busracavus

Investment Thesis

IBM (NYSE:IBM) has meaningfully outperformed the NASDAQ (COMP.IND) this year. While the Nasdaq index is down approximately 33% this year, IBM is down approximately 5% once we factor in its dividends.

This is my contention, value investing is back! Getting involved with low-growth, highly profitable stocks in a high-interest environment is a winning combination.

The State of Affairs

We are navigating the most interesting time. As interest rate increases start to percolate through the market, there’s a slow change in investors’ expectations.

We all become so obsessed with high-quality growth companies, that collectively we overbid those companies.

And now, across the board, there appears to be a small amount of divergence being witnessed. I’m not going to say that this market bifurcation is clean, because, for example, Netflix (NFLX) still got a significant rally on the back of what I believe is a mixed-bag earnings report.

But what we are now seeing is that companies that have a significant amount of earnings to support their valuation are getting a pass. Whereas companies with ephemeral earnings or unprofitable are getting hit hard, nearly irrespective of the narrative.

IBM’s Revenues Hit by FX

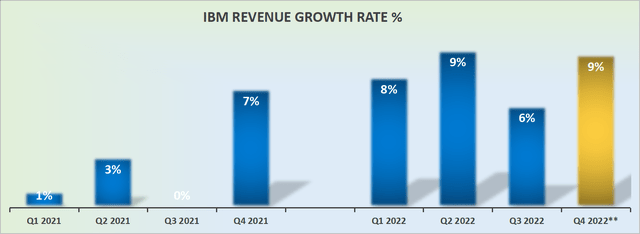

IBM revenue growth rates

In the graphic above I’ve used GAAP revenue growth rates. Previously, the difference between GAAP and currency-adjusted revenues was small, and investors weren’t likely to put too much consideration into this difference.

But as we look ahead to Q4 2022, currency FX will be a 700-basis point headwind, and that is not an insignificant amount.

This was a strong quarter for IBM, with growth across its portfolio, including Software, Consulting, and Infrastructure. The one area where IBM came up short was in Financing. But I don’t believe investors would be too put out if IBM’s Financing is the one area where IBM is dragging.

Moving on, for anyone that’s not followed all the turmoil in the market of late, here’s a quote from IBM’s CEO Arvind Krishna on the earnings call,

Clients are dealing with everything from inflation to demographic shifts from supply chain bottlenecks to sustainability efforts.

Of course, now we should add to those headwinds, currency impacts too.

IBM Stock Valuation – 10x This Year’s Free Cash Flow

IBM’s core business is business-to-business. IBM has nearly no exposure to the consumer. IBM’s business is selling technology to large enterprises.

So even though IBM may not be perceived as terribly exciting, it doesn’t have too much exposure to weaker parts of the market, such as consumer-facing, or even Europe for that matter.

In fact, during the Q&A section of the call, IBM notes that even if things end up challenging in Western Europe, IBM’s total exposure is not significant.

All in all, paying 10x this year’s free cash flow strikes me as attractive.

The Bottom Line

We are navigating a very challenging time as investors. Even though there’s a clear demand for Hybrid Cloud infrastructure software across enterprises, investors’ expectations are also really high.

And therein lies the problem, there’s been too much capital attempting to solve the same problem. So that leads to a lot of confusion amongst enterprises as to what product portfolio to adopt.

But that’s also where the opportunity lies for IBM. We can see that reflected in IBM’s consulting business, which makes up a third of IBM’s total business.

What’s more, unlike other enterprises where consulting is typically a loss leader, for IBM it brings in just over 10% pretax income margin. So, not only is it a large proportion of the business, but it’s also a highly profitable endeavor.

In conclusion, IBM might not be viewed by investors as a growth stock, but that’s a good thing! IBM is clearly still growing, even today, IBM is guiding for high single digits constant currency growth rates, plus offering investors a 5.4% dividend yield.

As I look around the carnage in tech stocks, for example, Netflix is also expected to grow its topline by approximately 10% currency-adjusted revenue growth rates, it’s also priced at very approximately $115 billion, but Netflix’s stock is priced at 100x this year’s free cash flow, with no dividend, while IBM is priced at 10x this year’s free cash flow, with a dividend.

I recognize that it’s not an apples-to-apples comparison. One is a tech company with a lot of competition growing at 10% FX-adjusted CAGR on the top line, priced at just over $110 billion, while the other is a tech company with a lot of competition priced at just over $110 billion, and expected to grow at 10% y/y revenue growth rates… oh!

Be the first to comment