da-kuk

Just because a company is growing rapidly does not mean that it represents a compelling opportunity for investors. It depends on the growth and it also depends on how shares are priced at the time and priced after factoring in the potential growth moving forward. A really good example of a company that has demonstrated significant growth recently but that is not exactly an ideal play for investors is RBC Bearings (NYSE:RBC). This enterprise, which produces highly engineered precision bearings, components, and essential systems that are used in the industrial, defense, and aerospace industries, has posted significant revenue growth and a massive improvement in its bottom line results. Previously, I found myself to be rather bearish about the enterprise. But in retrospect, I do think I was perhaps a bit harsh. Don’t get me wrong. I do believe that the stock is not exactly a great pick at this moment. But it likely does warrant a ‘hold’ rating at this time.

A change in expectations

In late September of this year, I set my sights on the question of whether or not RBC Bearings offered investors attractive upside down the road. In that article, I talked about the significant changes the company had undergone previously, the most significant of which was its acquisition of Dodge back in 2021. I found myself impressed by the company’s revenue growth, but I was also uncertain about its future prospects. Shares of the company also looked rather lofty at that time, leading me to be skeptical about the returns that investors might achieve. Ultimately, these thoughts coalesced into a bearish stance on the company that led me to rate the enterprise a ‘sell’ to reflect my view that shares should meaningfully underperform the broader market moving forward. So far, that call has proven to be fairly accurate. While the S&P 500 is up by 6.7%, shares of RBC Bearings have generated upside of only 2.9%.

Although my call on the company has been right so far, I am starting to change my mind on the business. Yes, in some ways, the stock does look rather pricey. But in other ways, the picture doesn’t look all that bad on a forward basis if recent financial performance can continue. To see what I mean, I need only point to the second quarter of the company’s 2023 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the enterprise. During that time, sales came in at $369.2 million. That’s 129.5% higher than the $160.9 million the company generated only one year earlier. The vast majority of this sales increase came as a result of the aforementioned Dodge acquisition. But even removing that from the picture, overall sales for the enterprise were up by 9.9% year over year, driven by an 11.4% increase in its aerospace and defense operations, combined with organic growth of 7.9% under its industrial operations. Management attributed the aerospace and defense side of the picture to a nice recovery in the commercial aerospace market, with sales there up 31.3% compared to the same time last year. Under the industrial umbrella, demand from the oil and gas industry also proved to be beneficial.

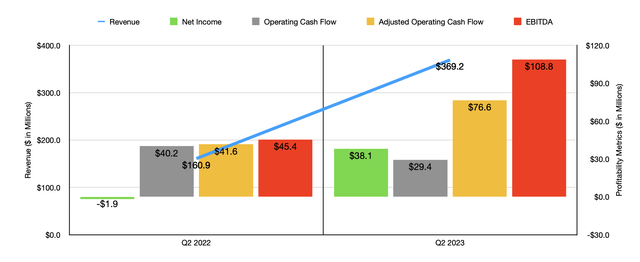

With this rise in revenue also came a massive improvement in profitability. The company went from generating a net loss of $1.9 million in the second quarter of 2022 to generating a profit of $38.1 million the same time this year. Other profitability metrics were mostly positive as well. Yes, operating cash flow fell from $40.2 million in the second quarter of 2022 to $29.4 million the same time this year. But if we adjust for changes in working capital, it actually would have risen from $41.6 million to $76.6 million. Also on the rise was EBITDA. That metric expanded from $45.4 million in the second quarter of 2022 to $108.8 million the same time this year.

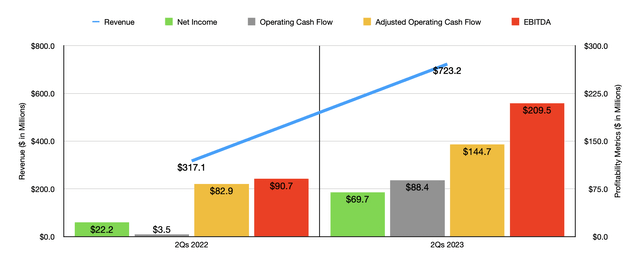

Thanks to this strong performance in the second quarter, the year-to-date results for the company are looking quite positive. Revenue of $723.2 million dwarfs the $317.1 million reported last year. Net income more than tripled from $22.2 million to $69.7 million. Just as was the case with the second quarter alone, operating cash flow is still lower year over year, having declined from $93.5 million to $88.4 million. But on an adjusted basis, the metric rose from $82.9 million to $144.7 million. And over that same window of time, EBITDA more than doubled from $90.7 million to $209.5 million. It’s also worth noting that backlog for the company continues to improve. In what should serve as a positive leading indicator. As of the end of the final quarter of 2022, backlog for the company was $603.1 million. By the end of the second quarter of this year, that metric had grown to $653.2 million.

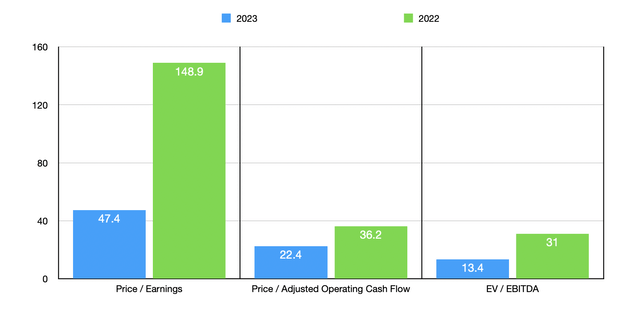

Although management has provided guidance for the third quarter this year, they have not provided much in the way of guidance for the entirety of the current fiscal year. If we simply annualize results experienced so far, we would anticipate net income of $134.1 million, adjusted operating cash flow of $307 million, and EBITDA of $615.6 million. Based on these numbers, the company is trading at a forward price-to-earnings multiple of 47.4. That’s astronomically higher than it likely should be. But it’s far better than the 148.9 reading that we get from 2022. The price to adjusted operating cash flow multiple should be, on a forward basis, 22.4. That’s down from the 36.2 reading that we get using data from last year. And over that same window of time, the EV to EBITDA multiple for the company has dropped from 31 to 13.4.

As part of my analysis, I did also compare the company to five similar businesses. On a price-to-earnings basis, the four companies with positive results saw their multiples range from 14 to 64. In this case, three of the four prospects were cheaper than RBC Bearings. Using the price to operating cash flow approach, the range was from 21.8 to 68.7. In this scenario, one of the five companies was cheaper than our target. And when it comes to the EV to EBITDA approach, the four companies with positive results ranged from a low of 12.4 to a high of 22.5. In this case, one of the companies was cheaper than our prospect, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| RBC Bearings | 47.4 | 22.4 | 13.4 |

| Pentair (PNR) | 14.0 | 21.8 | 13.4 |

| Donaldson Co (DCI) | 21.6 | 22.6 | 13.7 |

| Chart Industries (GTLS) | 64.0 | 68.7 | 22.5 |

| Symbotic (SYM) | N/A | 67.7 | N/A |

| ITT Inc. (ITT) | 19.2 | 29.0 | 12.4 |

Takeaway

Truth be told, I still remain cautious in my thinking when it comes to RBC Bearings. Its acquisition of Dodge has the potential to have significant positive impacts for the long haul. But how that ultimately turns out is something only time will tell. Right now, fundamental performance does look robust and backlog is quite large. I wouldn’t call the stock cheap by any means. Though from a cash flow perspective, it’s not exactly outrageously priced. In fact, using the EV to EBITDA approach, the shares look relatively affordable. Due to the historical volatility of the enterprise though, combined with how pricey it is in other ways, I do think that it may have some potential. Upon further reflection, I don’t believe the company warns the ‘sell’ rating I assigned it previously. But I would argue that it’s no better than a ‘hold’ at this time.

Be the first to comment