Dzmitry Dzemidovich/iStock via Getty Images

Introduction

On March 30, I wrote a bearish article on SA about tin mining company Alphamin Resources (OTCPK:AFMJF) in which I said that it could be a good time for investors to trim or close their positions as high tin prices seemed unsustainable.

Tin prices are currently down about 30% from the record high of $49,500 reached on March 8, while the company’s market valuation has declined by 18% since my article came out. While I continue to think that tin prices are headed to $20,000 per tonne in the near future, I’m changing my stance on Alphamin to neutral. The main reasons for this include rumors about the company putting itself for sale as well as robust drill results coming from Mpama South. Let’s review.

Overview of the recent developments

They often say that the cure for high prices is high prices and as you can see from the chart below, tin prices have declined significantly since early March.

Trading Economics

Tin’s record prices earlier this year have encouraged several companies from the sector to invest in new projects and boost output. Among the latest global players to announce an increase in production rates was Malaysia Smelting, which is aiming for a 20% increase over the next few years. In addition, an economic slowdown in China, the world’s largest consumer of tin, is forecast to result in a decrease in demand for base metals in the near future. While some market experts think that tin prices are unlikely to return to pre-Covid levels anytime soon due to disruption coming from the invasion of Ukraine, I’m not so optimistic and I think we could see prices of below $20,000 per tonne by the end of 2022.

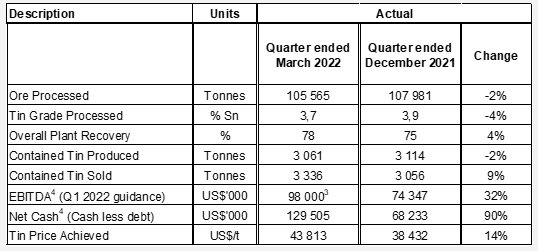

Turning our attention to what’s going on at Alphamin, I think the recent financial results of the company look good. In Q1 2022, the company’s Bisie project sold a total of 3,336 tonnes of tin concentrate, which is an improvement of 9% compared to Q4 2021. Thanks to a 14% increase in tin prices compared to December, Bisie’s EBITDA almost surpassed the $100 million mark in Q1 and this allowed the company to finish March with a net cash position of $129.5 million.

Alphamin Resources

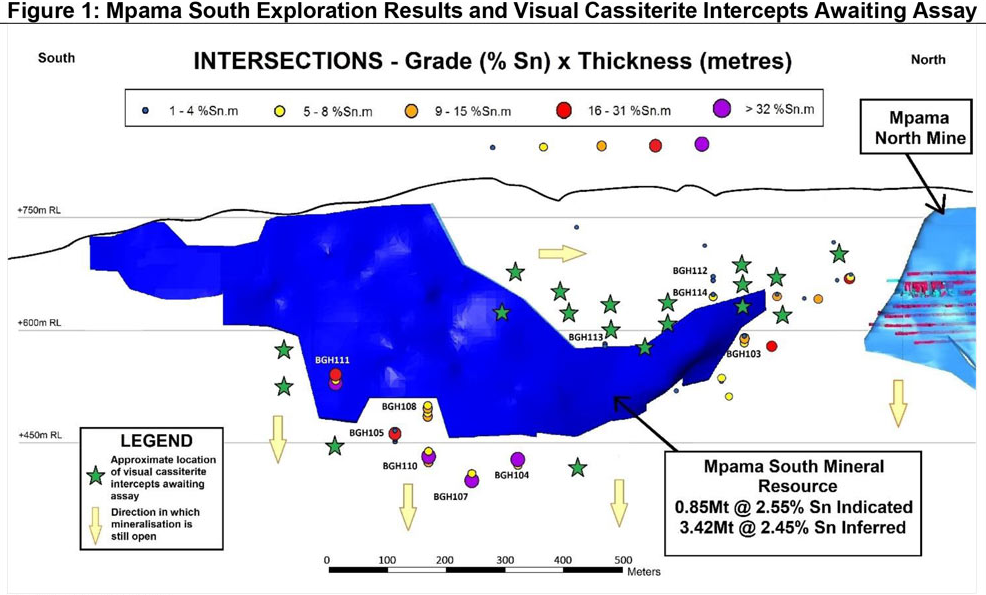

The net cash position is likely to be lower at the moment considering there was a $43.5 million DRC government corporate tax liability due for payment in April 2022. Also, Alphamin plans to invest around $20 million in exploration during this year, with a focus on expansion and infill drilling. Speaking of which, I’m impressed by the assay results coming from the Mpama South deposit as they’ve been consistently above 5% tin and Alphamin has intercepted high mineralization beyond the mineral resource boundary of the property.

Alphamin Resources

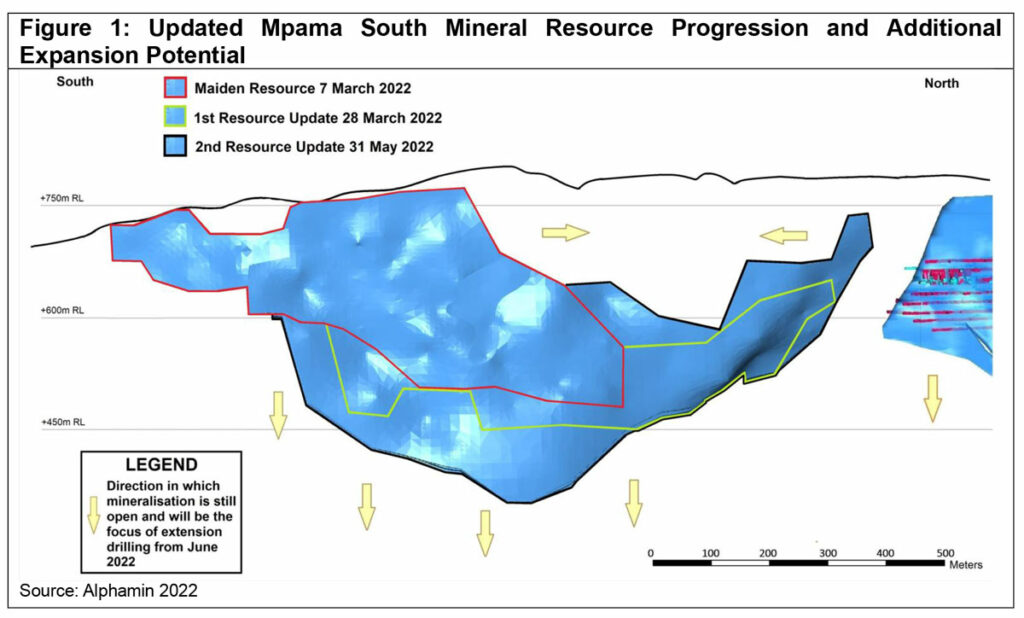

On June 3, the company revealed an updated mineral resource estimate for Mpama South, which showed a 46% increase in inferred resources to 4.99 Mt. The deposit is currently estimated to contain 21.4 kt of tin concentrate in the indicated category and 124.7 kt in the inferred category. The deposit remains open in multiple directions, and I think that the next resource estimate is likely to bring more sturdy growth.

Alphamin Resources

Alphamin recently said that the first tin production from Mpama South is targeted for December 2023. Considering that there’s a 20-month construction timeline for this project, the company needs to start building very soon. The estimated capital development cost for Mpama South is $116 million, which means that tin prices remaining high is crucial for Alphamin as the vast majority of its current net cash position should go into the development of this project. Yet, it seems possible that this could become someone else’s problem soon as there are rumors circulating in the media that Alphamin is seeking a buyer for its business in a bid to capitalize on high tin prices. The sale process was expected to attract interest from Chinese companies as well as private equity funds. The rumors came out in April and tin prices have lost about $7,000 per tonne since then but I think that there could still be interest from China as securing a significant market share of the global tin market could be more important than fundamentals for local state-owned firms. As a reminder, Alphamin currently accounts for 4% of the mined tin in the world and this figure will increase to about 6% with the commissioning of Mpama South.

So, how do you play this one? Well, I think that it could be best for risk-averse investors to avoid Alphamin’s stock. The majority of demand for tin comes from the electronics sector, where the metal is used for circuit board manufacturing. With high inflation and a global recession on the horizon, I think that tin prices are likely to come back to pre-pandemic levels before the end of this year. However, the market valuation of Alphamin could increase significantly if a Chinese company decides to present a takeover bid in the near future.

Investor takeaway

I view Alphamin’s Bisie project as the best tin mine in the world today and I’ve been bullish on the company’s stock since 2019. The recent financial and exploration results have been impressive, but the company doesn’t look cheap as its share price has increased more than 300% since my first article on it came out. And it seems that the world is heading for a recession which I think could push tin prices back to pre-pandemic levels.

However, short-selling seems dangerous as Alphamin could find a buyer soon. In November 2021, the company announced a strategic review to explore alternatives, including a potential sale. According to the media, the company has put itself for sale and this could attract interest from Chinese companies and private equity funds.

Be the first to comment