Olga Tsareva/iStock via Getty Images

The whole cannabis space is so beaten down an investor can easily make the case for buying a multi-state operator (MSO) such as Jushi Holdings (OTCQX:JUSHF). The company has licenses in some of the biggest cannabis states in the U.S., but the MSO does lack crucial licenses in New Jersey and New York driving industry growth in 2022 and 2023. My investment thesis is still Bullish on the stock due to the dip in the stock while other opportunities for Jushi to grow haven’t changed.

Expansion, Expansion, Expansion

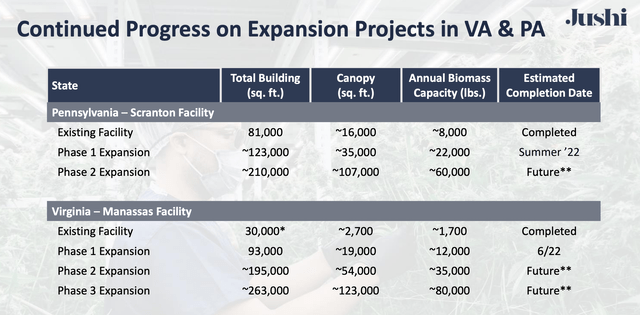

As detailed in the last piece on Jushi, the MSO was on a major canopy expansion plan to increase cultivation. The primary cultivation expansion comes in Illinois, Pennsylvania and Virginia.

Cultivation in Illinois doubled, while the following big expansion plans exist in Pennsylvania and Virginia. The company more than doubled the canopy sq. ft. in Pennsylvania with the Phase 1 expansion reaching 35,000 with a plan to triple canopy in the future. The Virginia facility is going from a canopy of only 2,700 sq. ft. to 19,000 leading towards a massive 123,000 sq. ft. in the future when the state approves recreational cannabis.

Source: Jushi Q1’22 presentation

The Virginia expansion will help fuel the opening of 3 new stores in the Q2/Q3 period, along with a greatly expanded medical cannabis program in the state. The program greatly reduces the friction for new patients and the state is already expected to launch recreational cannabis by the start of 2024, though the new Republican governor appears far more lukewarm regarding recreational marijuana.

Big Future

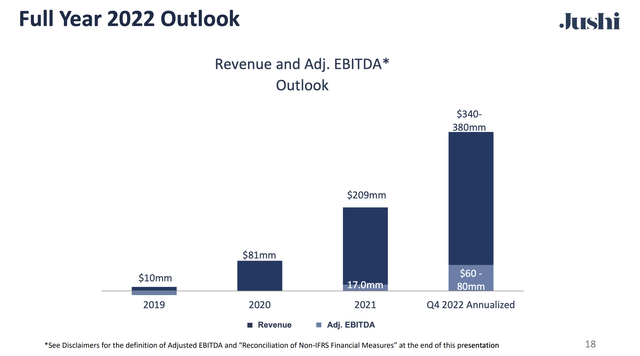

Jushi has crucial assets in states such as Illinois, Massachusetts, Ohio, Pennsylvania and Virginia. The MSO doesn’t have the flashy licenses in the Northeast outside of Virginia, but the company still forecasts revenues to surge to a $360 million annualized rate by the end of 2022.

Source: Jushi Q1’22 presentation

The Pennsylvania and Virginia recreational cannabis markets won’t even have launched this year, providing another major step up in sales in the future. Either way, the goal is to reach a quarterly run rate of $90 million during Q4’22.

Jushi has ~281 million shares outstanding for a market cap of $420 million. Not many stocks with this type of growth trade so close to the sales target. Analysts have the company quickly surging past those quarterly revenue targets to reach a 2023 sales target of $445 million for 45% growth.

Again, companies with those growth rates don’t trade below 1x sales targets. As with any MSO, Jushi has plenty of growth catalysts, including the launch of recreational cannabis in Virginia expected in 2024.

The company has ~$70 million in net debt and $140 million in total debt. The market is definitely not fond of any company holding debt, with the Fed hiking interest rates 75 bps for the first time since 1994 and promising far more hikes in the year ahead.

Jushi only produced Q1’22 adjusted EBITDA profit of $1.1 million. The market will want far better EBITDA margins in order to invest in this stock here. The larger vertical assets in Pennsylvania and Virginia will provide a solid margin boost leading to the goal for a $70 million EBITDA run rate in Q4, the equivalent of ~$17.5 million per quarter.

The MSO plans another $40 million to $60 million in capex for the rest of 2022 to further build out cultivation assets. The increased EBITDA levels will help offset any leverage concerns.

Takeaway

The key investor takeaway is that Jushi is far too cheap here, with a market cap dipping towards $400 million. At some point, another MSO will come calling to consolidate the business into a larger operation.

Just about any cannabis MSO will do at this point. Investors just need to get invested in the sector with stock valuations so low while the growth opportunity has not been altered. The company won’t like higher interest rates, but those rates and the collapsing valuations will restrict new investments in the sector, benefitting existing MSOs over the long haul.

Be the first to comment