Emir Memedovski

The VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (NYSEARCA:EMLC) provides exposure to a unique segment of high-yield fixed income. In this case, bonds issued by emerging market governments denominated in their local currencies are subject to credit risk, but at a reduced level compared to corporates from the same country. The underlying bonds in the fund also face FX risk which adds a layer of volatility.

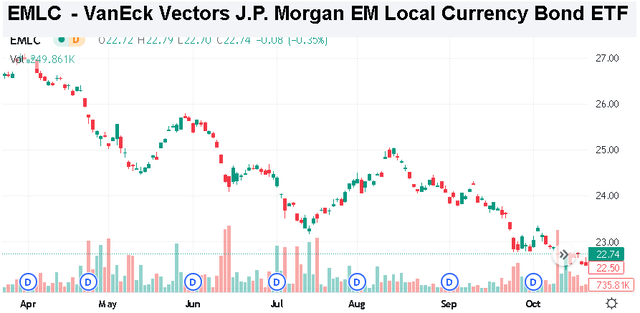

Indeed, EMLC has lost nearly 20% over the past year amid the global trend of rising interest rates and the strong Dollar. Concerns over a broader economic slowdown across both emerging markets and developed economies have also pressured sentiment toward the segment. That being said, we see the current level as presenting a good buying opportunity with signs both interest rates and the Dollar can reverse lower or at least stabilize from here. We also like EMLC as a compelling income vehicle considering the +7% yield distributed through a monthly dividend.

What is the EMLC ETF?

EMLC technically tracks the “J.P. Morgan GBI-EM Global Core Index” which includes both fixed and floating rate securities issued by emerging market sovereigns and quasi-sovereign entities. The index prioritizes liquidity, focusing on issuances with at least $1 billion in outstanding face value with at least 12 months to maturity. The index constituents feature a market capitalization weighting methodology at the individual bond issuance level.

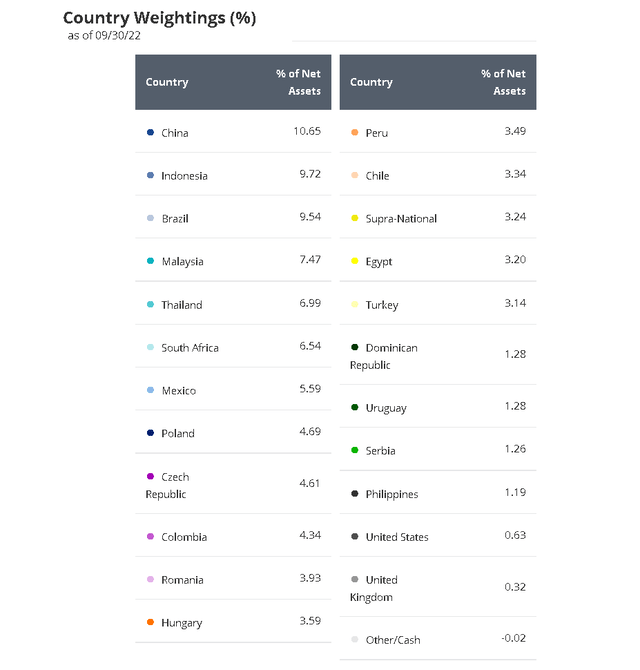

As it relates to EMLC, China has the largest representation by country at 11% in the fund. Indonesia and Brazil bonds are at around 10%, followed by Malaysia and Thailand at 7% each rounding out the top 5 countries. Overall, there is good global geographic diversification in the strategy.

The EM classification by country is based on income metrics thresholds for three consecutive years published annually by the World Bank. This is important because the term emerging markets have some ambiguities or even controversies in terms of the classification by other measures.

We bring this up because the composition by countries overall is relatively unique compared to other EM indexes. For example, South Korea is not considered an EM for the purposes of this fund while Indian sovereign bonds are not included due to liquidity constraints.

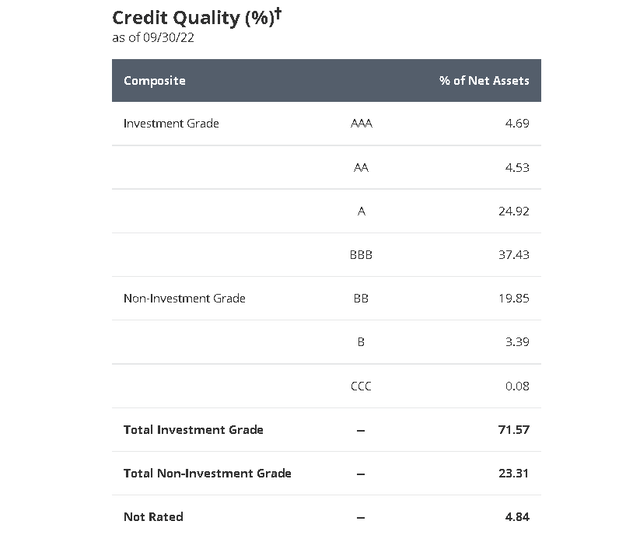

What’s interesting about EMLC is that despite its “high yield” profile, the portfolio is tilted in investment grade issuers at 72% of the holdings. This includes countries like China rated ‘A+’ by Standard & Poor’s and Chile with an ‘A’ rating on the Fitch scale. On the other hand, countries like Brazil at ‘BB-‘ or Egypt at ‘B’ have “junk status” on a relative basis, while offering higher yields.

Keep in mind that these sovereign credit ratings refer to each country’s external debt issued in foreign currencies like the Dollar. The understanding is that the local currency-denominated debt is not at the same risk of default because each government can simply print more money to pay off obligations in local debt.

Still, there is a relationship in the corresponding market yields based on fundamental and macro factors like debt to GDP levels, public deficit trends, inflation expectations, and the strength of their respective economy. These are the types of factors that drive the credit spreads against a risk-free benchmark like U.S. Treasuries.

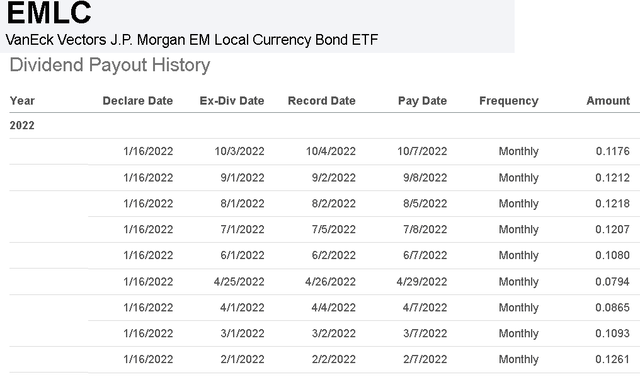

We mentioned the fund’s monthly dividend. The fund manager historically sets the distribution schedule at the start of the year while each monthly payout is variable based on the underlying bond portfolio coupon payments and interest income. Over the past year, EMLC has distributed $1.36 representing a 6% yield on a trailing twelve-month basis.

That said, VanEck published a higher “SEC Yield” at 7.7% which is meant to normalize the most recent distributions. As market rates have climbed the portfolio gets turned over as underlying bonds mature, the allocations are made into securities with a higher yield to maturity that naturally drives the interest income higher. By this measure, investors picking up EMLC today can expect a higher yield as the underlying income climbs relative to the cost basis.

Bullish on EMLC

A couple of things need to happen for local currency EM sovereign bonds to regain positive momentum and break out higher. First, it will be important for the U.S. Dollar to reverse lower as support of foreign currencies. We’re watching the U.S. Dollar Index which has favorably pulled back from its cycle high in September, down around 5% from its high.

The idea here is that even as the Fed is hiking rates with hawkish monetary policy messaging, the theme is global with Central Banks worldwide also moving in the same direction. Notably, the European Central Bank hiked its reference rate by 75 basis points this week. In EM, Brazil’s Central Bank for example has hiked the policy rate by over 600 basis points in the past year as part of its inflation-hiking efforts. The result is that even as higher rates in the U.S. add to Dollar strength, the interest rate differential impact is balanced against higher rates in foreign currencies.

On this point, some sort of stabilization is U.S. Treasury yields would also be supportive to EM bonds. Here, the next steps will largely depend on U.S. inflation data over the next couple of months as it relates to the need for further Fed tightening. Some confirmation that the CPI has peaked and will trend lower going forward could be reflected in a broader Dollar selloff as positive for emerging markets.

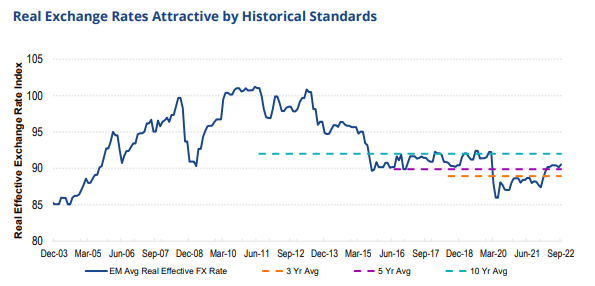

This is a dynamic captured in “real exchange rates” which adjusts for the effects of inflation and currency yields. VanEck notes that EM currencies, including those with exposure in the EMLC fund, are at historically attractive levels, below their 10-year average, as a tailwind for EM bonds.

source: VanEck

Finally, the other aspect of EM bonds that we like is the general exposure to trends in commodity pricing. Going back to the portfolio with bonds from countries like Brazil, South Africa, and Chile as major exporters of natural resources; high pricing for energy and metals often translate into stronger external account metrics and trade data. In many ways, these countries benefit from some of the inflationary aspects that are more damaging to developed economies.

In terms of risks, we can bring up a deeper deterioration of the global macro outlook or a significantly stronger Dollar opening the door for more downside in EMLC. Expect volatility to continue, but a small allocation to the fund at the current level can capture compelling value with a bullish outlook.

Final Thoughts

EMLC is a high-quality fund that can work in the context of a broader portfolio for income diversification and exposure to an important corner of the market most investors skip. Putting it all together, the headlines have been poor but emerging markets are an area that is well positioned to recover with room for EM bonds to lead higher. Over time, we see it as a great way to trade a weaker Dollar going forward which will add to the fund’s return potential.

Be the first to comment