gorodenkoff/iStock via Getty Images

Investment Thesis

In my last article on the iShares Self-Driving EV and Tech ETF (NYSEARCA:IDRV), I expressed some skepticism regarding IDRV’s future expected returns and concluded they are likely to be very different than past returns. Moreover, I pointed out the fact that IDRV was relatively expensive (the fund was trading at more than 20x earnings) and that volatility will be a key feature in the short term. Since then, IDRV has lost ~31% vs. a loss of ~22% for the S&P 500 and has underperformed the US market.

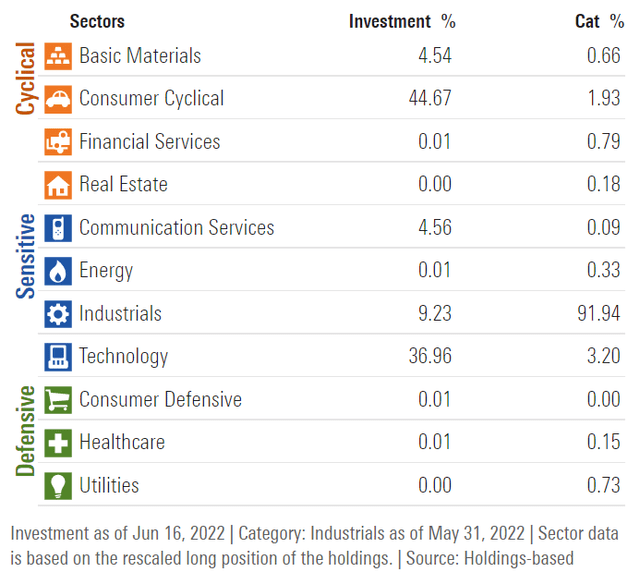

In the context of higher rates, I believe it’s crucial for investors to differentiate between the short and long-term benefits of owning this fund. The self-driving technology isn’t yet in the mass adoption phase, and companies aren’t likely to get an immediate return on their investment. This becomes costly in a rising rate environment and we might see firms prioritizing projects that are already profitable. Lastly, I think it’s important for investors to understand that IDRV invests nearly 50% of its assets in cyclical industries such as auto manufacturers. Given the higher odds of a recession over the next couple of months, investing in cyclical stocks can exacerbate the drawdowns and the volatility of your portfolio if the economy turns south.

What Has Happened Since My Last Article

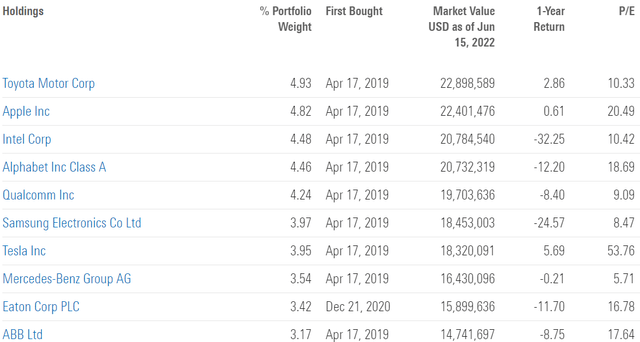

As a reminder, the iShares Self-Driving EV and Tech ETF tracks the performance of the NYSE FactSet Global Autonomous Driving and Electric Vehicle Index, which provides exposure to developed and emerging markets equities that may benefit from growth and innovation in and around electric vehicles, battery technologies, and autonomous driving technologies. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

I have compared below IDRV’s price performance against the Global X Autonomous & Electric Vehicles ETF (DRIV) and the SPDR S&P 500 Trust ETF (SPY) over the last 6 months to assess which one was a better investment. Since my previous article, IDRV has lost ~30% and vs. a loss of ~21% and ~27% for SPY and DRIV, respectively. It is interesting to note that IDRV performed worse than DRIV despite having a similar strategy and portfolio. I believe this is due to the way IDRV’s portfolio is constructed. DRIV’s top 10 holdings only account for 29% of the portfolio compared to IDRV which invests over 40% of assets in the top ten positions.

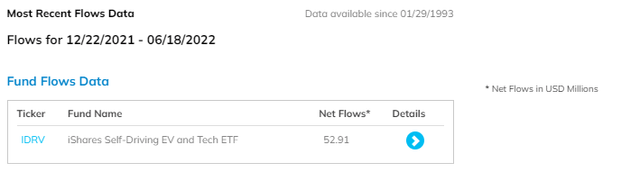

Despite the abysmal returns, investors remain bullish on IDRV. The fund registered nearly $53 million of inflows since late December 2021, which shows that investors are buying the dips with the hope of getting a good deal. To see recurrent inflows despite a 30% drawdown illustrates a lack of capitulation and more broadly speaking, it reinforces my hypothesis that we are nowhere near a bottom yet.

Differentiating Between Short and Long-Term Opportunities

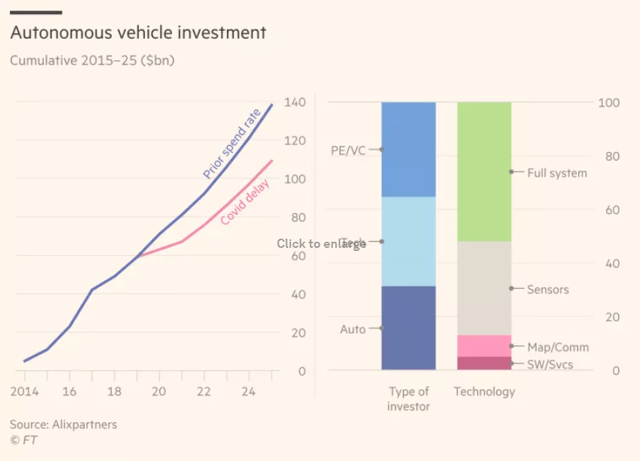

Self-driving vehicles have interesting long-term growth prospects, which should make every investor pay attention to this emerging trend. Recent estimates predict that more than 30 million self-driving vehicles will be sold by 2040. Although the greatest gains are expected after 2030, several OEMs have announced commercial market entry for 2021/2022. The revolutionary potential of this technology has pushed both traditional OEMs and software companies to boost investment in order to win the technology race. While the Covid-19 pandemic has reduced the spending rate, it is expected that the cumulative investment in this technology will reach nearly $90 billion by 2024.

However, the technology hasn’t yet reached mass adoption, which makes it still unprofitable given the amount of investment that was required to develop it. Recent estimates suggest that widespread deployment of autonomous driving systems without a safety driver will take at least a decade, while the expansion will most likely be gradual and region-by-region in specific modes of transportation. There are currently few examples of smaller-scale commercial adoption. Waymo One is one of the few commercial ride-hailing services in Phoenix, Arizona that provides fully autonomous rides.

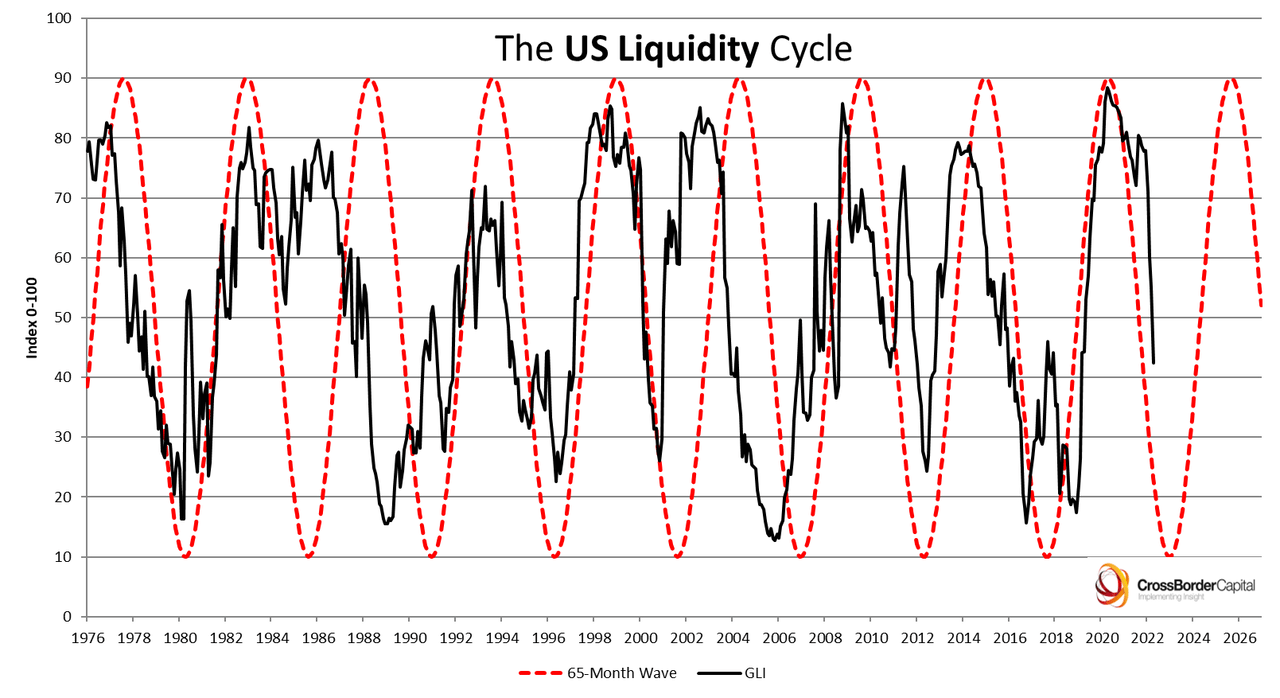

Not generating positive cash flow is becoming an important issue in this market environment where liquidity is rapidly drying up. The market is now starting to re-price some of the lossmaking companies/technologies accurately, especially in the credit market where credit spreads between junk and investment-grade bonds have increased dramatically over the last couple of months. I believe higher rates will push companies to prioritize profitable projects that have the ability to generate money today.

CrossBorder Capital

I think it’s increasingly important for investors to look at what are the potential risks over the next 18 months. In my opinion, the probability to have a recession in the US is now much higher than six months ago, which should make you reconsider investing in cyclical stocks. Nearly 50% of IDRV’s assets are invested in cyclical industries, including auto manufacturers and basic materials providers. These are the sectors that had some of the largest drawdowns so far this year, and that are likely to continue to underperform when the economy turns south.

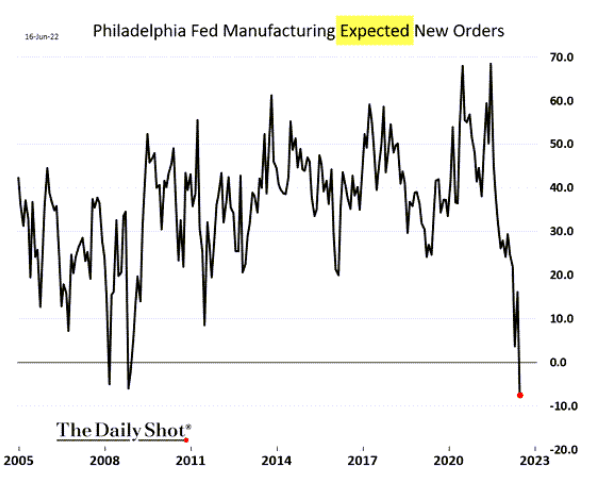

While the market has readjusted prices to reflect higher risks, I think we are still nowhere near a bottom in equities given the fact that earnings estimates are untouched. In other words, I expect the next leg down to be driven by downward earnings revisions stemming from poor economic conditions. Some leading indicators are starting to turn red which should be concerning for investors at this point of this cycle when the Fed is doing quantitative tightening. I believe the next 12 months will be extremely volatile and downside risks from the current level continue to be the main concern for me.

The DailyShot

Key Takeaways

In the face of rising interest rates, I believe it’s critical for investors to distinguish between the short and long-term benefits of owning IDRV. While the long-term picture comes with appealing prospects, we are still in the early stages of self-driving today, and companies are unlikely to see an immediate return on their investment. In a rising-rate environment, this becomes costly, and firms may prioritize projects that are already profitable. Finally, I believe it’s critical for investors to understand where we are in the business cycle and how that could impact IDRV. The fund invests nearly half of its assets in cyclical industries such as automakers. If you believe the recession risks are real, I personally think it’s better to avoid cyclical stocks since they generally tend to increase the portfolio’s volatility, as well as drawdowns.

Be the first to comment