Feline Lim

Thesis

Apple (NASDAQ:AAPL) is a high quality company and stock that investors should want to own at the right price. I think that Apple is a bit overvalued today, but also expect positive returns over the next decade with room to surprise to the upside. Thus, I retain a buy rating on Apple stock, although I don’t view it as a strong buy today and don’t think that the fundamentals support a $200 price target for 2023.

Can Apple Stock Reach $200 In 2023?

To answer the question in the article title, if a stock market bottom is reached in 2023 that’s somewhat near current levels, then regular market volatility would probably allow AAPL stock’s price to fluctuate enough to reach $200 at some point in 2023, even if it doesn’t end the year there.

That’s because AAPL stock has fluctuated by an average of 82% per year over the last 15 years, as measured by the difference between its low and high price in each year. For comparison, the S&P 500 (SPY) fluctuated by an average of 34% per year over the last 15 years.

Of course, if the market fails to bottom and continues the downtrend that started in 2022, it’s likely that Apple will follow it to lower lows. In that case, it would experience most of its volatility to the downside and would likely fail to touch $200.

While fluctuations of 82% per year may seem unhealthy, a 2017 study found that the average S&P 500 stock experiences about twice as much price fluctuation as the S&P 500 in a year. That puts Apple just slightly above average in terms of volatility, a fact which is also reflected in its beta value of 1.25. This above average volatility is due to a variety of factors including high retail interest in AAPL stock and Apple’s somewhat cyclical business, neither of which should be concerning for long term investors in Apple.

To summarize this section, AAPL stock will reach $200 in 2023, or it won’t. That doesn’t sound very useful, and it shouldn’t because short term market movements are almost impossible to predict (and yes, even one year is short term). So, nobody can say for sure what price range Apple’s stock will trade in next year.

A better way to phrase the question posed in the article title might be “Do the fundamentals of Apple’s business support a $200 price tag for Apple stock by the end of 2023?” But that title wouldn’t fit on the screen of the iPhone that many of you are probably reading this on. I’ll explore this rephrased question in the rest of this article.

Is Apple A Good Long-Term Stock?

First, let’s look at Apple from a qualitative perspective. Although the company’s products are somewhat controversial due to their walled garden design and high price tags, there’s no denying that Apple has many loyal customers and benefits from strong network effects (e.g. iMessage, Airdrop).

Apple is especially popular with young people in the United States, with an estimated 87% of teens having an iPhone. Popularity with this demographic sets them up well for the future, even if the picture is a bit blurrier internationally.

Apple (along with big tech peers Amazon, Microsoft, and Google) has a wide moat and great long term trajectory due to its oligopoly in multiple hardware and software sub-industries. In Apple’s case, it will continue to boast best-in-class hardware margins by asserting dominance in the smartphone and PC supply chain, where it’s the largest customer of most of its suppliers. It’s a similar story with the App Store duopoly, which allows Apple to take a large cut of revenue from the many, many companies making iOS apps. Going forward, Apple will leverage its walled garden approach to ensure that it says relevant in any post-smartphone computing medium like smart watches, smart speakers, AR/VR headsets, and possibly even cars.

I could go on and on about why Apple has great and unique products that position it well for the long term. But most investors are probably already familiar with Apple’s products, so let’s move on.

AAPL Stock Key Metrics

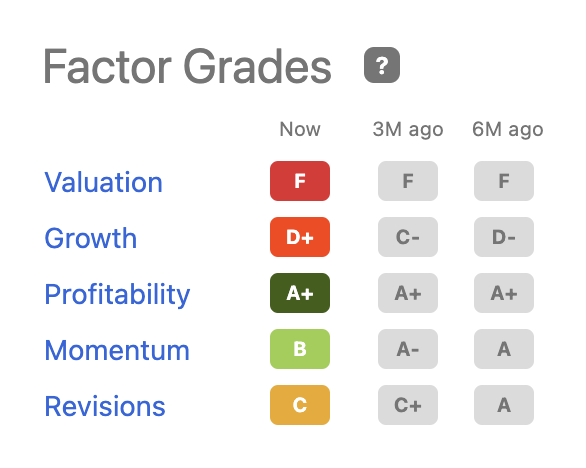

Seeking Alpha

According to Seeking Alpha, Apple’s factor grades are mixed. It gets an A+ for profitability, which is no surprise as Apple boasts profit margins of 26%. It also scores well on momentum, as it’s fared better than most tech names in the recent market selloff. However, Apple has had 21 downward revisions against 14 upward revisions in the past three months, which shows that sentiment is mixed.

Turning to growth, Apple scores poorly on this metric. Unlike its peers, it missed out on the public cloud infrastructure boom. I don’t really knock Apple for this miss since it’s a B2C focused company and developed a strong suite of B2C SaaS offerings like News, Music, and TV in the meantime. But it does mean that Apple is projected for the slowest growth of the big tech companies going forward. I model Apple growing revenue at just a 6% CAGR over the next 10 years, which is similar to the Seeking Alpha analyst consensus of 7%.

It’s possible that Apple’s growth will surprise to the upside if it has success in a new product category like AR/VR headsets and/or smart cars. I also expect the company to take market share in laptops/PCs thanks to the incredible ARM-based microprocessors it released in 2020. However, Apple’s largest segment remains iPhone, and I don’t expect stellar growth there.

Although it’s not directly highlighted in the key metrics, another metric worth pointing out is Apple’s ROI of 50% and ROE of 153%, which are both the best among the big tech companies. I look at these two metrics for a quantitative indicator of whether a company has a moat, and typically consider them solid when they’re above 20%. What these metrics mean is that even though Apple is slower growing, it’s making very profitable and efficient use of the capital that it does invest back into its business. That fact, combined with Apple being a highly profitable business, means that Apple will continue to be a very shareholder-friendly company.

In addition to paying a dividend, Apple has reduced its shares outstanding by at least 3% yoy in every quarter since 2013. While Apple might not be the hyper growth company it once was, it’s going to be difficult for Apple to be a terrible investment when it has positive growth and essentially a >3% dividend, assuming it can keep these shareholder returns going.

What Is The Target Price For AAPL Stock?

The last factor grade that I didn’t cover yet is valuation. AAPL gets an F for valuation, likely due in part to its PEG ratio above 4. Nevertheless, analysts – who typically have a time horizon of one year – have a consensus price target of $181 according to Seeking Alpha. I’ve seen consensus estimates as high as $184. The lowest target I’ve seen is Morningstar’s at $130.

At Tech Investing Edge, we invest with a 10 year time horizon, so I don’t have an explicit target price for Apple at 2023. However, if we assume linear growth using my 10 year price target, it would give a $141 price target at the end of 2023.

Overall, while there is a wide range of price targets for AAPL stock, it’s safe to say analysts are modestly bullish but don’t expect $200 in 2023. I agree with this perspective.

Final Thoughts

Investors might be surprised to see that I’m long Apple even though I don’t believe that the fundamentals support a $200 price target – or even the current price – in 2023. I’m still long because I believe in using both qualitative and quantitative factors when investing.

It’s likely that I’ll be wrong about at least some of the assumptions that I made when forming my price target, such as 6% revenue growth. If that growth elevates to just 8%, then my price target moves above the current price. What I’m more certain about than the exact growth rate and fair value are the qualitative factors I previously highlighted that make Apple’s business great and well-positioned for the long term. I chose to publish this article before Thursday’s earnings because I’m confident that these qualitative factors won’t change, regardless of what numbers Apple posts this quarter.

What price targets (analysts’ and my own) tell me is that Apple is not insanely overvalued. It’s likely slightly overvalued or slightly undervalued. And, to repeat a probably overused quote, it’s better to buy a great business at a fair price than a fair business at a great price.

Be the first to comment