bjdlzx

(Note: This is a Canadian company that reports in Canadian Dollars unless otherwise noted.)

(Note: This article appeared in the newsletter on July 14, 2022, and has been updated as needed.)

I covered Headwater Exploration (OTCPK:CDDRF) (TSX:HWX:CA) when it was known as Corridor Resources. Back then the company was primarily a natural gas producer from an aging field with long-lived wells. All that began to change when new management took over the company through a reverse merger. Mr. Market generally treats something like this as a new company. Therefore, the stock is likely to be volatile until the company establishes a track record with the new strategy.

As I noted when the reverse merger took place, this management has built and sold companies before. When that is combined with the very conservative debt-free balance sheet and a big cash balance, then a lot of the new company risk is reduced. So, any of the typical new company exaggerated pullbacks are likely to prove to be buying opportunities.

Managements that have built and sold companies in the past are far more likely to sell the current company in the future. They are not going to sell the company unless they make a decent profit. Even though their timing is not exact, it is often a very good indicator of when it is time for investors to pare down to core holdings in the industry. Following experienced management like the managers in this company can often enable investors to avoid some big permanent losses while benefiting from much of the industry cycle.

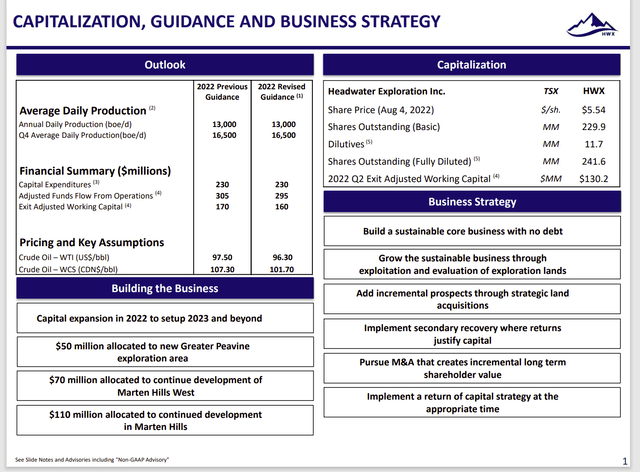

Headwater Exploration Business Summary Presentation (Headwater Exploration August 2022, Corporate Presentation)

The share price has held fairly steady since this presentation was made. Even so, the forward adjusted funds flow has been steadily adjusted in a favorable direction as strong commodity prices continue to dominate the quarterly outlook. Far more importantly, this company sold a lot of shares to keep the financial leverage non-existent.

One of the things about no debt and lots of working capital is that this kind of new issue will survive missteps and often be able to overcome anything unfavorable in the future. Leveraged companies often cannot afford bad news of any kind. Therefore, loss of principal is reduced in the long term when this kind of financial strategy is used.

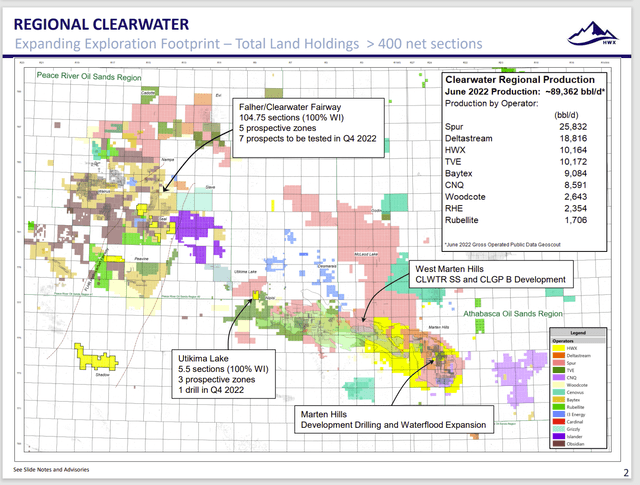

Headwater Exploration Map Of Current Leaseholdings (Headwater Exploration August 2022, Corporate Presentation)

The current map of company leases shows a lot of potential areas that are not yet claimed in this emerging play. Canadian lease prices are often a small fraction of the lease prices in the United States. Therefore, the company is likely to be able to continue to grow its leasing position at a fairly low cost in the future.

It appears that the company can grow quite large by simply concentrating on the Clearwater area. That would be a fairly low risk way to grow because management will be more familiar with the characteristics of nearby potential leases than they are of new basins. The possibility of “bolt-on” lease acquisition further reduces the risk of purchasing new leases.

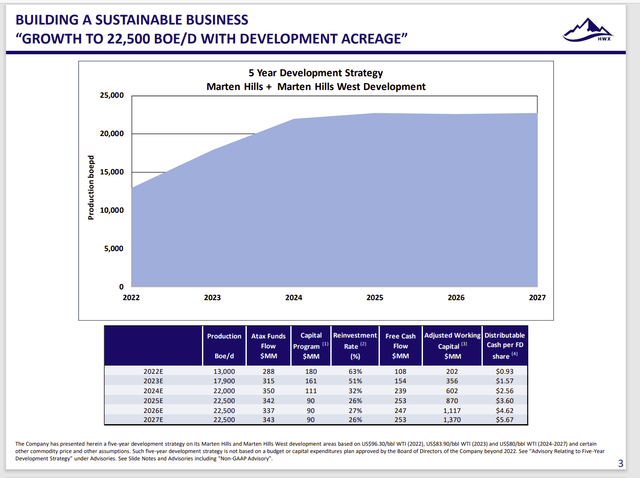

Headwater Exploration 5 Year Development Strategy (Headwater Exploration August 2022, Corporate Presentation)

Note that management is assuming some robust pricing for the next five years. The outlook for the industry has dramatically changed since 2021. This is generally a very low visibility industry. Therefore, investors need to be prepared for the outlook to change materially in unexpected fashion.

With that warning in mind, the development envisioned above carries relatively low risks because of the many “discoveries” in the area. These “discoveries” are intervals that have long been known to hold oil. But the technology now exists to produce that interval commercially.

There are even more possibilities that management has not yet tackled but are likely considered low risk due to the activities of neighboring competitors. This is one of the advantages of the unconventional business. That could make the above slide obsolete very quickly. There is a lot of uncharted low risk potential that management has not yet “gotten to”.

The rapid growth of the business is made possible by the low breakeven point of these wells. Therefore, a commodity price decline to (for example) WTI $60 would slow progress and definitely decrease earnings. But that setback would be overcome by a still decent (though reduced) growth rate. This is one of the reasons that a low breakeven point is so important.

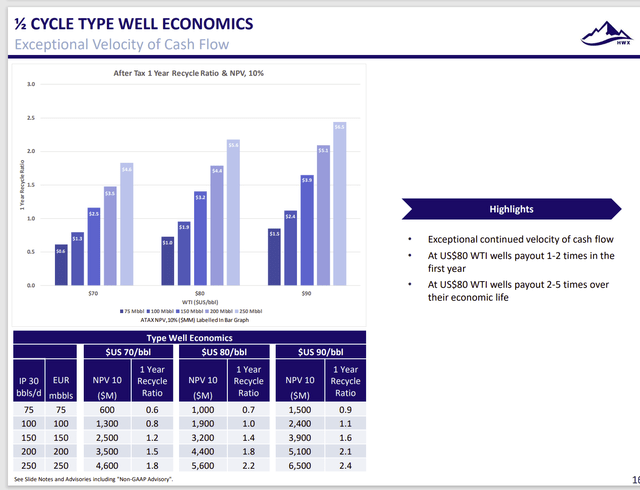

Headwater Exploration Presentation Of Clearwater Well Profitability Characteristics (Headwater Exploration August 2022, Corporate Presentation)

Anytime a well pays back in less than two years, then that proposal to drill that well is an acceptable proposal. Here, there is a further cushion in that wells that pay back as fast as noted above can be hedged for a reasonable profitability so that future price variances still ensure at least a minimum profitability.

What is even more likely is the wells that are likely to pay back two to three times in the first year will be preferentially drilled. In that fashion, management has the cost of the well back to use that same capital to drill another well to ensure rapid cash flow growth in preparation for the next cyclical downturn.

Actual well profits will vary over the lifecycle of the well as oil prices vary. But a starting projection of profit similar to what is shown above means that some very good money is booked before a cyclical downturn ends the current profit cycle. Even while wells are produced for positive cash flow until prices improved, those initial profits mean that the costs have been recovered.

Therefore, the well adds to company profits even though the accounting allocation is different. Accounting forces a guestimate of the well life to produce an estimated depreciation amount over the life of the well. That often results in an overestimate of early profits to be followed by losses long after accounting shows that the costs were recovered.

The biggest risk to any heavy oil play is that the price discount to the WTI price widens to force production shut-ins. In this case, the debt-free balance sheet and large working capital budget should enable the company to get through a lot of downturns that would bury more leveraged competitors.

In fact, the debt-free balance sheet may enable management to make some cheap acquisitions during the next cyclical downturn.

Summary

This management has built and sold companies before. That experience sharply reduces a lot of new company risks. The market, however, focuses on the new company created by the reverse merger and lumps this company into the same “boat” as other new companies. But that makes for a potential buying opportunity on every pullback.

Management is very likely to sell the company in the future at the right price. Therefore, long-term holders are likely to be more than adequately rewarded for holding long-term.

Quarterly revenues have now passed the C$100 million mark. They will easily pass the C$200 million mark unless oil prices fall materially and remain lower. Cash flow is growing fast because the wells pay back quickly in the current commodity price environment. That fast payback will enable growth to continue for the foreseeable future. This company will be much larger very quickly in the 5-year horizon due to the good industry conditions when production was low.

This company can grow quite large simply by focusing on the Clearwater area. The large working capital balance and no debt policy reduce a lot of upstream and new company risks as well. That makes this relatively new company suitable for a wider variety of investors than is typically the case for both new and smaller companies. For many investors, a basket of this kind of company is probably better than loading up on one company.

Be the first to comment