cemagraphics

Introduction

Jerash Holdings (NASDAQ:JRSH) is a Jordan-focused apparel company which I covered on SA in early July. It’s still on my shortlist and I think the Q1 FY23 results were strong as revenues grew by 12% and the gross margin increased to 19.8%. However, revenues for Q2 FY23 are expected to decline year on year and the gross margin goal for FY23 is 16-18%. In addition, there are expectations for flat sales growth for the full fiscal year.

In my view, Jerash looks cheap even without revenue growth as the annual gross income at a 16% margin is about $23 million. The company had a net cash position of $5.8 million at the end of June, and its enterprise value stands at only $40.3 million as of the time of writing. Let’s review.

Overview of the Q1 FY23 financials

In case you haven’t read my first article about Jerash, here’s a short description of the business and the reason it’s manufacturing facilities are based in Jordan. The company produces t-shirts, polo shirts, pants, shorts, and jackets for major U.S. brands such as The North Face, Calvin Klein, and American Eagle and its annual capacity is about 14 million pieces per year. Capacity was boosted by about 20% in October 2021 when Jerash acquired its sixth factory in Jordan. USA and Jordan have had a free trade agreement for 20 years now and this means that the company’s exports are exempt from customs duties and import quotas. Jordan also has a similar agreement with the EU and Jerash thus has a strong competitive advantage over competitors from Asia.

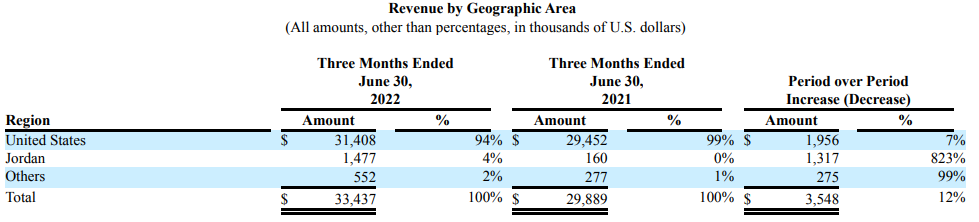

Turning our attention to the Q1 FY23 financial results, revenues increased by 12% year on year to $31.4 million thanks to the addition of its sixth factory. This helped Jerash trim the concentration of its sales to the USA a bit as a significant part of the revenue growth comes from domestic orders.

Jerash

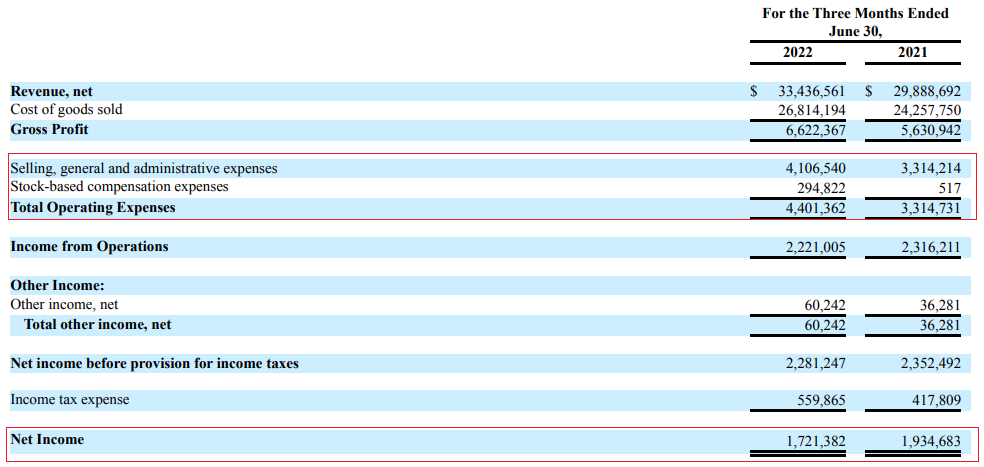

The gross margin increased by 100 basis points, mainly thanks to a lower average cost basis as a result of economies of scale. However, the net income declined to $1.7 million from $1.9 million a year earlier due to a 24% increase in operating expenses to $4.4 million following higher stock-based payments, delivery, and foreign worker travelling expenses.

Jerash

Looking ahead, Jerash will start working on initial orders for Skechers and Timberland in Q2 FY23, which represent an estimated 700,000 pieces annually. However, the 500,000 pieces order for Skechers is for women’s polos, while the 200,000 pieces order for Timberland is for four fleece styles of outerwear and the company said in its Q1 FY23 earnings call that these products have lower margins compared to the current mix. Jerash added that its major customers are now placing smaller purchase orders due to high inventory levels and inflationary pressures around the world. This means that the company will have to rely more on local orders to keep operating at full capacity, and this will shift the product mix to things like shorts, crew neck and pullover shirts that have lower average selling prices. In light of this, Jerash now expects FY23 revenue growth to be basically flat, with a decline in Q2 to $41-$43 million compared to $45.7 million a year earlier. The company should have good visibility for the quarter considering its manufacturing capacity is fully booked through December 2022.

Overall, it seems the contract apparel manufacturing sector in Jordan is facing significant headwinds at the moment due to deteriorating global macroeconomic conditions, but the silver lining is that Jerash seems to be navigating through this situation well for now. At the Q1 FY23 earnings call, the management said that this is the only local company running at full capacity and that some of its competitors are running at 30% below full capacity.

I think that a lot of the negative investor expectations are already priced in Jerash’ market valuation as the share price is down by almost 40% over the past 12 months. In my view, gross margins of 16% sound compelling even without growth and I continue to think that the company should be trading above $7.00. There don’t seem to be any potential catalysts here in the near term, but the downside risk could be limited as Jerash has a $3 million share repurchase program.

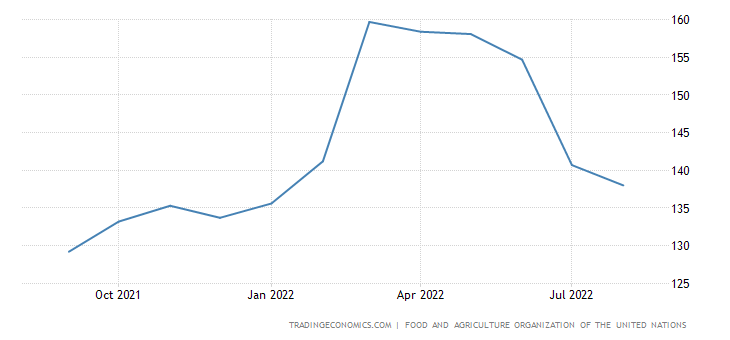

Looking at the risks for the bull case, the main ones that I mentioned in July included a reliance on a limited number of customers and suppliers and rising social unrest across the Middle East due to high global food prices. In Q1 FY23, VF Corporation accounted for 66% of revenues but this share should decrease somewhat over the coming months due to the shift to local orders. Yet, the potential loss of such a large client would still have a devastating impact on the business of Jerash. Looking at global food prices, the FAO Food Price Index has declined significantly over the past two months, and I no longer think that we could see another Arab Spring in the near future.

Trading Economics

Investor takeaway

Jerash has been growing rapidly over the past few years, but it seems that FY23 will be a challenging period as major customers are placing smaller orders, and this means that the product mix has to shift to lower margin items. In my view, Jerash is well positioned to weather this storm thanks to a strong balance sheet and a strategic advantage coming from its positioning in Jordan.

In my view, this stock is a speculative buy as there are no clear potential catalysts in the near term and client concentration risk remains high.

Be the first to comment