zorazhuang/E+ via Getty Images

Valero Energy Corporation (NYSE:VLO) is one of the two largest US independent oil refiners. It is well-positioned for this high-inflation environment as a) it has the ability to increase prices with increasing costs (especially oil but also labor, natural gas, and electricity) and b) its asset-heavy infrastructure is already extant — there is no waiting for material and contractors to build new equipment, and c) it has the merit of producing energy-dense transport fuels in use and in demand against a backdrop of limited supply, and d) as many forget, the demand is not for oil qua oil but hydrocarbon products like gasoline, jet, and diesel that help provide world-vital services of transportation and trade.

Even prior to today’s high margins, Valero already had good cash flow and is an investor-friendly dividend payer.

Refiners are expected to report strong 1Q22 results. The sector is coming into the 2Q and 3Q travel seasons. The Biden administration has announced an oil sale of up to 180 million barrels from the Strategic Petroleum Reserve (SPR), putting more oil on the market. Private oil producers are increasing west Texas oil production.

Valero is a key ethanol provider and will benefit from lifting summer E15 ethanol restrictions. It is one of the largest renewable diesel (RD) manufacturers and profits as that market grows.

I own shares of Valero and recommend investors consider buying it. Value investors may want to wait for a lower price entry point.

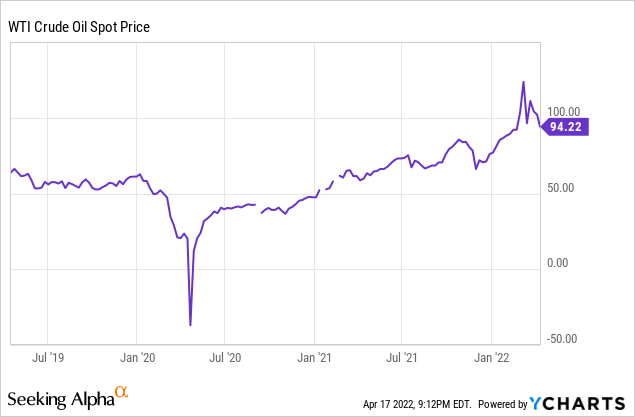

Oil Supply, Prices, and SPR Release

US oil production in the week ending April 8, 2022, was 11.8 million barrels per day (BPD) after reaching a high of 13.1 million BPD in February 2020.

Demand has recovered from Covid — except for the new Chinese shutdowns — evident in more traffic, marine logistics snarls, and high jet fuel prices. Demand pressures were exacerbated after Russia invaded Ukraine. Many European countries and the US limited or stopped buying Russian oil. Prior to the invasion, Russia was producing 10.1 million BPD of crude oil and condensate and exporting 4.7 million BPD.

The April 18, 2022, closing NYMEX oil price was $107.03/barrel for West Texas Intermediate (WTI) crude for May 2022 delivery. The NYMEX closing gasoline (reformulated blendstock for oxygenate blending or RBOB) price was $3.37/gallon ($141/barrel), also for May 2022 delivery.

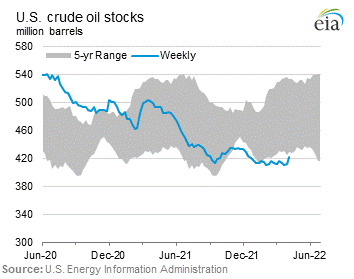

High oil prices translate to high gasoline prices since oil is the largest cost in making gasoline. Trying to reduce gasoline prices, the Biden administration plans to sell up to 1 million BPD of crude from the SPR for six months, or 180 million barrels. More oil — not only from the SPR but from gradually increasing production in west Texas and elsewhere — is hoped to lower its cost, and subsequently that of gasoline. The immediate effect for Valero is larger crude availability.

Another possibility is that draining the SPR could result in a perceived crude shortage – the stocks will have to be replaced – and cause the oil price to increase.

EIA

Oil Refining Margin Illustration

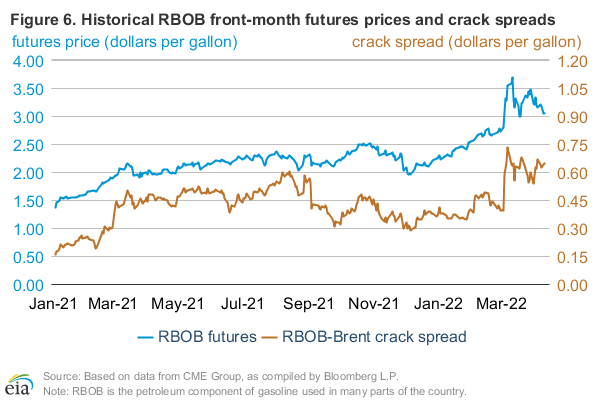

Refining margins differ by crude type (light/heavy and sweet/sour), operating costs, and product slate (how much gasoline and distillate). Distillate is further divided into major fuels of diesel/heating oil and jet fuel.

A reference metric for gasoline is shown below, with the futures price of a high-quality (light, sweet) crude — Brent, in blue on the left axis — compared to the difference between the price of the higher-valued gasoline “stand-in” (RBOB) and the futures price of Brent. This is the crack spread shown in light brown on the right axis.

EIA

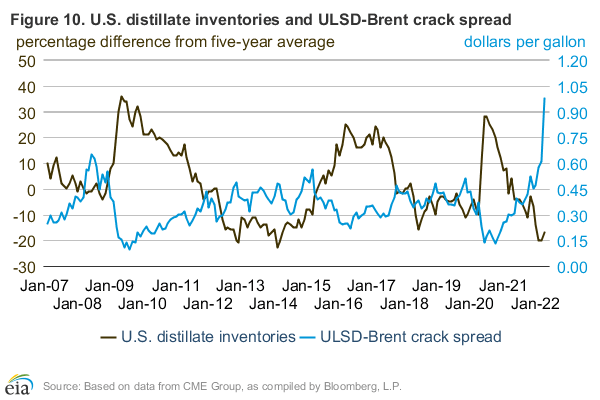

Because many countries are no longer buying Russian distillate exports, the distillate crack spread is also unusually high.

EIA

Finally, jet crack spreads bounced up to new highs in the last few weeks. According to analysts at Tudor Pickering Holt, this is due to increasing air travel, a lack of European distillates being imported to the US East Coast, and lower jet fuel production.

Valero Energy 2021 Results

In 2021, Valero reported net income of $930 million, or $2.27/share, compared to a 2020 net loss of -$1.42 billion, or -$3.50/share. The 2021 results included losses in 1Q21 due to Winter Storm Uri. So, upcoming 1Q22 results will look quite good compared to 1Q21.

Operating income for 2021 was $2.13 billion compared to an operating loss of -$1.6 billion for 2020. The company divides into three segments: refining, renewable diesel, and ethanol. In 2021:

- Refining reported $1.86 billion of operating income.

- Renewable diesel reported $709 million of operating income.

- Ethanol reported a $473 million of operating income.

- Corporate and intersegment eliminations resulted in a -$914 million subtraction to operating income.

Operations

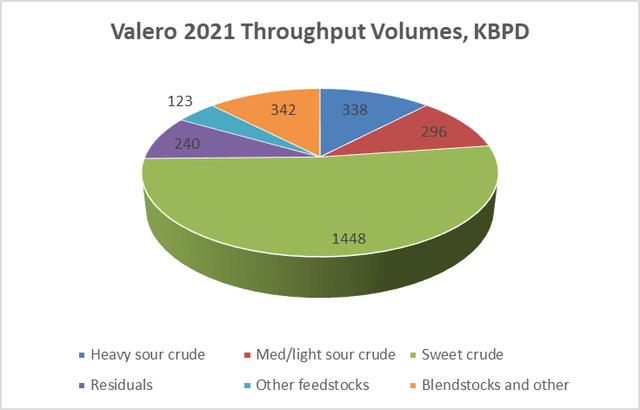

Oil Refining: Valero has a total of 3.15 million barrels per day (MMBPD) of oil refining capacity in thirteen refineries in the US, one in Canada, and one in the UK (Wales). In 2021, throughput volumes were 2.44 million BPD of feedstocks and 0.34 million BPD of blendstocks (2.8 million BPD total). The 2021 feedstock breakdown shows the continued importance of sweet crude oil — like that produced in the US — to Valero’s operations.

Valero.com, Starks Energy Economics, LLC

Renewable Diesel: The renewable diesel segment includes the operations of Diamond Green Diesel, a joint venture with Darling Ingredients (DAR). Renewable diesel is made from recycled animal fats, used cooking oil, and inedible corn oil. Capacity at the St. Charles, Louisiana plant is 700 million gallons/year. The Port Arthur, Texas plant under construction will add another 490 million gallons/year. The company’s renewable diesel sales averaged 1.01 million gallons per day (about 24,100 BPD) in 2021.

Because of commodity and food inflation across the board, RD feedstock costs are higher.

Ethanol: Valero owns twelve ethanol plants, all located in the Midwest, with a capacity of 1.6 billion gallons per year. Valero’s sales are made primarily to the wholesale gasoline blending market.

Valero’s total ethanol capacity is 105,000 BPD. This is about the size of the company’s Ardmore, Oklahoma refinery, or 4% of Valero’s total oil refining capacity. The company’s 2021 ethanol production was 3.95 million gallons/day (about 94,000 BPD) which was 90% of ethanol capacity.

Recall that ethanol can be blended into gasoline up to 10% (a few places up to 15%), and gasoline and blendstocks were about half of Valero’s oil refining yield in 2021.

Effect of 15% Summer Ethanol Blend

Since 2011, selling 15% ethanol gasoline blends (E15 instead of E10 or zero-ethanol) has not been allowed June 1-September 15 to reduce smog. The Biden administration is overriding this regulation.

Although this was promoted to lower gasoline prices by $0.10/gallon (for E15), only 1.5% of gasoline stations sell E15 (2300/150,000), so nationally savings will be near zero. And the boomerang effect increases: more ethanol demand could raise food prices. Already, ethanol accounts for 40% of corn demand. Yet the historical meme, as in a New York Times editorial from 2012, is that corn should be “food, not fuel.”

Still, E15 stations near Valero’s Midwestern ethanol plants will be able to blend in more ethanol, so the summer exception is a regional boon for Valero.

Refining Competitors

Valero is an independent oil refiner and marketer headquartered in San Antonio, Texas, and one of the world’s largest, along with Marathon Petroleum Corporation (MPC).

Other competitors range from large Exxon Mobil (XOM) on the US Gulf Coast to smaller Delek (DK) in inland markets.

Barriers to the US oil refining industry remain high due to siting issues; the large, fixed cost of capital assets; policies from the federal level and some large states – like California – that are anti-hydrocarbon; and a regulated, consumer-facing gasoline, jet fuel, and diesel business that is competitive and much-scrutinized.

Renewable Diesel Competitors

The primary market for renewable diesel is California due to its incentives. The Energy Information Administration (EIA) estimates 2022 and 2023 US RD capacity of 93,000 BPD and 117,000 BPD, respectively. Valero’s Diamond Green Diesel comprises about half of 2022 RD capacity and, with completion of DGD3 in 2023 would comprise 60% of 2023 capacity.

EV Fueling Competition

In 2020, light-duty electric vehicles (EVs) are estimated to have displaced 500 million gallons of gasoline. Yet according to the EIA the US used 123 billion gallons of gasoline in 2020, so EV displacement of gasoline was 0.4%. Moreover, the costs of mining extra lithium and copper for more EVs are expected to increase inflation even further.

While states like California plan to eliminate sales of gasoline-powered vehicles by 2035, apparently to help with fires, EVs are more expensive than their internal combustion counterparts. (California was the second-largest gasoline-consuming state in 2020, with a 10% share of total US gasoline consumption at 31.64 million gallons/day or 0.75 MMBPD.) Ironically, the cost of electricity (for fueling) is expected to rise in California and elsewhere due to large, expensive grid upgrades to accommodate renewables but maintain reliability.

Governance

At April 31, 2022, Institutional Shareholder Services ranked Valero’s overall governance as a 4, with sub-scores of audit (6), board (5), shareholder rights (6), and compensation (3). In this measurement, a score of 1 represents lower governance risk and a score of 10 represents higher governance risk.

Approximately 2.8% of the floated stock is shorted and insiders own 0.4% of the company’s stock.

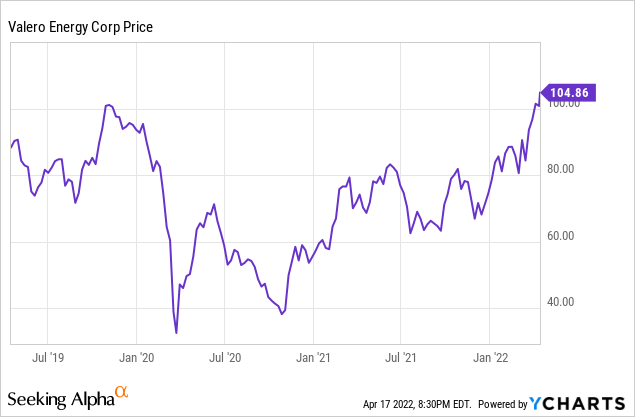

Valero’s beta is 1.98, volatility well above the market average.

Financial and VLO Stock Highlights

Valero’s April 18, 2022, closing price was $110.35/share for a market capitalization of $45.2 billion. The 52-week price range is $58.85-$110.48 per share, so the closing price is at the one-year high.

Trailing twelve months’ earnings per share (EPS) is $2.27. Analysts’ average projected 2022 and 2023 EPS are $8.29 and $7.99, respectively, for a forward price/earnings ratio of 13.3-13.8.

At December 31, 2021, the company had $38.1 billion in liabilities of which $12.6 billion was long-term debt and finance lease obligations and $16.9 billion was current liabilities, and $57.9 billion in assets giving Valero a liability-to-asset ratio of 66%. Since then, the company has issued $650 million of 4% senior notes due 2052 and used the proceeds plus cash to retire $1.4 billion of other senior notes.

Trailing twelve months’ operating cash flow was $5.86 billion and levered free cash flow was $4.28 billion. In 2021 dividend payouts totaled $1.6 billion. Valero’s dividend is $3.92/share for a yield of 3.6%.

The company’s mean analyst rating is 2.4, or “buy” leaning toward “hold” from 21 analysts. Bank of America and RBC have become more bullish on oil refiners.

The enterprise value/EBITDA ratio is 11.4, above the preferred (bargain) maximum of 10.0.

Valero reports 1Q22 results April 26, 2022.

Recommendations for Valero

Valero has considerable debt. Its primary risk is inflation raising the costs of its feedstocks, especially crude oil. It could also experience lower results from planned maintenance and unplanned downtime. However, it is well-positioned to recover those costs at today’s higher demand and product prices for gasoline, jet, and diesel. This is positive in an inflationary environment. So is the fact that Valero is meeting demand with existing assets and not primarily relying on new construction for future profits.

Although the stock price is at a 52-week high, the company pays a 3.6% dividend, generated operating cash flow in 2021 of $5.9 billion, has a moderate forward price-earnings ratio of 13.3, and is moving into high-volume, high-value summer travel season.

The company’s long planning and operations experience means it benefits from factors like the increased oil availability from the SPR release, increasing Permian oil production, a dominant position in renewable diesel, the minor but regionally-significant uplift for E15 production, regional diversification, and a good competitive position vis-à-vis other refiners and in inter-transport fuel competition with electricity for EVs.

I recommend Valero to investors; value investors may want to wait for a lower price entry point.

Valero.com

Be the first to comment