Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 3.

Yields across a wide variety of income assets have risen sharply this year. Many income assets feature yields that have only been higher during the COVID crash and the GFC. In fact, it’s now relatively easy to find decent securities that are generating true double-digit yields.

Although this article’s focus on double-digit yields may seem gimmicky the main takeaway is that true double-digit yields are actually very difficult to find in any normal market environment.

Investors who bought into double-digit yields in 2021 either bought very low quality securities or securities like CEFs that distributed but never earned double-digit yields. The trouble is that in the former case low quality securities are now facing much greater likelihood of loss if, as nearly everyone expects, the Fed is successful in pushing the economy into a recession to cool off inflation. And in the latter case investors just got their own capital handed back to them with the impression it was earned. In retrospect, neither case now looks particularly appealing.

Our message here is that investors ought to keep three things in mind. First, it’s important to keep an eye on quality to ensure all securities in the portfolio, however attractive they look at any given time, can make it through a potential downturn. Second, it’s a good idea to follow a countercyclical approach to income allocation which avoids stretching for yield when valuations are expensive as they were in 2021. And third, it’s important not to confuse distributions with true yield as distributions on investment vehicles like CEFs are often devoid of any underlying reality.

Yields Then And Now

It is fair to say that the broader income space was unusually expensive in 2021 with very low Treasury yields, very tight credit spreads and tight discounts (if any) on closed-end investment vehicles such as CEFs and BDCs.

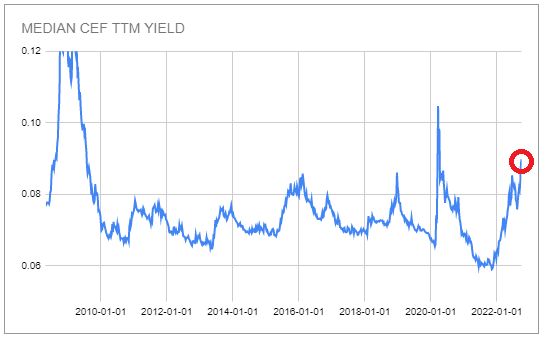

The median CEF yield ended 2021 at an unusually low 6% and has now risen significantly from that low level.

Systematic Income CEF Tool

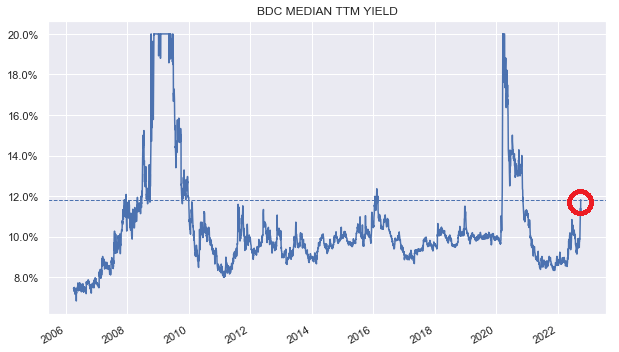

We see much the same picture in the BDC space where the median trailing-twelve month yield traded close to its decade low and has now also risen substantially.

Systematic Income

As we touched on above and as these charts show, the situation in 2021 for income investors was pretty dire with yields being unusually low. The knock-on effect is that investors who wanted to maintain exposure to double-digit yields had to either move lower in quality or allocate to securities that divorced their distribution rates from their actual true underlying yields.

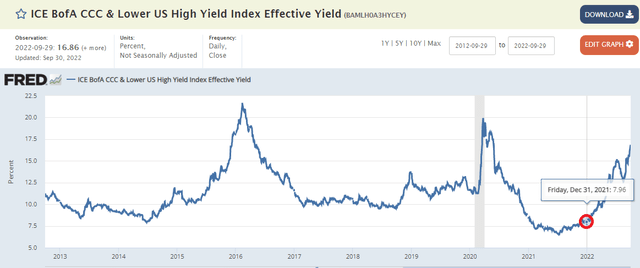

Let’s look at the first part of this dynamic – quality – using high-yield corporate bonds as a proxy for the broader income space. CCC/C-rated corporate bond yields finished 2021 around 8% as the chart below shows. For some perspective, there are a handful of rating levels that separate these bonds from those rated D (i.e. those in default) which are CC and C. In other words, for investors to hold 10%-yielding bonds at the end of 2021 they would have had to hold default-adjacent bonds. Certainly, occasionally there are mispricings and inefficiencies in the market but by-and-large securities with true double-digit yields in 2021 were very speculative.

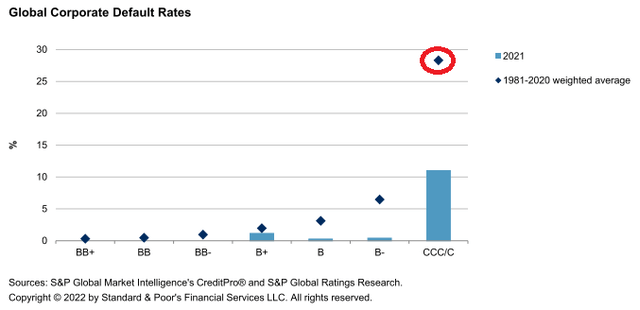

To get a sense of the default risk in CCC/C-rated securities we can look at the chart below which shows the annual default rate for this bucket which is just shy of 30%. What it also means is that the high yields of these kinds of securities are “optical” i.e. they are significantly lower once we adjust for the amount of losses they accrue which detracts from their headline yields. Many investors fail to account for this yield headwind when looking at such “juicy” optical yields.

Moving to the second part of the yield dynamic, the other common type of security that paid out double-digit yields in 2021 was one that held decent-quality securities but whose distributions were significantly in excess of its underlying yield capacity. For example, many CEFs will tend to pay out distribution significantly in excess of their true yields for the simple reason that they can.

For example, a typical poster child fund here is the RiverNorth/DoubleLine Strategic Opportunity Fund (OPP) which has a managed distribution policy of distributing 12.5% of the fund’s average NAV at the end of the year. The fund’s last shareholder report shows that it generated $0.0725 in net income per share monthly while paying out $0.1478 or twice as much.

The key takeaway from this section is that, by and large, double-digit yielding securities in 2021 were either grossly unearned or were from highly speculative securities.

And Some Ideas

The market environment has clearly shifted from 2021. Treasury yields are much higher, credit spreads are much wider and discounts on closed-end investment vehicles like CEFs and BDCs are much wider. All of these shifts have increased yields available to income investors.

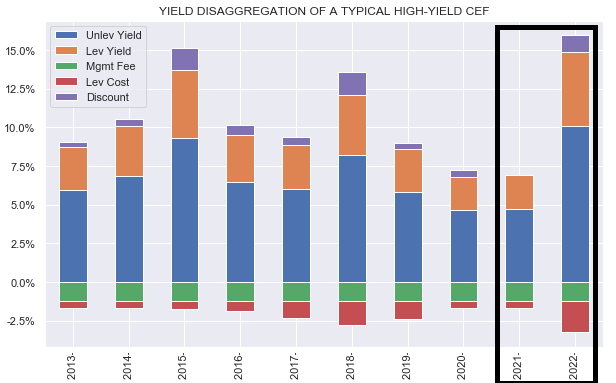

For perspective, the following chart breaks down the yield in a typical High-Yield corporate bond CEF, highlighting that most components of the yield earned by the fund have grown with the net number growing significantly as well.

Systematic Income

The upside is that to reach double-digit yields investors no longer have to dumpster dive. And they also don’t have to hold funds that overdistribute as it’s now much easier for CEFs to reach a double-digit true underlying yield.

In this section we highlight securities that are trading near or above a double-digit yield.

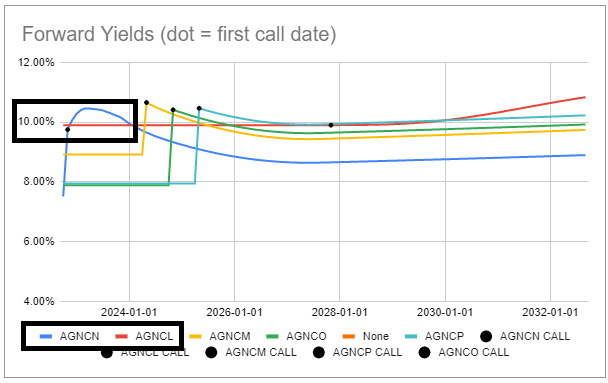

First, we highlight the AGNC suite of preferreds. In this suite we like (AGNCN) which is about to float in the middle of October at a coupon of 3M Libor + 5.111%. We also like the recently launched (AGNCL) which has a 7.75% fixed coupon until 2027 and then switches to 5Y Treasury yield + 4.39%, reset as expected every 5 years. AGNCL trades at a 9.9% stripped yield which is expected to eventually rise above 10% if current forward Treasury yields are realized. AGNCN will very soon quickly shoot up to an above 10% yield which is then expected to subside slowly as short-term rates reverse. Obviously, if short-term rates fail to fall back as the market expects AGNCN could maintain its double-digit yield for an extended period of time.

Systematic Income Preferreds Tool

We also like the Western Asset Mortgage Opportunity Fund (DMO) which trades at a 10.8% distribution rate at the moment. As we discussed earlier, we expect the fund to generate a double-digit underlying yield on NAV at around Libor of 3% which is behind us already. Given its double-digit discount this underlying portfolio yield will rise closer to 11%. In other words, the fund’s current 10.8% distribution rate is pretty close to the actual underlying yield-generating capacity of the fund. We also like the fund as it outperformed most other leveraged credit CEFs this year (for instance, outperforming the PIMCO taxable funds by about 6% this year in total NAV terms) due to its lower-beta profile. Its focus on the household mortgage sector is also attractive given the strength of the consumer.

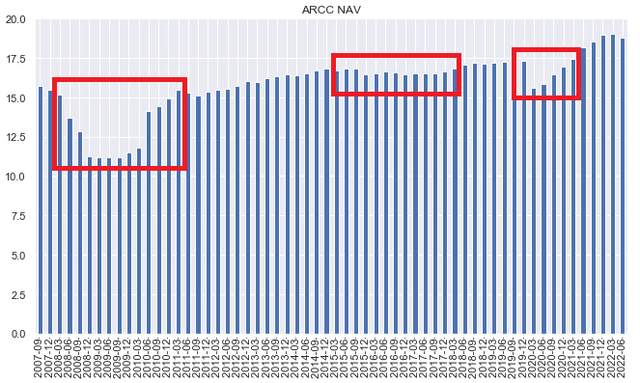

There are a number of opportunities in the BDC sector as well. Specifically, we think investors ought to have a look at the Business Development Company Ares Capital (ARCC) which is currently trading at a 10% discount to Q2 book value and a 10.9% yield. The company has been very resilient through previous market shocks as the following NAV profile shows. A number of other BDCs are also worth a look in our view such as GBDC and OCSL both of which carry high-quality portfolios at double-digit yields (in terms of both distribution rates and actual net income yields).

Finally, we will highlight the mortgage REIT Arlington Asset Investment Corp. 6.75% 2025 notes (AIC) which trade at a 9.8% yield-to-maturity (with occasional spikes above 10%). Arlington Asset run a very low-beta portfolio that has a high agency MBS allocation with low leverage. The bonds are covered by 4.3x of assets after secured borrowings are paid for which is a very high level of coverage for the quality of the portfolio. This is a conservative figure as it doesn’t include the company’s recent sale of a big chunk of its single family residential portfolio.

Takeaways

Our main takeaway in this article is that investors who wanted to earn double-digit yields in 2021 had to mostly either hold highly speculative securities or pretend they were earning double-digit yields by allocating to overdistributing CEFs.

Today investors no longer have to dumpster dive or get their own capital back to enjoy true double-digit yields. The rise in Treasury yields and the widening in credit spreads and discounts this year means that investors can get 10%+ yields in decent-quality assets that truly generate double-digit yields. This is particularly important as these assets are likely to better withstand the ongoing volatility in markets than some of the lower-quality securities.

Be the first to comment