AsiaVision/E+ via Getty Images

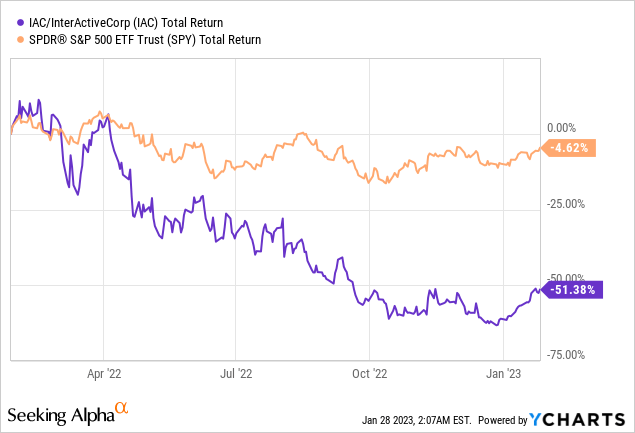

IAC Inc. (NASDAQ:IAC) is an internet company that builds other companies and invests opportunistically. Its current assets include Angi, care.com, 12% MGM Resorts, Dotdash Meredith, Mosaic Group, Vivian Health, 27% of Turo, and other small start-ups. The recent stock performance has been weak compared to S&P 500, given the multiple headwinds IAC is facing. However, I think the underlying opportunities for this stock are still significant. Here, I will share some of my thoughts.

Recent update

IAC’s Q3 results are not satisfactory. Both key businesses have experienced slowdowns. Dotdash Meredith’s total revenue decreased by 19%, with digital revenue at 221M (-13%YOY) and print revenue at 251M (-24%YOY). There was a 95M of operating loss and 31M EBITDA in Q3 2022. Restructuring charges and transaction-related items from the Meredith acquisition has an 18M impact on EBITDA. The good news is that print revenue actually performs very well, as the 24% YOY decline is overwhelmingly due to the elimination of 8 titles. For the existing brand portfolio, we see a 29% growth on a same-store basis. Angi’s revenue grew 8% YOY with an operating loss of 11M and EBITDA of 23M. Emerging & other segments increased revenue by 7% to 181M (Vivian health 77% YOY).

Dotdash Meredith hasn’t met its migration expectation

Back in 2021, IAC paid 2.7B to acquire Meredith which was a large publisher that covers world-class brands in home, food, health, beauty & style, lifestyle, and entertainment. Currently, the combined Dotdash Meredith has 174M unique users. This should be a big deal (Disney (DIS) only has 177M) since they did have the intangibles like editorial talent, brand authority, trust, and customer relations as a publisher.

Most of the Meredith assets were known as print magazine businesses and slowly decreasing revenues. IAC would like to migrate Meredith’s content to Dotdash platforms and unleash the potential of disseminating content through larger audiences in mobile, TV, social media, Video platforms, etc. It is expected that the migration could create 15-20% digital growth and 450M adjusted digital EBITDA in 2023. However, Dotdash Meredith is clearly behind in terms of their migration processes. Some sites have not been adapted to the Dotdash platform and the integration performance in marketing and e-commerce of Meredith content is still not good. The management is very candid about their performance. They admit some unexpected issues were exposed and they are 1.5 years behind schedule. Now, Dotdash Meredith lowered its EBITDA guide to 240-250m from 300M.

Joseph Levin as the new Angi CEO

Oisin Hanrahan, the founder of Handy, stepped down as Angi CEO. Joseph Levin will assume the role of Angi CEO in addition to his duties as IAC CEO. I think this is a good move. Joseph has lots of experience building companies that handle the search, monetization, and conversion. He has expressed the issues with the Angi business in a prior interview stating the mistakes to push the combination of HomeAdvisor and Angi too hard. In a recent conference call, he admits the current Angi operations are not efficient and the expenses are too high as Capex growth outpaced gross profit. He revealed his intention to simplify the business and to be ‘more consistent, reliable and less hassle’.

While I do see the market opportunities for Angi, there are too many uncertainties about how successful the business can be. The combination of HomeAdvisor and Angi has cost IAC 100M worth of traffic coming from search engines because of changes or URLs. Recent monthly metrics show that Angi’s service requests, monetized transactions, service, and ads professionals have dropped for 12 months in a row. This is a very worrying sign indicating a weakened trend of business expansion and awareness.

Investing through headwinds

With both of its key businesses underperforming, IAC is transitioning. Analysts definitely have skepticism about its success since no improvement will show in the next quarter or so. This explains why both EV/sales and price/book ratios are at all-time lows. I personally have strong faith in Dotdash Meredith, given the large audience and strong brand portfolio. The recent tech hype around ChatGPT is a little concerning as I worry machines may rewrite all Dotdash Meredith articles. But the designs, the original ideas, and brand recognition will still be there. In the realm of premium content in publishing, I do not perceive significant competition for Dotdash Meredith.

Regarding Angi, I am starting to be skeptical about whether this will grow into the next large business. The Homeservice platform is a very difficult problem to solve. Angi has been around for a long time and still cannot dominate the market. Unless the traffic starts to grow and surpass its previous peak, it is very difficult for me to have confidence in it. I think Joseph Levin is doing some damage control, IAC may go ahead spinning Angi off to focus on other opportunities, just like the recent sale of Bluecrew.

Bottom line

IAC owns many valuable assets and has a long track record of creating shareholder value. Currently, Barry Diller owns 7.8% of IAC shares, and Joseph Levin owns 5.4%. The management has all the incentives to take care of holding businesses and to be responsible for capital allocations. With an enterprise value of 6.72B, 1.24B worth of ANGI stake, and 2.65B of MGM stake, investors can actually buy all other assets for 2.83 B, including Dotdash Meredith, Care.com, Turo, Vivian Health, search, and Mosaic Group. As IAC can gain a 355M EBITA just with Search and Dotdash Meredith, the current valuation offers a good opportunity for long-term return.

Be the first to comment