grinvalds/iStock via Getty Images

A Quick Take On Agora

Agora (NASDAQ:API) recently reported its Q1 2022 financial results on May 23, 2022, beating revenue estimates and missing expected earnings results.

The company provides embedded video and related software capabilities to businesses worldwide.

API has produced an anemic growth trajectory and high and increasing operating losses, so I’m on Hold for API for the near term.

Agora Overview

Shanghai, China-based Agora was founded in 2013 to offer software developers with tools to embed video, voice and messaging functionalities into Internet applications.

The firm is headed by founder, Chairman and CEO Bin [Tony] Zhao, who was previously director and Chief Technology Officer of YY, a video social network and was a senior engineer at WebEx Communications.

The company’s primary offerings include embedded software for these functionalities:

-

Video

-

Live Streaming

-

Voice

-

Chat

-

Signaling

-

IoT

-

AR/VR

The firm acquires customers through direct sales and marketing efforts as well as through advertising and marketing events.

Agora has offices in Shanghai and Santa Clara.

Agora’s Market & Competition

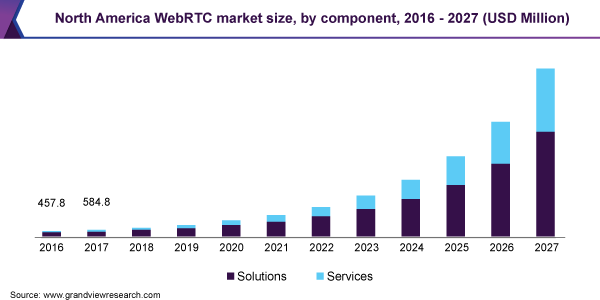

According to a 2020 market research report by Grand View Research, the market for Web real-time communications [RTC] products was an estimated $2.3 billion in 2019 and is expected to reach $41 billion by 2027.

This represents a forecast extremely high CAGR of 43.4% from 2020 to 2027.

The main drivers for this expected growth are the need for a better user experience, reduced costs and an increase in work-from-home employee work environments.

Also, the chart below shows the historical and projected future growth trajectory of the N. America WebRTC market through 2027:

N. America WebRTC Market (Grand View Research)

Major competitive or other industry participants include:

-

Amazon (AMZN)

-

Google (GOOG)

-

Facebook (META)

-

Cisco (CSCO)

-

Oracle (ORCL)

-

Ribbon (RBBN)

-

Avaya (AVYA)

-

Apidaze

-

Dialogic

-

Plivo

-

Quobois

Agora’s Recent Financial Performance

-

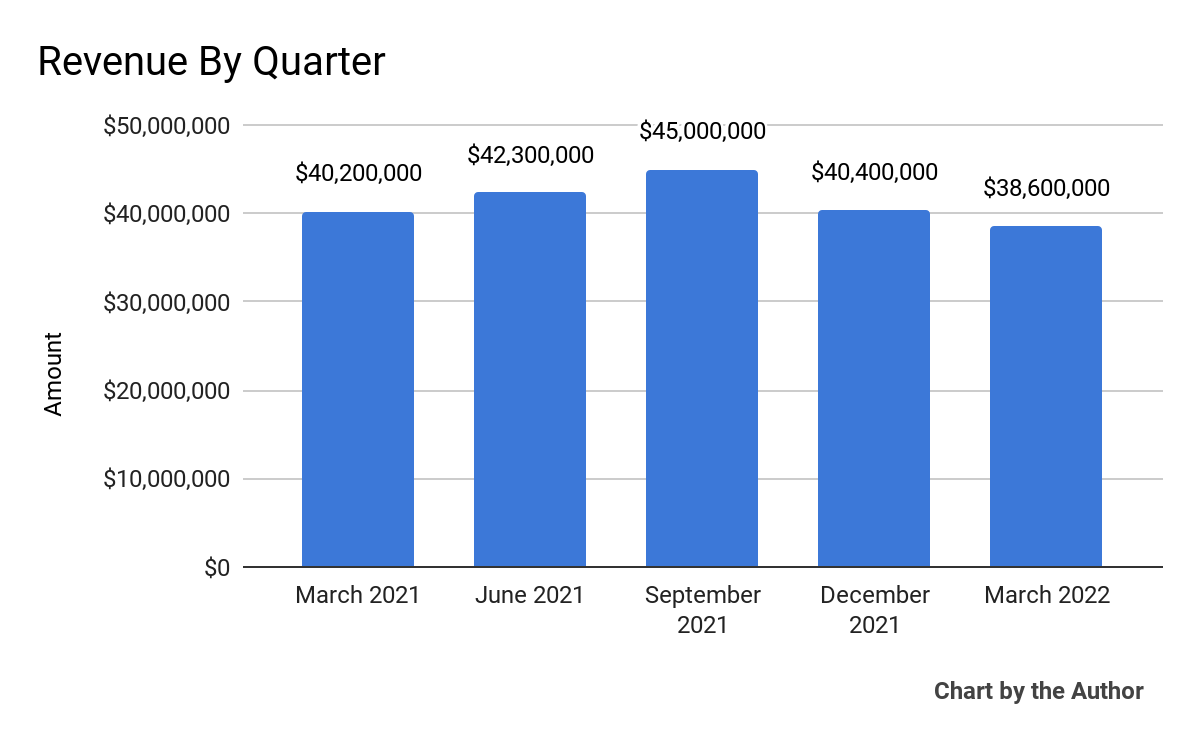

Total revenue by quarter has produced only slight growth or contraction over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

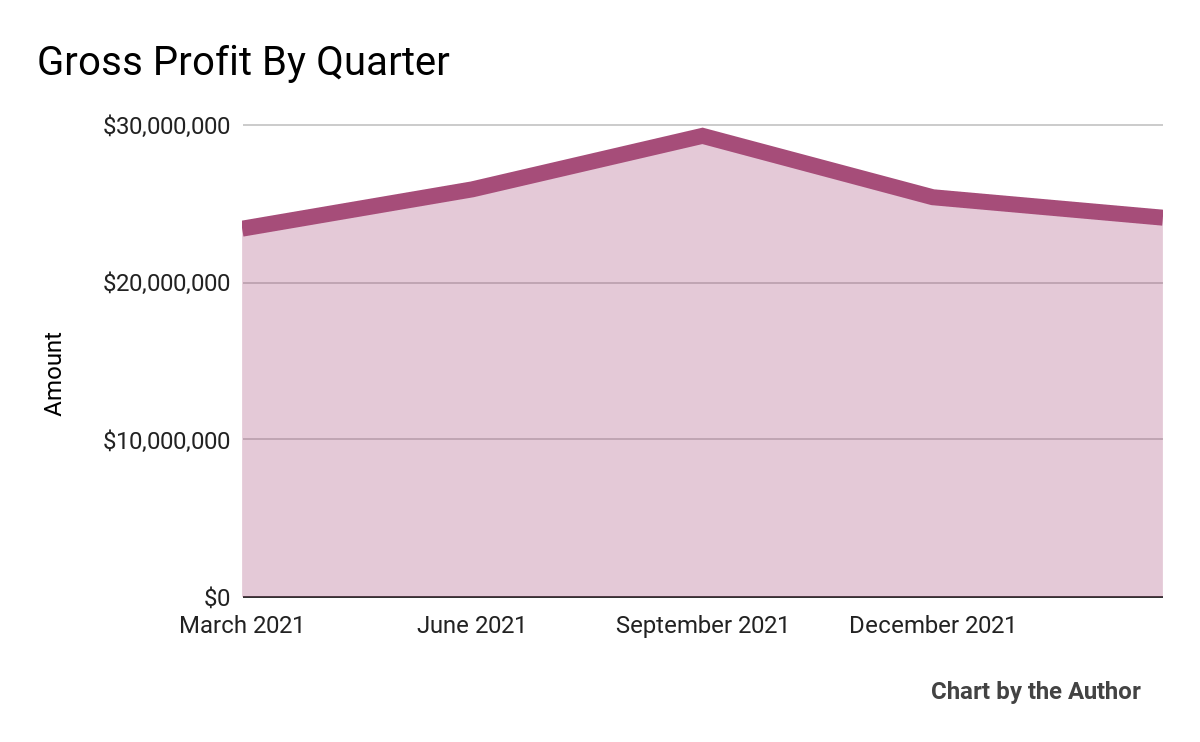

Gross profit by quarter has followed approximately the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

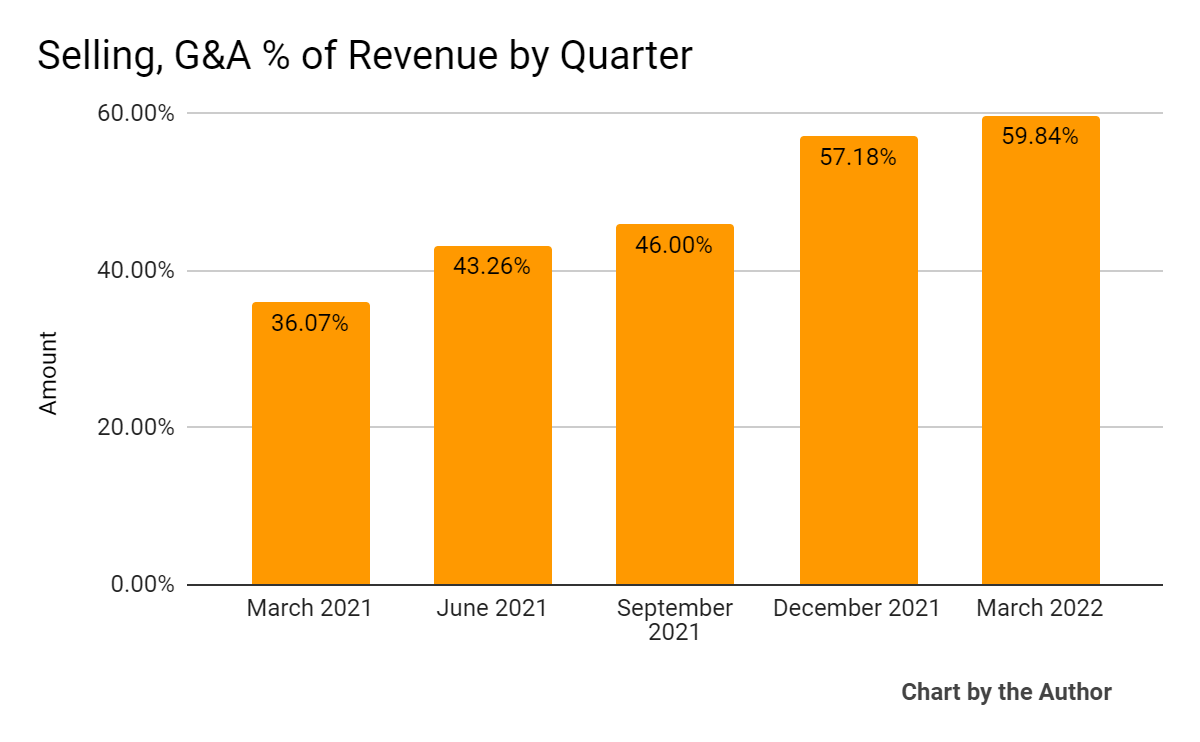

Selling, G&A expenses as a percentage of total revenue by quarter have increased markedly as revenue has risen and contracted:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

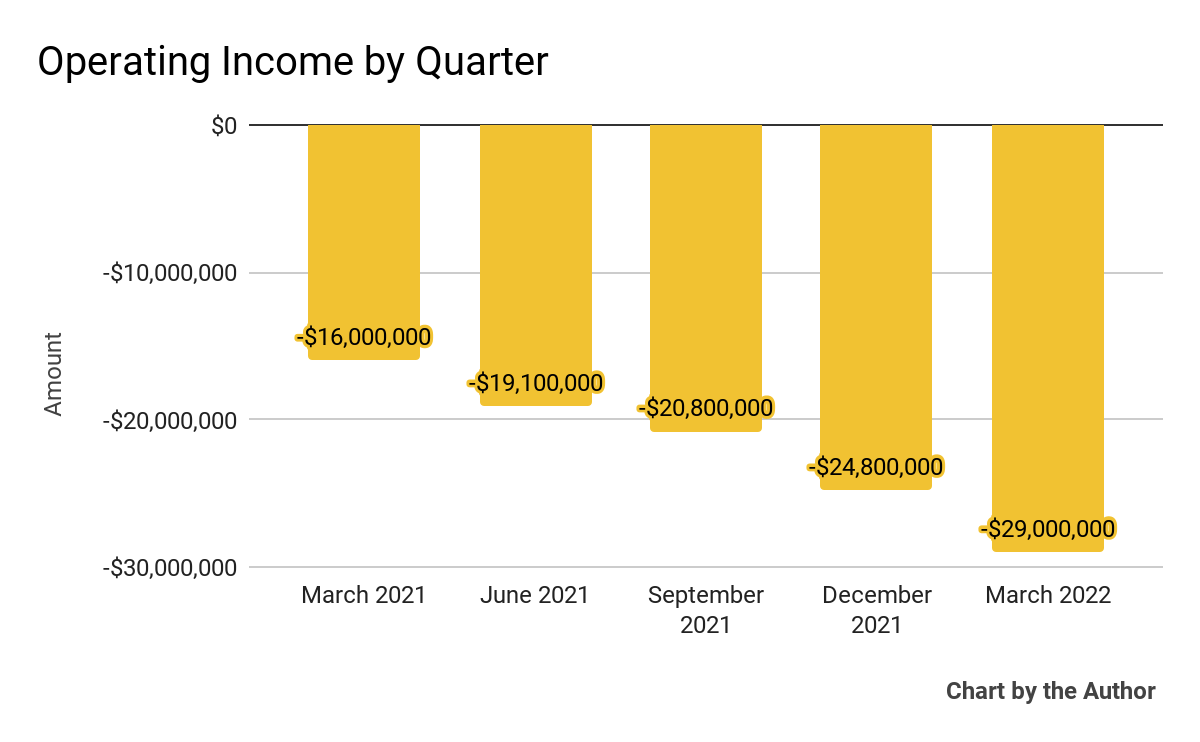

Operating losses by quarter have worsened considerably:

5 Quarter Operating Income (Seeking Alpha)

-

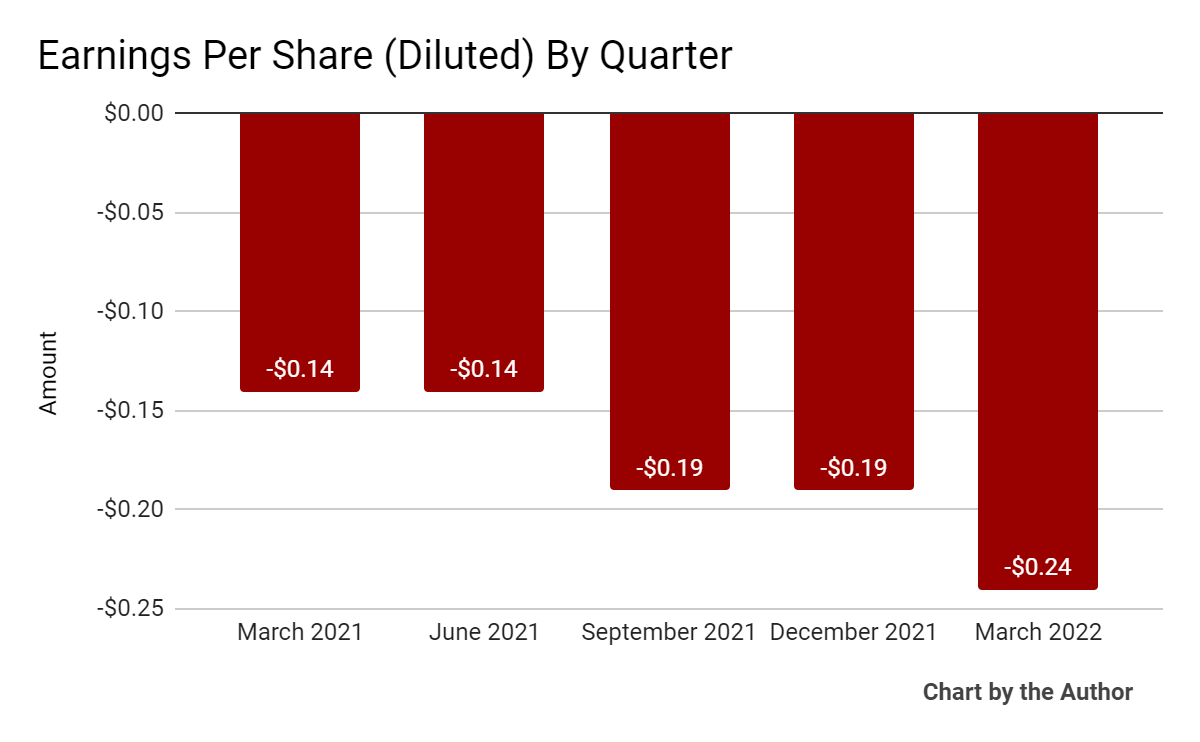

Earnings per share (Diluted) have also performed poorly:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

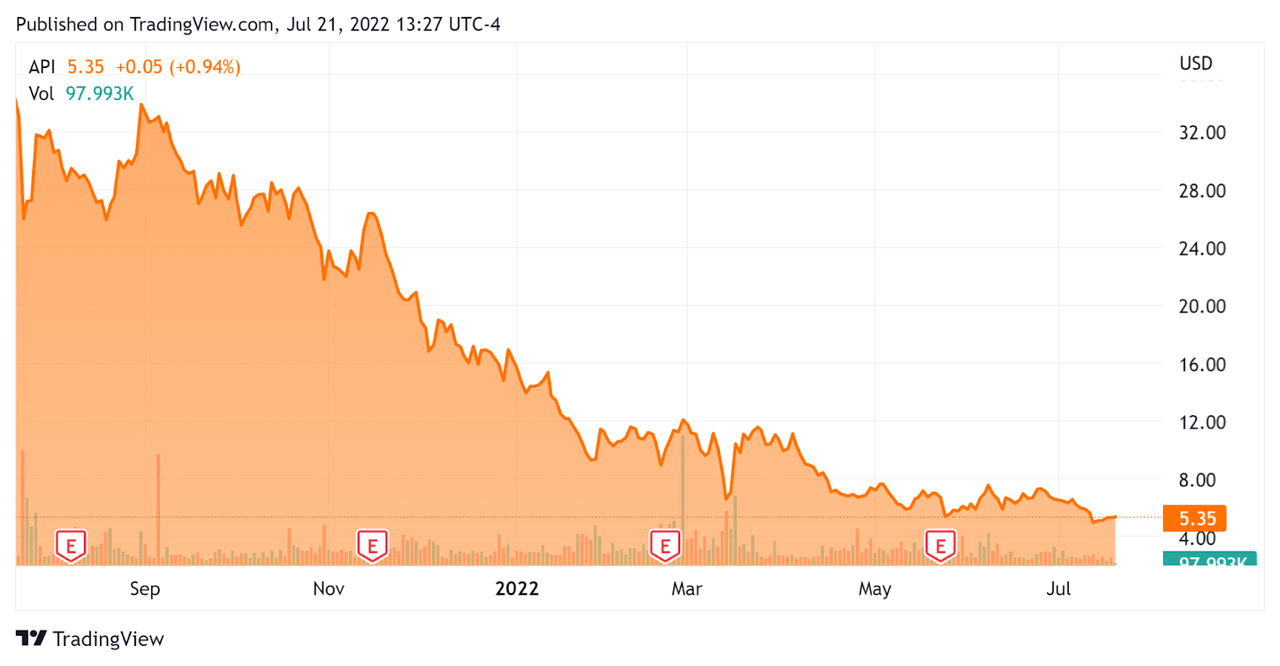

In the past 12 months, API’s stock price has dropped 84.4 percent vs. the U.S. S&P 500 index’s drop of around 8.7 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Agora

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

-$97,130,000 |

|

Market Capitalization |

$614,110,000 |

|

Price / Sales [TTM] |

3.56 |

|

Revenue Growth Rate [TTM] |

20.34% |

|

Operating Cash Flow [TTM] |

-$33,120,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.76 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

API’s most recent GAAP Rule of 40 calculation was negative (29%) as of Q1 2022, so the firm needs to improve materially in this regard, per the table below:

|

GAAP Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

20% |

|

GAAP EBITDA % |

-50% |

|

Total |

-29% |

(Source – Seeking Alpha)

Commentary On Agora

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the limited impact of the Shanghai COVID-19 lockdowns on its operations there.

CEO Zhao noted the firm’s ‘number one market share in RTE SDK installation globally.’ The firm’s software is used in ‘five out of the top 10 social dating apps in North America and seven out of the top 10 in China.’

However, the firm’s revenue was negatively impacted during the quarter due to a drop in demand from K-12 academic tutoring clients as a result of changing Chinese regulatory actions.

Despite this, API saw ‘strong growth momentum in markets such as the Middle East, Southeast Asia and Europe,’ which served to further diversify its revenue streams.

As to its financial results, total revenue decreased by 4.1% year-over-year as a result of its K-12 segment dropping precipitously, from $10 million in Q1 2021 to $1.3 million in Q1 2022.

However, U.S. and other ex-China markets grew nearly 50% year-over-year.

Non-GAAP gross margin improved while R&D expenses increased 45.3% year-over-year and sales and marketing expenses increased by 54.5%, both a worrisome trend against flat revenue growth.

For the balance sheet, the firm finished the quarter with $718 million in cash, equivalents and short-term investments while free cash flow was a negative $17 million.

Regarding its U.S. listing, the SEC has determined that in 2021, the firm used an auditor whose working papers cannot be inspected by the PCAOB. So if the company, for three consecutive years from 2021, has not had its working papers inspected by the PCAOB, its shares will be prohibited from trading on U.S. markets.

Looking ahead, management maintained its full year 2022 guidance with revenues expected to be $177 million at the midpoint of the range.

Regarding valuation, the market is currently valuing API at a Price/Sales multiple of around 3.6x.

The median Rule of 40 result for major U.S. SaaS companies is currently around 41%, so Agora’s negative (29%) is disappointing.

The primary risks to the company’s outlook are the uncertainty of Chinese regulatory actions as well as the potential for its stock to be under a cloud for possible delisting by 2024.

Given these risks, the firm’s anemic growth trajectory and increasing operating losses, I’m on Hold for API for the near term.

Be the first to comment