FinkAvenue

The past three years have seen massive consolidation in the North American ride-sharing market. After years of solid growth, the revenue of Lyft (NASDAQ:LYFT) and Uber (UBER) has begun to moderate, and margins have come under pressure as driver wages rise. While neither firm has achieved financial stability, Uber has become the dominant player, with over twice the market share. Comparatively, Lyft has seen its stock price dwindle as it struggles with desperately negative working capital and a growing inability to raise new money.

The interest rate increase has dramatically changed the landscape for Lyft and Uber. For most of the decade before 2022, ultra-low interest rates allowed cheap financing encouraged massive venture capital spending, and promoted very high equity valuations. Firms like Uber and Lyft could rely on this steady flow of capital to offset significant losses, and the firms grew. Many people believe that Uber and Lyft “outcompeted” traditional taxi services, but if it were not for cheap capital that offset immense negative cash flows, that feat would likely be impossible.

Today, as interest rates are higher and the Federal Reserve tightens monetary policy, cash has become far more valuable – forcing cash-burning firms like Lyft to make a steady profit or face bankruptcy. Lyft has thus far lost around 85% of its value as the firm risks relying on large equity dilutions to offset losses; however, as its market-share drops, it must pursue even larger dilutions to raise the same level of cash. Of course, Lyft is trying to restore its stability, encouraging many investors to consider the firm a “fire-sale” bet. On the other hand, LYFT has a short-interest level of 15%, implying many speculators are betting the company may soon fall underwater.

A Close Look At Lyft’s Financial Stability

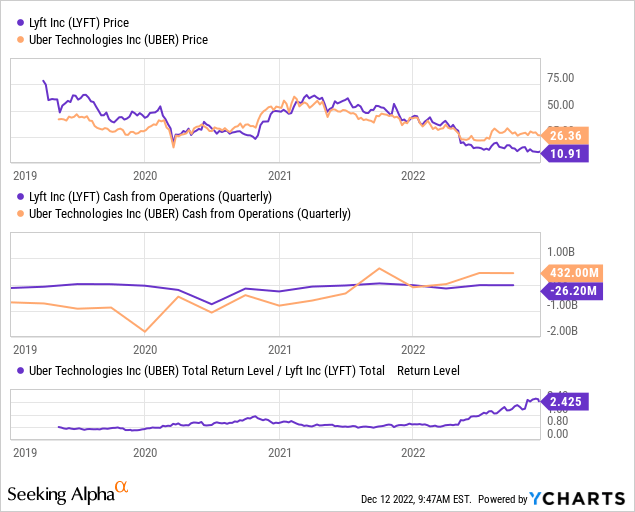

Lyft and Uber pioneered a new business model that upended traditional taxi services. While this model has achieved immense customer demand, it has not yet proved successful, as neither firm has achieved steady positive cash flows and income, instead surviving on market financing. Lyft’s cash flow and net income have been chronically negative at a relatively stable level. Uber did achieve positive cash flow last quarter but did post a relatively significant net loss of -$1.2B. That said, because Lyft’s losses are far more consistent, its financial stability appears lower, causing its stock value to dwindle below Uber’s. See below:

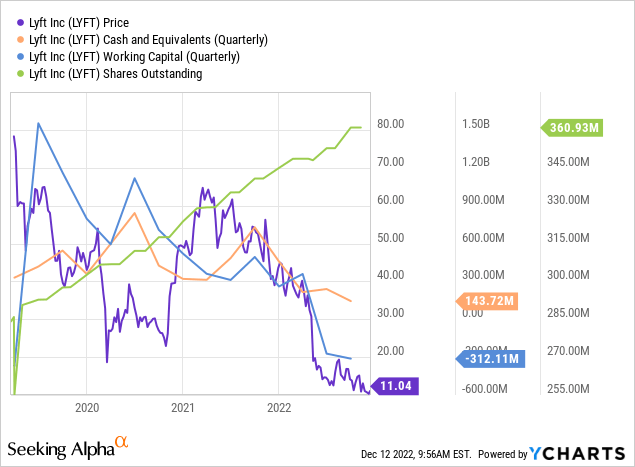

From 2019 through early 2022, Uber and Lyft traded in near lock-step. That pattern broke in late spring of this year, coinciding with the extreme rise in interest rates. That factor is important because it limited the flow of accessible capital into these firms through a mass exodus from “negative-cash flow high valuation firms” (see ARK ETFs as a macro example). This change has dramatically increased Lyft’s bankruptcy risk, as illustrated by its dwindling cash and negative working capital:

Since 2019, when Lyft went public, its cash and working capital position has trended lower at a relatively steady pace. The company’s working capital crashed deeply into negative territory this year, giving it a deficit of $312M at the end of last quarter. The firm’s cash position has also declined to a shallow level of $143M. The firm burned $230M through operations over the past twelve months, indicating its remaining cash will likely be gone by early-to-mid 2023 unless it can stem losses or raise some money. The company also continues to dilute equity via significant stock-based compensation but may need to sell equity outright soon to raise much-needed capital. Lyft did open a $420M revolving credit facility in Q3, but I do not think that will provide sufficient liquidity given its negative working capital position.

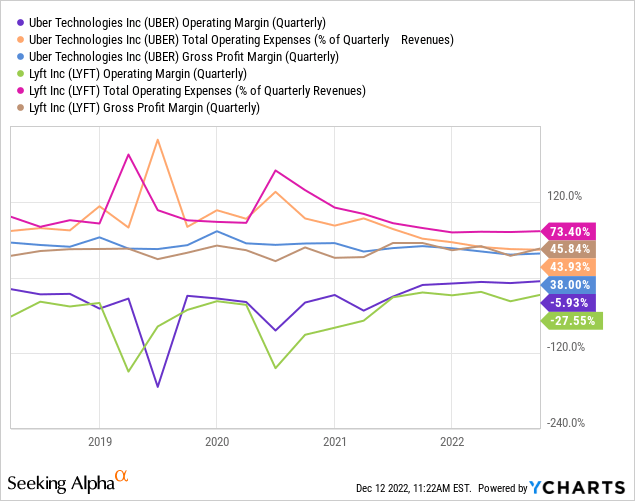

Lyft may obtain sufficient liquidity sources or reduce costs sufficiently to slow its bleeding, but it does not have much slack given its working capital deficit and inability to raise margins. Both Uber and Lyft have chronically negative operating profit margins, but Lyft’s are far worse at -27% and never rising above that level. Due to their ongoing competition, Uber and Lyft have remarkably similar gross profit margins, but Lyft’s operating expenses-to-sales are significantly higher than Uber’s. See below:

The chief reason for Lyft’s higher operating costs is its higher share compensation compared to sales. Over recent years, Lyft’s stock-based compensation has consistently been around $500M-$700M per year, or about 15% of its current market capitalization. Uber’s stock compensation is twice as high, but it generates dramatically more sales and has a much larger market capitalization, so it only dilutes shareholders by 3% per year.

One other issue with Lyft’s high stock-based compensation is that it dilutes shareholders faster the more its share-price declines. In my view, this pattern is highly opposed to sustaining shareholder value. While good management and employees should be rewarded, Lyft’s managerial success is highly questionable, given its large margin deficits to Uber.

I believe there is very little Lyft can do today to stem its losses. A fundamental flaw in its business model is that Uber and Lyft easily compete for wages and fares, so neither can keep customers or employees if they try to use those levers to increase profits (raising fares or lowering driver wages). However, they can compete for greater operating efficiency, and, by far, Uber has outcompeted Lyft in that category. Looking forward, I do not believe it is a question of whether or not Lyft will remain afloat but if it manages to attract a buyer before bankruptcy.

Is There Any Value in Lyft?

As Lyft stands today, it appears likely to face bankruptcy by 2024, if not sooner. Neither Lyft nor Uber have proven their business model, as witnessed by chronically negative operating margins. Still, Lyft is highly likely to fall sooner due to its negative working capital, enormous operational costs, and dilutive stock-based compensation. Further, as the firm faces a persistent labor shortage, margins may fall faster as wages rise more quickly.

In my view, the only potential bullish argument to be made for Lyft is for its buyout potential. For months, rumors have come and gone regarding a strategic acquisition from GM, the “big tech” companies, Uber, activist investors, and more. Uber offered to buy Lyft years ago to eliminate competition but has little reason to do so today due to monopoly regulation risks – and the likelihood that it can rely on Lyft dying on its own.

For other potential investors, Lyft does have potential from its sub $4B market capitalization, around 7.5% of Uber’s. Of course, Lyft’s sales are only ~16% of Uber’s and are far less geographically and operationally diverse. Fixing Lyft’s operating costs could be an opportunity for buyers. Still, as seen in Uber, even a dramatic decline in operating expenses may not be sufficient to create positive operating profits. Google, Apple, or similar firms could gain exposure to the ride-sharing market through Lyft, but it is a terribly unprofitable business with limited organic growth potential (particularly in North America), so they may have no reason to buy a sinking ship.

One positive for Lyft and Uber is the growth of driverless technology this year, with both firms partnering with Motional to author driverless rides in select cities. The core issue with Lyft and Uber is tight driver-wage competition, which tends to eliminate all potential profits. If driverless technology expands and is well-received by customers, then Lyft and Uber’s business model could become far more successful – with the only remaining competition being prices and operating costs. At this point, I believe Lyft’s financial situation is desperate enough that it will not live long enough to gain profits from this technology; but it is possible with a sufficient capital injection. Still, Motional is also struggling with the economic change and recently pursued layoffs, indicating the AV business venture may be “more form than substance.”

The Bottom Line

Many investors may see Lyft as cheap following its significant stock-price decline this year. However, I believe bullish arguments surrounding the stock carry some rings of survivorship bias. Many stocks that suffer such extreme losses eventually go bankrupt and are delisted, but those looking at stocks today only see a few recovery cases. I believe stocks with insufficient liquidity and chronically negative operating margins are usually falling knives.

One core challenge for Lyft is its stock-based compensation, which effectively dilutes investors more aggressively the more the stock falls. Now that the technology sector is facing widespread layoffs, I expect stock-based compensation packages to decline but still pose a significant immediate threat to Lyft. Still, its operating cash flow is also chronically negative, indicating it would likely struggle to survive even if all stock-based compensation is eliminated.

Overall, I am bearish on Lyft and believe it will likely face bankruptcy by 2024, if not sooner, based on its cash-burn rate, liquidity level, and negative macroeconomic pressures on wages and fares. While there could be a short opportunity in the stock, I would not personally bet against it as its upside potential under an acquisition deal (or rumor) is quite large. Personally, I doubt the firm will be acquired since it may be easier for a competitor with capital to start a new growth brand that is more driverless-centric. Additionally, many large investors (private equity and large technology firms) have dramatically reduced acquisitions this year due to economic constraints. Still, since Lyft often rises dramatically even on the rumor of such a deal, it may be too volatile to short.

Be the first to comment