Torsten Asmus

On 10/12/22 the markets had a rocky open due to a somewhat above expectations 0.4 increase in the final demand producers price index (PPI). 10/13/22 will bring the CPI numbers which are the bigger read on inflation so I anticipate the market will once again react strongly.

The impact of inflation on consumers is fairly straightforward – things we need to buy cost more than they used to. It is much harder to discern how inflation impacts the market because there are so many moving parts. This article will discuss the economic mechanisms by which inflation impacts the markets and through understanding these mechanisms one can get a good sense of which areas of the market are positioned to outperform.

Here are the 4 key pieces to understanding inflation with respect to investment:

- What is causing inflation in this particular environment

- How inflation is causing the markets problems

- How inflation is impacting earnings

- How inflation solves the market’s problems

What is causing inflation?

Pundits often discuss the cause of inflation being excess liquidity due to a combination of fiscal stimulus and quantitative easing.

I think it goes much deeper than that. Stimulus packages are not inherently inflation causing. It all depends on how the money is spent and this whole thing is much simpler if we think of it in terms of supply and demand.

Stimulus packages that increase supply of goods or services do not cause inflation. For example, infrastructure spending increases productivity of the parts of the economy that use said infrastructure, thereby increasing supply. This supply offsets the increased demand that results from the extra money in the pockets of those that build the infrastructure.

It so happens that the massive injections of money into the economy were done in such a way that they did not increase supply and to some extent decreased supply.

- COVID era stimulus checks increased aggregate demand but did not come with any supply component. In fact, they paid people to NOT work so it may have decreased supply.

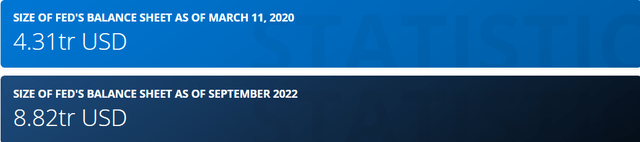

- Fed quantitative easing injected 4.5 trillion dollars into the system.

Statista

Note that I am not passing judgement on either of these measures. The emergency stimulus allowing people to stay home in the pandemic may have saved lives and frankly, I am not qualified to weigh that against the economic harm of the ensuing inflation.

Quantitative easing involved the Fed buying Treasuries and other similar instruments. Every dollar that the Fed spent buying Treasuries meant the seller of those Treasuries could then reinvest their proceeds in something else. Thus, the expansion of the Fed’s balance sheet is literally a 1 for 1 injection of capital into the system.

Does quantitative easing increase supply to offset the increased demand?

It depends on how the proceeds get reinvested. If the market invests the capital into companies that produce goods and services, it absolutely does increase supply which would counteract inflation.

Unfortunately, 2020-2021 was a time period in which the market was infatuated with investments that did not produce goods or services in any material quantity. This was the era of the meme stock with NFTs, and speculative way off in the future investments being the darlings of the market. Most of these were relatively small, but crypto was the big offender.

Keeping in mind that the entirety of the Fed stimulus was about $4.5 trillion, fully $2 trillion was invested in crypto. Regardless of whether you view crypto as a good investment or not, this was $2 trillion of investment that produces no goods or services. Thus, it was $2 trillion injected into the demand side of the economy without any offsetting production.

To make matters worse, investment in crypto resulted in huge crypto mining farms which ate up exorbitant amounts of electricity and gobbled up supply of computer chips. Energy and semiconductors have been major contributors to inflation.

To sum up this section, it was not the stimulus itself that caused the inflation, but rather the combination of the large stimulus with a dearth of offsetting supply growth.

How inflation caused the market’s problems

As inflation weighs on consumers’ budgets, the Fed is compelled to uphold the price stability portion of their dual mandate. The ensuing rapid rise in interest rates is what took the market down, rather than the inflation itself.

We have discussed this mechanism before, but at its simplest form it was a matter of discount rates for equities going from ~5% to ~8%. This 60% delta to the denominator of the time value of money unsurprisingly resulted in a collapse in earnings multiples of equities.

There is always going to be some variance among individual stocks, but overall this sell-off has been quite uniform. If one looks at interest rates as an isolated variable, the uniformity of the selloff is totally rational. All stocks are valued on a discount rate. When that discount rate rises it hurts all stocks.

However, the myopic focus on interest rates has caused the market to ignore the other side of inflation which is its impact on earnings.

How inflation impacts earnings

Unlike discount rates which affect all companies, earnings will move quite disparately as a result of inflation. The simplest way to differentiate earnings beneficiaries from the disadvantaged is to look at the inputs and outputs.

How much have input costs risen relative to the amount a company can charge?

If both costs and revenues are up by 10% the company’s earnings are up by 10%. Inflation as an isolated variable significantly increases the earnings of the market. It is the distribution, however, that I am more interested in.

The nature of one’s inputs determines the magnitude of cost increase.

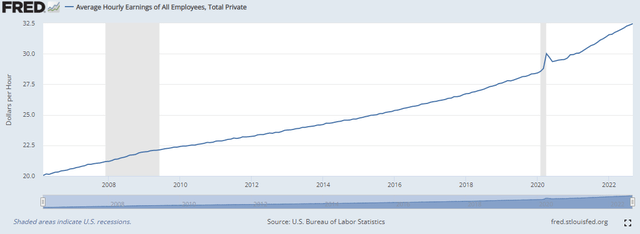

Labor is a terrible input to have right now. Companies are getting hit with a double whammy of rapidly rising wages and decreased productivity.

FRED

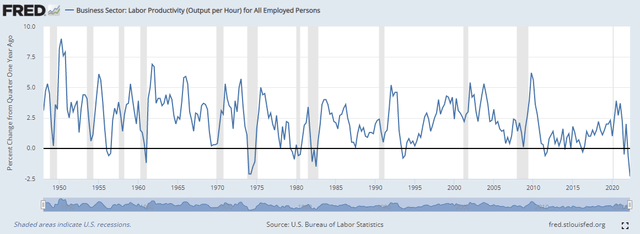

FRED

You now have to spend more to produce less if labor is your main input.

Wages have consistently gone up for a long time, but the factor that makes this environment unique is that the wage increases now correspond to decreasing productivity per hour which is quite rare.

The ~7% decline in productivity at the start of 2022 was one of the biggest drops in history and compares terribly to the normal roughly 2% increase in productivity.

As a result, I would lean away from investments that have high labor costs. Instead, I would favor companies that have their primary costs being assets they already own.

- Intellectual property

- Physical property (land/buildings)

- Mineral rights

The revenue side of inflation

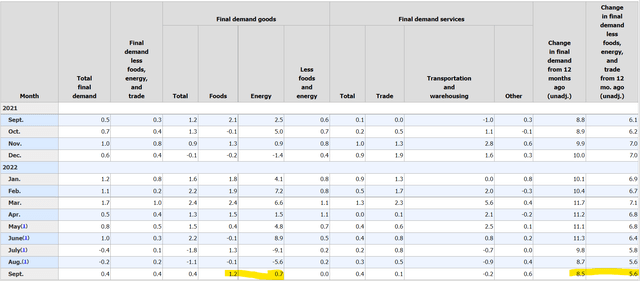

A deeper dive on the PPI report reveals the breakdown of where prices are rising the most. Food and energy are the biggest sources of inflation by far.

BLS.gov

In fact, if you net out foods and energy, the PPI for final demand goods came in at 0.0%.

Other big contributors of inflation that are more readily seen in the CPI than the PPI are housing, rent, travel & leisure, and healthcare.

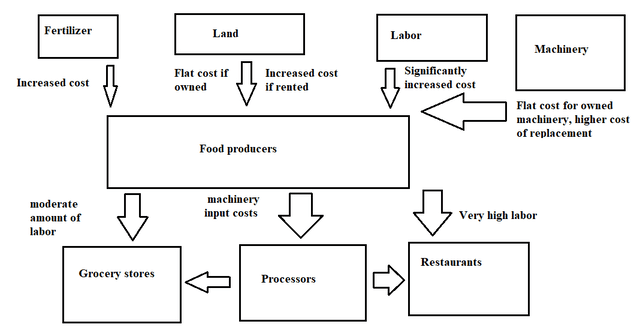

Beyond the industry silos, it might be wise to think about which sections of the industry verticals have the best mixes of revenue benefits and evasion of cost inflation. Let’s take the food vertical as an example.

2nd Market Capital

In my opinion, the most favored sections of this vertical are landowners and food processors that primarily use machinery rather than labor. They get the full benefit of inflation on the revenue side but have rather muted cost increases.

PepsiCo (PEP), for example, just raised guidance to 10% earnings per share growth due to its ability to raise prices in this environment with minimal offsetting cost increases.

Summary of inflation’s impact on earnings

Overall earnings for the market will go up roughly the magnitude of inflation. 2 years of 8% inflation would be roughly 16% increase in overall earnings.

The distribution of earnings increases will heavily favor companies that are advantaged in supply chains such that they get the increased pricing benefits on the revenue side, but have cost inputs that are not subject to inflation.

How inflation solves the market’s problems

The best cure for inflation is inflation.

Higher prices of goods and services incentivizes companies to produce more of those goods and services. The increased level of supply will then create competition, thereby putting a lid on prices of those goods and services.

There is a lag time as it takes a while for production to kick in. Right now we are in the phase of factories, oil rigs and other procuring infrastructure getting built. As they come online, the actual supply output will increase and that is when inflation will come back down to a healthier level.

The impact of pricing on supply can be clearly observed in energy production. During the pandemic, use of oil dropped off a cliff and the price collapsed. WTI Crude oil even briefly dipped into negative pricing.

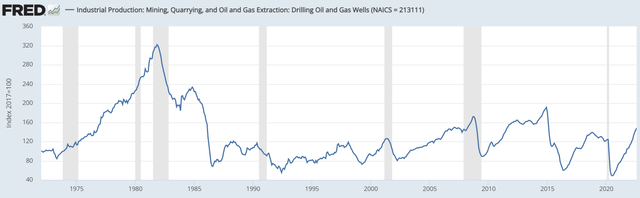

In response, the free market capped wells as can be seen on the sharp down line in 2020 below.

FRED

Since the pandemic, oil prices have rebounded to high or even very high levels which incentivizes drilling new wells.

Unlike capping which can be done quickly, opening new wells takes time which is why the supply line above ramps up instead of jumping up. Eventually the supply will get to a level that adequately meets demand and prices will stabilize.

The same will happen in other industries and that is why I am confident inflation will come back down. I don’t know if it will be months or years, but the supply side increases that will tame inflation are already being put into place.

In turn, this will go a long way to fix the turmoil of the market. Once inflation consistently reads lower the Fed’s level of aggression will calm down and interest rates will moderate slightly. I don’t think interest rates will go back down to zero, but maybe a healthy 3-3.5% yield on the 10-year treasury in a couple years.

The net result of the inflationary cycle

At a consumer level, people’s bank account will be worth less in terms of purchasing power.

At an investment level, earnings multiples will stabilize and earnings broadly will increase materially to reflect the prior years of inflation. Remember that while GDP is in real terms, company earnings are stated in nominal terms and stocks are priced in nominal dollars.

Logically it would follow that stock prices would be higher, not lower. It will be a bumpy path to get there, but I strongly believe it is better to be invested than to have money losing purchasing power in a bank account that gives a negative real return.

Be the first to comment