Davel5957/iStock Unreleased via Getty Images

Federal Realty Trust (NYSE:NYSE:FRT) is a perfect example of what can go wrong in REIT investing. It is tempting to buy these stocks based on that “feel-good” feeling that comes with knowing you’re owning prime retail real estate. FRT indeed owns stunning assets, but over the long term, the math does not lie. If you buy into a stock at too high of a multiple, then forward returns may be muted. That has happened at FRT as the stock is trading at the same levels it did one decade ago. That underperformance, however, has created an attractive buying opportunity: now you can “feel good” and eat the cake too.

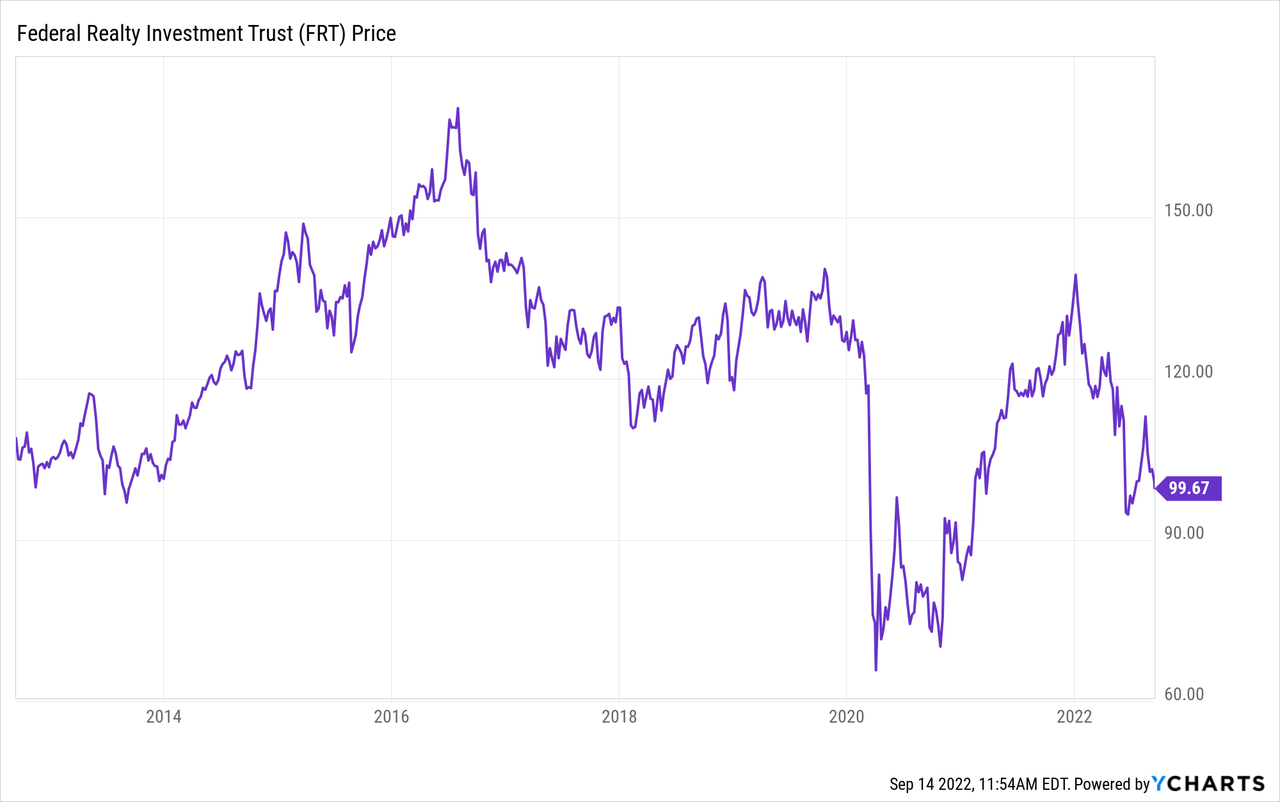

FRT Stock Price

FRT traded as high as $140 per share earlier this year but has since traded sharply lower, perhaps due to fears that rising inflation would negatively impact the health of its retail tenants.

I last covered FRT in February of 2021 where I explained why I was selling my position due to valuation. The stock has done very little since then in spite of the company making great strides at getting its business back to pre-pandemic levels.

Federal Realty Key Metrics

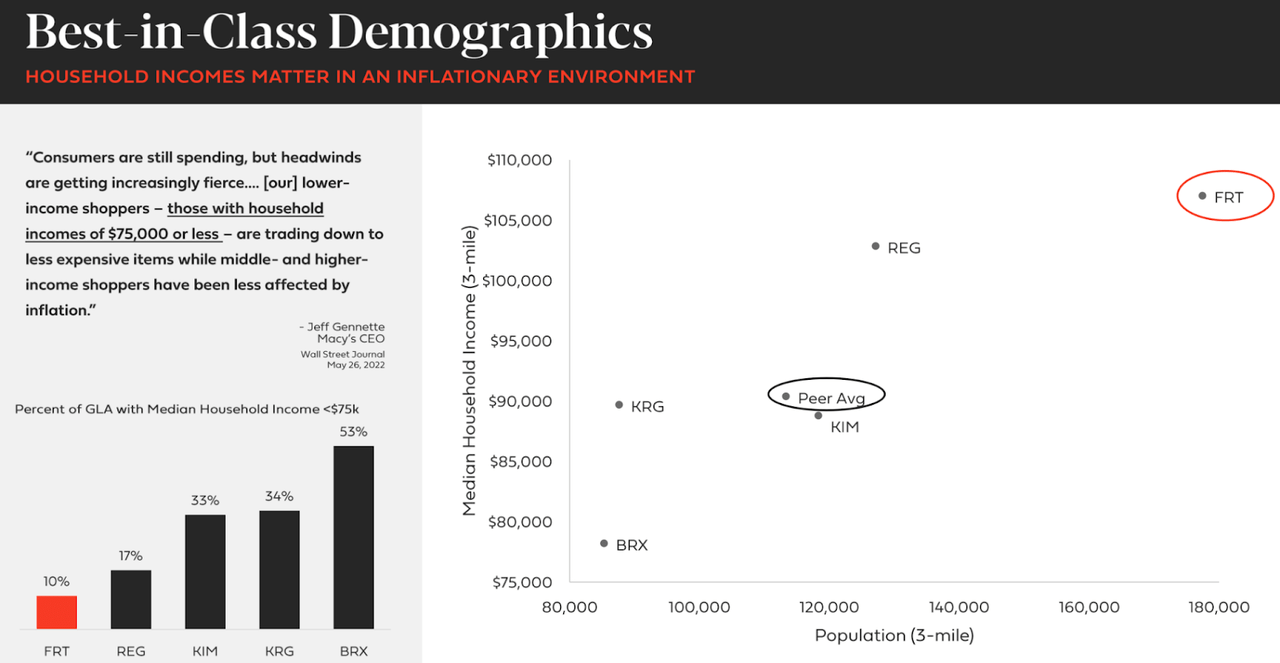

It isn’t easy to quantify what makes FRT so special. When you visit one of their properties, you can feel it: it is self-evident by the quality of the experience. But how does one put it into numbers? FRT has provided a metric in median household income versus 3-mile population density in which it ranks far and above peers.

2022 Q2 Presentation

In times of a weakening economy, higher income shoppers tend to be more resilient in their spending habits – this all benefits shopping center REITs like FRT that have focused on high-income demographics.

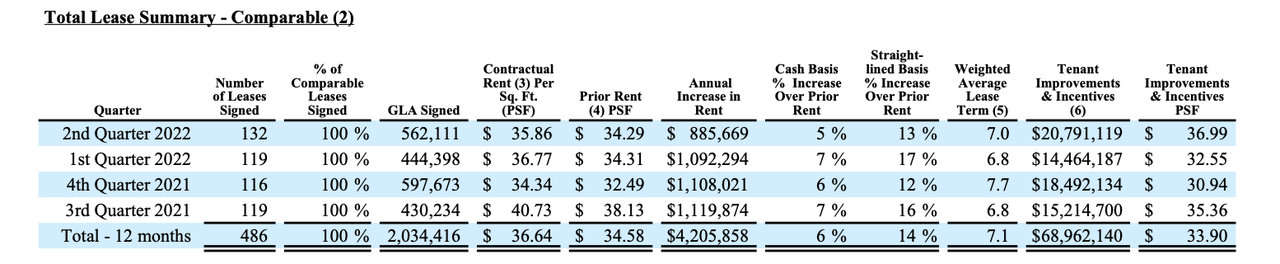

The times of pandemic lockdowns and low rent collection are over. FRT has returned to generating solid leasing spreads on lease expirations as evidenced by the 6% cash spread generated over the past 12 months.

2022 Q2 Supplemental

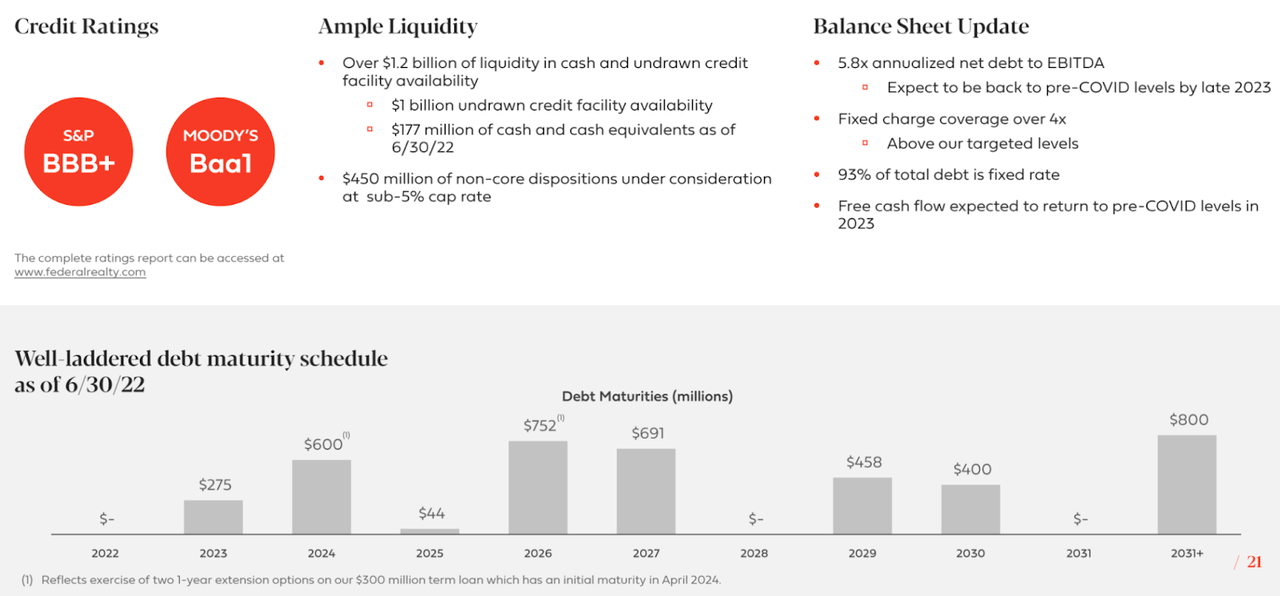

FRT previously had an A- rated balance sheet, but that has been downgraded due to the elevated leverage as a result of the pandemic. FRT still boasts a BBB+ rated balance sheet with debt to EBITDA standing at 5.8x – the company expects to return to pre-pandemic levels by late 2023 (5.5x debt to EBITDA).

2022 Q2 Presentation

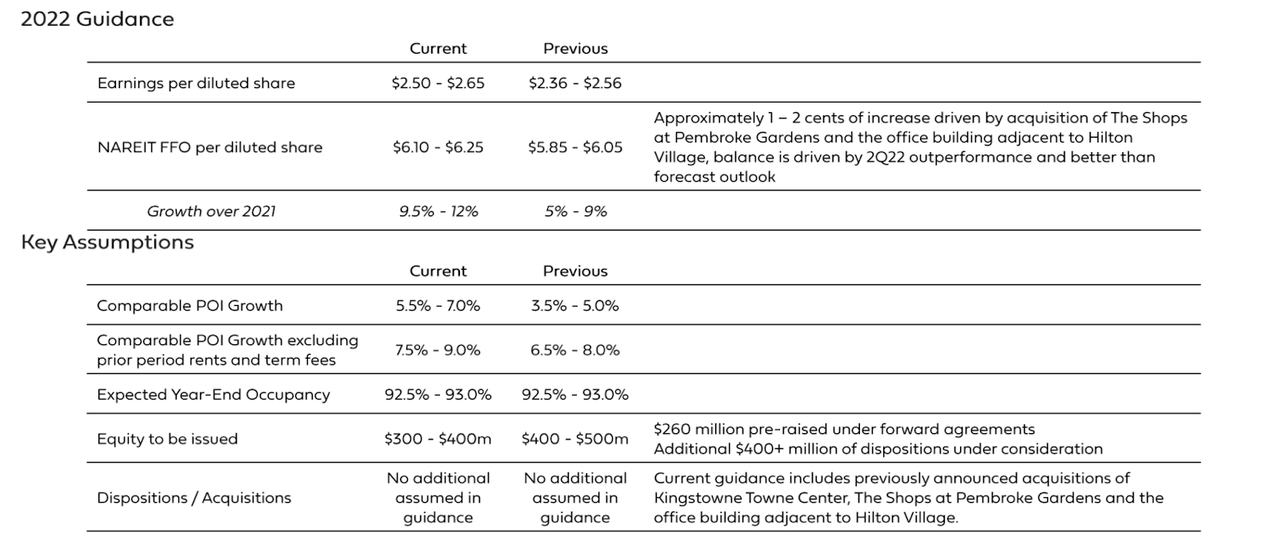

FRT has increased 2022 guidance, expecting up to 12% FFO growth to $6.25 in FFO per share. That guidance assumes up to 7% comparable POI growth, a stunning figure as the company continues to recover from the pandemic.

2022 Q2 Presentation

For comparison, FRT generated $6.33 in FFO per share in 2019 (after excluding charges related to the buyout of a Kmart lease). FRT is quite close to pre-pandemic metrics, with 92% occupancy (and guidance for 93% by year end) versus 93.3% pre-pandemic.

Is FRT Stock A Buy, Sell, or Hold?

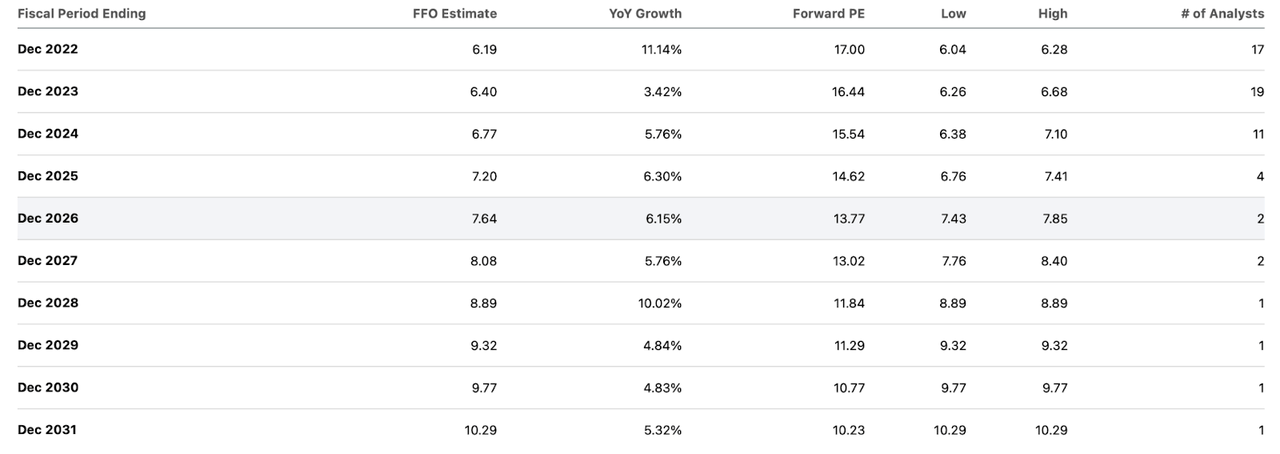

With FRT it is important to remember that no matter how beautiful its properties look, it is still just a shopping center REIT. Excess beauty does not typically lead to tech-like growth, and investors should not expect stunning outperformance relative to peers. Consensus estimates call for mid-single-digit FFO growth over the next decade.

Seeking Alpha

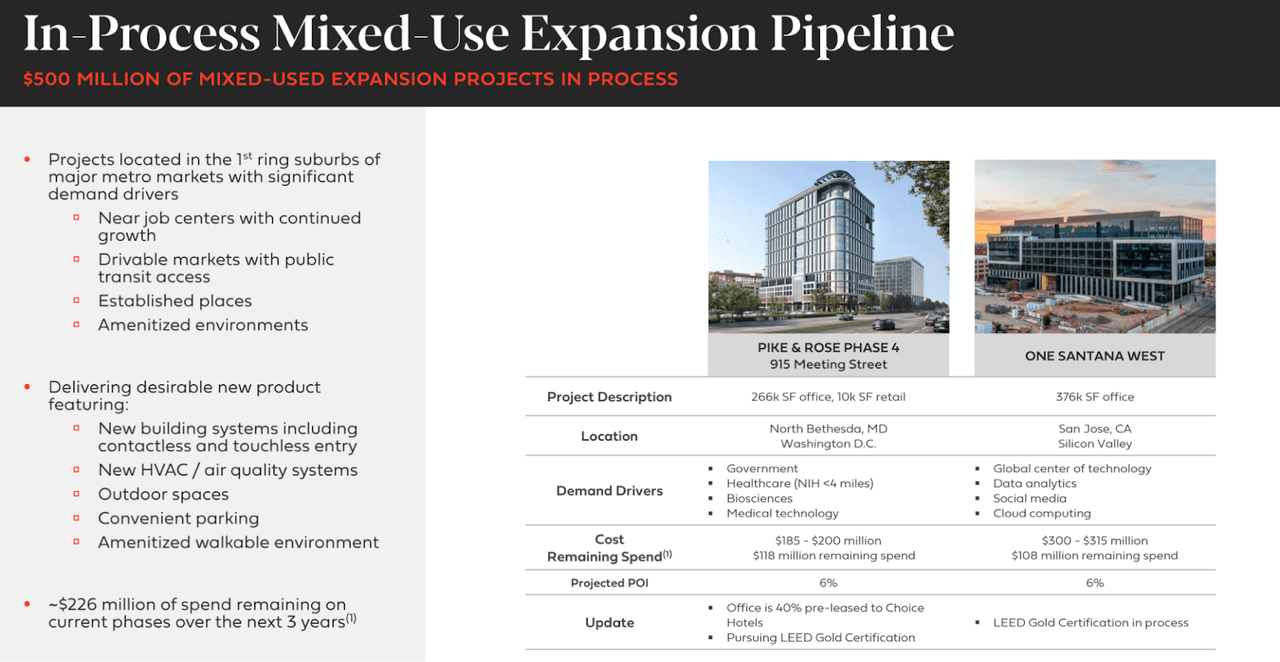

FRT can increase cash flows via three main levers: increasing occupancy, generating positive leasing spreads, and funding redevelopment projects. Occupancy is already nearing pre-pandemic levels, so that is unlikely to be a meaningful part of growth. Approximately 10% of leases expire every year. Assuming 5% to 6% spreads, FRT might see approximately a 0.8% boost to net operating income annually. The company typically spends around $400 million on development and redevelopment projects annually. In this case, the high income profile of its neighborhoods works to the negative by keeping ROI low. FRT typically sees around a 6% return on investment from redevelopment projects. I estimate the company to see around 3% to 4% annual FFO growth from these projects.

2022 Q2 Presentation

That brings us close to consensus estimates of around 5% FFO per share growth. The impact of leverage may help juice the returns slightly, but a higher interest rate environment may also lead to higher costs of capital upon refinancing of debt. Investors should not be expecting materially stronger growth than mid-single-digit FFO per share growth from this company.

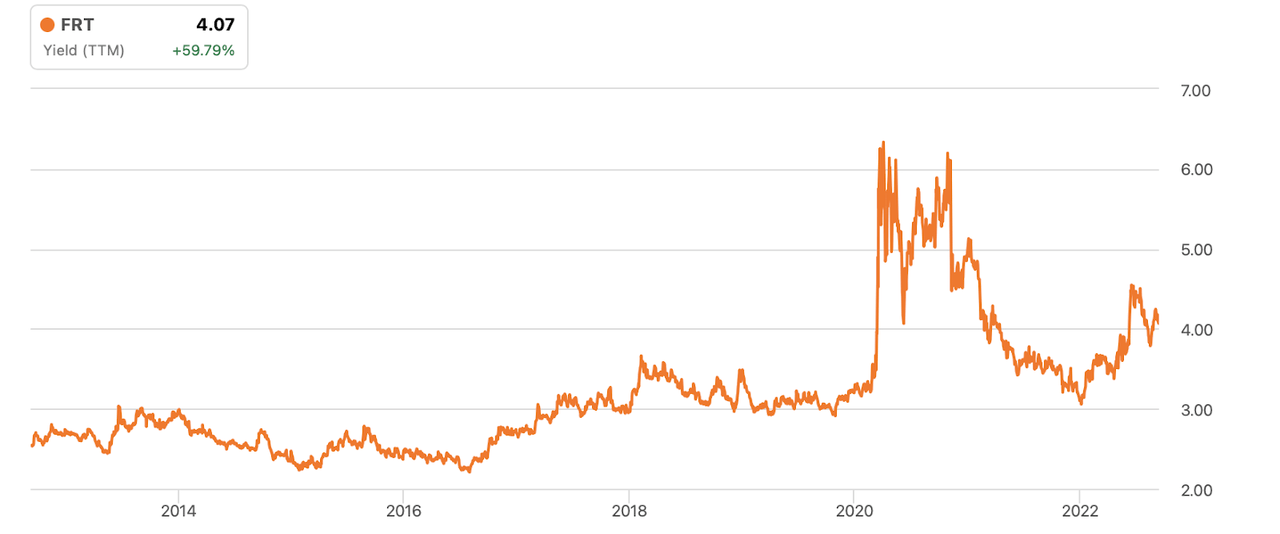

Due to FRT having just undergone a “lost decade,” its valuation has improved dramatically. Whereas FRT traded at a 2.5% yield at the beginning of the decade, it is now yielding 4.3%.

Seeking Alpha

These valuations finally make the stock worthwhile to buy. Without assuming multiple expansion, FRT might be able to deliver around 9% annual returns (calculated based on the 4.3% yield and 5% growth profile). As FRT returns to and surpasses pre-pandemic financials, I can see the company earning back its A- credit rating and achieving some multiple expansion, perhaps to around a 3.5% yield. That reflects another 19% potential returns from multiple expansion alone. Assuming that multiple expansion occurs over several years, FRT appears priced to deliver around 10% to 12% returns annually. It is reasonable to have doubts about whether this is the right time to be buying the stock considering the toll that inflation is having on the economy, but FRT is strongly positioned in top tier shopping centers which should be more resilient than others. I view FRT as typically having been a play on lower volatility, but the pandemic may have displaced that thesis and thus the stock might not provide such qualities moving forward. There is also the risk that FRT’s high rents are unsustainable in spite of the high quality of its properties and might lead to negative leasing spreads in the future. At these valuations, I view FRT to be a buy but not a strong buy on account of these risks.

Be the first to comment