robertomm/iStock Editorial via Getty Images

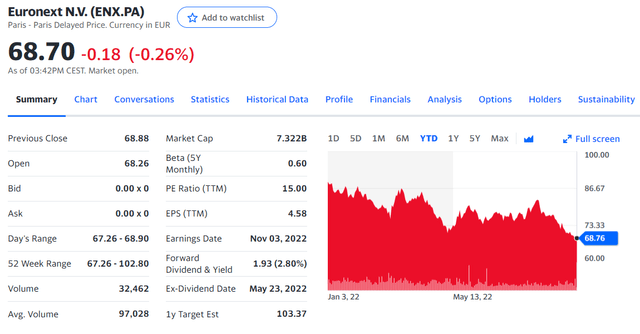

After the Russian invasion of Ukraine, here at the Lab, our internal team decided to move Euronext’s rating from neutral to buy (OTCPK:EUXTF). Since then, it has been a continuous decline in the company’s stock price. Looking at the year-to-date performances, we see that:

- Euronext has lost 23%;

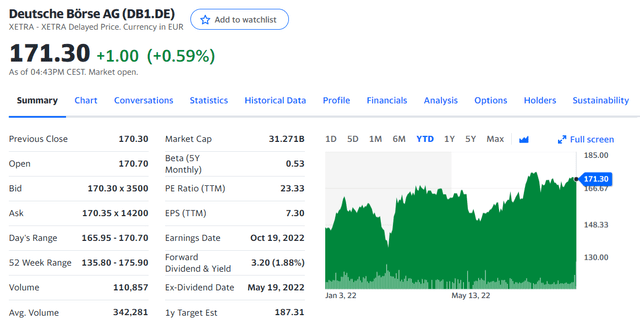

- Deutsche Börse has gained 16%;

- the London Stock Exchange is positive by almost 10%.

Euronext stock price evolution YTD Deutsche Börse stock price evolution YTD London Stock Exchange stock price evolution YTD

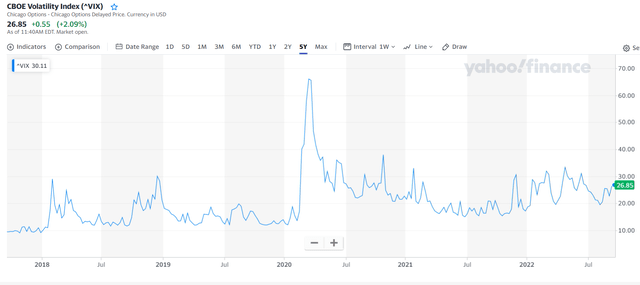

Euronext buy case recap was based on 1) higher market volatility (using VIX as a proxy), 2) synergies from Borsa Italiana, 3) IPO acceleration and 4) a strong cash flow that was supportive of an increase in the dividend per share. After our comments on the Q1 and Q2 results, we were even more positive. So, today we are wondering what has happened and what’s next for this jewel.

Starting with the negative news, the Italian Index called the FTSE MIB has lost more than 20% since January and many investors sold their investments due to the European energy crisis. It is also true that there were several delistings from Euronext in 2022, among the best-known names are Tods and Exor (which we recently analyzed). This is due to the persistence of different tax systems in Europe. It is a reality that some corporations choose Amsterdam over Euronext to go public for tax reasons.

In addition, a few large-cap IPOs were postponed and others were listed abroad such as Ferretti in Hong Kong. Related to our point 3) and looking at the new entries on the Euronext market, IPOs were 70% less compared to 2021.

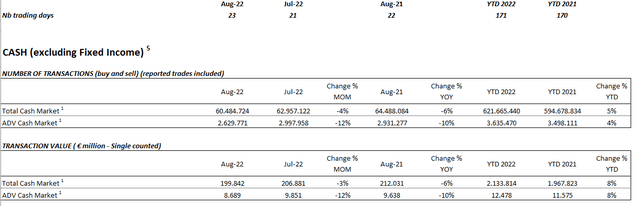

Looking to the just-released data, we see a decline in trading activities with lower volumes on a monthly basis. Despite the fact that this August had two more working days, transactions were recorded minus 6%.

Euronext transaction volume monthly data

Why are we still positive?

First of all, on a monthly basis, transaction volumes are down but on a yearly basis are up. This did not justify a loss in market cap of more than 23%. Moreover, we are positive about the new IPO regulation that will simplify the rules for the listing. But how will the listing process change? And, how the IPO rules will positively affect Euronext? Borsa Italiana is working to increase the admission process efficiency by streamlining bureaucracy, time and costs. This will support companies and increase the listed numbers. Borsa Italiana approved the elimination of two documents considered burdensome or no longer indispensable which at the European level are not acquired either by the market operator or by the regulators. To sum up, simplification will save up to a month and part of the documents can only be in English. Regulator’s ok is expected at the end of September and once the green light has been obtained, the amendments will enter into force in October 2023.

Regarding the valuation, we recently decreased our buy target price from €100 to €98 per share maintaining our outperforming rating. IPO negative flow is much more compensated by the new rules designed to speed up the process. Volatility remains at a very high level and Euronext will benefit from this environment. Buy rating is confirmed.

Be the first to comment