JHVEPhoto

Introduction

I give Johnson & Johnson (NYSE:JNJ) a buy rating because I believe the company is a very safe investment for the poor future economic conditions. If an investor is looking for a defensive recession play, I think Johnson & Johnson fits the bill nicely.

Johnson & Johnson is a $440 Billion conglomerate in the health care sector located in the pharmaceutical industry of that sector. The company is best thought of as three separate multibillion-dollar companies. Those three companies are the MedTech, Pharmaceutical, and Consumer Health divisions.

Per the company’s latest quarterly presentation, Johnson & Johnson had $24 Billion in sales in Q2 with $6.9 Billion in earnings and $2.59 EPS. Those sales were split between $3.8 Billion in Consumer Health, $13.3 Billion in Pharmaceutical, and $6.9 Billion in MedTech. The company currently pays a 2.72% dividend while having a PE of 24.

Four Reasons Johnson & Johnson is a Safe Investment

1. Great Sector

The number one reason is that Johnson & Johnson is in the health care sector, which is not a cyclical sector. Companies in this sector tend to over-perform during recessions because their earnings are relatively consistent. Medical products are not something that people can cut out during poor economic conditions. Additionally, many drugs are paid for by insurance companies which shields the consumers from the true price of them. Once again, allowing the consumer to cut other things before Johnson & Johnson products. The strong sector is a significant reason why so many companies in this sector have become dividend aristocrats, as Johnson & Johnson has. Stability in all economic conditions allows companies to pay and raise their dividends consistently. A cyclical company would run into cash issues during a prolonged recessions forcing them to cut their dividend, and since a recession comes roughly every 7 years they would not be able to have the 25+ year dividend history needed.

2. Diversification

The second reason is that, unlike most pharmaceutical companies controlled by their pipeline, Johnson & Johnson has alternative sources of revenue. In the pharmaceutical business, companies only have a certain amount of years for the exclusive sale of drugs. Therefore, pharmaceutical companies must consistently produce new drugs from their pipeline, acquire promising companies, or make strategic partnerships. While Johnson & Johnson still has to do these things, they are much less reliant on them because only 55% of their revenue last quarter came from their pharmaceutical division. The consistency in future earnings is why investors are paying such a premium when you look at the 24 PE of the company compared to the more industry typical PE of 10-15. While it can be frustrating to pay this premium, it greatly decrease the downside of the company.

3. Solid Dividend

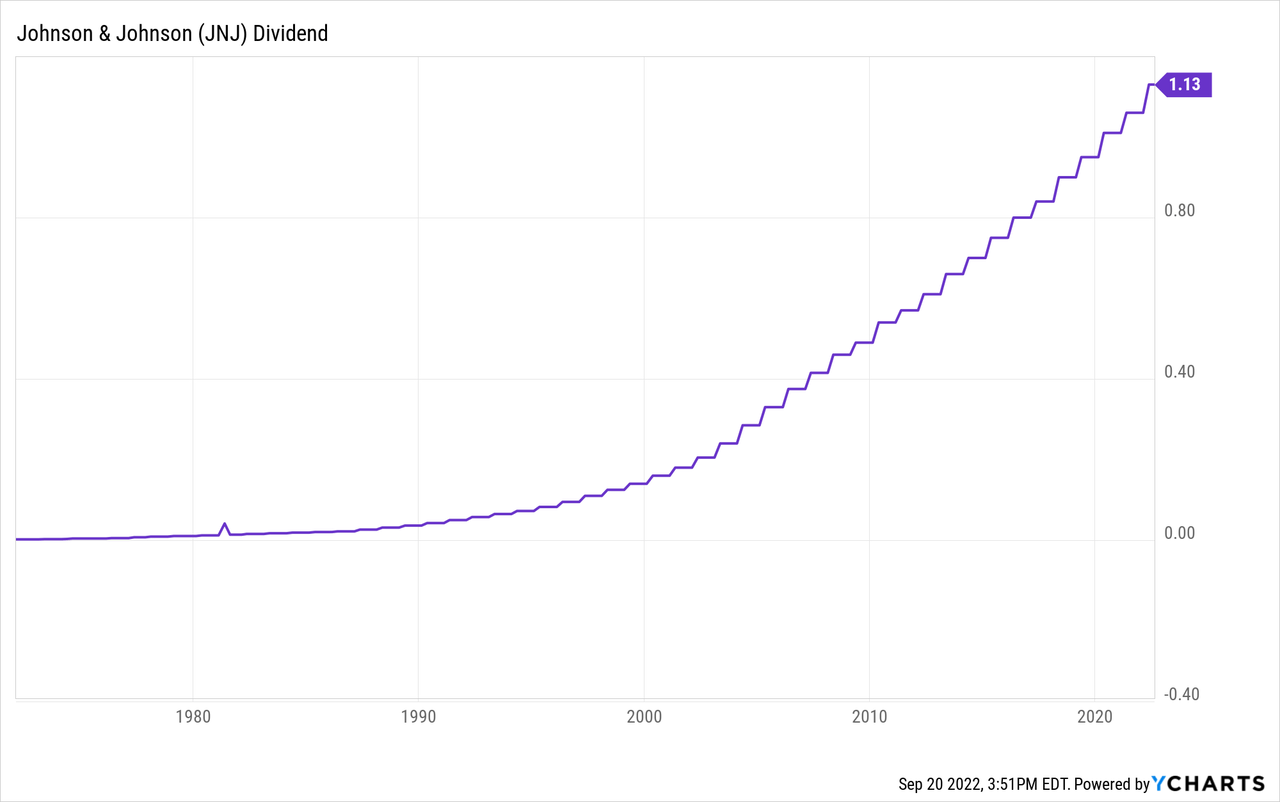

As mentioned earlier, Johnson & Johnson is a dividend aristocrat, which is the third reason. There are currently only 65 dividend aristocrats which makes this title very prestigious. While the current yield of 2.72% is not the best in the market, it is a solid 2.72%. If the market continues to fall then there will likely be an even better yield in the coming months. Dividends are great for investors in down markets as they allow funds to purchase discounted stocks. Additionally, a strong dividend record means the company has a solid financial history. To have a strong economic record, the company must have outstanding leadership, and investing in great leadership is always a big benefit. The chart below shows the company’s impressive dividend history.

4. Great Historical Returns

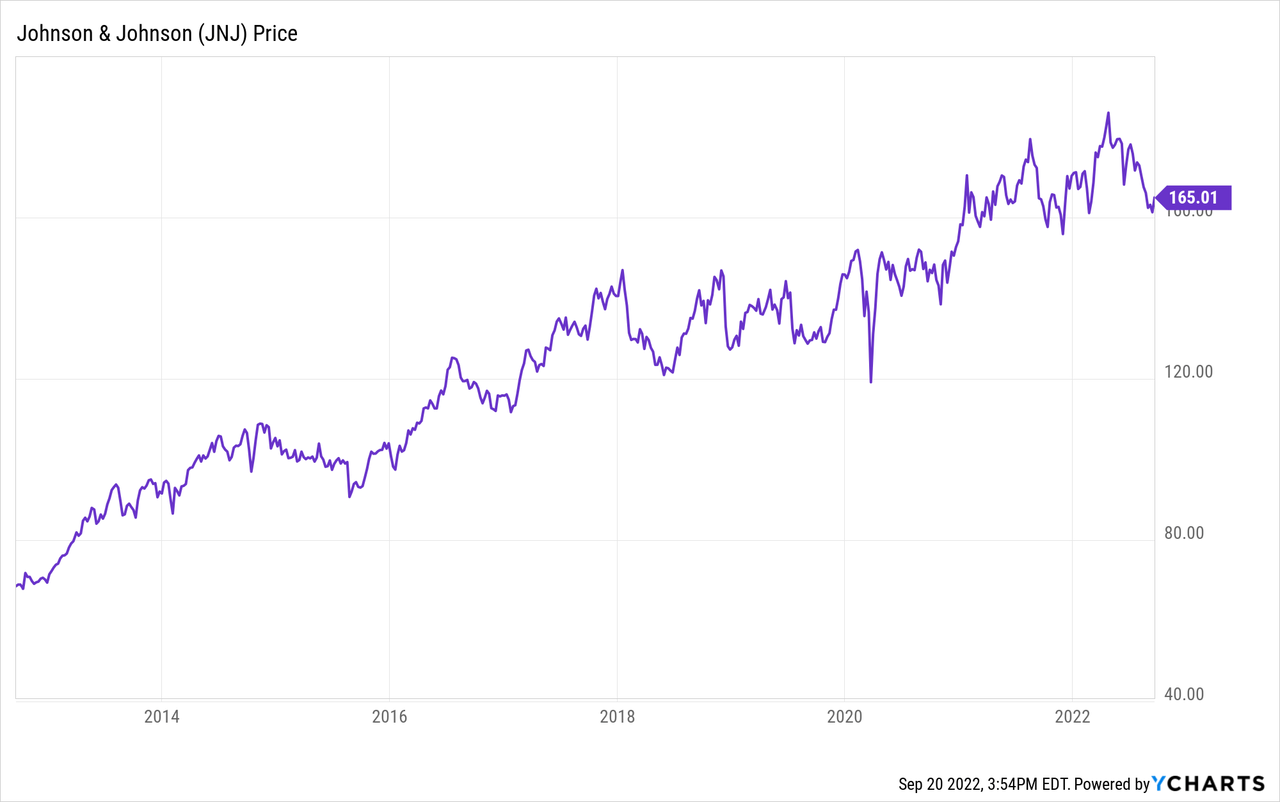

Finally, the fourth point is the company has an excellent track return of returns. Over the past ten years, the share price has grown 139.5%, 14% per year. If you add in a 2.5% dividend for those years, the company had a return of 16.5% every year for the past ten years. While this is slightly underperforming the market which averaged a roughly 18% return including dividends, this return was done in a strong bull market that favors cyclical stocks and high growth companies which Johnson & Johnson is neither. As the market shifts, then those companies will underperform the market while strong and steady companies like Johnson & Johnson will outperform the market. Below is a chart to show the company’s stellar growth record.

Risks and Conclusions

The most significant risk in this company is the lack of future growth. In a bull market, many other growth companies will outperform this stock. Stability and recession downside comes at this cost. I give Johnson & Johnson a buy rating and believe it is a great defensive recession play. Unlike other defensive plays in the healthcare sector, Johnson & Johnson has more diversified earnings, which allows it to be a more stable company. The future looks poor economically, so a recession play like Johnson & Johnson could be a good idea.

Be the first to comment