gorodenkoff/iStock via Getty Images

Investment Thesis

Globant S.A. (NYSE:GLOB) is a fast-growing company with significant profitability. The stock is relatively cheap compared to what it was during the pandemic levels. Additionally, the company is serving great blue-chip stocks, which could add more security to this investment if these blue-chip companies remain to work with GLOB. The company has solid cash flows, which is excellent for a company in the IT services industry since they can use that money to:

- Acquire more companies to diversify its portfolio.

- Return some of its capital to its shareholders.

Globant also continues to expand in several other geographical locations and significant high-CAGR end markets, which can further boost the company’s long-term profitability. Overall, I think that the company’s growth and profitability compared to its industry shows that Globant is a better-performing company, which leads me to rate the stock as a Buy.

Brief Overview Of Globant

Big Companies That Globant Works With – Globant Q3 Investor Presentation

Globant provides many IT services for various clients, such as Walt Disney Parks and Resorts online, which accounted for 10.9%, 11%, and 11.2% of the company’s revenues during the years ended December 31, 2021, 2020, and 2019, respectively. Globant provides engineering, innovation, and design at scale. We can determine that Globant is participating in the global IT services market. Globant works with big companies and continues to acquire more clients, solidifying the company’s long-term performance if they maintain connections.

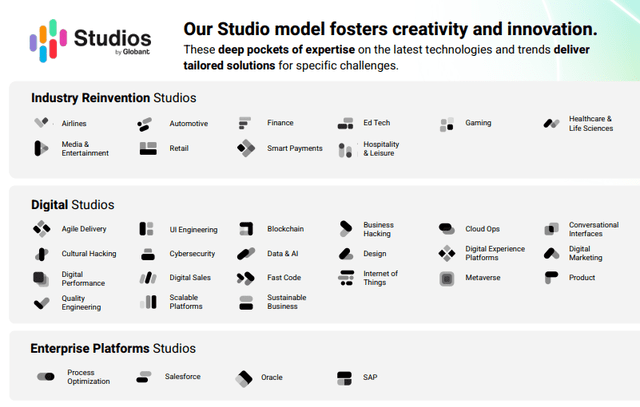

Globant Studios – Globant Q3 Earnings Presentation

The company operates in different studios and end markets. The company has excellent opportunities to expand in diverse end markets. Globant can continue to expand geographically, or software-wise by using its reputation as a good software company plus its history of working with other blue-chip companies.

I believe the global IT services market will continue to grow as technology leans more toward the digital world. According to Grand View Research, the global IT professional services market is expected to register a compound annual growth rate [CAGR] of 11.2% from 2022 to 2030 since the rise of automation to eliminate repetitive and mundane tasks is what enterprises are aiming to provide a better customer experience.

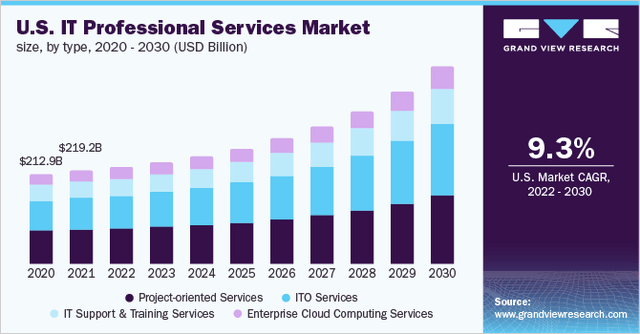

Grand View Research – US IT Professional Services Market

Considering that Globant gets 60% of its revenues from the United States, it’s worthwhile to mention that the US IT professional services market is expected to grow at a 9.3% CAGR by 2030, which is a relatively high number. Globant generated $803 million in revenues in the US of its $1,297 total revenues, which means that Globant is in an excellent position to capitalize on growth in IT services.

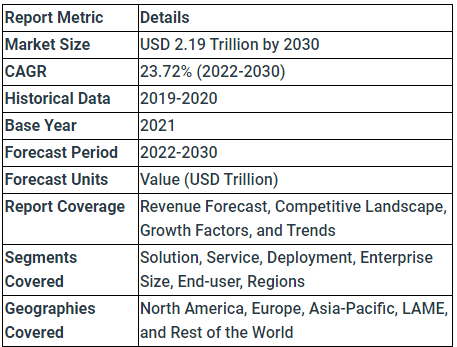

Straights Research – Digital Transformation

Additionally, Straits Research expects the digital transformation market size is expected to reach $2,198 billion by 2030, growing at a CAGR of 23.72% by 2022-2030. The growing market means that Globant is well-positioned to:

- Acquire more customers since they have a great history of working with blue chip companies.

- Use its reputation to expand in different end markets.

- Acquire more companies that can provide more digital transformation services.

- Expand the company’s geographical footprint.

Since Globant offers many services through its reinvention studios, the company is well-positioned to maintain and improve its position in the digital transformation market. Furthermore, I think the company’s recent acquisitions will further enhance the company’s performance and help the company expand in different geographical locations.

Recent News and Acquisitions

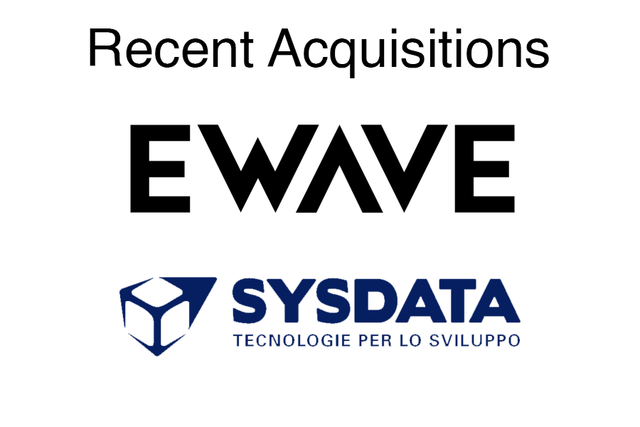

Logos from eWave and Sysdata – Image by Author

Since Globant is fast-growing, the company is making acquisitions to expand and diversify its portfolios while making sure they enter different end markets. One of the growth opportunities a company could find through acquisitions is improving its geographical reach. Companies like:

eWave – A digital commerce experience consultancy. Born in Australia, the company is an award-winning Adobe Platinum Partner and a Salesforce gold partner. eWave can reinforce Globant’s digital commerce capabilities and expand in the Asia Pacific region.

Sysdata – Provides advisory capabilities and services to blue-chip companies in data analytics, business intelligence, mobile apps, and other related fields. Since Sysdata is located in Italy, the company can bring in new clients, such as Maserati, a luxury vehicle company.

The company has shifted its focus to the Asia Pacific and Western Europe regions. Although geopolitical issues will still be hard to deal with, expanding to these markets will set up the company for long-term performance once the recession subsides.

For the company to improve its services, it must ride on the technology trends and improve its position to acquire new clients through its company acquisitions. Globant is also working closely with software companies like Salesforce (CRM), SAP (SAP), and Oracle (ORCL), to launch enterprise studios and support Globant’s reinvention efforts to meet clients’ needs. According to Martín Migoya on the company’s Q3 earnings call, Globant’s CEO:

This cluster we consolidate our alliance and efforts with Salesforce, SAP and Oracle. All of our finance platform specialists will be working closer together in order to support clients’ reinvention from their own core. This involves improving process optimization as a backbone of the organization while taking into account the ever-changing context for every industry.

The new studio sounds promising, knowing Globant is working with companies like Salesforce, SAP, and Oracle. The new enterprise studio aims to improve sales force, process optimization, increase productivity, reduce costs, and maximize business results.

Financial Analysis

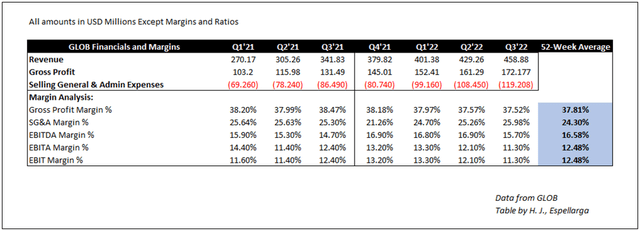

GLOB Financial Performance – Data from GLOBANT – Table by Author

Globant has been showing positive signs through its growth and profitability metrics. On its recent Q3 results, the company achieved $458 million in revenues, a 34.2% year-over-year increase, and a 6.9% sequential increase. The company has maintained its profit margins, with its 52-week average of 37.81%, while also maintaining its SG&A margins of 25.98%, in line with its 52-week average of 24.30%.

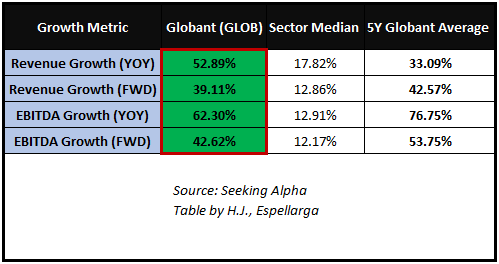

Globant Growth Metrics – Source: Seeking Alpha

As previously mentioned, Globant is a fast-growing company performing way better than its sector median. According to Seeking Alpha’s quant ranking, Globant is ranked 91 out of 654 in the IT sector, which is high, considering that the company is growing fast.

Globant’s year-over-year revenue growth of 52.89% exceeds the sector median’s 17.82% and its five-year average of 33.09%. It also exceeds the sector median’s 12.86% forward revenue growth. Similar to the company’s EBITDA growth, it pretty much exceeds the sector median’s performance of 12.91% since it has 62.30% year-over-year. Overall, Seeking Alpha gives a growth grade of B, which is excellent and could signify that the company is beating its sector in terms of growth.

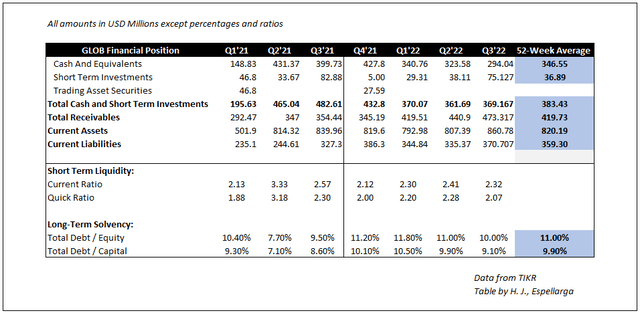

Globant Balance Sheet – Data from TIKR: Table by Author

The company generated $369 million in total cash and short-term investments on the balance sheet. Although the company had excellent top-line performance, the company’s recent acquisitions (like eWave and Sysdata) decreased the company’s total cash, hence, a decrease in cash year-over-year and sequentially.

Looking at the company’s liquidity and solvency, the company has no short/long-term balance sheet problems. Globant has $860 million in current assets and $370 million in current liabilities, which gives us a 2.32 current ratio. Since the company had $294 million in total cash and equivalents, add it to its total receivables of $473 million, giving us $767 million of cash, equivalents, and receivables.

After dividing $767 million by the company’s current liabilities of $370 million, we get a 2.07 acid-test ratio, commonly known as a quick ratio. With a relatively high current ratio and a quick ratio of 2.32 and 2.07, respectively, we can say that the company can pay off its current liabilities with its assets, so there are no liquidity problems here for Globant.

Globant also has relatively low debt levels. On the third-quarter results, the company has $142 million in total debt; divide that by the company’s total equity of $1.42 billion, we get a debt-to-equity ratio of 0.10, which is very low, especially for a company that is looking to acquire more companies to diversify its portfolios further.

Overall, Globant shows a solid balance sheet which means that this company has been generating cash, has low debt levels, and has no short-term liquidity problems.

Valuation

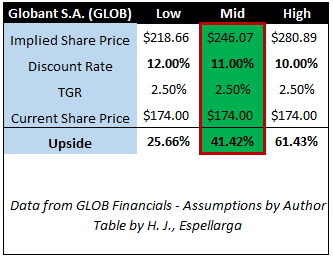

Globant 5-Year DCF Valuation – Data from GLOB Financials: Assumptions and Table by Author

I believe that Globant has a high upside potential (low estimate of 25% upside) if the company continues to grow at the current speed. My DCF model shows that the company has excellent upside potential; even when using a high discount rate, it still shows that the company is expected to have a 25% upside potential.

Assuming that the company maintains an 8.5% average revenue growth over the next five years, EBIT margins at a five-year average of 16%, taxes being 2.0% of EBIT, D&A remains to be at an average of 3.69% (in line with past performance), CapEx to be 5.49% (slightly higher than past performance), and a discount rate of 10-12%, we can potentially have a 25% upside on the stock.

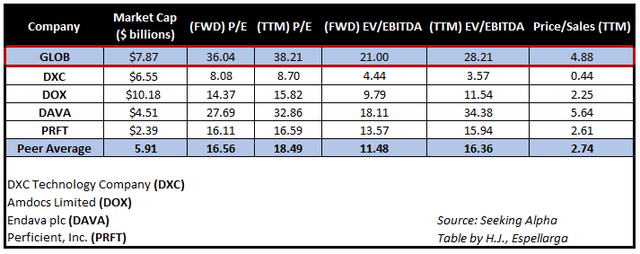

Globant Compared To Its Peers – Source: Seeking Alpha

On the pricing and valuation side of things, Globant trades higher than its peers. You may be thinking, why would I rate the stock as a Buy when it’s trading higher than its peers? There could be two things, the stock is heavily overvalued, or it’s expected to generate high returns, hence, a higher valuation, and I’m leaning on the latter. It couldn’t be the first because we already determined that Globant is a fast-growing company, plus it can maintain its profit margins, which further proves my point that the company is valued higher than its peers since it’s expected to generate higher returns in the future.

When compared to companies like DXC Technology Company (DXC), Amdocs Limited (DOX), Endava plc (DAVA), and Perficient, Inc. (PRFT), Globant sits at a higher valuation. The peer average of 16.56 FWD P/E is way below the company’s high 36.04 FWD P/E. The company also has a high FWD EV/EBITDA ratio of 21, almost double its peer average of 11.48. Although the high valuation looks intimidating, the market thinks Globant is at a high valuation since it’s expected to have high returns in the future.

Overall, I think Globant can achieve the 25% upside potential. The stock has been on a 44% decline year-to-date. With the current markets they are in, management’s recent acquisitions, and geographical expansion that can help the company’s overall performance in the short and long term, I rate the stock as a Buy.

Risks

Although the 25% sounds so promising, it also has associated risks. These risks will tremendously affect the company’s performance in the long term. For companies like IT services, customers are very important. Without customers, the company has no other means of generating revenues, that’s why investors should take note of these risks:

Client’s Performance – The client’s performance affects Globant and its services. If a client (like Disney) performs well, then generally, it would also mean that Globant would perform well, resulting in the company extending its partnership with its clients. However, if a client performs unfavorably, then a client could completely cut ties with Globant and transfer to another IT service company, which could result in a massive loss for the company, especially with the companies they have worked with over a decade.

Inability To Acquire New Customers – For Globant to scale and grow, they need to acquire more and more customers and expand in different markets and locations. Since they’re an IT service company, more customers mean more money. If Globant fails to do so in the future, it’ll be the start of the company’s downfall, especially if it decreases its margins and expenses in the future.

Potential Acquisitions –All acquisitions have associated risks with them. Since Globant is a fast-growing company generating a lot of cash, a bad acquisition could cripple the company’s momentum and overall growth, which can significantly affect the company’s progress in scaling efforts.

I want to point out these three main risks that investors should be wary of. In essence, Globant is an IT service company, a company that’s focused on digital transformation for companies. If they lose clients, aren’t able to acquire new ones, and waste their money on investment efforts, then investing in Globant would be risky.

Final Take On GLOB

Globant S.A. is a fast-growing IT services company. Just like service-based businesses, it’s easy to gain momentum in the company since revenues could increase without substantially increasing its expenses. Management’s acquisitions have been tremendous and served a double purpose: to increase revenues and expand its geographical reach by signing new clients in new regions. Globant has shown great growth in the past few quarters and is profitable in the long term. Since the company is involved in a high CAGR market, it can use its current position to sign more clients to capitalize on the high CAGR market. Overall I think that Globant is a good company. The recent news, acquisitions, end markets, and my valuation lead me to rate Globant as a Buy.

Thank you for reading, and have a great day!

Be the first to comment