debibishop

ProShares TQQQ Offers Tremendous Upside Over The Short to Medium Term

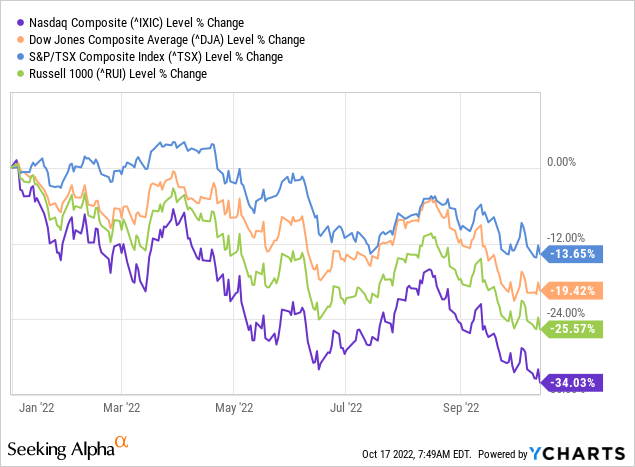

The NASDAQ has fallen over 34% year to date (Figure 1), and has shown no signs of slowing down, being the worst performer out of the main indices. Many analysts such as Alliance Bernstein say it could fall even further due to high inflationary environments and hawkish Federal Reserve outlook. We believe the bottom is much closer than analysts expect. The Fed is expected to ease rate hikes in late 2022 into 2023 and history points to broader market declines until rate hikes are eased. With this potential relief around the corner, we believe the market will begin to turn for the better in anticipation of easing of rate hikes and continue to run up this winter season. As rates level off, this could signal that tech could be a leader and go on a big bull run in 2023 even into 2024. ProShares UltraPro QQQ ETF (NASDAQ:TQQQ) offers a chance to leverage that bull run giving a three times stake in the NASDAQ weighted Invesco QQQ ETF (QQQ). This presents a significant upside opportunity to profit off of a market turnaround with only a moderate amount of downside risk still available in our opinion.

Figure 1. The chart above shows how the NASDAQ has been beaten down further than all other major market indices over the last 10 months

Furthermore more than two-thirds of Decembers have historically resulted in positive gains. This year more than ever could end with a big “Santa Claus rally” closing out the year up big.

Valuing TQQQ

Trying to put a value on the NASDAQ as a whole can be tricky due to a number of macroeconomic conditions. Upside estimates if new highs are again obtained in 2023 look very promising. A best case scenario of short term upside if the market were to run up very quickly (6-9 months to new highs) would put a return on TQQQ of around 180% +/- 10-20% depending on the months necessary to be invested. Looking towards general downside, a worst case scenario, in our opinion, if the NASDAQ falls another 15 to 20% closer to COVID lows, would be that you would lose around 60 to 80% in value again incorporating rough convexity. This makes this play a very high risk, high return investment, but in our opinion, TQQQ has very good upside versus downside potential. Holding on to leveraged ETFs for longer periods of times can begin to have a negative impact on overall returns over longer deadlines. Therefore, we recommend not holding TQQQ for longer than 2-3 quarters to a year at a time if possible. If looking for longer term plays on the NASDAQ QQQ may be your better option.

Risks

Any leveraged ETF will bring along with it heightened risk, that is a given. With TQQQ tracking 3x leveraged QQQ, a NASDAQ weighted ETF, the volatility is significant. 10% daily swings are to be expected easily almost weekly. Therefore the right investor is needed for TQQQ, one with a high propensity for risk. The losing situation here is a bear market that drags on another 1-2 years+. Recessions typically do not last much more than a year making TQQQ a good stock for small buy ins to average down and then hold when a bull market run kicks back in. Investors must be aware of the risks of leveraged ETFs and realize that perfect 3x leveraged tracking of the NASDAQs QQQ ETF is not a reality.

Conclusion

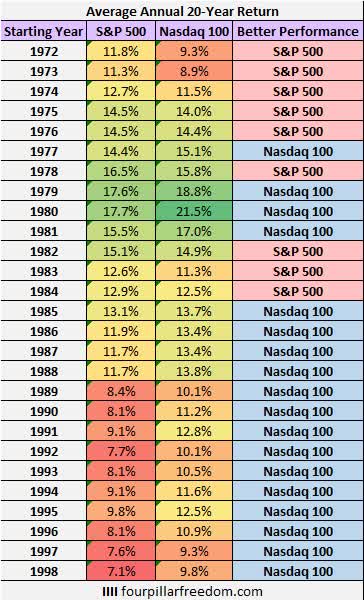

A stake in TQQQ is a leveraged bet on the resurgence of the NASDAQ. The NASDAQ has beaten out the S&P in yearly returns 28 out of the last 49 years (Figure 2). This increased volatility allows for greater crests & troughs allowing for big runs down as we have seen the past 10 months and big runs up as we expect over the next 10-12 months.

FourPillarsFreedom

Figure 2. Yearly returns pre-2000 show a shift from traditional investing in the S&P towards tech which has continued for the most part through the 2000s

Tech is here to stay; therefore we expect average P/E ratios to return to historical averages in the short to medium term. This could hint at as much as a 60% run up in the NASDAQ back to all-time highs in as little as a year delivering up to 180% returns in TQQQ best case scenario. With further downside likely limited we feel the ProShares UltraPro QQQ ETF is one of the best ways to aggressively play the market rebound. Rather than going all in on a few stocks, TQQQ offers high potential for big returns across a wide variety of tech names, making it our favorite name to add heading into the holiday season.

Be the first to comment