Teen00000/iStock via Getty Images

First, The News

IBM (NYSE:IBM) reported results on July 18th. Non-GAAP beat by $0.02 with EPS of $2.31, which was reasonable. Revenue was about $15.5 billion, up over 9% YoY, which was also a beat. Cash was also up to just under $8 billion, and total debt (including financing debt) was down $1.4 billion.

Looking forward, there’s potentially more good news. Revenue is expected to be up mid-single digits, perhaps at the high end in the 7-9% range. That includes potential currency headwinds, which are estimated to be about negative six points. Lastly, FCF is expected to be about $10 billion.

On the whole, this doesn’t look so bad. In fact, long-term investors are probably happy, or at least happy enough. But, there is plenty of darkness, and IBM isn’t a wonderful company. At best, it’s a hold.

The Storm Clouds

Ironically, the strong U.S. dollar is hurting IBM. Here’s what I mean:

IBM makes a little over half of its total revenue outside of the U.S., with around 30% in Europe.

Furthermore:

IBM CFO Jim Kavanaugh said in the company’s Q2 conference call that the rate at which the U.S. dollar has strengthened is “unprecedented.” He noted that over half of the currencies that IBM hedges against have dropped by double digits compared to the U.S. dollar so far this year.

So, while the $10 billion in FCF sounds good, it’s down 4-5% from previous guidance of $10.5 billion. That roughly lines up with the six point hit from currency headwinds. Hedging doesn’t seem to be working well enough.

Now, we have another problem, and it’s called Russia. Like many other companies, the extraction is incredible:

IBM has suspended business in Russia, including engagement with Russian clients, business partners, suppliers, vendors, resellers, developers and OEMs and is conducting an orderly wind-down of all business there. IBM is closely monitoring the war in Ukraine and has taken action to protect client and internal operations and to continue delivery of products and services to customers worldwide.

Interestingly, IBM didn’t say “Russia” even once in the Q2 2022 press release. In some ways, that’s odd, but in other ways, it’s not big news at all. After all, Russia accounting for roughly 0.5% of IBM’s total revenue in 2021. My rough math says that $28-30 million so it’s kind of a footnote.

Adding it all up, the biggest issue appears to be the strong dollar. I’ve seen very little about the impact of inflation, in terms of inputs, such as labor and materials. Instead, it’s all about the currency itself. Of course, things could change rapidly and we’ll continue to watch.

Momentum & Sentiment

I’m not a huge fan of momentum since it’s generally used for short-term trading, and options activity. However, I do pay attention when there’s a vertical fall to the bottom of the well – plop!

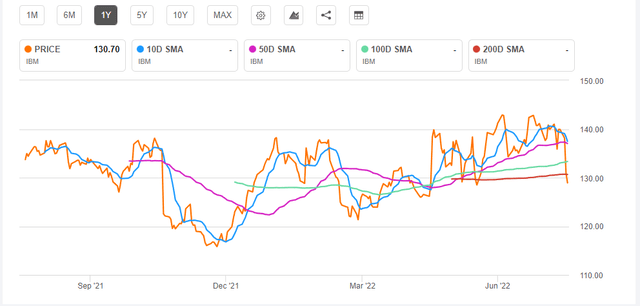

IBM – Moving Averages (Seeking Alpha)

We’re looking straight down right now:

10D = (6%)

50D = (6%)

100D = (3%)

Of course, the numbers aren’t huge, but the price is directly down, ripping through all moving averages. That said, there’s not a death cross here because the 10-day, 50-day and 100-day are all above the 200-day SMA.

So, we’ll be watching this as well. But, at least on the surface, there’s been a warning shot fired. Sentiment appears to be turning negative here.

Good News & Bad News About The Dividend

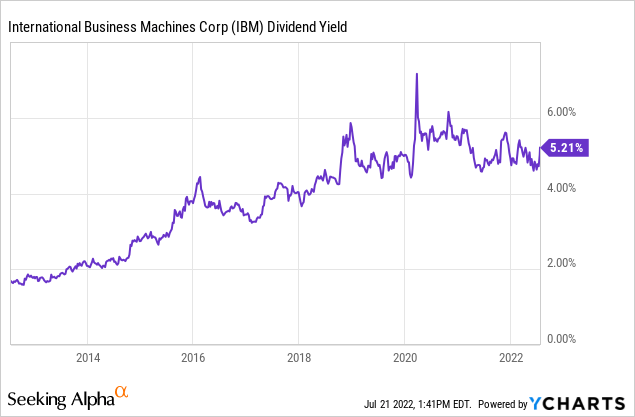

Here’s the good news in one simple chart:

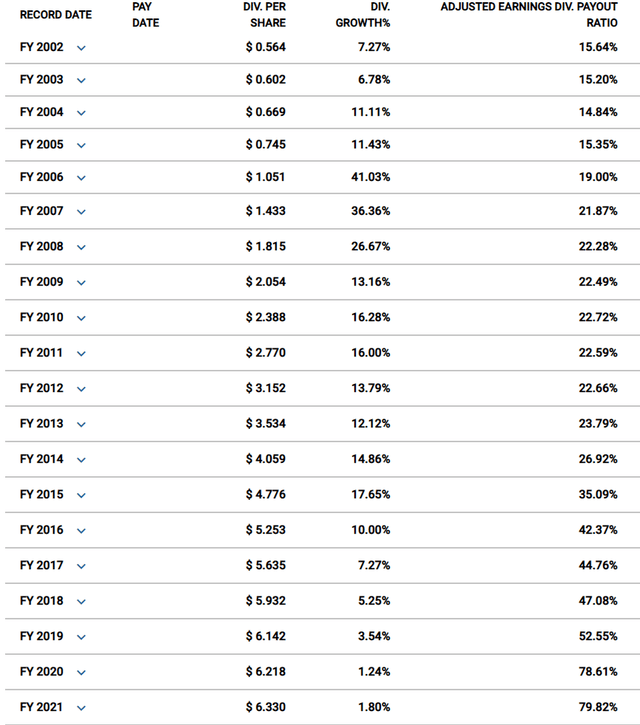

In this environment, a yield of 5.2% is certainly appealing. And, for long-time investors, it’s nice to get paid to hold. In general, for years and years, that dividend has been creeping upwards.

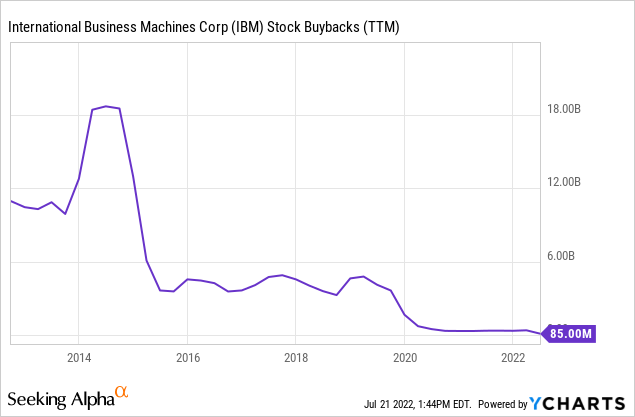

But, is this from constant “sugar” injections? Consider IBM’s buybacks.

Although the buybacks have declined significantly, billions and billions were burned to juice EPS but also keep the dividends flowing. By reducing the shares, IBM was able to maintain the growth in dividends.

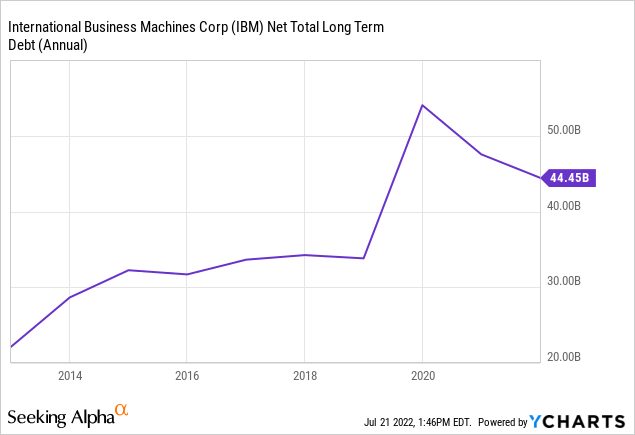

Of course, the debt picture is cloudy due to Kyndryl (KD) and also financing debt. But, what matters is that in general, IBM has piled on debt. Pushing out KD helped to manage that debt a bit. What matters here is simple. IBM kept the dividend high, and growing, via buybacks and debt. Stated another way, management employed financial engineering.

But wait, there’s more.

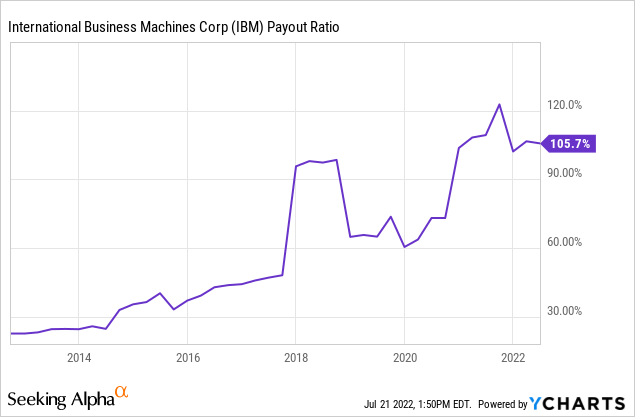

Basically, what we’re seeing is a relentlessly growing payout ratio. IBM continues to grow the dividend, and maintain its impressive growth streak, but the cost is tremendous. Here’s another view of the problem:

Like most of my analysis, I’m not looking for perfection. That is, the differences between YCharts and FASTgraphs don’t both me. We’re looking for converging evidence. Every tool calculates things a bit differently, in my experience. What matters is the extremely obvious trend. Bottom line: IBM has gone from being a conservative dividend machine to a stretched rubber band. Who knows if it’ll snap. There’s tension, even stress.

Wrap Up

Roughly speaking, IBM seems to be navigating the current environment fairly well. The business is facing macro problems, especially currency headwinds, but it’s certainly more focused now. With KD in the rearview mirror IBM is starting to get more serious about core competencies, including the hybrid cloud and artificial intelligence. Put another way, IBM isn’t going away.

On the other hand, the company seems to still be stuck in the past. This isn’t a nimble company. It’s like an old “smokestack” business but in IT instead of industrial production. It’s also tried financially engineer its way to success. This has been unsuccessful in my opinion.

On the surface, one bright spot has been the dividend. The yield is high, and IBM is a dividend champion. But, they’ve loaded up on debt over the years, and the payout ratio has been ugly. Frankly, I see risk in the dividend. At a minimum, I don’t see much growth in the dividend. For many investors, that’s perfectly acceptable. I understand, but then it makes IBM something of a bond proxy. That’s not what I find acceptable, but I see why others want it that way.

Adding it all up, I see IBM as a hold. It’s fine for dividend investors and income investors, I suppose. But, it’s very much a “has been” in terms of high growth, even with A.I. and the cloud. Also, in full disclosure, I sold out of my last IBM shares back in early 2022. I’m not short, but I’m definitely not buying.

Be the first to comment