Imladris01/iStock Editorial via Getty Images

Published on the Value Lab 16/4/22

ING Groep (NYSE:ING) is primarily a retail banking business that has been leaning into the transition away from interest based income due to the low rate environment. This might have been good before, but rates might rise a lot, and if that happens, this transition is in the wrong direction. The data suggests the duration gap wouldn’t be favourable in ING’s case either. Given the recovery in ING’s price, we’d look elsewhere for a banking trade in the current environment.

Economic Commentary

Our economic outlook can be boiled down to the following and informs the rest of the article. We have massive inflation due to an excessive demand for goods and a shortage in supply as a result. Goods demand has increased meaningfully due to the shift from expenditure on services. With the share of goods demand having grown meaningfully in the mix, and that increased demand not being met with supply, means that a meaningful decline in disposable income is going to be required for that increase to be reversed. Supply side inflation is the most malignant form, and while we think that capacity increases incoming would have stopped it, shortages add further risk premiums onto commodities in addition to the scarcity raising prices, and these can persist through expectation effects, especially where employment is so high and wage flexion is likely. Rates will have to increase meaningfully in order to nip this in the rapidly blooming bud. Banks know this, but they’ll have to move hard and fast as Poland has done, a political arena and economy less hamstringed to be able to take the necessary action. Our house view is that taking into account the level of money growth, as well as the interaction effects of the pandemic on productivity, rates will have to grow to 6% on treasuries for the US in order to reverse the goods demand that is causing the problems.

Where ING Stands

Let’s have a look at headline figures, which already tell us much.

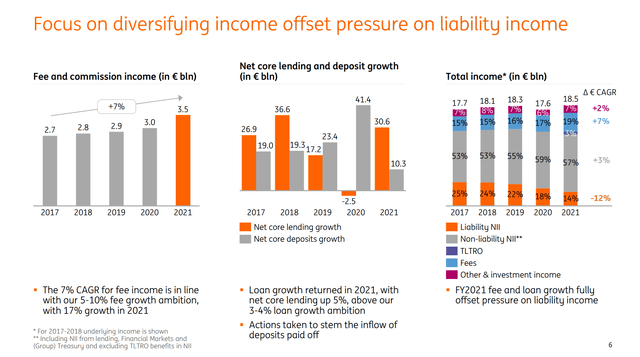

Headline Figures (Q4 2021 Pres ING)

Non-interest related income has grown to 19% of total income. This would have been impressive if we thought the low rate environment would continue, but with inflation being supply side and needing real hurt on the economy to slow down, that will not persist. In an environment where we are looking for defensive exposures, this income which relates to activity levels in the economy and banking, as well as investment income which has grown in the mix and is not robust in a downturn, should not be contributing to the outperformance that is seeing a recovery in ING’s price relative to pre-COVID levels.

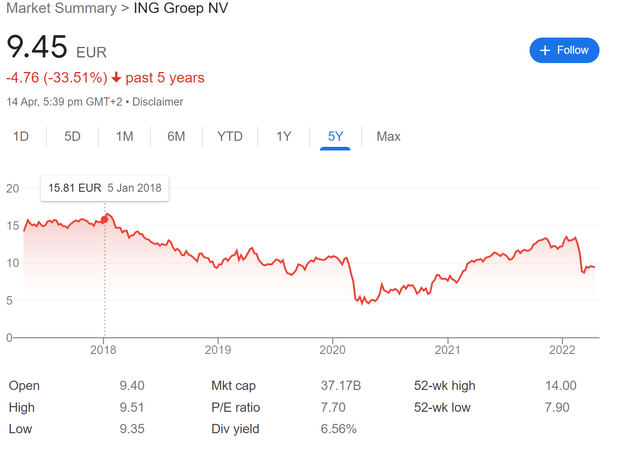

ING Stock Price (Google Finance)

With a mix that has been buoyed by factors related to economic health and activity, one would want that at least there were some offset from the corporate and retail banking assets in the case of rate increases. Corporate banking is about 33% of the assets, while retail is 66%. Retail loans are more likely to be variable rate, and should be alright even if with longer durations. Corporate loans are less likely to be variable rate due to the better bargaining positions of enterprises. With durations tending to be quite long in the ING assets due to recent loan growth, which was a way to offset rate declines, ING is not as ideally positioned as you might want a retail exposure to be.

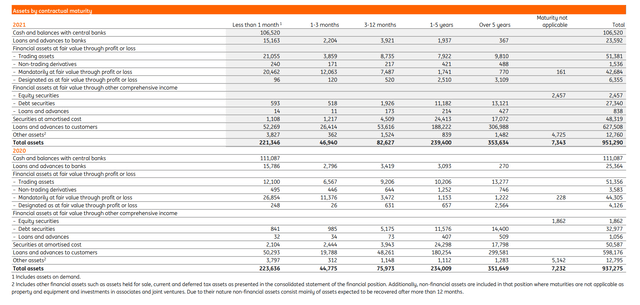

Maturity Analysis (ING Annual Report 2021)

Most assets have a maturity in more than five years, indicating a larger duration gap which is less favourable in an environment where rates will increase.

Conclusions

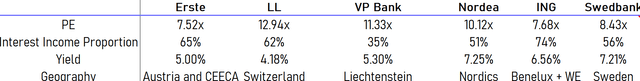

Admittedly, ING does trade relatively cheaply which is a benefit to its story and does compensate it for what’s perhaps a less ideal direction. Moreover, it has a larger interest based income proportion than some other banks in Europe.

Regional Bank Valuation Spread (VTS)

However, we believe that fundamentals could deteriorate for the company as fee and commission based income has become more prominent. Also, while the duration gap probably doesn’t indicate a problem for the company due to variable rates, it does suggest that the ability to leverage and improve the interest income meaningfully with larger rates might be more limited, especially if loan growth becomes harder to achieve in what might be a high rate environment incoming. Overall, we pass on ING.

Be the first to comment