After this low point, we should witness significant EPS growth in the coming years. Next year, Alibaba will likely report about $8.50 in EPS, illustrating roughly a 17% YoY growth rate. Considering that Alibaba’s stock price is only about $70 now, the company is trading at a rock bottom 8.3 times next year’s EPS estimates.

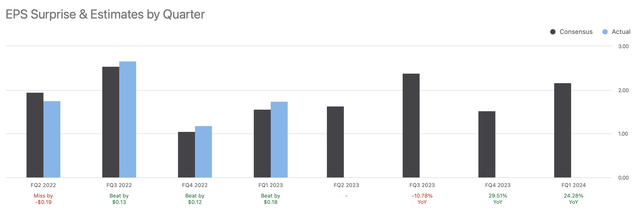

Revenue Growth Estimates

Revenue estimates (SeekingAlpha.com)

In addition to healthy EPS growth, revenue growth should persist, and the company’s sales will probably move much higher in future years. As the company moves forward, we should see annual revenue growth of 8-15%, and revenues should reach approximately $200 billion by fiscal 2028.

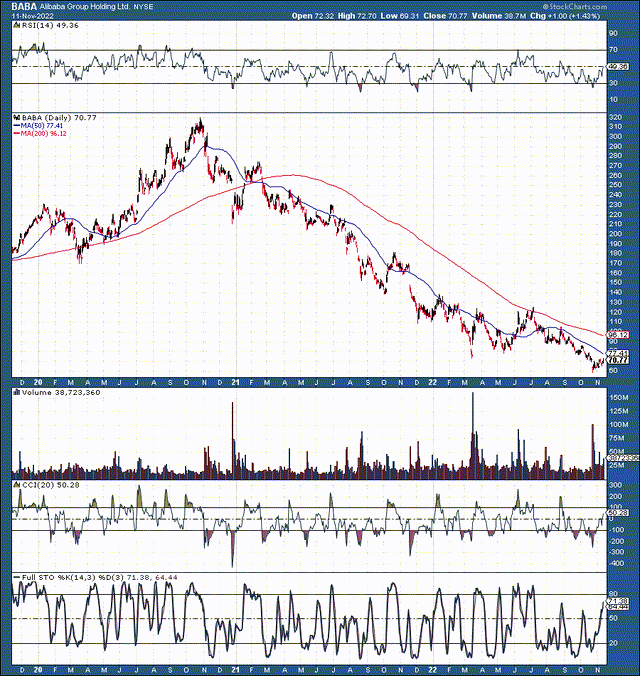

Alibaba is Accustomed to Beating

EPS surprises (SeekingAlpha.com)

Despite the negative sentiment and the slowdown in China’s economy Alibaba has surpassed analysts’ estimates in its last three quarters. EPS estimates may be too low now, and the company should continue outperforming estimates as we advance.

Wall St.’s Analysts

Price targets (SeekingAlpha.com)

The average one-year price target on the street is approximately $138, roughly 95% higher than Alibaba’s current share price. The minimal one-year price target is around $71, still higher than Alibaba’s November 12th closing price of $70.77. The higher-end one-year price target is about $218, roughly 207% higher than the company’s recent stock price. This dynamic implies that Alibaba’s shares got significantly oversold recently, and the stock price is probably deeply undervalued now.

Here’s what Alibaba’s financials could look like in future years:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Revenue Bs | $128 | $147 | $165 | $182 | $198 | $215 | $232 | $251 | $268 |

| Revenue growth | 1% | 15% | 12% | 10% | 9% | 9% | 8% | 8% | 7% |

| EPS | $7.30 | $8.50 | $10.21 | $12.25 | $15 | $17.50 | $21 | $25 | $30 |

| Forward P/E | 8.2 | 12 | 14 | 15 | 17 | 18 | 17 | 16 | 15 |

| Price | $70 | $122 | $172 | $225 | $298 | $378 | $425 | $480 | $520 |

Source: The Financial Prophet

Relatively modest revenue and EPS growth coupled with mild P/E ratio expansion should enable Alibaba’s share price to increase substantially in future years. Despite staying at a forward P/E ratio of 18 or lower, Alibaba’s stock price could appreciate to roughly $500 by the end of this decade. A $520 price target by 2030 equates to approximately 650% stock appreciation, making Alibaba a top candidate for a long-term investment.

Risks to Alibaba

While I’m bullish on Alibaba, various factors could derail my thesis for the company. For instance, the CCP could resume its tough stance and clamp down further on Alibaba and other Chinese tech giants. Moreover, despite the optimistic tone from Chinese authorities, U.S. regulators could still decide to delist Alibaba. Increased competition could impact Alibaba’s growth and profits. The company’s growth could be worse than my current anticipation. Also, Alibaba’s profitability could continue to struggle for various reasons. This investment has numerous risks, and shares are very cheap right now. I believe Alibaba remains an elevated-risk/high-reward investment, and investors should carefully examine the risks before opening a position in Alibaba stock.

Be the first to comment