alanphillips/E+ via Getty Images

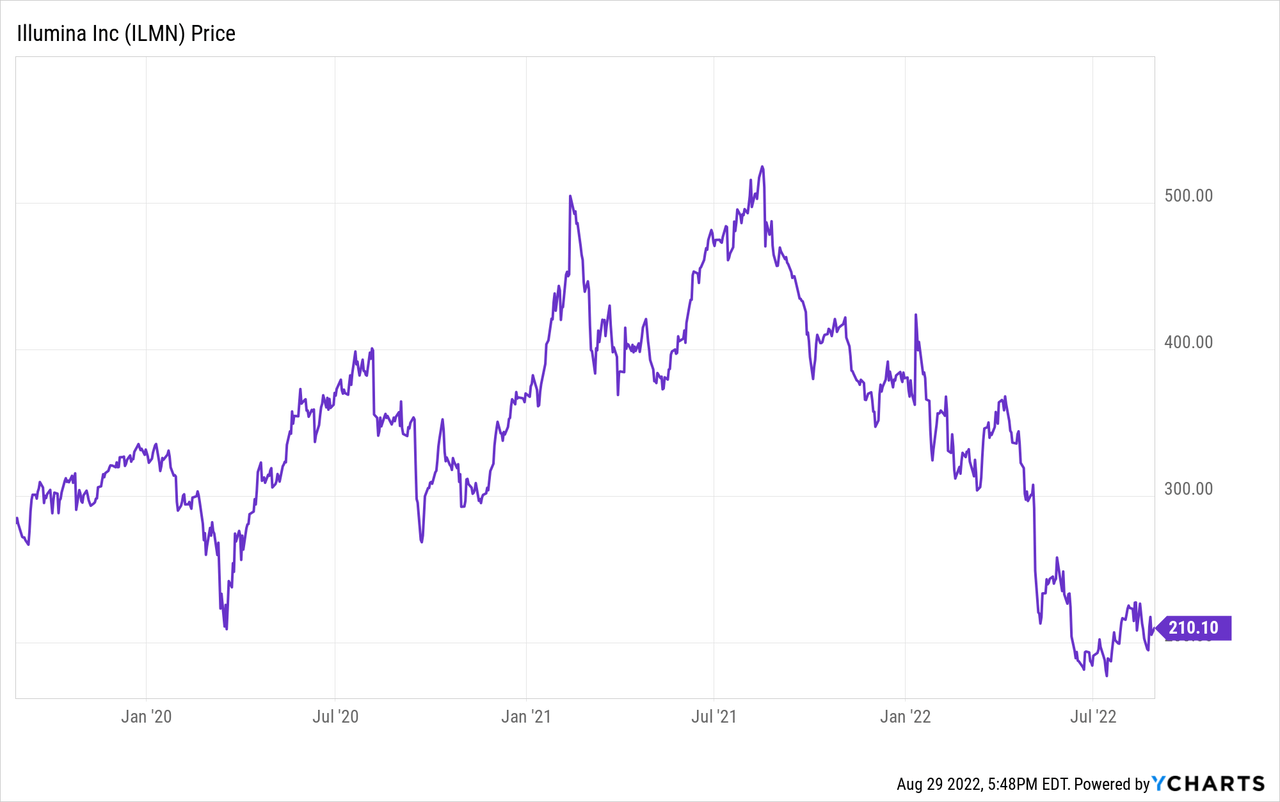

Illumina (NASDAQ:ILMN) is the primary maker of DNA sequencing and analysis equipment in the world. It dominates its market, and that market grew rapidly from its inception up until about 2019. Lately y/y growth has been anemic. It is difficult to predict the rate of future growth, and there is a wild card not yet turned over: whether the EU will approve Illumina’s acquisition of Grail. This creates a situation where investor expectations can be quite divergent. This article mainly serves as a warning against assuming the price is near a bottom.

Q2 2022 Results

The latest hard data we have is Illumina Q2 2022 results, which were released on August 11, 2022. On a GAAP basis revenue was $1.16 billion, down 5% sequentially from $1.22 billion and up 3% from $1.13 billion in the year-earlier quarter. Net loss was $535 million, down sequentially from net income of $86 million, and down from net income of $185 million year-earlier. Resulting diluted EPS was a loss of $3.40, down sequentially from a gain of $0.55, and down from a gain of $1.26 year-earlier.

Even allowing for exclusion of special items, non-GAAP numbers were not so great. Non-GAAP net income was $91 million, down 46% sequentially from $169 million, and down 67% from $276 million year-earlier. Diluted EPS was $0.57, down 47% sequentially from $1.07, and down 70% from $1.87 year-earlier.

Cash flow from operations was $125 million and free cash flow was $54 million. No cash was used for stock repurchases and Illumina pays no dividend. But there is still a substantial cash balance, $1.29 billion at the end of the quarter.

Some of the issues in the quarter included foreign currency exchange rates, having Grail expenses exceeding revenue, and customers delaying sequencer purchases, likely due to concerns about macroeconomics. Legal costs also had an outsized impact on the quarter. The operating loss at the Grail division was $187 million. Grail was re-acquired (it had been spun off from Illumina) in August 2021, impacting the y/y profit comparisons.

Long-term revenue and profit trends

Illumina currently has a P/E (price-to-earnings) ratio of 73, a number usually associated with companies rapidly growing revenue and profits. Or over-excited investors, or some combination thereof. Some would argue that Grail will become a source of growth. The reality is we do not know what revenue or profit growth will be going forward. At 3% annual revenue growth a PE of 20 is at the high end of what I would pay.

Looking at revenue growth over a longer period, the past 5 years, it is clear growth rates have been inconsistent:

|

Year |

Revenue in $ billions |

% Increase from prior year |

|

2017 |

2.752 |

15% |

|

2018 |

3.333 |

21% |

|

2019 |

3.543 |

6% |

|

2020 |

3.239 |

-9% |

|

2021 |

4.526 |

40% |

Source: Seeking Alpha ILMN

Note that prior years do not make good predictors for any given following year. I believe 2017 and 2018 were in the typical growth spectrum of most of Illumina’s history. Those growth rates sufficient to support a P/E well over 20. 2019 was pre-pandemic and should have been a warning to investors, but it could be treated as at the very low end of the growth rate spectrum. 2020’s decline could be attributed to COVID. But then 2021 not only saw a bounce-back, but part of the revenue was from a need to sequence COVID strains.

Given all that, it is possible to interpret Q2 2022 results in more than one way. 3% growth against a year that saw 40% growth still leaves us with over 20% per year. But Illumina is guiding to full revenue up just 4-5% for 2022. Using 5%, we would have revenue of about $4.75 billion. From 2018 to the end of 2022 the average growth rate is in the vicinity of 10% per year. That is a great growth rate that many companies would be happy to have. Nevertheless, it is a fair question to ask, if that is our new expectation, what PE does it justify? Not 73. Perhaps, however, we are underestimating future revenue and profit growth unless we take the Grail division into account.

Grail as a Wild Card

Grail was spun off from Illumina in 2016. It specializes in identifying cancers by finding DNA fragments in blood samples. Illumina acquired it (for $8 billion, a much greater outlay than it received for it when it was spun off) in August 2021. Illumina did not get prior EU regulatory permission to make the acquisition, and so has run into trouble. Currently EU regulators require Illumina to run Grail as a separate company while the merger review continues. In late July Reuters reported the EU would likely veto the Grail merger. That could be overcome by more concessions from Illumina, but until there is a definitive decision it seems like it is not smart to plan on Grail remaining in Illumina. The concessions, which involve royalty-free patent licenses to BGI, take away much of Grail’s advantage over rivals.

But if Grail does become part of Illumina, the first significant income would be from the Galleri blood test. This test can detect cancers before that is possible with current diagnostics. In theory everyone in the world should get the test every so often. In reality, payers will be wondering if the cost of broad screening pays for itself. Also, there is likely to be rival technology (from BGI and others), and competition drives down pricing. In Q2 2022 Grail had just $12 million in revenue. That could be the first drop in what could become a deluge in a few years. Whether investors believe Illumina is overvalued or undervalued, at present, depends largely on whether they believe that there will be a Grail deluge, and whether that will be within Illumina.

Conclusion

A new investment in Illumina at this time is largely a bet on what other investors will do. I do not like to invest in that type of situation, but many investors, including institutions, do quite well specializing in it. Given the decline from the 52-week high of $471.10, clearly a lot of investors have gotten out of Illumina or at least taken profits on part of their position. Keep in mind that even at today’s price near $208, someone who bought in 10 years ago is up by a factor of almost five. Investors from, say, 2002 are up by a factor of over 100. So buying at a high P/E sufficiently far in the past has worked out gloriously. Selling that sort of gain results in a substantial capital gains tax, which is some incentive for holding. I expect competitive pressure to keep making genetic sequencing cheaper, even as the demand for sequencing continues to rise. I expect core Illumina to grow modestly over the next few years. Not fast enough to convince investors to sustain the current P/E ratio of 73, unless a story is circulated, and widely believed, about some factor that would cause the current growth rate to accelerate.

I see no reason to bet on rapidly ramping Grail revenue unless the EU decides to allow the merger to go ahead. I think, looking back to about the beginning of 2018, when the slowing growth rate became apparent, some investors have been selling into new highs, so those peaks have been short-lived. That is the most likely investor behavior pattern until either the P/E ratio returns to a rational level for the current rate of growth, or signs of a fast sales ramp from Grail emerge. I am calling this situation a Sell because even if the latter case comes to be, for me it will only make the company a Hold at the current stock price, at least until earnings do more to catch up with the stock price. I believe on the whole Illumina is a company with good products and a bright future, so there is a stock price where I would be a buyer, but I prefer not to name that price here.

Be the first to comment