gorodenkoff/iStock via Getty Images

Illinois Tool Works (NYSE:ITW) is a global industrial product and equipment manufacturer. It has a wide range of products and services and operates in 7 different segments, but this seems to be working well for the company, especially with its growing organic growth as a result of its 80/20 strategy. 80% of the company’s focus to plans to expand organically and to markets with solid long-term growth and 20% to divesting its weaker businesses, leaving the company with a high-quality, diverse portfolio that increases shareholder value. As ITW strictly implements this strategy, they are expecting it to positively contribute 100 basis points to the company’s operating margin in FY22.

However, there are short-term headwinds from the company’s recent MTS Test & Simulation acquisition, which resulted in 50 basis point headwinds, lowering its operating margin to 23.1% this quarter, down from 24.3% in the same quarter last year. Furthermore, ITW will be under pressure from rising input costs, which translated to a negative impact of 100 basis points. With the aforementioned catalyst in place, management’s flat margin growth outlook, and today’s bearish environment, I believe this makes this stock unattractive as of this writing. Given the company’s long-term potential, a deeper pullback will improve its valuation and dividend yield, especially taking into account its liquid balance sheet and strong ROIC growth. ITW remains a solid dividend stock, making it a good buy on its further drop.

Company Overview

ITW ended its Q2 2022 with a $4,011 million top line, up 9.11% from $3,676 million recorded in Q1 2021, with an outstanding organic growth rate of 10.4% year over year. On top of this, its recent MTS acquisition contributed 3% of this total revenue already, although it put pressure on its operating margin as mentioned before. The management is confident that it can significantly improve this within the next five to seven years. This could happen in the future, especially given the growing simulation market, and the company’s expertise to provide operational synergies as quoted below.

We acquired the Instron in 2006 and today it is a business growing consistently at 6% to 7% organically with operating margins well above the company average. We’re confident that MTS has the potential to reach similar levels of performance over the next five to seven years through the application of the ITW business model. Source: Q4 2021 Earnings Call

Speaking of its Test & Measurement and Electronics segment, it experienced an outstanding growth of 15% year over year to $696 million, up from $606 million recorded in Q1 2021. It also produced a concerning organic growth of 0.9%, which is way below its 7.9% recorded growth in Q1 2022, but according to the management, this is just due to timing differences and on an adjusted basis should be around 7%.

with organic growth of 1%, which, as you know, is uncharacteristically low for this segment and entirely due to the timing of a large equipment order from an Electronics customer in Q2 last year. Adjusted for that order, segment organic growth would have been about 7%, which is a more accurate representation of how strong the order intake is. Source: Q2 2022 Earnings Call Transcript

This segment remains as the company’s second largest revenue generator, trailing behind the Automotive OEM segment, which is currently under pressure due to a supply chain shortage and current inflationary pressure. That is likely why management reduced its top line year-over-year growth projection for FY2022 to 6% to 9% from 7.5% to 10.5% in Q4 2021. Furthermore, ITW expects foreign currency translation headwinds to increase to 4%, up from 1.5% in Q4 2022. Despite the lowered outlook, I believe this is still an outstanding performance when compared to its peers, 3M Company (NYSE:MMM), with a negative 1.19% year-over-year growth, and Honeywell International Inc. (NASDAQ:HON), with a 3.8% growth.

Divesting another $500 million annual revenue this FY2020

As previously stated, one of ITW’s objectives is to sell off 20% of its portfolio that is not as strong as the rest of the portfolio. This will allow management to focus more on the high-growth businesses and less on the low-growth ones. A part of this strategy is to divest businesses with annual revenues of up to $1 billion, and in Q4 2021 management re-launched its plan to divest five businesses with a total annual revenue of $500 million in FY22.

During this quarter, the management announced to divest one of its businesses in Polymers & Fluids and one in Food Equipment segment with a combined total annual revenue of $115 million recorded in FY21. This is around 1% of its total revenue in FY21. I believe this transaction is still immaterial, and will be offset by the MTS acquisition, which is expected by the management to contribute 3% of the total revenue in FY22.

With its disciplined approach, it is no surprise that the management was able to maintain a growing top line in today’s challenging environment. With its current pace, I believe we can expect another round of significant acquisitions, especially given its ongoing plan to divest a total of $1 billion of its business.

Strong Cash Flow

ITW remains liquid, despite its low cash and cash equivalent balance of $879 million. This is mainly because of its previous MTS acquisition and continued share repurchase this year. In fact, the management gave positive guidance regarding cash flow and share repurchase in FY22, as quoted below.

Finally, there’s no change to free cash flow generation or share repurchases of $1.5 billion. Source: Q2 2022 Earnings Call Transcript

On top of that, despite the acquisition and growing dividend payment, ITW successfully reduced its total debt to $7,640 million, down from $7,881 million in FY21 and $8,310 million in FY20. Given its improving interest coverage ratio of 18.31x, which is higher than the 5-year average of 14.87x, I believe ITW can maintain its growing dividend in today’s inflationary environment.

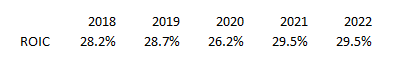

ITW: Growing After-Tax-ROIC (Source: Company Filings)

This is especially true where management expects an adjusted-tax-ROIC (tax benefit adjusted) of between 29% and 30%, way better than its 3-year average of 28.13% and 5-year average of 28.26%.

Relatively Cheap

After the drop from its 2021 high, ITW is now trading at 23.43x below its 5-year P/E of 25.9x. Additionally, considering its 2026 forward P/E of 16.12x, we can safely assume the company is currently trading at a discount.

With a forward P/S of 3.37x and an estimated FY26 revenue of $18.17 billion, combined with ITW’s 5-year average P/S of 4.20x, peers’ average P/S of 2.72x (MMM of 1.91x and HON of 3.53x), and a conservative discount rate of 10%, I believe ITW still trades below its fair price of about $235.

Caveat

As previously stated, ITW exhibits some operational inefficiencies due to its slowing margins. This is particularly with its trailing operating margin of 23.27% and its EBITDA margin of 26.16% which are both slower than its three-year averages of 23.84% and 27.22%, respectively.

However, I believe ITW can achieve its long-term goal of a 28% operating margin, especially considering its working enterprise strategy and, of course, in light of global recovery from the current rising inflation and supply crunch.

Trading Above Support Area

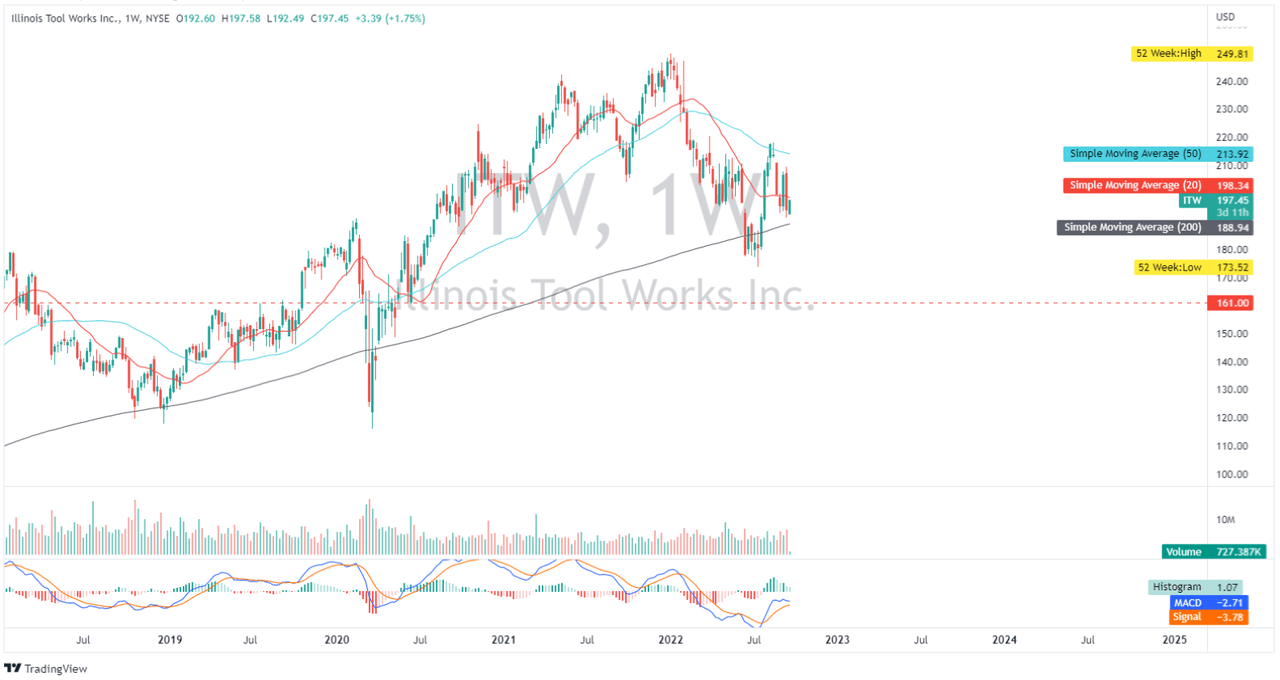

ITW: Weekly Chart (Source: TradingView.com)

ITW is trading above its 200-day simple moving average on its weekly chart, indicating a bullish pressure supporting the stock. The MACD indicator is still below zero, indicating that there is still bearish pressure that could cause the stock to retest its $188 level. If this occurs, I will be delighted to acquire ITW at a lower price and with a higher dividend yield.

Final Key Takeaways

The company has grown organically, and it is continuously growing. It has a disciplined approach to expanding, which I believe will be the key to its success in the future. Today’s weakness in its profitability seems controlled, and it has a liquid balance sheet that can support its improving shareholder value. ITW is fairly valued and attractive in today’s bearish environment.

Thank you for reading!

Be the first to comment