IvanZivkovic

A Quick Take On Innovation Beverage Group

Innovation Beverage Group (IBG) has filed to raise $8.5 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company designs and sells a range of premium alcoholic and non-alcoholic beverages to consumers.

Given the firm’s contracting topline revenue and high valuation expectations, I’m on Hold for the IPO, although the low nominal price for the stock may attract volatility seeking day traders.

Innovation Beverage Group Overview

Seven Hills, Australia-based Innovation Beverage was founded originally as Australian Boutique Spirits to develop premium and super premium alcoholic and non-alcoholic brands for sale through distributors and direct to consumers.

Management is headed by Chief Executive Officer Dean Huge, who has been with the firm since February 2022 and was previously CFO of Splash Beverage Group (SBEV) and CFO of Discovery Gold Corporation.

The company’s primary offerings include:

-

Bitters

-

Light spirits

-

Non-alcoholic spirits

Innovation Beverage has booked fair market value investment of $3.9 million as of December 31, 2021 from investors including Samstock SZRT, 114 Assets and others.

Innovation Beverage Customer Acquisition

The company sells its products through online ecommerce websites and through offline distributor networks such as through Coca-Cola Europacific Partners, Australia’s largest beverage distributor, according to management.

In 2021, the firm generated 64% of its revenue from the Australian market and 36% from the U.S. market.

Sales and Marketing expenses as a percentage of total revenue have risen as revenues have plateaued, as the figures below indicate:

|

Sales & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

15.3% |

|

2020 |

4.1% |

(Source – SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, was 0.0x in the most recent reporting period. (Source – SEC)

Innovation Beverage’s Market & Competition

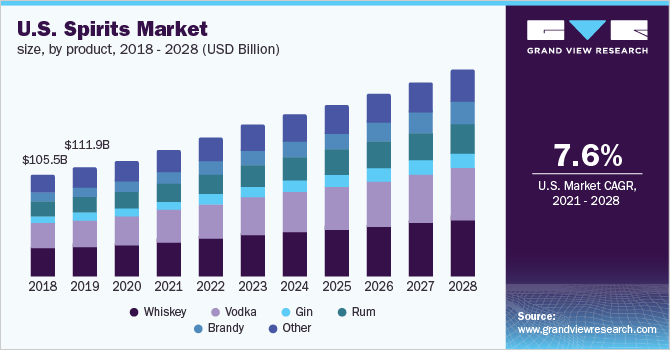

According to a recent market research report by Grand View Research, the North American market for spirits was an estimated $154 billion in 2020 and is forecast to reach nearly $279 billion by 2028.

This represents a forecast CAGR of 7.7% from 2021 to 2028.

The main drivers for this expected growth are an increase in demand for premium quality products with unique flavors and distinct tastes.

Also, the chart below shows the historical and projected future growth of the U.S. spirits market:

U.S. Spirits Market (Grand View Research)

Major competitive or other industry participants include:

-

Angostura Bitters

-

Lyre’s

-

Seedlip

-

Dan Murphy’s

-

First Choice

-

Sans Drinks

-

Others

Innovation Beverage Group Limited Financial Performance

The company’s recent combined pro forma financial results can be summarized as follows:

-

Slightly contracting topline revenue

-

Increased gross profit and gross margin

-

Reduced operating profit

Below are relevant financial results (combined pro forma) derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 5,919,405 |

-0.6% |

|

2020 |

$ 5,956,854 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 3,170,090 |

2.4% |

|

2020 |

$ 3,094,963 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

53.55% |

|

|

2020 |

51.96% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ 44,490 |

0.8% |

|

2020 |

$ 1,074,650 |

18.0% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

2021 |

$ 31,286 |

0.5% |

|

2020 |

$ 982,798 |

16.6% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

N/A |

|

|

2020 |

N/A |

|

As of December 31, 2021, Innovation Beverage had $1.6 million in cash and $2.8 million in total liabilities.

Innovation Beverage Group IPO Details

IBG intends to sell 1.7 million shares of common stock at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $8.5 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $39.4 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 18.5%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

We intend to use net proceeds from this offering to pay, in connection with the acquisition of Reg Liquors LLC d/b/a/ Wired for Wine, USD$600,000 to the seller, for working capital and for general corporate purposes, including operating expenses. Additionally, we may use a portion of the net proceeds from this offering to acquire or invest in complementary products or assets.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company is not a party to any legal proceedings that would have a material adverse effect on its business.

The sole listed bookrunner of the IPO is EF Hutton.

Valuation Metrics For Innovation Beverage Group

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$46,014,360 |

|

Enterprise Value |

$39,418,350 |

|

Price / Sales |

7.77 |

|

EV / Revenue |

6.66 |

|

EV / EBITDA |

886.00 |

|

Earnings Per Share |

$0.00 |

|

Operating Margin |

0.75% |

|

Net Margin |

0.53% |

|

Float To Outstanding Shares Ratio |

18.47% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Debt / EBITDA Multiple |

8.78 |

|

Revenue Growth Rate |

-0.63% |

(Source – SEC)

Commentary About Innovation Beverage Group

IBG is seeking U.S. public capital market investment to fund its acquisition of Reg Liquors LLC and for its general corporate expansion plans.

The company’s financials have generated slightly reduced topline revenue (year-over-year), higher gross profit and gross margin but lowered operating profit.

Free cash flow for the pro forma unaudited combined financial statements was not available.

Sales and Marketing expenses as a percentage of total revenue have risen sharply as revenue has flattened.

The firm currently plans to pay no dividends (although it paid out a dividend in 2021) and intends to retain most future earnings to reinvest back into the business.

The market opportunity for spirits and related products is large and expected to grow at a moderate rate of growth over the coming years.

EF Hutton is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (41.8%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is its tiny size and thin capitalization as it seeks to expand in large markets with significant competition.

As for valuation, compared to a basket of publicly held alcoholic beverage companies compiled by noted valuation expert Dr. Aswath Damodaran with an EV/Sales multiple of 4.8x, management is asking IPO investors to pay a premium valuation of 6.7x at IPO.

Given the firm’s contracting topline revenue and high valuation expectations, I’m on Hold for the IPO, although the low nominal price for the stock may attract volatility seeking day traders.

Expected IPO Pricing Date: To be announced

Be the first to comment