vzphotos/iStock Editorial via Getty Images

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) reported its FQ3’22 earning card to much dismay from the market, as the harsh realities of the industry’s inventory stockpile and weaker demand finally came home to roost.

We had already cautioned of such potential headwinds in our May article that PC and Mobile could cause more pain in Micron’s near-term performance.

The consensus estimates have also been revised significantly, given management’s lowered guidance. While the stock has been trying to stage a bottom after its initial post-earnings, we urge investors not to buy this dip. MU remains mired in a bearish bias, and its price action signals remain tentative.

Furthermore, we maintain the conviction in our valuation model which suggests investors should continue to be patient in adding exposure, as MU could underperform at the current levels.

As such, we reiterate our Hold rating on MU stock.

What To Expect After Earnings?

The focus of Micron’s FQ3 earnings call was almost entirely on its forward guidance, given the markedly downgraded forecasts. The company guided for revenue of $7.2B (+/- $400M) in FQ4, with an adjusted gross margin of 42.5% (+/- 1.5%). It also expects an adjusted EPS of $1.63, which came in significantly below the overly-optimistic bullish Wall Street consensus.

It also highlighted significant weakness in China due to weak spending complicated by the COVID lockdowns. In addition, management’s commentary suggested that it seems to have been blindsided by the extent of the industry’s recent weakness.

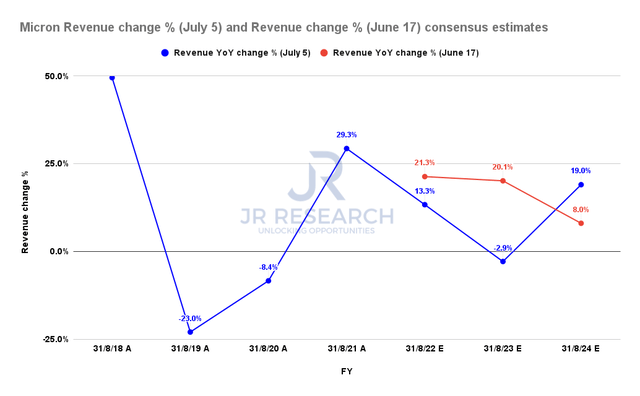

Micron revenue change % comps consensus estimates (S&P Cap IQ)

As a result, the consensus estimates (still bullish) have been revised significantly, as seen above. Micron’s revised estimates suggest it’s on track to post revenue growth of 13.3% in FY22, down from the previous forecast of 21.3%. Notably, the impact of Micron’s weaker end-market is expected to persist through FY24. As a result, the Street now expects Micron to post revenue of $36.28B in FY24, down from its previous estimates of $43.62B.

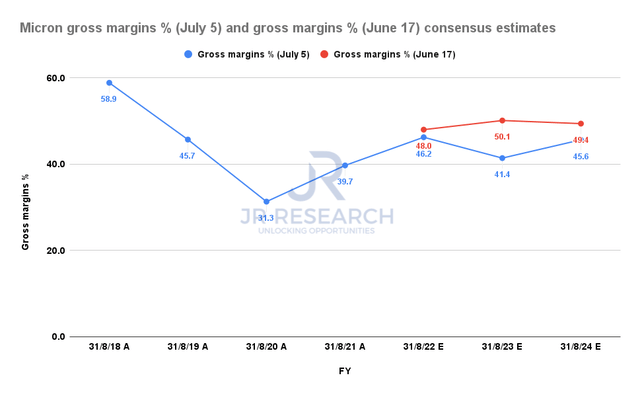

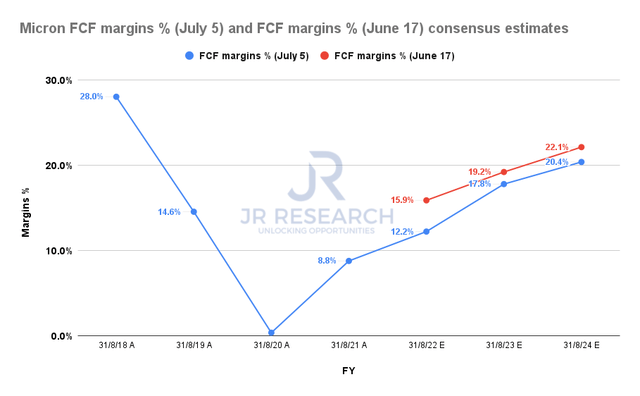

MU adjusted gross margins % comps consensus estimates (S&P Cap IQ) Micron FCF margins comps % consensus estimates (S&P Cap IQ)

Consequently, the changes in its revised adjusted gross margins guidance also impacted the consensus estimates markedly through FY24. Given its inherent operating leverage/deleverage, Micron’s free cash flow (FCF) margins have also been revised downwards.

Notwithstanding, Micron’s business model is still expected to be much healthier compared to its profitability over the past five to ten years. Notably, MU posted an average FCF margin of 13.6% (5Y mean) and 8.4% (10Y mean), respectively.

However, its supine outlook could continue to weigh on its performance in the near term. Bloomberg reported recently that Korea’s chip inventory has increased at a record pace since March 2018.

Moreover, DIGITIMES also reported that Samsung (OTC:SSNLF) could reduce its chips pricing in H2’22 to “further expand its market share.” It also highlighted that “server memory chip inventories have also been swelling.”

Earnings commentary by Micron also did not rule out a potential cutback in data center demand. We believe management also astutely downplayed the benefits of its longer-term agreements (LTA) on lifting its current malaise in response to an analyst’s concerns. Management articulated (edited):

So I understand your concern that, okay, if they’re not going to buy based on the LTA volume, what good are these LTAs. And we have repeatedly said that these LTAs are never meant to be take-or-pay agreements. That was not the goal for which they were set up. And there is no pricing in these agreements either. They are more a volume-based agreement, and the price is negotiated every quarter or every month, depending on what kind of customer arrangements there are. (Micron FQ3’22 earnings call)

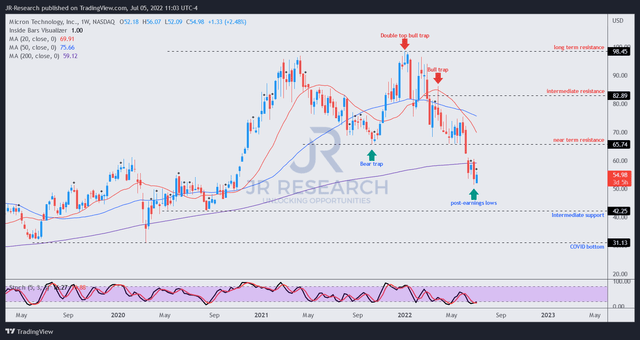

MU – Price Action Indicates Caution Is Warranted

MU continues to be entrenched in a bearish bias, as its initial post-earnings sell-off broke its previous June lows.

Currently, MU is attempting to rally and form a near-term bottom, going against the dominant bearish momentum. We believe the opportunity to cut exposure in MU is not attractive due to oversold technicals. Hence, investors should wait for another subsequent bull trap (significant rejection of buying momentum) to form before layering out.

In contrast, investors considering adding exposure are urged to remain patient, as there’s no bear trap yet (significant rejection of selling momentum).

Is MU Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on MU stock.

We shared our valuation model previously that highlighted even an entry close to its intermediate support ($42.25) could underperform. With the markedly revised consensus estimates, we urge investors to consider a level below $40, coupled with constructive price action, before adding exposure.

Our price action analysis highlights that MU could be forming a near-term bottom after taking out its recent June lows. However, the lack of a bear trap does not augur well given its dominant bearish momentum.

Be the first to comment