Bill Oxford/iStock via Getty Images

REITs have really suffered in the rate rise cycle this time. That of course makes us look for opportunities for low-risk entry points. We cover closed end fund CBRE Global Real Estate Income Fund (NYSE:IGR), which now sports a double digit yield (10.6%), a sharp contrast to the sub 4% from Vanguard Real Estate ETF (VNQ).

Let’s have a look at what you should consider before diving in.

The Fund

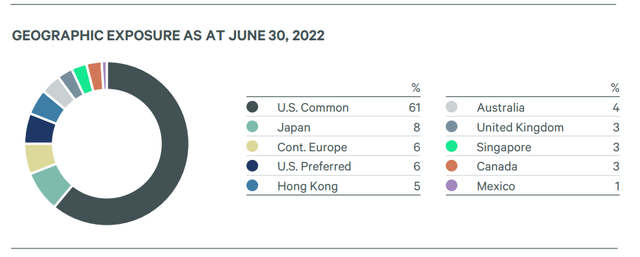

IGR is an actively-managed closed-end fund that invests in publicly-traded real estate securities including REITs and real estate operating companies. IGR has excellent geographic diversity. It holds around a third of its assets outside of the United States, in contrast to most locally oriented funds.

IGR Semi_Annual report

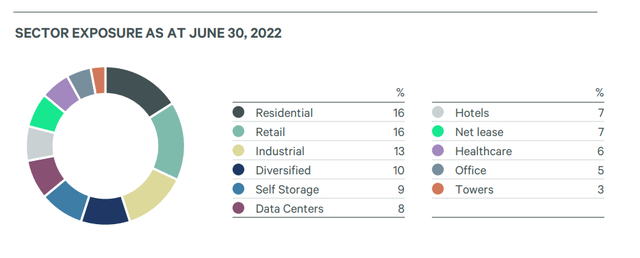

Its primary exposure is given to residential, retail, diversified, industrial, and storage REITs.

IGR Semi_Annual report

These make up more than half of the fund’s assets. IGR distinguishes from other funds by having a modest exposure to US REIT preferred shares. That 6% won’t move the needle much in either direction but it is a good alternative for the fund to have when the common shares are very expensive and or dangerous. We have deferred to the preferred shares quite often as well. In our recent article on Digital Realty Trust Inc. (DLR) we wrote why you should stay away from the common, but consider the preferred shares, is a good example.

Performance

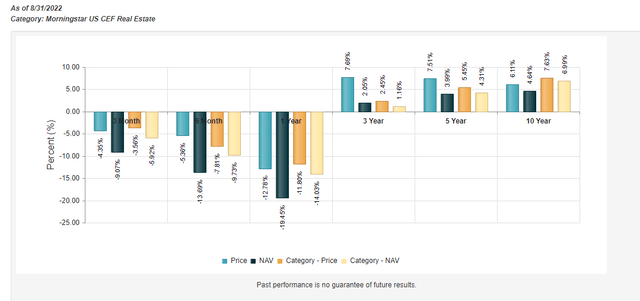

IGR has had a torrid past year with total return including distributions coming in at almost -20%. Here, we are referring to NAV changes and we will get to the price aspect (which outperformed) later.

CEF Connect

3, 5 and 10 year returns are equally unimpressive with the fund lagging its category average by a fair berth. What has been the cause of this? In our opinion the biggest drag on performance to this point has been the overseas exposure. Despite popular opinions, the USD remains one of the most coveted assets out there and its strength has been a bane for funds reaching outside US borders. Since the bulk of the funds in the real estate category don’t actually go overseas for investing, IGR has lagged. Of course, if the cycle is about to turn, then this might become a tailwind to performance and the past would be irrelevant. We get that in spades, but we are going to tell you why we would still be cautious with this fund.

REITs Most Vulnerable To Valuation Compression

IGR’s top 10 holdings include Prologis inc. (PLD), Crown Castle Inc. (CCI), Rexford Industrial Realty Inc. (REXR) and Sun Communities (SUI). While these have been the darlings of the 2010-2021 boom in REIT prices, they are also the ones most vulnerable to valuation compression. Yes, their growth remains strong but when you push up the risk-free rate these companies tend to suffer from multiple angles. First their borrowing costs rise rapidly. Second, their existing property cap rates move up, decreasing their NAV. Finally, the spread between the cost of capital and returns on new investments, compresses. Yes, we get that they are reporting strong numbers for now, and no, that won’t stop the valuation compression in our view.

IGR’s Own Borrowing Costs About To Move Up

As a leveraged fund, IGR has used the largesse of the Federal Reserve to the maximum. Based on the last semi-annual report, the fund was borrowing close to $400 million and paying 1.2%.

The Trust has access to a secured line of credit from BNYM for borrowing purposes. Borrowings under this arrangement bear interest at the Federal funds rate plus 75 basis points. Subsequent to written consent of the Trust’s Board dated October 21, 2021 and pursuant to an executed Fifth Amended and Restated Master Promissory Note dated December 1, 2021, the line of credit limit was raised from $300,000,000 to $400,000,000. At June 30, 2022, there were borrowings in the amount of $355,684,300 on the Trust’s line of credit. The average daily amount of borrowings during the period ended June 30, 2022 was $355,659,078 with an average interest rate of 1.20%. The maximum amount outstanding for the period ended June 30, 2022, was $383,935,700. The Trust had borrowings under the line of credit for all 181 days during the period.

Source: IGR Semi-Annual Report

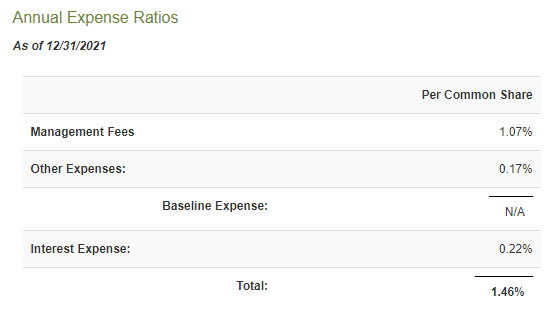

This rate is about to go ballistic. By the end of 2022, interest should be over 4%. Fed fund futures imply peak rates of close to 4.75% in Q1-2023. By then IGR will be paying over 5.5%. For all of 2021, IGR paid $2.3 million in interest. That was just 0.22% of common assets.

CEF Connect

At peak funds rate we will be looking at an annualized $20 million. That will be almost 3% of common assets. So the management expense ratio will look extremely bad. At those rates, we don’t see any investment being accretive. In other words a liquidation of the leverage makes more sense than holding more assets.

Extremely Poor Distribution Coverage

Obviously, when the total return on NAV has been sub 5%, in an extremely bullish setup, we can conclude without looking further that the distribution is not remotely covered. That distribution relied on capital appreciation, which clearly was missing in action over the last decade. This coverage will now get worse whatever IGR decides. Holding on to leverage and paying 5.5% makes it bad. Liquidating assets also decreases distribution coverage relative to where we were in 2021.

Verdict

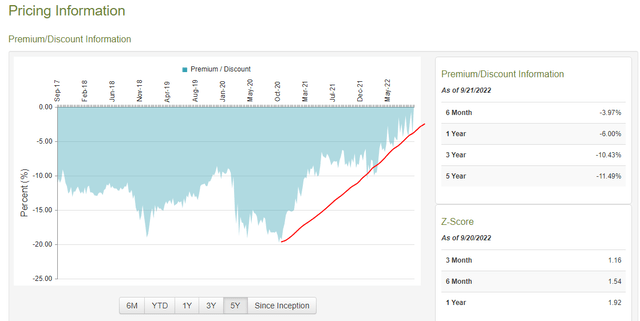

We see the biggest problem here as the possibility of moving to a big discount to NAV. Historically IGR has traded at a discount and the current 1% discount is really strange.

CEF Connect

Those elevated Z-scores on all timeframes should be a warning.

The compression of the discount is the main reason that investor price returns have been better than NAV returns.

Investors rushing in here could get the double whammy of a falling price and rising discount. If IGR tries reducing leverage in that environment or cutting its distribution (which it really needs to do), things could get uglier. We would stay out of this one.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment