KLH49/iStock via Getty Images

After releasing an operating update on 1/18/23, Innovative Industrial (NYSE:IIPR) dropped about 16% on the 19th. I think it will fall much further as time goes on. Much of their report can be described as kicking the can down the road and throwing good money after bad. This article will dig into the real estate fundamentals and explain why I think this is just the tip of the iceberg of missed rent.

Here are their statements about rent collection.

Rent collection for IIP’s operating portfolio (calculated as base rent and property management fees collected over contractually due amounts) was as follows:

- 92% collected as of today for the month ending January 31, 2023 (including approximately $324,000 of a security deposit applied for payment of rent for IIP’s lease with Holistic Industries Inc. (Holistic) at IIP’s Michigan property and receipt of the full rent payment from Sozo Health, Inc. (Sozo))

- 94% collected for the three months ended December 31, 2022 (including approximately $541,000 of security deposits applied for payment of rent for IIP’s lease with Sozo); and

- 97% collected for the year ended December 31, 2022 (including an aggregate of approximately $2.7 million of security deposits applied for payment of rent for IIP’s leases with Kings Garden Inc. (Kings Garden) and Sozo).

Eating security deposits does not count as collecting rent. Actual collection figures should be substantially lower.

Sometimes tenants run into a bit of operational trouble. It happens in every industry and most REITs at some point in their operations have periods where tenants default on leases. These defaults in themselves are not the problem. It is IIPR’s acquisition process that makes defaults so dangerous.

Not all defaults are created equal

Earlier this month I wrote about the concept of the value of a tenant to the landlord. In that article I explained that if properties are fungible and the rent being paid is approximately market rent the landlord is unlikely to be adversely affected by tenant default. The REIT can re-lease the space at similar rates and might incur some minor leasing expenses in doing so, but overall it’s not a big deal. I then went on to suggest that for IIPR specifically, loss of tenant is a devastating event. There are 3 aspects specific to IIPR that make tenant troubles exceedingly dangerous.

- Leases are dramatically above market rates

- Property values are a fraction of prices paid

- Properties are not fungible at that price point

This all boils down to IIPR’s sale leaseback strategy functionally baking loans into the leases.

Over 90% of IIPR’s properties are industrial. They are located in the following areas.

S&P Global Market Intelligence

In premier locations, industrial warehouses cost about $100 per foot. In these locations you can buy warehouses for $50-$70 per square foot. Here is the line from IIPR’s press release that I found to be the most troubling:

Total invested / committed capital per square foot: $274.

So the warehouse itself is worth about $70 per foot. What is the other $200 per foot that IIPR paid for the sale leaseback?

Officially it is designated as landlord reimbursed capex on the property as these warehouses are outfitted to become growing facilities.

I think it is more accurately described as a loan that IIPR is paying to the tenant with hopes to make it back through rent over the very long lease terms. Here is the other troubling line of IIPR’s report:

Weighted-average lease length: 15.3 years.

So IIPR gives somewhere in the ballpark of $200 per square foot of TI or equivalent (tenant improvement allowances) on a $70 per square foot building. In exchange, IIPR gets rent that is many times higher than what is typically paid on an industrial property.

If the tenant pays rent for the full 15 year term, IIPR is made whole with a healthy profit on top. It is a fine business model if you have great tenants, but just like any other loan type of investment, you have to make sure the counterparty is good for the money.

This is what differentiates IIPR from other REITs. Most REITs invest in the property. The properties themselves are valuable such that the REIT does not rely on its tenants because the sheer value of the property allows the REIT to find new tenants and get paid rent.

IIPR instead chose a business model where it invests in its tenants. Remember the numbers from above: $70 per square foot for the building. $200 per square foot to the tenant for TI.

That makes IIPR extraordinarily reliant upon its tenants. If the tenants fail, that $200 is out the window.

Well, unfortunately the marijuana business is a rather fragile and nascent industry with inexperienced players and shaky financials. It was only a matter of time before at least some of the tenants ran out of money.

Back in June of 2022 I warned about the weakness of IIPR’s tenants. I was swiftly vindicated as on June 30th a large tenant, Green Thumb, had difficulties.

However, as time went on the market seemed to forget about the risk involved with IIPR and the stock continued to trade at a rather astronomical valuation relative to the value of its properties.

With the recent announcement, however, it seems as though the flood gates have opened. Tenant troubles can no longer be thought of as an isolated incident. It is industry wide with a large number of tenants failing to pay rent. Again from IIPR’s operations update:

As of January 18, 2023:

SH Parent, Inc. (Parallel) was in default on its obligations to pay rent at one of IIP’s Pennsylvania properties (approximately 2.9% of invested / committed capital).

Green Peak Industries, Inc. (Skymint) was in default on its obligations to pay rent at one of IIP’s Michigan properties under construction (approximately 2.7% of invested / committed capital).

Affiliates of Medical Investor Holdings, LLC (Vertical) were in default on their obligations to pay rent at IIP’s California properties (approximately 0.7% of invested / committed capital).

As of January 18, 2023, IIP had executed lease amendments to include cross-default provisions and/or extend lease terms in exchange for limited base rent deferrals for the following three properties:

One California property and one Michigan property leased by Holistic (approximately 1.8% of invested / committed capital in the aggregate):

100% of base rent to be applied from the security deposits held by IIP for the nine months ending September 30, 2023 with respect to the Michigan property and the eight months ending September 30, 2023 with respect to the California property, with pro rata payback of the security deposits over 12 months starting January 2024.

One Missouri property leased by Calyx Peak, Inc. (approximately 1.2% of invested / committed capital):

100% base rent deferral through March 31, 2023, with pro rata payback over the following 12 months.

The report goes on to detail how IIPR is still putting more money into these tenants.

Construction in progress: two properties (previously leased to Kings Garden), and an expansion project at a property where Kings Garden continues to occupy the property and pay rent, representing approximately 395,000 rentable square feet in the aggregate.

San Bernardino property (approximately 192,000 rentable square feet): IIP is actively evaluating alternative non-cannabis uses for the property due to market conditions in California and changes in the zoning of the property.

Cathedral City property (approximately 23,000 rentable square feet): IIP executed a letter of intent to lease the property and is negotiating lease terms with the potential tenant. There can be no assurance that IIP will lease the property on the terms anticipated, or at all.

I find the San Bernadino property to be particularly telling of the risks to IIPR as they are now trying to lease the property as a regular warehouse. Regular warehouses generate rent per foot of about $7 and as I am repeatedly pointing out IIPR is paying $274 per foot. $7 of revenue is prior to any expenses.

At that rate it will take a very long time just to break even.

Where is the bottom?

IIPR has consistently operated at fairly low leverage financing most of their acquisitions with equity. As such, I don’t see bankruptcy as a real concern here. However, if enough tenants stop paying rent the value of their leases goes away which leaves just the value of their properties.

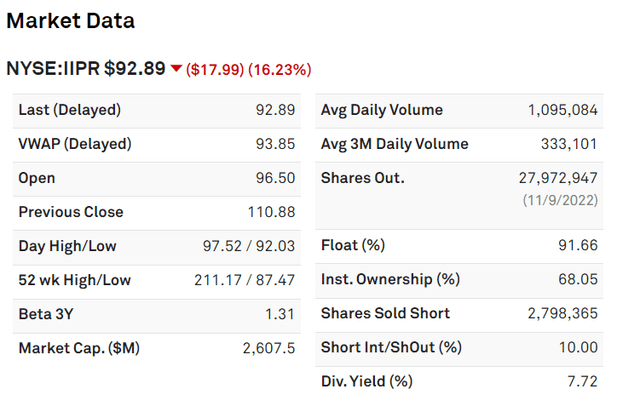

They have 110 properties with a total of 8.7 million rentable square feet. If they lose their marijuana related tenants these are just warehouses and would return to a warehouse valuation of about $70 per foot. That would be a property value of just over $600 million. That would be a rather significant drop from their current market cap of $2.6B

S&P Global Market Intelligence

I don’t think every tenant will default so perhaps they can retain some of the value of their leases, but I do think a significant portion will fail.

As such, the fair value of IIPR is somewhere between $600 million and $2.6B depending on the severity of the tenant default wave.

There is still time to get out

Even with the 16% or so drop since the operations update, IIPR remains substantially overvalued. There is still plenty of time to sell and move on to better things.

Perhaps capital would be better invested in a different industrial REIT that invests in its properties rather than its tenants. There is only one other industrial REIT that invests in tenants rather than property and that is LXP Industrial Trust (LXP). Otherwise, throw a dart, the choices are quite solid. Warehouses are performing well and industrial REITs broadly are undervalued.

Be the first to comment