Juanmonino

Voya Emerging Markets High Dividend Equity Fund

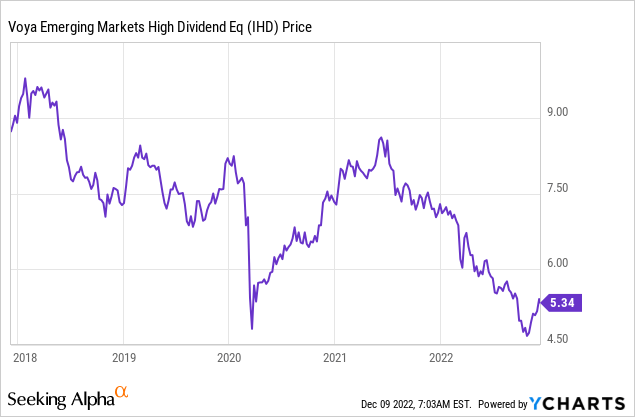

The Voya Emerging Markets High Dividend Equity Fund (NYSE:IHD) is an interesting option for investors who want broad exposure to emerging markets equities without investing in individual ETFs. The management fee of around 1.35% is high relative to many emerging market ETF fees. However, I am still interested in this fund because of the high dividend yield and a significant discount to NAV.

Holdings Overview

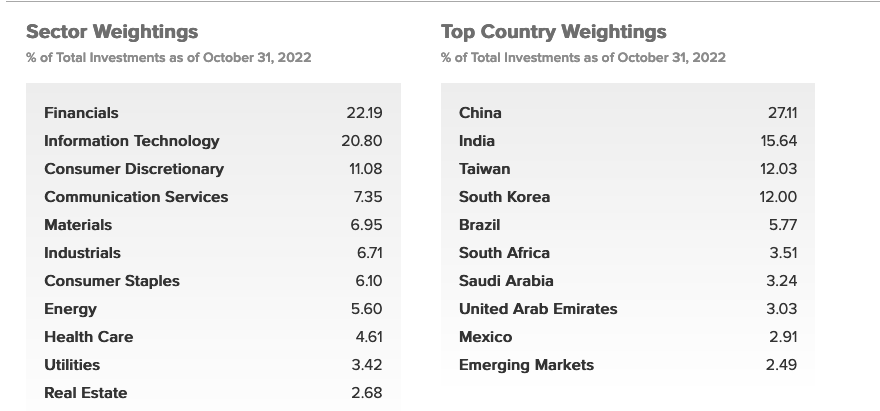

Diversified Exposure: This closed-end fund provides diversified exposure to emerging markets by investing in over 300 companies. The top 10 holdings only account for around 22% of the fund’s total assets.

Voya

Another unique aspect of this fund is that it sells calls. These investments can account for around 15-50% of the fund’s total portfolio.

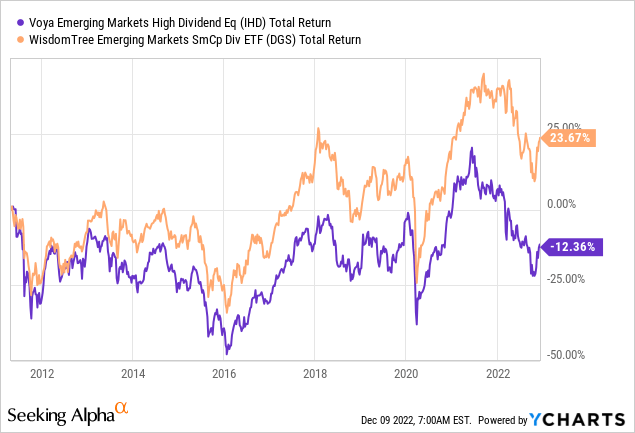

I included the WisdomTree Emerging Markets Small Cap ETF (DGS) because this ETF is similar in terms of its diversification and geographical exposure.

2022-2023 could be a good time to take advantage of the volatility and to lock in at a 10+% dividend yield.

Country and Sector Thoughts

This ETF is designed to track the MSCI Emerging Markets Index, as both this fund and the index have China, India, Taiwan, and South Korea as their top 5 countries.

Voya

Notably, the fund also has a higher weighting in high-growth industries like IT and consumers, which typically command a premium to the index. The fund has around half its assets invested in information technology, consumer themes, and healthcare. As I mentioned when I covered the Wisdom Tree EM ETF, I typically prefer some smaller emerging markets like South Korea and Brazil, but this country mix is decent. This ETF invests in larger emerging markets that I typically don’t cover, so investing in this ETF+ other Latam/MENA ETFs could provide decent diversification and exposure to commodities.

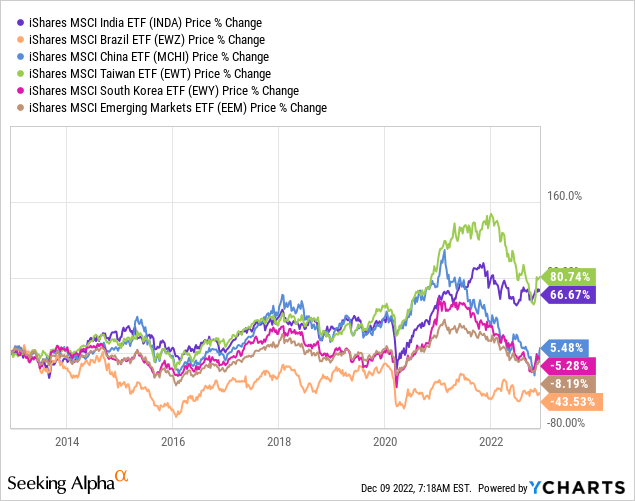

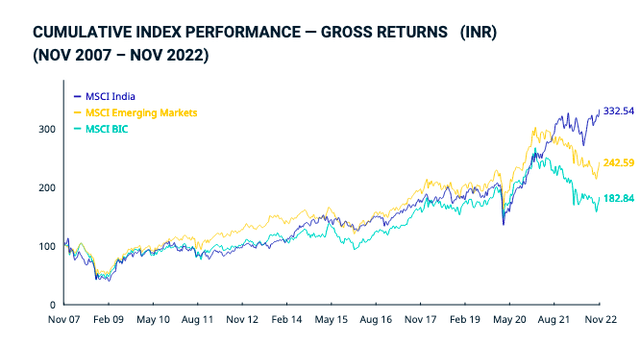

With China Covid lockdowns appearing to be waning/over, China’s growth may be able to return to 5% moving forward. Furthermore, further economic challenges in 2023 may decrease the probability of China-Taiwan conflicts escalating, as the countries are economically dependent on each other. Countries like Brazil may be able to benefit from rising commodity prices and increased exports to China, although the overall impact on the ETF is limited. The recent outperformance of equity markets in India is also worth noting. The market returned 29% during 2021 after returning 18.6% during the previous year.

India and Taiwan have been long-term outperformers consistently, while most countries have returned less than 5% during the past decade. Despite its long-term underperformance, Brazil is still a favorable addition, as it currently trades at less than 6x earnings.

Dividend Thoughts

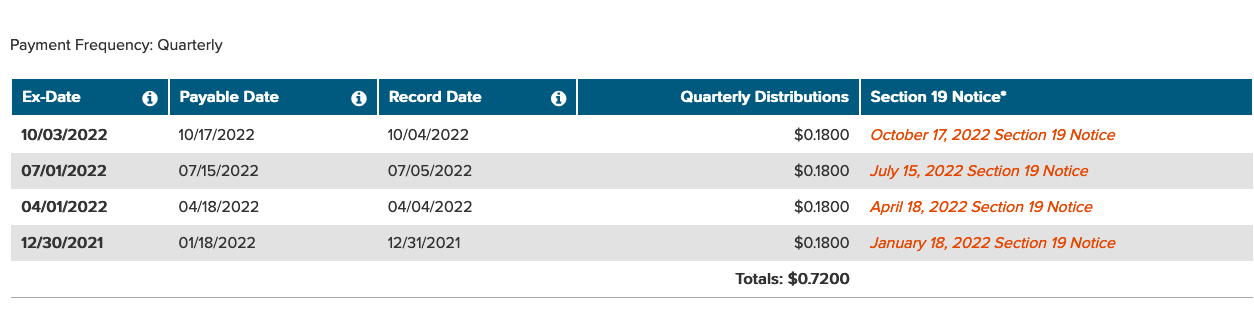

One of the main appeals of this fund is the relatively high dividend yield, which is paid out quarterly. This yield means there is only some, but limited, downside pressure on the fund.

Voya

If this trend continues, this implies an annual yield of around 13%, which is very appealing. This to me signals a relative bottom of the fund’s share price, especially considering that the discount to NAV is around 13.5%.

Emerging Market Considerations

If you are bullish on emerging markets, it makes sense to invest a small amount in a fund like this and then balance it out with regional or country-specific bets. I am holding a lot of cash/gold, which I will later invest in emerging markets, and also being very selective about what funds/ETFs I choose for the time being.

One of the main risks in emerging markets moving forward is slower growth in their respective export markets, as many economies have built themselves up on exporting to developing countries. S&P Global recently lowered 2023 emerging market growth projections from 4.1% to 3.8%. However, weaker economic data from the United States and Europe could change these projections and plunge some economies into a recession.

Many emerging markets are not very separated from developed market growth, and emerging markets are also becoming significant contributors to global growth. Emerging market economies account for ⅔ of global growth. Emerging market shares of total global exports rose from only 25% in 1996 to 45% in 2010. It’s becoming harder and harder for US investors to avoid emerging market exposure, and for emerging markets to provide meaningful diversification from developed markets. The best solution, which I will cover later, is to filter through emerging markets one by one based on their export structure (type and destination) and see how this connects to global growth trends.

Upside growth surprises could include China, which may grow faster than anticipated, and MENA countries like Saudi Arabia and Qatar, which could benefit from higher oil prices. Other Latam commodity exporters could also grow faster than expected.

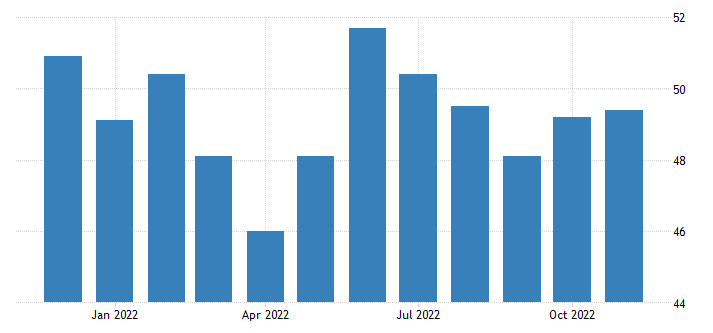

China PMI

Trading Economics

The PMI fell below 50 for the first time in Europe this July, and China’s PMI has remained below 50 for the past four months. Many emerging markets have begun to recover in terms of growth in 2022, but I think Q1 2023 data coming out of Europe and the United States will be telling.

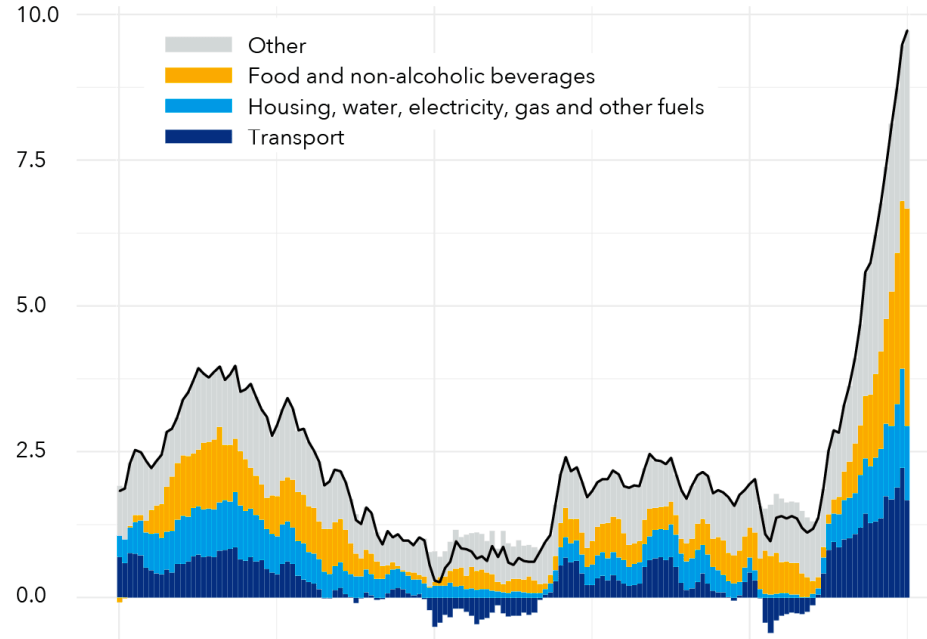

Inflation In Emerging Markets

The impacts of inflation are likely to hit frontier and emerging markets harder. Even though the reported inflation may be lower in some countries (because of the lower weighting of food and/or energy) it still has a stronger impact because lower-income countries spend a higher % of their income on food and energy. Furthermore, many countries in frontier markets in Africa are net food importers, which makes them more vulnerable to inflation.

IMF

Lowering the global cost of capital isn’t a simple solution to lower food and energy prices, as inflation of these products is also the result of supply issues. Arguably, higher interest rates could actually cause companies in these industries to raise prices.

One positive factor to note is that emerging markets were quicker to raise rates relative to other central banks. Emerging markets in Latin America may be able to cut rates now, while emerging markets in Europe may have a harder time. Inflation has also been tamer in larger emerging markets like Taiwan (2.86%), South Korea (5%), and Brazil (5.9%). This fact demonstrates how certain emerging market central banks have moved quicker than the ECB and Federal Reserve to keep inflation below the levels in the US/EU.

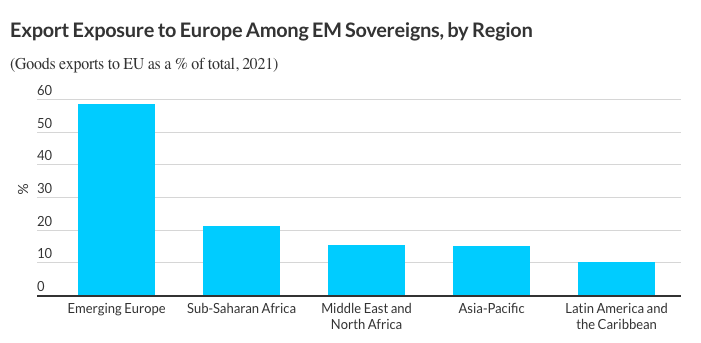

Europe Exposure

Investors who are worried about European economic data could choose to focus on MENA, Latin America, and Asia.

Fitch Ratings

However, there are certain standouts within these regions, where a high % of these countries’ goods are exported to Europe. These countries include Egypt (31%), Sri Lanka (24%), Morocco (61%), Bangladesh (38%), and Pakistan (26%).

Outlook

The risk of rising sovereign debt defaults is becoming a greater risk, especially amid a strengthening USD and rising interest rates. More defaults, even in smaller markets, could have a spillover effect on emerging market equities. Geopolitical risks are still very relevant, although I am less concerned about China-Taiwan tensions relative to H1 2022. Late 2022 is an okay entry point for emerging markets, if you selectively shop. However, I expect more pullbacks in 2023.

Be the first to comment