luoman

This is our last article about RADA Electronic Industries Ltd (NASDAQ:RADA). We rate the stock a hold despite, on October 19, 2022, RADA management and board members approved an Agreement and Plan of Merger with privately held America-based Leonardo DRS. It is a subsidiary of Italy-based defense products manufacturer Leonardo S.p.a. ADR (Pink Limited: OTCPK:FINMY).

Leonardo plans to spin off the couple in an IPO trading under the symbol DRS. For three reasons, the new shares will not pop in price and hold up to the benefit of current RADA shareholders, in our opinion.

The Merger

“Merger” is a meme enticing retail value investors to acquire shares. RADA’s board released a statement in June that Leonardo S.p.a. and RADA shareholders will own approximately 80.5% and 19.5%, respectively, on a diluted basis.

A word of caution: An ADR is an American Depository Receipt, i.e., a negotiable certificate issued by a bank that allows U. S. investors to purchase stock in overseas companies. Stock swaps from M&As have tax implications specific to countries of incorporation and countries of residence/citizenship of stockholders. Shareholders need to consult with accountants or tax attorneys about holding shares and buying additional issues, though DRS will be in an America-based corporation.

Merger Lethargy

Our first reason for downgrading our bullish rating of RADA to hold is the companies are minor operators in the humongous defense industry. Growth means beating the big competition for contracts. Leonardo S.p.a. ranked 21st as a prime contractor among the top 100 in 2020 for the U. S. DoD. It has a $4.5B market cap. RADA Electronic Industries has a $493M market cap. Similar defense companies each have market caps in the tens of billions of dollars.

None of the three governments publicly objected to the merger because these are not major players. This is probably because Israel, Italy, and the U. S. are strategic allies. Without controversy, news and financial coverage of the merger are rare and sentiment blanch. In addition, the 2022 IPO market has been a boom to bust. Rachel Gerring, IPO leader at EY Americas, tells CNBC, Investors are “looking for companies that are focused more on growth and profitability as opposed to the growth at all costs that we were seeing in 2021.”

Leonardo 5-Year Price (eekingalpha.com/symbol/FINMY)

Currently, there is no WOW! factor. We do not expect the new DRS shares to generate much attention, excitement, or investment to drive up the share price. Also, the environment for IPOs has risks.

Board members and officers of RADA are seemingly the greatest financial beneficiaries of the merger to date after voting bonuses and other rewards for executing the consolidation. They talk about a +30% premium for shareholders. At the time of the announcement, management expected the IPO shares to the price at $22 per share, raising ~$807M with a $3B valuation.

News of the merger in June caused FINMY shares to spike. They moved from $3.60 to $5.70, but the share price slipped back to $3.60 closing before Thanksgiving at ~$3.84. RADA shares went from $9.35 to $16.43 on the news but also are down.

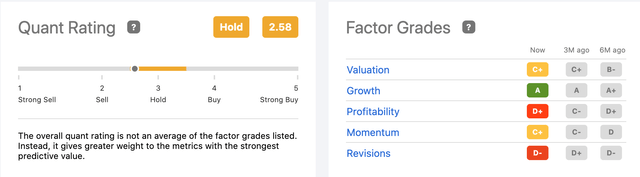

Seeking Alpha gave RADA shares a strong buy rating before the merger announcement. It slipped to hold at the end of May through July ’22 and wavered between hold and sell in August. SA tagged it mainly as a sell from August into November as the share price stumbled from the mid-teens to $9.58 per share; in November, the rating went to hold when the shares closed before Thanksgiving at $10.08.

RADA Quant Rating Factor Grades (seekingalpha.com/symbol/RADA/ratings/quant-ratings)

For further information and analysis, read Kinix Research’s excellent September article on Seeking Alpha. We agree with Kinix that over the long-term “there is merit” to the merger, but we believe retail value investors will do better keeping the new shares on a watchlist for six or eight months.

The Companies

Rada and its three subsidiaries (RADA Technologies, RADA Innovations, and RADA USA) are merging with Leonardo DRS. RADA produces and markets proprietary radar and avionics systems primarily for defense departments worldwide. It is an innovator in mini-tactical radars, used for military protection (SHORAD, C-RAM), counter-UAS missions, and critical infrastructure protection like shipping and border surveillance.

Leonardo DRS, Inc. is a U. S. private defense industry company. It is a wholly-owned subsidiary of Leonardo S.p.a. Advanced Sensor and Computing and Integrated Mission Systems sectors comprise DRS. The new company listing might be DRS.

30% of Leonardo S.p.a. shares are owned by the government of Italy. It develops and markets battlefield and commercial electronics, helicopters, aircraft, cyber and security solutions, interplanetary probes and orbiting modules for space, drones and unmanned systems, aerostructures, and robotics for automation. The company offers geoinformation, satellite communications, ground systems, navigation, and satellite operations. The company was founded in 1948 in Rome, Italy.

What Are You Doing for Me

Our second reason for a hold on RADA rather than reasserting our former bullish position is last quarter’s poor financial report combined with the timing of the merger and worry this will continue to dampen investor enthusiasm.

This is a tumultuous time for defense industry stocks. The SPDR S&P Aerospace & Defense ETF (XAR) share price, for instance, is -8.2% over the last 12 months, and almost that much year-to-date. Some analysts think defense stocks are overvalued.

RADA Electronic did not report a vibrant Q2 ’22 financial in August. The GAAP EPS was -$0.09. Revenue was -18.5% Y/Y to $23.06M when the consensus was revenue of nearly $30M. Gross profit declined by 29.2%. Margin fell 527 basis points to 34.6%. EPS was nine cents from $0.20 Y/Y, and the company had an operating loss of ~$3M compared to a profit of $4.5M the year before. This is not the momentum an investor wants to see entering a merger. We think the stock price is reasonably valued, perhaps down by $1. The next report date is November 20, 2022.

Our third reason is a lack of clarity from Leonardo S.p.a. and its subsidiaries on the plan for building the assets of RADA Electronic. The CEO described to shareholders, as S.A. relates it, that merger with RADA,

reinforced DRS core business of sensor and integrated systems. This is positioning the combined entity in the fastest-growing segments of the U.S. DoD budget and as well as current global military requirements and needs. And it brings significant commercial and technological benefits.

That is well and good for DRS but tells nothing said about RADA’s future. The focus ignores the first of Drucker’s 5 rules for successful acquisitions. Peter Drucker writes in the Wall Street Journal, success is achieved if the purchaser “thinks through what it can contribute to the business it is buying. Not what the acquired company will contribute to the acquirer…”

Will RADA Electronic lose Israel’s business that comprises the company’s majority of sales? RADA employs 255 in Israel and 80 in the U. S. ELTA Systems and Israel Aerospace Industries are in the radar business. Elbit Systems (ESLT) EW and SIGINT – Elisra (Elisra) sells radar systems integrated with intelligence, surveillance, and reconnaissance (ISR) ground solutions and coastal surveillance. These systems are also mobile, portable, vehicle-mounted, or mast-mounted. The highly secretive Israel Defense Forces might turn to domestic suppliers and dent expected DRS’s revenue expectations.

Image is Blurry

The picture of shareholder value for this merger is blurry. There is potential value in the transaction but more for DRS. The takeover of RADA Electronic is not prohibitively expensive for Leonardo S.p.a. It is the 7th largest European defense contractor and holds $716M in cash. Leonardo S.p.a. has the resources to capitalize on the technologies of RADA Electronic. But what will the purchaser do for RADA and DRS? Right now, there is a wait-and-see attitude in financial circles. There is not a lot of buzz around RADA stock; 12 hedge funds held the stock early this year, four sold their holdings and in the last quarter only two added them. Howling merger is a barker’s tease for retail value investors; unimpressed, we recommend a hold of RADA.

Be the first to comment