dogayusufdokdok/E+ via Getty Images

On September 13, I published an article – something I do most days, admittedly. This one was titled “The 3 Highest-Quality REITs in the World Are All on Sale.”

Those three real estate investment trusts (“REITs”) were:

As I wrote:

“Looking through the iREIT Ratings tool, I noticed something rather extraordinary this week…

“The three highest-rated stocks on the tracker are all currently in ‘Buy’ territory.

“When I say highest-rated, I’m talking about the iREIT IQ quality rating system. This is a 100-point rating scale that’s based off of a wide variety of operational, fundamental, and balance sheet-related metrics.”

Moreover…

“One would imagine that, during a volatile time like this in the markets, we’d witness a flight to quality as investors flock toward safe and reliable income (and fundamental growth prospects). However, after the selloff that we’ve seen in recent weeks, that doesn’t appear to be the case.

“Yet these blue-chips with perfect quality ratings are the perfect types of stocks to own during uncertain times. This is why I’m writing about [them]…”

Like all those other articles on all those other days, I got some comments on what I wrote. That included this one from LittleMilk:

“I respect your work… [but] I can’t justify PLD’s premium valuation, especially in comparison to peers. Great business, but as Obi-Wan stated, ‘This is not the valuation you’re looking for.'”

Clearly, I disagree with his conclusion since I listed – and still list – Prologis as a Buy. At the same time, he gave me another great idea for a future article.

For which I have to give him a shout out and a thanks!

The Right REITs at the Right Times

Before I go any further, I want to make a few clarifications:

- In case any Star Wars enthusiasts are about ready to scroll down and leave a comment for LittleMilk and me, we fully recognize that “This is not the valuation you’re looking for” is not a direct Obi Wan quote. That bit of tongue-in-cheek commentary should be obvious, but you never know what “copyrightests” might be lurking around the corner.

- I would like to thank LittleMilk for his comment regardless of whether he gave me a new article idea or not. I’d even thank him regardless of whether he began his comment with “I respect your work” or not. As I’ve said so many times before, I’m very grateful for all my readers and the feedback they give – even the feedback that doesn’t call me a 100% genius who can do no wrong.

You guys keep me on my toes. And that’s a good thing. That’s why I was quick to write back:

“I get it… I’m also buying STAG… But I just can’t ignore consolidators like O, VICI, and PLD. Scale and cost of capital have considerable advantages… I’m writing an article titled, ‘If I Were to Own Just 5 REITs, I Would Own These 5.'”

Regular readers of mine can probably make a few educated guesses about what stocks might make that list. And for what reasons, especially considering the “scale and cost of capital” reference above.

In which case, I don’t mean to bore you. I know I pound the table about certain stocks at certain times – perhaps even at all times when it comes to Realty Income.

But that’s because I know the power these REITs can bring to your portfolio.

I say “can” because, of course, nothing is ever completely guaranteed – only more or less likely. Plus, you need to be sure to buy these “table pounding” stocks at the right prices.

Buying in too high can mean your share price crashes, leaving even your dividends unable to buoy you up for years.

According to my calculations though, that’s just not the case for the three REITs I listed in my previous article. And you might just find some well-priced picks down below as well.

Read This First

Consider this section of my article a disclaimer, that you should always own more than 5 REITs. Although I’m providing you with my list of 5 must-have picks, please remember the words of Sir John Templeton:

“The only investors who shouldn’t diversify are those who are right 100 percent of the time.”

I’m thrilled that you’re reading my article (and hopefully you’re also following me), but I must stress the importance of not betting all of your hard-earned capital on one horse.

Perhaps the reason that I’m such a good roulette player is that I grasp the concept of diversification, and also that I allocate capital on names that are deemed to be of the highest quality.

So, for the record, I do not advocate owning just 5 REITs.

At a minimum, scoop up 10, which means that on an equal-weight basis you have better odds of protecting your principal. Now, on to the picks…

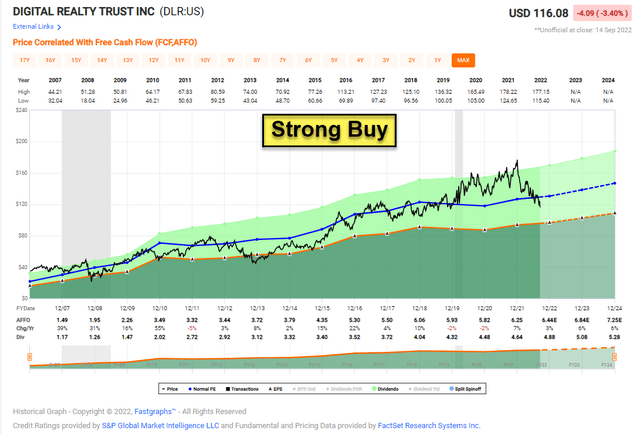

REIT #1: Digital Realty Trust, Inc. (DLR)

DLR is a data center REIT with a global portfolio that spans over 4,000 customers in 50 different metro areas. The company is the 8th largest publicly traded U.S. REIT.

Their extensive development experience, economies of scale, and process-based approaches to design and construction have provided significant cost savings and added value to DLR’s customers.

As you will find out, all five of the REITs on this list benefit from their scale advantage, and it’s because of their size that risk is mitigated due to the power of diversification.

Another common thread for all five REITs is their balance sheet. In the case of DLR, the company is rated BBB with a debt maturity profile that’s very well managed, and this gives another level of security for investors.

Dividend safety is also critical to the selection process, and DLR has a track record of paying and growing dividends for over 15 years in a row. The payout ratio is ~75%, which provides an ample buffer for future dividend increases.

Analyst are forecasting the company to grow AFFO per share by 6% in 2023 and in 2024, which provides added comfort and prospects for enhanced total returns.

Shares are attractively priced, with a P/AFFO of 18.2x, compared with the normal multiple of 20.3x. We consider this one a steal right now and we are maintaining a Strong Buy with a 12-month Total Return forecast of 20% to 25%.

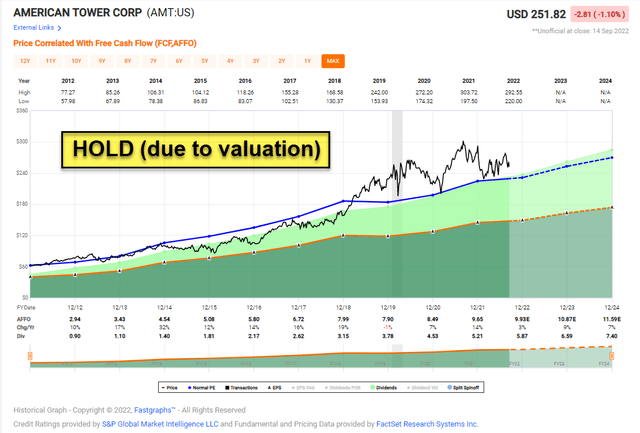

REIT #2: American Tower Corporation (AMT)

AMT is a cell tower REIT with over 222,000 global tower sites in 6 continents and 25 countries. More recently AMT acquired data center REIT, CoreSite, for $10.1 billion, that includes 25 data centers (in 8 U.S. metro areas).

This deal established AMT as a leader across multiple classes of communications real estate as 5G and wireless accelerates globally.

Once more, scale has its advantages, and one of the reasons we like this REIT is because of its global dominance and the fact that the industry is highly fragmented.

Another common theme with AMT (and the other REITs) is the balance sheet and enjoys investment grade ratings with access to diverse sources of capital at competitive terms. In Q2, the company increased its percentage of a result of fixed debt to nearly 80%, up from 66% as of the end of Q1-22, and pro forma net leverage dropped to around 5.5x.

Now that CoreSite has closed, AMT looks to deleverage back to 3-5x (its target range) over time.

Dividend strength is another common theme, and in Q2-22 AMT raised its AFFO per share guidance to $9.74 from $9.72, despite absorbing the negative effects from FX and a continued rise in interest rates.

The company said it “expects to dedicate approximately $2.7 billion subject to board approval towards 2022 dividends…represents approximately 12.5% in year-over-year growth on a per share basis.”

Notably, AMT has only been paying dividends since 2009, so it’s not in the aristocrat club yet. However, the prospects look promising based upon based on 13.8% AFFO per share growth (“CAGR”) since 2013.

Shares are soundly valued right now, which means we rate the company as a HOLD, just around 4% higher than our FV target. The P/AFFO multiple is 25.6x, which is above the normal range of 23.5x. The dividend yield is 2.2% and well-covered.

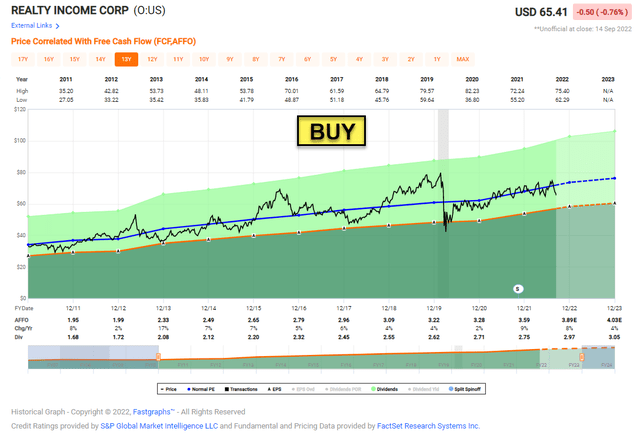

REIT #3: Realty Income Corporation (O)

O is a net lease REIT that owns 11,427 commercial real estate properties in 50 states and Europe. The company has been known for owning top notch real estate in the U.S., and in recent years the company has taken advantage of this expertise, combined with low rates across the Atlantic, to build out a European portfolio as well.

At the end of the second quarter, O owned more than $5 billion worth of European real estate investments, increasing its overall diversification.

Overall, 43% of Realty Income’s tenants carry investment grade credit ratings, providing peace of mind during markets like this when more and more investors are talking about an impending recession.

Just like DLR and AMT, O is considered a highly diversified platform, which is one of the reasons it has avoided a dividend cut since inception.

Another reason for the dividend success is the fact that O maintains a fortress balance sheet (A3 with Moody’s and A- with S&P) – one of only seven S&P 500 REITs with to A3/A- ratings or better. This means that the company has significant liquidity ($3.25 billion) and low borrowing costs that support enhanced financial flexibility.

During the 28-year period since O’s IPO, the company has posted the 6th lowest beta in the S&P 500, which is why I consider this a perfect “SWAN” (Sleep Well At Night) stock.

With all of that in mind, you’d think that the market would be willing to pay a premium for O shares; but, as you can see below, O is currently trading at a discount to its long-term average P/AFFO multiple.

Realty Income shares are down by 9.41% during the last month, and this selloff has pushed the blended P/AFFO ratio attached to shares down to 17.2x. On a forward basis, O is trading for 17.0x 2022 full-year expectations and just 16.5x 2023 full-year estimates.

The dividend yield is 4.5% and well-covered. We maintain a BUY with a 12-month Total Return forecast of 15%.

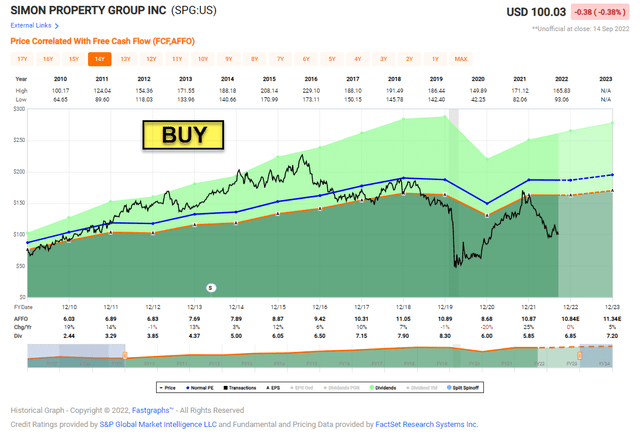

REIT #4: Simon Property Group, Inc. (SPG)

SPG is a mall REIT that owns and interest/ownership in 199 income-producing properties in the U.S., consisting of 95 malls, 69 premium outlets, 14 mills, 6 lifestyle centers, and 15 other retail properties in 37 states plus Puerto Rico.

SPG also owns a majority noncontrolling 80% interest in TRG (Taubman Realty), which in turn has interest in 24 regional, super-regional, and outlet malls across America and Asia.

Additionally, SPG has international exposure. The REIT owns interest in 33 properties in Asia, Europe, and Canada, and also owns a 22.4% equity stake in Klepierre SA (OTCPK:KLPEF), one of the premier real estate businesses in France and Europe.

Like the other REITs referenced, SPG is a dominant player in its category, and this is important because the company has pricing power with tenants within its portfolio.

When looking for safe, high-quality REITs to invest in, it is always smart to start at the top, the leaders in the respective industry. SPG is easily the highest-quality mall landlord in its respective space, and it is not all that close.

SPG also has a fortress balance sheet which has credit ratings of A3 from Moody’s and A- from S&P. This is a major advantage for the company and one reason why it dominates the sector with the highest rated portfolio.

SPG shares are also cheap, trading at a P/AFFO of 9.2x compared with a longer-term average of 17.x. The dividend yield is 7.0% and well-covered. Analysts are forecasting growth of 5% in 2023. Once more, we see value here, with our 12-month total return forecast of 20% to 25%

REIT #5: VICI Properties Inc. (VICI)

VICI is the final pick, and I’m sure this one may surprise you.

One thing I’d like to point out here is that all four of the other REITs referenced have excellent management teams, and in fact, had it not been for management, none of these REITs would have generated the powerful fundamentals I just told you about.

This is also true for VICI.

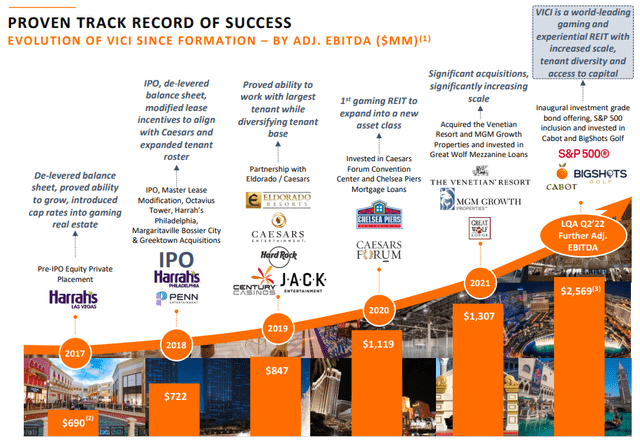

Although VICI is somewhat new to REIT-dom (formed 5 years ago), the company has grown its Adj. EBITDA from $690 million to around $2.6 billion.

Currently VICI’s high-quality portfolio is spread across 43 properties that generate resilient and stable cash flows (100% rent collection to date through the ongoing COVID-19 pandemic). We’ve watched the evolution of this net lease REIT as it has generated massive scale in record time.

The good news is that we identified this one in the early innings, and over the last few years this REIT has become a sizeable part of my portfolio holdings.

We consider the gaming properties “Mission Critical” based on the regulatory environment that creates high barriers to entry and limits the tenants’ ability to move locations, contributing to VICI’s 100% occupancy rate. VICI is now the largest triple net lease REIT and one of the top four-wall REITs by LTM Q2’22 Adj. EBITDA.

Once again, management matters, and we credit the CEO and CFO for achieving an investment-grade rated balance sheet that broadens access across capital markets. We would not be surprised to see the company expand into Europe in the future.

Once more, dividend growth is the mark of quality, and VICI has not disappointed.

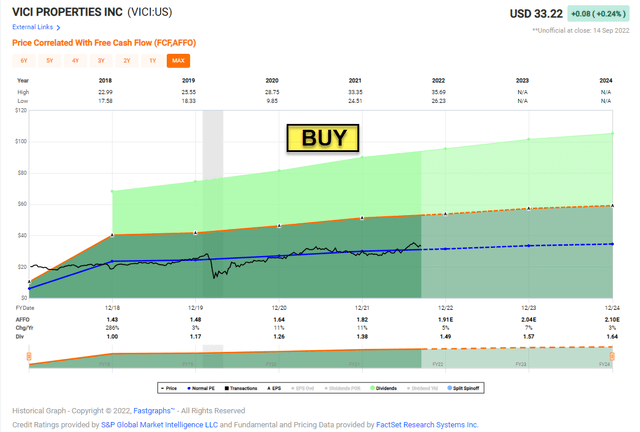

Shares are now trading at $33.22, 6% below our FV target. The P/AFFO multiple is 17.6x, with a dividend yield of 4.7%. Given the success with VICI thus far, we see plenty of runway with the seasoned management team and steady pipeline of ROFR’s (right of first refusals) and fragmented marketplace. IREIT forecasts shares to return 15% over the next 12 months.

In Closing

Once more I’ll stress that I am not advocating to own just five REITs, and while I provided you with a list of some fan favorites, there are others that we recommend at iREIT on Alpha that provide sound risk management guardrails.

Believe me, I’ve seen plenty of one-hit wonders, but the funny thing is that everyone likes to talk about the winners, but not so much the losers.

So, in a few days I promise to write an article on my losers, and the most important lesson to learn is that I hold far more winners.

Over the years, I have learned that transparency is critical to the trust-building process, and that’s why showing you the good, the bad, and the ugly is what life is all about.

As always, thank you for reading and happy SWAN investing!

Be the first to comment