Pranita Thorat

Investment Thesis

ICL Group Ltd (NYSE:ICL) is a manufacturer of specialty minerals and fertilizers. The company has recently announced the launch of biodegradable coated fertilizer technology, which can increase nutrient use efficiency by effectively reducing nutrient loss. I believe this new innovative technology can act as a primary growth factor as it can have high demands in the market due to its agricultural and financial benefits to the farmers.

About ICL Group

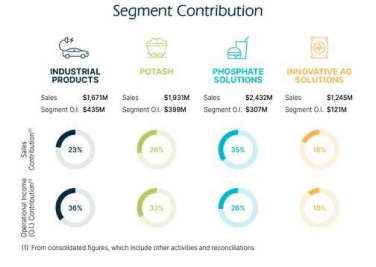

ICL Group Ltd mainly focuses on producing and marketing specialty minerals and fertilizers. The company deals in four operating segments: Industrial Products, Phosphate Solutions Potash, and Innovative Ag Solutions. The Industrial Products segment operates in the bromine value chain. Bromine is a natural product found in seawater and underground brine deposits, which is used for rubber production, water purification, oil & gas drilling, and in the pharmaceutical and food industries. In addition, the Industrial Product segment also produces phosphorus-based products and several others, such as calcium, carbonate, magnesia, and salt products. It deals in three main sub-business lines: flame retardants, Industrial Solutions, and Specialty minerals. The Industrial Product segment contributes approximately 23% to the company’s total sales. The Potash segment focuses on the production and sales of potash for direct application as a fertilizer and to manufacturers who manufacture compound fertilizers. The production of magnesium, salt, excess electricity, and Polysulphate is also part of the Potash segment. The potash business primarily focuses on markets of Brazil, India, China, Europe, and the USA and contributes 2.4% to the company’s total sales. The Phosphate Solutions segment produces various products such as sulphuric acid, green phosphoric acid, and phosphorus rock which can be utilized to make other multi-purpose phosphate products and can be sold to other fertilizer producers as a raw material. This segment’s sales comprised approximately 35% of the total company’s sales. The Innovative Ag Solutions segment develops, produces, and distributes nitrogen, potash, and phosphate-based fertilizers. The company is also planning to expand the segment portfolio of specialty plant nutrition, plant health solutions, and plant stimulation. This segment’s sales constituted 18% of the company’s total sales.

Revenue by Segment (Annual Report of ICL)

Launch of Coated Biodegradable Fertilizer Technology

ICL recently announced the launch of eqo.x, a biodegradable coated fertilizer technology specially developed for open-field agriculture. This technology includes a coating that helps in the reduction of nutrient loss and increases nutrient use efficiency by 80%. This innovation can significantly help farmers to maximize agricultural crop performance and gains. I believe this innovative technology can have a massive demand in the market as this technology helps achieve increased or similar levels of yields with reduced fertilizer use, which can reduce the cost of production for farmers. This technology is the first in the market to provide a Controlled Release Fertilizers (CRF) coating for urea. This biodegradable coating technology will be applied to the company’s CRF products, including its Agromaster brands. The company expects it to be ready for farmers in the European Union by 2023. As per Fortune Business Insights, the global controlled release fertilizer market size was recorded as $2.3 billion in 2018 and is projected to reach $3.86 billion by 2022, representing a CAGR of 6.37%. Observing these projections, I believe there is a lot of scope for this new technology to be successful and capture a huge customer base looking at agricultural and financial benefits for farmers. I think the demand for this biodegradable fertilizer technology might be huge in the coming period as it is a first-of-its-kind release technology introduced in the market. As there can be a massive demand for this technology, it can significantly increase the company’s sales and help it grow in the coming years.

13.68% Forward Dividend Yield

The company announced a quarterly dividend of $0.29 per share, up 20.83% compared to the previous quarter from $0.24 per share. As per my analysis, I believe this dividend payment is sustainable as the company is well-positioned and has recently announced the launch of biodegradable coated fertilizer technology, which can result in high revenue and profit margins for the company. I believe the dividend might keep growing in the coming years, but to keep my estimates conservative, I estimate the dividend of $0.29 per share can remain constant for coming quarters, which is an annual dividend payment of $1.16 per share. At the current share price of $8.49, an annual dividend payment of $1.16 gives a forward dividend yield of 13.68%. I think this is a perfect opportunity for retirees and risk-averse investors to earn a fixed income on their investments.

What is the Main Risk Faced by ICL?

Risk of Oversupply

In addition to seasonal and cyclical variations, the company’s businesses are vulnerable to changes brought on by supply-side factors, such as the introduction of new manufacturers and products, mergers of important players (producers and suppliers), an increase in the manufacturing capacity of current producers, and changes on the demand side, such as alliances or mergers between important clients. The current global demand exceeds all players’ prospective production capacity, which can impact price levels. Some items’ pricing is affected by market prices, whereas low prices in the agricultural sector and oversupply in the case of commodities like potash and phosphates both have a negative impact on their respective prices. If the industry faces an oversupply of products, it can reduce product prices, adversely affecting the company’s financials.

Valuation

The company has introduced an innovative biodegradable coated fertilizer technology that can help farmers to improve agricultural crop performance and reduce production costs. I believe this can act as a primary growth factor for the company and increase the sales level driven by anticipated high demand in the market. After considering all the above factors, I am estimating EPS of $1.60 for FY2023 which gives the forward P/E ratio of 5.43x. After comparing the forward P/E ratio of 5.43x with the sector median of 10.52x, we can say that the company is undervalued. I believe the company might gain significant momentum as it is on a growth spree. I estimate the company might trade at a P/E ratio of 10.20x, giving the target price of $16.32, which is an 87.3% upside compared to the current share price of $8.71. In a bear case scenario, a significant decline in product prices due to oversupply in the market can affect the financial performance of the company. I think, in that case, it can contract the profit margins and EPS of the company. I believe, in the bear case scenario of reduced agricultural production, the EPS of FY2023 might be $1.25 and trade at a P/E ratio of 8.50x, which gives a target price of $10.63, representing a 22% upside from the current share price.

Conclusion

The company has recently announced the launch of biodegradable coated fertilizers technology, which I believe can help the company to grow in terms of sales as the technology has both agricultural and environmental benefits. At the current share price of $8.49, an annual dividend payment of $1.16 gives a forward dividend yield of 13.68%. After comparing the forward P/E ratio of 5.43x with the sector median of 10.52x, we can say that the company is undervalued. After considering all the above factors, I assign a buy rating for ICL.

Be the first to comment