DisobeyArt/iStock via Getty Images

Go back just over a year ago and you would find Workhorse (NASDAQ:WKHS) flush with cash and its management still pushing hope over the USPS Next Generation Delivery Vehicle contract. A year later, this cash is now down by nearly 60%, with the USPS contract firmly left in the past. Questions around the company’s future have also started to rise against what are now consecutive quarters of zero revenue, entrenched cash burn, and no real strategic direction.

Its flagship C-1000 has been recalled with all sales suspended, a move which capped off a tumultuous 2021 for the company that was mostly characterized by a collapsing share price.

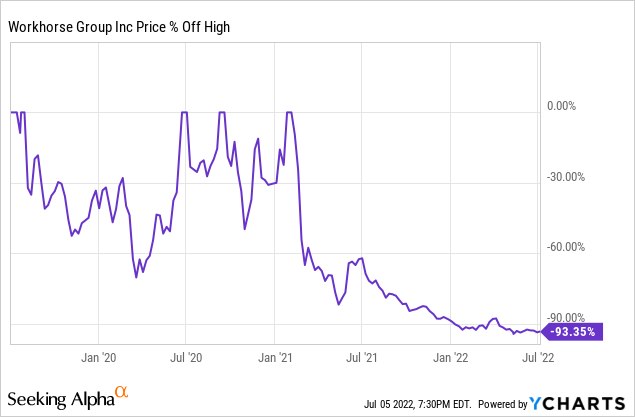

The company traded as high as $42 per common share, but this has since fallen by 93.35% as stock market investors pulled back heavily from pre-revenue companies and growth stocks. Whilst it would be difficult to describe Workhorse as a growth stock as the company has often traded more on a narrative than financial results, the company is indeed chasing a fast-expanding market being buoyed by an incredible mix of supportive government policy and rising consumer sentiment.

The EU just announced a framework to phase out the sale of new internal combustion engine vehicles by 2035 and a growing number of companies including Amazon (AMZN) are looking to decarbonize their operational footprint. This has set the background for the market for commercial EVs to grow dramatically in the coming years as more and more companies look to play their part in the global push toward net-zero.

Revised Product Portfolio Roadmap Will Be Constrained By Falling Cash Balance

Bringing a new vehicle to market is an incredibly capital-intensive process and the core reason so many new automobile manufacturers fail. It requires a deep pool of capital, a barrier that has driven the growth of the long list of defunct US automobile manufacturers.

To be clear, Workhorse does hold cash and equivalents of $167 million with zero debt as of its last reported fiscal 2022 first quarter. This was after swapping outstanding convertible notes for common stock. However, the company’s cash burn during the quarter came in at $34.3 million, higher than the preceding 2021 fourth quarter. So assuming this rate of cash burn remains constant and with no other sources of outside liquidity, Workhorse would have around 5 quarters of runway left. This is problematic because of the company’s revised product portfolio roadmap.

The company anticipates a Q3 2023 Start of Production for its W56, a vehicle serving the class 5 and 6 delivery van and truck market segments. The W34, a new Class 3-4 vehicle, is scheduled to start production in an unspecified quarter in 2024. These will require an increase in capital expenditure beyond current levels and would come on the back of the company starting production for the W750 class 4 delivery vehicle in the third quarter of this year. This comes on top of the company moving to repair and redeliver its recalled C-1000 from August. All these operational developments will drive an increase in near-term demand for cash and will likely see both operational cash burn and capital expenditure increase in the quarters ahead.

Hence, the company’s future is at risk with the current capital market conditions not being conducive to companies looking to raise new capital. Heightened inflation driven by high energy and commodity prices has wreaked havoc on the capital markets and economy and now threatens to plunge the US into a recession. The bankruptcy of a public EV company Electric Last Mile has also established a new painful narrative in a space that was once defined by excessive hype and euphoria. EV companies despite their previous halo status and ability to raise an almost unending amount of cash now face financing bottlenecks with most down significantly from their highs. The money tree has withered and what comes next is likely going to be wholesale difficulties with companies in the space remaining a going concern.

Failure Even As Demand For Zero-Emission Transport Grows

Despite near-zero revenue realized during the first quarter of this year, management is still guiding for fiscal 2022 revenues of $25 million with at least 250 vehicles sold. Workhorse currently sports a market cap of $451 million, so assuming this guidance is reached, the company’s forward price to sales stands at 18x. Not exactly cheap with several other companies in the space trading on single-digit forward multiples.

Workhorse is not a buy. Fundamentally, the company requires significantly more cash for a ramp of its operations than it currently has. Management can try to raise this cash through an equity offering, but with the current stock market conditions, this will be completed at a significant cost to current shareholders. Workhorse’s future is unfortunately too uncertain even as demand for EVs ramps up.

Be the first to comment