kmatija/iStock via Getty Images

The malaise that has befallen the financial markets this year has had countless impacts on various industries and sectors. Very little has worked this year, but one thing that has unequivocally not worked is any sort of growth-oriented stock. We generally think of tech, consumer discretionary, and the like for growth, but in real estate, there’s one superstar REIT that fits that bill as well.

Innovative Industrial Properties (NYSE:IIPR) is the fastest-growing REIT I’ve seen, and the potential is massive longer-term. However, the stock has lost two-thirds of its value during this bear market, and I think it’s overdone.

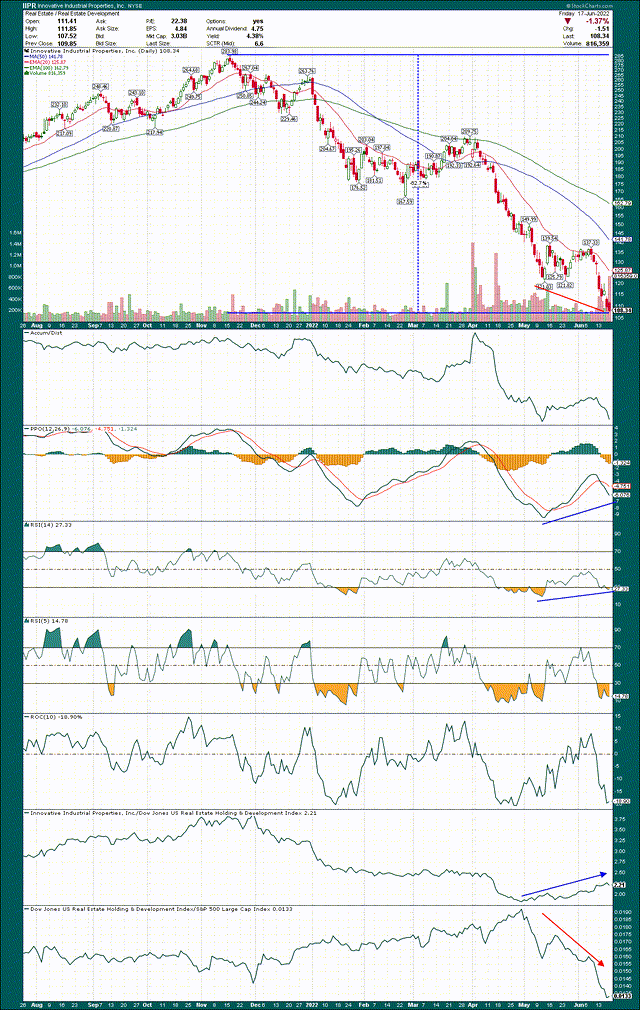

StockCharts

The daily chart above is obviously very ugly, as we’ve seen an endless downtrend since growth became out of favor on Wall Street. However, I happen to believe we’re not that far from growth coming back into favor, and if I’m right, IIPR stands to benefit enormously.

On the price chart, I’ve annotated the most recent relative low along with the positive divergences we’ve seen in momentum. Basically, when price is making a new low, but momentum is improving, we call that a positive divergence. While not a guarantee, it often portends a change in the dominant trend. This works in reverse as well, helping to call tops on securities that have rallied for a very long time. We have positive divergences in place for both the 14-day RSI and PPO, so that’s a very good start.

The 10-day rate of change is also extremely oversold at -19%, and IIPR is outperforming its peer group. To be fair, its peer group has been horrible, but I think that will change as well.

Spiking interest rates are never good for real estate companies because they tend to borrow very heavily to maximize returns. For anyone borrowing heavily, if your borrow rate goes from 2% to 5%, for instance, that greatly increases the cost of borrowing without any sort of commensurate gain in your ability to generate revenue. That’s what we’ve seen, and that’s at least part of the reason why REITs are getting pounded. However, IIPR, as I’ll show below, should be well insulated from this, and continues to deliver on its growth trajectory.

With this in mind, and what I believe looks to be the start of a bottoming process on the chart, IIPR should be much higher a year from now than it is today.

The growth case

IIPR is the first publicly traded REIT that is focused solely on the regulated cannabis industry. That means it has a first move advantage in the space, and given the way it has grown in the past couple of years, it has a scale advantage as well.

IIPR focuses on purchasing specialized industrial properties that it then leases to cannabis operators of various types. Cannabis operators with limited capital can take advantage of IIPR’s sale-leaseback program to preserve that capital and invest it in their business, rather than their space. It works, and I think it has the potential to fuel years of outstanding growth for IIPR.

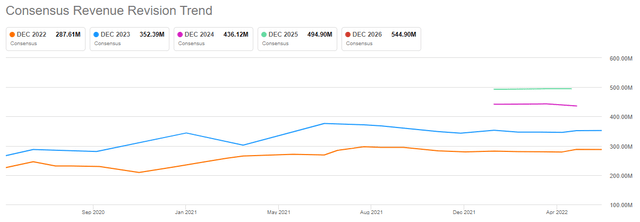

I’m not the only one that thinks IIPR will grow at high rates, as analyst estimates and revisions can be seen below.

Seeking Alpha

Estimates for this year have been essentially flat since last summer, while 2023 estimates have come down somewhat. This has undoubtedly contributed to IIPR’s share price decline because when growth companies start seeing lower revisions, the bullish shine fades quickly from the stock. Just ask any software company that has seen their stock decimated this year.

The point is that these estimates look very stable, and I don’t see any fundamental reason why we should expect further downward revisions. Given the valuation of the stock – which we’ll get to below – that should be plenty good enough.

We’re also looking at massive growth in the top line year-over-year, which is something I’m not sure market participants realize given how the stock has performed. Revenue growth is set to 40% this year, and 20%+ in each of the next two years. I’m not sure what else you could ask for but that looks good to me.

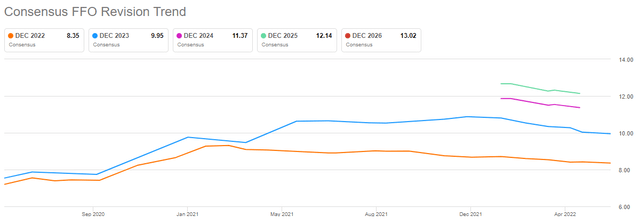

Another contributing factor is the decline in FFO estimates, which look less stable than the top line, to be fair.

Seeking Alpha

This isn’t a good situation for the bulls and reflects expected waning profitability on revenue, indicative of lower margins. While IIPR may face higher funding costs in the future, I’m not seeing any sort of cause for alarm.

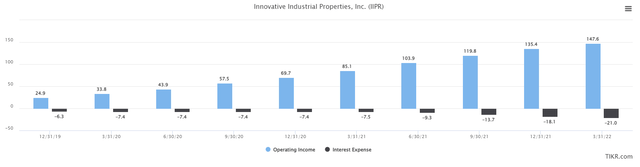

I like evaluating interest expense against operating income, because if we know the company’s liability against its ability to produce earnings against that liability, we can assess sustainability of the debt. To do this, I’ve plotted operating income on a trailing-twelve-months basis along with interest expense both in millions of dollars.

TIKR

Interest expense is certainly rising, but that’s because IIPR is growing rapidly, and some of that is due to issuing debt as a capital base. There is nothing inherently wrong with this unless it’s overused, but that is certainly not the case here. Interest expense was only 14% of operating income in the most recent TTM period, which is very low for any company, but extremely low for a REIT. In other words, if IIPR has seen lower estimates and lower valuation because of spiking interest rates – which I believe it has, along with the rest of the REITs – those fears are unfounded based upon the facts.

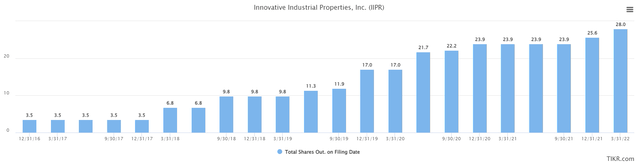

Of course, IIPR dilutes shareholders via common stock issuances, as is the case with most REITs. One recent dilution was to swap debt for equity with noteholders, which I’m not a big fan of.

TIKR

The impact is that it becomes more difficult to grow AFFO-per-share over time, and don’t forget that when IIPR issues shares, the dividend becomes more costly as well. That can mean the actual cash outlay is actually greater when shares are issued than it would be if the debt were just rolled into a longer maturity. However, this is what management has chosen and it is something to keep in mind if you want to own this stock; you’ll be diluted over time, and you won’t know by how much until it’s already occurred.

Despite this, IIPR’s pace of acquisitions continues to fuel big leaps in revenue year-over-year, and given the strength of the balance sheet, and the highly profitable model IIPR employs, I have little reason to think that will change. The poor performance of the stock this year is a gift to new buyers, and below I’ll detail why I believe that to be the case.

Valuation screams ‘buy’

Let’s begin the valuation discussion by taking a look at price/AFFO, which is below for the past three years.

TIKR

IIPR’s P/AFFO is down to just 11.8X on a forward basis, which is very near the COVID panic low from two years ago. Keep in mind that in the past two years, IIPR has grown by leaps and bounds, and has proven unequivocally that its model works. It has two more years of expertise and acquisitions under its belt, but trades for nearly the same trough multiple.

I’m not suggesting we see 40X FFO again, but 20X? Absolutely. In a growth-oriented bull market we could even see 25X FFO again without much of a stretch. We’re less than half that today, so the point is the risk on the valuation is very much to the upside.

Given we’re looking at a REIT, price-to-book is a relevant measure, and I like tangible book value because it strips out goodwill and other nonsense and gives us only real assets and liabilities.

TIKR

IIPR’s P/TBV is also very near COVID panic lows at just 1.7X today. The average for this period is near 3X, and just like P/AFFO, we could (and should) see a reversion back to the mean. That would provide for a ~75% upside scenario, similar to the P/AFFO multiple.

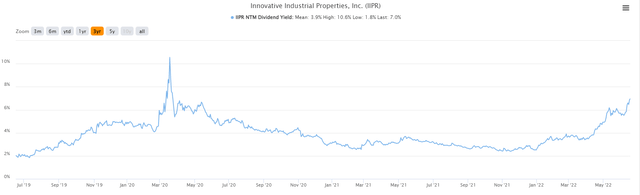

Finally, one thing I haven’t mentioned is the yield, because for most of IIPR’s time as a publicly-traded company, its yield has been fairly small. However, today the yield is 7.0%, which is almost unbelievable.

TIKR

This company has raised its dividend over and over again in its relatively short history, and today, you can reap the benefit of that by owning a premier growth stock and get a gigantic yield to boot. I don’t typically base my recommendations off of dividend yield, but it’s difficult to ignore in this case.

In addition, as a valuation tool, the dividend, like the others we looked at, is saying very clearly that IIPR is undervalued. The average yield is under 4%, and we’re at 7% today, once again lining up with the other valuation methods to say there’s massive upside potential today.

Final thoughts

IIPR’s business is unique, especially in a sea of also-ran REITs that have extremely similar business models. IIPR has found a niche that is affording it huge growth, with many years of runway remaining. In addition, the growth stock pummeling that has occurred this year has made IIPR far too cheap by any valuation metric you choose.

I see P/AFFO, P/TBV, and the dividend yield all pointing to ~75% upside just from the valuation alone, irrespective of any growth the company can produce. I think the chart is showing early signs of a sustainable bottom as well, meaning we’ve got what is likely to be very near the best value you’ll be able to buy IIPR for years to come.

I’m targeting at run at $200 later this year, which would be ~85% higher than today’s price. While that sounds outlandish today, all we need is a reversion to the mean on the multiples we looked at. Twenty times forward earnings by the end of this year would be $200 ($9.95 X 20), and I see no reason that isn’t achievable. This is a golden opportunity to own what I think is the best REIT this market has to offer at an extreme discount.

Be the first to comment