monsitj

Introduction

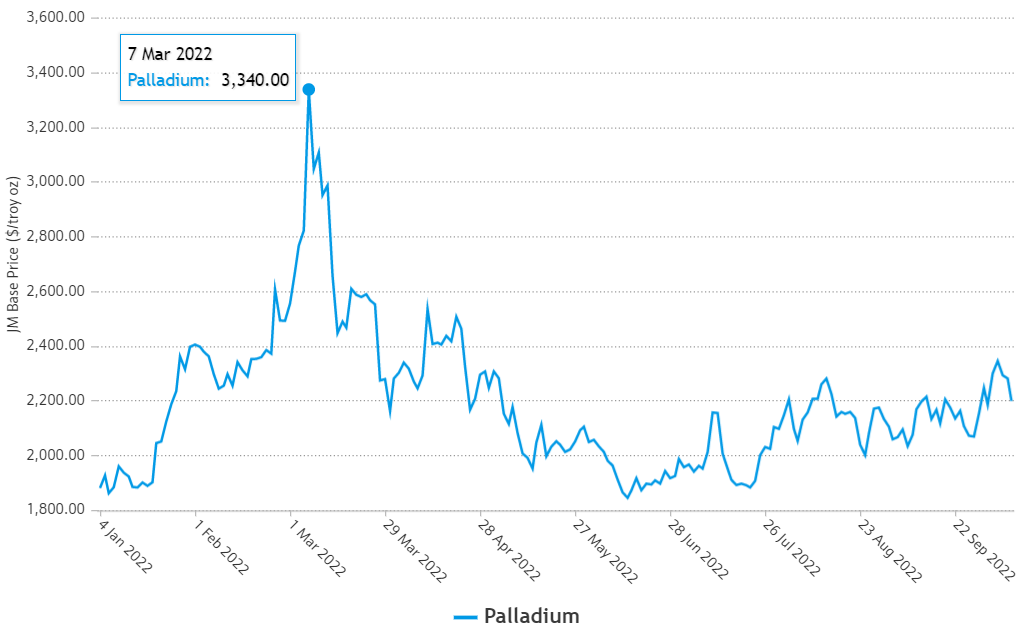

In March 2022, I wrote a bullish article on SA about platinum group metals [PGM] producer Impala Platinum (OTCQX:IMPUY) (OTCQX:IMPUF) in which I said that the company looked cheap as the Russia-Ukraine conflict pushed palladium prices above $3,000 per ounce.

Palladium and rhodium prices declined shortly after, but they have been stable over the past few months due to supply issues in South Africa which are unlikely to be resolved soon. In addition, Impala Platinum recently posted strong FY22 results, and it had 26.5 billion rand ($1.46 billion) of net cash as of June. In view of this, I’m surprised that the market valuation of the company has declined by over 40% since my March article and stands at 154.1 billion rand ($8.49 billion) as of the time of writing. Overall, I think that Impala Platinum is undervalued at the moment as the short-term outlook for palladium and rhodium prices is compelling. Let’s review.

Overview of the recent developments

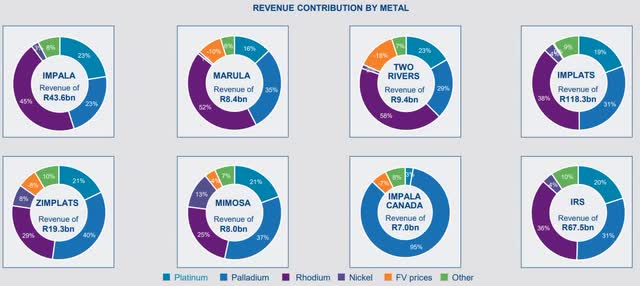

In case you haven’t read any of my previous articles about Impala Platinum, here’s a brief description of its business. The company owns several major PGM mines across South Africa, Zimbabwe, and Canada as well as a 40.46% stake in JSE-listed sector player Royal Bafokeng Platinum (RBPlat). The majority of Impala Platinum’s revenues come from three operations, namely Impala, and Impala Refining Services [IRS] in South Africa, and Zimplats (OTCPK:ZMPLF) in Zimbabwe. In FY22 ended on June 30, the group booked revenues of 118.3 billion rand ($6.52 billion), which represents a decrease of 8.7% year on year as a result a 4.5% decline in the PGM basket price and a 3.7% slump in concentrate production due to operational issues at Impala. As you can see from the charts below, rhodium and palladium accounted for the majority of revenues in FY22.

Impala Platinum

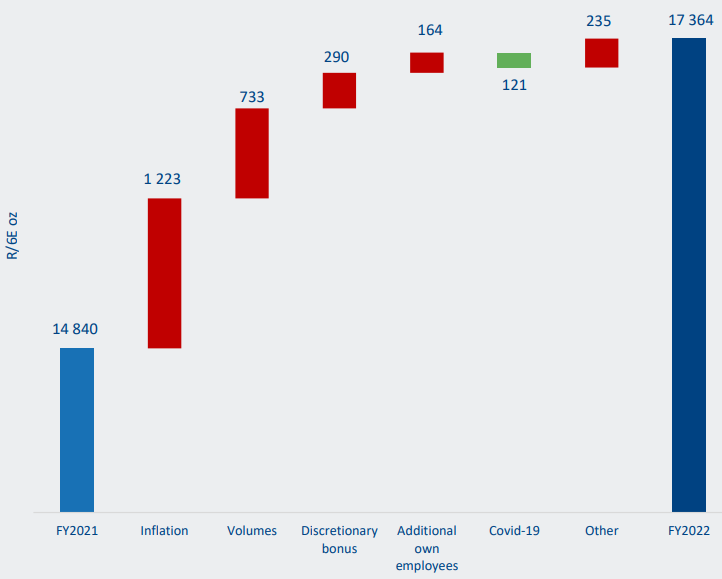

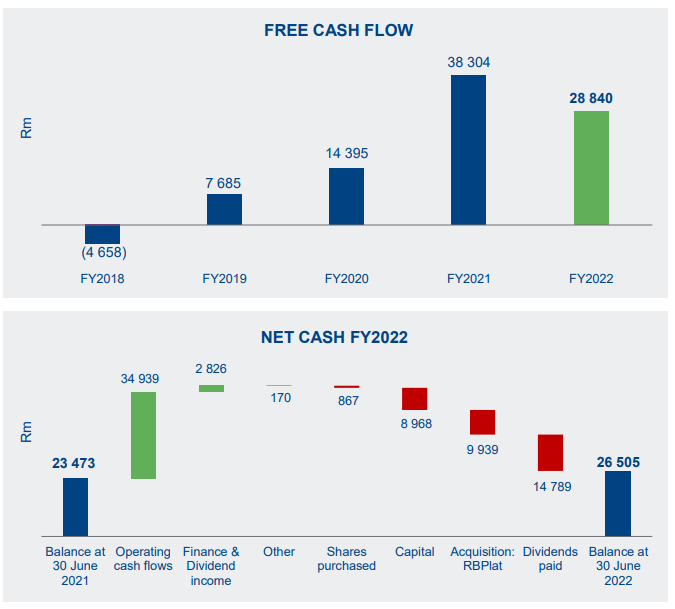

Gross unit costs per 6E ounce rose by 17% to 17,364 rand ($956), mainly due to inflation, lower volumes, and employee discretionary bonuses. This led to a decline in free cash flow by almost 25% to 28.8 billion rand ($1.59 billion). Yet, this amount is still two times higher compared to FY2020. Net cash, in turn, rose by 12.9% despite Impala Platinum paying 14.8 billion rand in dividends ($815 million) during the fiscal year and spending 9.9 billion rand ($548 million) in cash for purchases of RBPlat shares.

Impala Platinum

Impala Platinum

Overall, I think the FY22 financial results were good although rhodium and palladium prices were a bit softer. The 17% unit cost increase looks alarming at first glance, but you have to take into account that inflation is strong across the whole PGM industry at the moment. The FY22 EBITDA came in at 53.3 billion rands ($2.94 billion) which means that Impala Platinum is trading at just 2.4x EV/EBITDA as of the time of writing.

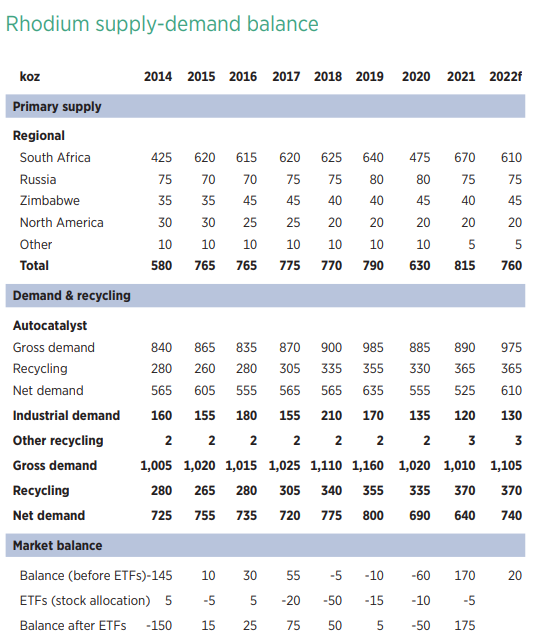

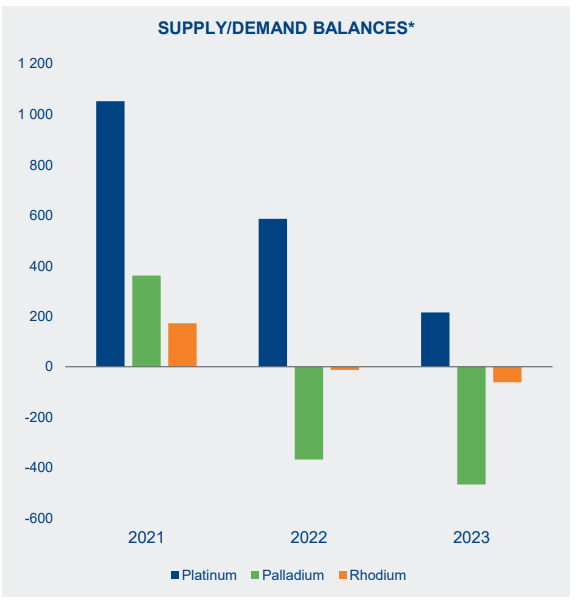

Turning our attention to the rhodium and palladium markets, you can see from the charts below that prices decreased from their highs when the invasion of Ukraine started but they’ve been holding well over the past few months despite strong global battery electric vehicle [BEV] sales.

Johnson Matthey

Johnson Matthey

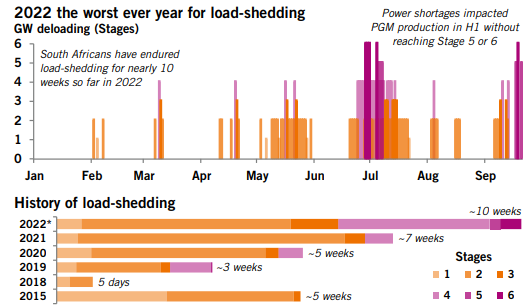

South Africa accounts for about 80% of global primary rhodium supply as well as a third of palladium output and the country is currently experiencing its worst energy supply issues in its history as state-owned power utility Eskom is implementing stage 6 load-shedding once again. The first time that stage 6 load shedding was implemented was back in 2019 and this impacted about 90 koz of work-in-progress PGMs as smelting facilities were shut down. It seems that the situation will be worse.

Heraeus

In addition, Anglo American Platinum (OTCPK:AGPPY) announced in September that the rebuilt of its Polokwane smelter was getting delayed due to sub-standard materials and this should push about 210 koz of palladium into 2023 as work-in-progress stock.

Despite recent motor vehicle production downgrades, Heraeus is now forecasting that the palladium market will be in deficit for 2022. This should put upward pressure on prices in the near term. With load shedding intensifying, I wouldn’t be surprised if the rhodium market also enters deficit territory.

SFA (Oxford)

Looking at the situation in 2023, the restarts of smelters will put the unprocessed stock from the second part of 2022 back into the market and this is likely to push down rhodium and palladium prices unless global auto production increases. Impala Platinum currently expects the rhodium and palladium markets to be in significant deficits in FY23 due to Russian sales uncertainty as well as spot market purchases from China, but I think this could be too optimistic.

Impala Platinum

Turning our attention to the guidance, Impala Platinum expects to have a refined production of 3.1 Moz to 3.3 Moz with unit costs of between 18,200 rand ($1,000) and 19,200 rand ($1,060) per ounce in FY23. In my view, it’s a strong guidance considering units costs are expected to show little change and I think it’s likely to be another strong year from a financial point of view as rhodium and palladium markets should be tight in the second part of 2022. The dividend yield currently stands at 8.72% and I expect Impala Platinum to keep the size of its dividends unchanged in FY23. In my view, the company should be valued at above 4x EV/EBITDA due to the good outlook for rhodium and palladium prices over the coming months.

Looking at the risks for the bull case, I think that there are three major ones. First, many analysts are forecasting that the world economy is on the brink of a recession, and I think that a repeat of the Great Recession could spell trouble for auto sales. This could significantly decrease PGM demand. Second, an accelerated adoption of BEVs would decrease demand for diesel and gasoline cars. Third, it’s possible that Eskom finds a way around stage 5 and 6 load shedding but it’s looking unlikely this will happen in the near future.

Investor takeaway

Rhodium and palladium prices have stabilized at high levels, and this helped Impala Platinum close FY22 with strong financial results. The company increased its cash position and energy supply issues and delays in the rebuild of the Polokwane smelter are likely to lead to a significant decrease in South African rhodium and palladium output over the coming months. In view of this, I’m bullish on Impala Platinum over the near term.

I think that there are too many moving parts in the PGM market to make a reliable forecast about 2023 prices, so I rate this stock as a speculative buy. If you want to get exposure to Impala Platinum shares, keep in mind that it could be best to do this through the JSE as trading volumes on the LSE and OTC are light.

Be the first to comment