gguy44/iStock via Getty Images

Introduction

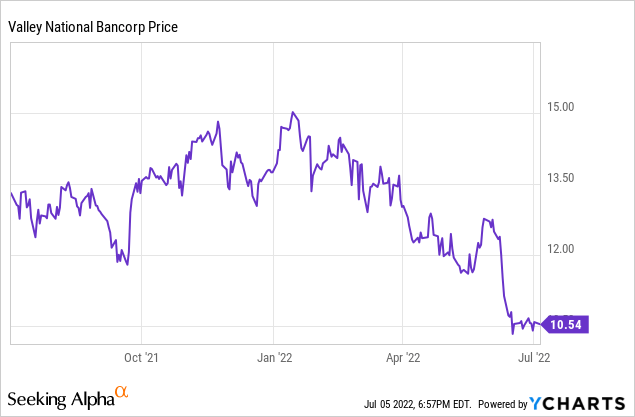

As it has been almost 15 months since I last discussed Valley National Bancorp (NASDAQ:VLY) here on Seeking Alpha, I felt an update is warranted, especially as the share price has lost about 25% since my previous article. I liked the bank’s performance back in 2021 but wasn’t sure about paying almost twice the tangible book value, so my approach was to write out of the money put options. All options expired out of the money so in hindsight I should probably be happy I wasn’t assigned any stock.

The profitability in Q1 was still very decent

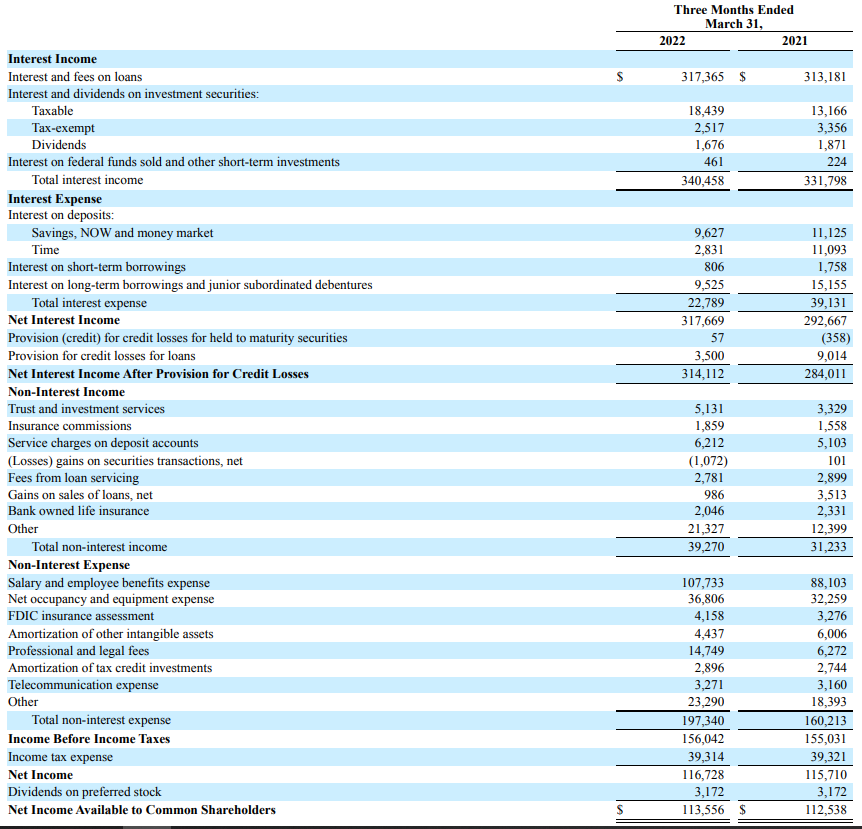

In the first quarter of the current financial year, Valley National saw its net interest income expand again due to the combination of a higher interest income and lower interest expenses. As you can see below, the interest income increased by almost 3% while the interest expenses fell by more than 40% to just under $23M.

Valley National Bancorp Investor Relations

As the bank barely had to record any provisions for loan losses, the NII including the loan loss provisions was $314M, an increase of more than 10% compared to the previous financial year.

Unfortunately the bank saw its operating expenses increase. The total non-interest income increased by more than 20% to $39M but this was neutralized by a $37M increase in the non-interest expenses. This caused the pre-tax income to remain pretty flat at around $156M for a net income of $116.7M before making the preferred dividend payments. After taking these preferred dividends into account, the net income was $113.6M for an EPS of $0.27. As Valley National is currently paying a quarterly dividend of $0.11 per share, the payout ratio is just around 40%, so about 60% or around $80M of the quarterly earnings are retained on the balance sheet.

Valley National Bancorp Investor Relations

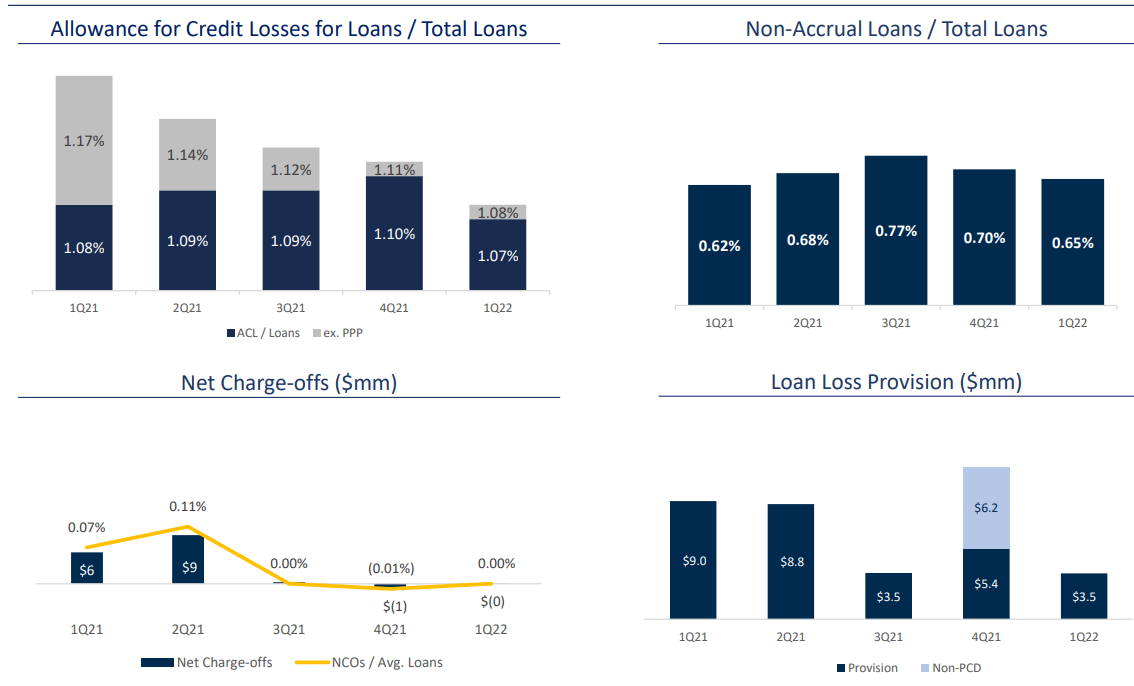

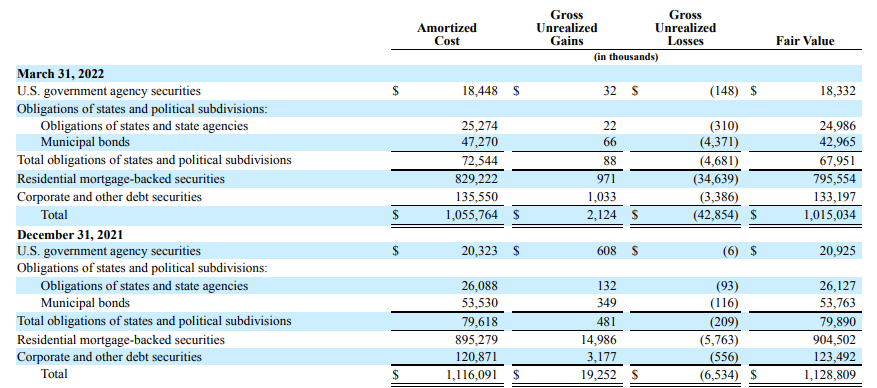

The book value: hit by the lower value of the securities portfolio but nothing to worry about too much

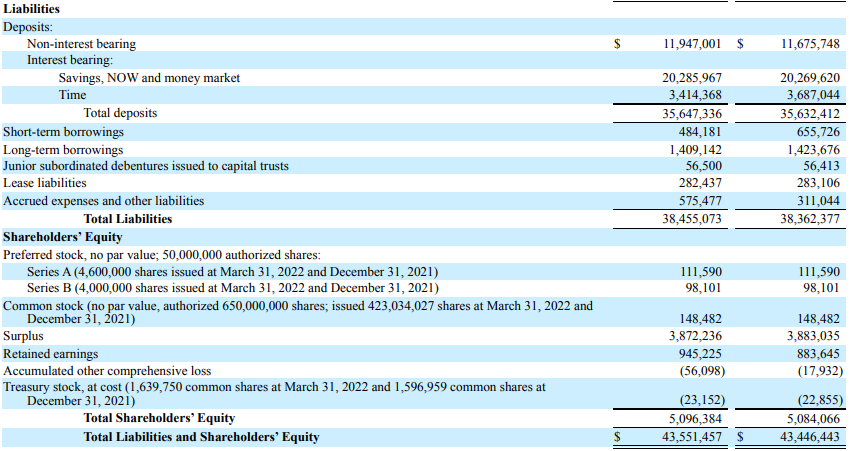

One would expect this to result in a corresponding $80M increase in the book value of the bank, but the total shareholders’ equity increased by just over $12M to just under $5.1B. So what happened?

Valley National Bancorp Investor Relations

As explained in some of my previous articles, banks with a portfolio of debt securities that are classified as ‘available for sale’ have to mark these securities to market. So as interest rates are increasing, the value of those debt securities is decreasing to adjust for the higher interest rates. This had a negative impact of around $40M on the book value.

Valley National Bancorp Investor Relations

As of the end of March, Valley National had a book value of $4.88B after deducting the $215M value of the preferred shares. There also is about $1.54B in intangible assets on the balance sheet (mainly goodwill) so the tangible equity value attributable to the common shareholders of VLY was approximately $3.34B. Divided over the net share count of 421.4M shares, the tangible book value per share was $7.92. That’s better than 15 months ago as the current premium to the tangible book value has fallen to just over 30%.

At least, that was the situation as of March 31st. On April 1st, Valley National completed the acquisition of Bank Leumi Le-Israel for a consideration of $113M in cash and 85 million shares. This acquisition was timed well, especially because Valley National paid for the majority of the acquisition with its shares valued at approximately $13/share when the deal closed. So while the deal was worth $1.2B at the moment of closing, the current share price means Valley National did well offering stock versus an all-cash acquisition.

The acquired bank had a total balance sheet size of in excess of $8B and an equity value of approximately $1.2B. It should obviously start to contribute to Valley National’s earnings from Q2 on although we should expect some merger-related and restructuring-related expenses to pop up. That was also already the case in Q1 where about $4.4M in acquisition-related expenses were recorded which reduced the EPS by about $0.01.

Investment thesis

I currently don’t have a long position in Valley National Bancorp but have been keeping an eye on the bank’s preferred shares. The preferred series A trading as VLYPP have a 6.25% preferred dividend until June 30 2025 where after the preferred dividend gets converted to the 3M LIBOR + 3.85%. The Series B are trading with VLYPO as ticker symbol and paid just 5.50% until now. As from the current quarter on, the B-shares will pay the 3M LIBOR + 3.578%. With the 3 month USD LIBOR rate at 2.32% (and the SOFR rate below that), the B-series will likely start paying close to 6% on the $25 principal making the current share price of $23.29 interesting with a yield of 6.3% (but that’s not materially better than the A-shares). I will likely remain on the sidelines for a quarter to see how the bank deals with the SOFR as benchmark versus the LIBOR in the prospectus of the preferred securities.

So for now, I am on the sidelines. I like the bank’s M&A approach and am impressed with how it has been able to fit in previous acquisitions.

Be the first to comment